Nine Months Net Income Increased to $0.27 Per

Diluted Share versus $0.17 Per Share in the Same Period Last

Year

Trio-Tech International (NYSE MKT: TRT) today announced

financial results for the third quarter and first nine months of

fiscal 2017:

- Fiscal 2017 third quarter revenue

increased 5.0% to $9,825,000 compared to $9,355,000 for the third

quarter of fiscal 2016.

- Fiscal 2017 third quarter net income

increased 133% to $350,000, or $0.10 per diluted share, compared to

$150,000, or $0.04 per share, for the third quarter of fiscal

2016.

- Revenue for the first nine months of

fiscal 2017 increased 8.8% to $27,900,000 compared to revenue of

$25,639,000 for the same period of fiscal 2016.

- Net income for the first nine months of

fiscal 2017 increased 60.8% to $963,000, or $0.27 per diluted

share, compared to $599,000, or $0.17 per share, for the same

period of fiscal 2016.

CEO Comments

S.W. Yong, Trio-Tech's CEO, said, "Higher revenue and improved

gross margin for the third quarter of fiscal 2017 combined to drive

a 50.2% increase in operating income compared to the same quarter

last year. Net income increased 133%, generating earnings of $0.10

per diluted share compared to $0.04 per diluted share in the same

quarter of last year.

"Our improved third quarter results are primarily due to

increases in revenue and improved operating profitability in our

semiconductor testing services business. Our distribution business

also reported strong growth in the quarter versus the same quarter

last year. Although manufacturing revenue declined, improved gross

margin led to higher profitability for this segment as well. Taken

together, overall gross margin for the third quarter increased to

24.9% of sales compared to 22.8% of sales in the third quarter of

fiscal 2016.

"For the first nine months of fiscal 2017, operating income was

up 20.0% and net income increased more than 60.0%.

"Our customers know that they can count on Trio-Tech to

consistently deliver high quality products and services when and

where they are needed and at competitive prices. This strategy has

served us well for many years."

Fiscal 2017 Third Quarter Results

For the third quarter ended March 31, 2017, revenue increased

5.0% to $9,825,000 compared to $9,355,000 for the same quarter of

fiscal 2016. Testing services revenue increased 9.8% to $3,977,000

in the quarter compared to $3,622,000 in the same quarter last

year, reflecting increasing testing volume at the Company’s Asian

facilities. Increased demand for products in the Singapore

operation raised distribution revenue 28.3% to $1,581,000 compared

to $1,232,000 in the same quarter last year. Manufacturing revenue

declined 5.3% to $4,230,000 for this year's third quarter compared

to $4,468,000 for the same quarter of fiscal 2016, primarily due to

reduced sales for Singapore and United States operations.

Operating expenses for the third quarter of fiscal 2017

increased to $1,962,000, or 20.0% of revenue, from $1,809,000, or

19.3% of revenue, for the same quarter last year.

Third quarter fiscal 2017 operating income increased 50.2% to

$485,000 from $323,000 in the same quarter last year.

Net income attributable to Trio-Tech International common

shareholders for the third quarter of fiscal 2017 increased 133% to

$350,000, or $0.10 per diluted share, compared to $150,000, or

$0.04 per diluted share, for the third quarter of fiscal 2016.

Third quarter fiscal 2017 net income benefited from a $45,000 gain

in other income compared to a loss of $97,000 in the same quarter

last year, primarily due to a decline in foreign exchange losses to

only $88,000 compared to foreign exchange losses of $218,000 in the

same quarter last year.

Fiscal 2017 Nine Months Results

For the nine months ended March 31, 2017, revenue increased 8.8%

to $27,900,000 compared to revenue of $25,639,000 for the first

nine months of fiscal 2016.

Gross margin for the first nine months of fiscal 2017 increased

10.5% to $7,099,000 from $6,425,000 and improved to 25.4% compared

to 25.1% of sales in the same period last year.

Income from operations for the first nine months of fiscal 2017

increased 20.0% to $1,140,000 compared to $950,000 for the same

period last fiscal year.

Net income attributable to Trio-Tech International common

shareholders for the first nine months of fiscal 2017 increased

60.8% to $963,000, or $0.27 per diluted share, compared to

$599,000, or $0.17 per diluted share, in the same period last year.

Net income for the nine month period benefited from a gain in other

income of $209,000 compared to a loss of $22,000 in the same period

last year. The improvement in other income is primarily due to a

foreign exchange gain of $93,000 compared to a foreign exchange

loss of $126,000 in the same period last year.

Shareholders' equity at March 31, 2017, was $20,751,000, or

$5.89 per outstanding share, compared to $20,871,000, or $5.94 per

outstanding share, at June 30, 2016. There were 3,523,055 and

3,513,055 common shares outstanding at March 31, 2017 and June 30,

2016, respectively.

About Trio Tech

Established in 1958 and headquartered in Van Nuys, California,

Trio-Tech International is a diversified business group with

interests in semiconductor testing services, manufacturing and

distribution of semiconductor testing equipment, and real estate.

Further information about Trio-Tech's semiconductor products and

services can be obtained from the Company's Web site at

www.triotech.com, www.universalfareast.com and www.ttsolar.com.

Forward-Looking Statements

This press release contains statements that are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and may contain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and assumptions regarding future activities and results of

operations of the Company. In light of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995, the

following factors, among others, could cause actual results to

differ materially from those reflected in any forward-looking

statements made by or on behalf of the Company: market acceptance

of Company products and services; changing business conditions or

technologies and volatility in the semiconductor industry, which

could affect demand for the Company’s products and services; the

impact of competition; problems with technology; product

development schedules; delivery schedules; changes in military or

commercial testing specifications, which could affect the market

for the Company’s products and services; difficulties in profitably

integrating acquired businesses, if any, into the Company; risks

associated with conducting business internationally and especially

in Southeast Asia, including currency fluctuations and devaluation,

currency restrictions, local laws and restrictions and possible

social, political and economic instability; changes to government

policies, potential legislative changes in U.S. and global

financial and equity markets, including market disruptions and

significant interest rate fluctuations; and other economic,

financial and regulatory factors beyond the Company’s control.

Other than statements of historical fact, all statements made in

this Quarterly Report are forward looking, including, but not

limited to, statements regarding industry prospects, future results

of operations or financial position, and statements of our intent,

belief and current expectations about our strategic direction,

prospective and future financial results and condition. In some

cases, you can identify forward-looking statements by the use of

terminology such as “may,” “will,” “expects,” “plans,”

“anticipates,” “estimates,” “potential,” “believes,” “can impact,”

“continue,” or the negative thereof or other comparable

terminology. Forward-looking statements involve risks and

uncertainties that are inherently difficult to predict, which could

cause actual outcomes and results to differ materially from our

expectations, forecasts and assumptions.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

UNAUDITED (IN THOUSANDS, EXCEPT EARNINGS PER SHARE)

Three Months Ended Nine

Months Ended March 31, March 31, Revenue 2017

2016 2017 2016 Manufacturing $ 4,230 $ 4,468 $

11,221 $ 10,884 Testing Services 3,977 3,622 12,204 11,106

Distribution 1,581 1,232 4,360 3,566 Others 37

33 115 83 9,825

9,355 27,900 25,639

Costs of Sales Cost of manufactured products sold 3,345

3,597 8,762 8,177 Cost of testing services rendered 2,597 2,570

8,069 7,827 Cost of distribution 1,407 1,025 3,899 3,118 Others

29 31 71 92

7,378 7,223 20,801

19,214 Gross Margin 2,447 2,132 7,099 6,425

Operating Expenses: General and administrative 1,659 1,600 5,178

4,861 Selling 222 158 587 470 Research and development 51 51 156

148 Loss (gain) on disposal of property, plant and equipment

30 -- 38 (4 ) Total

operating expenses 1,962 1,809

5,959 5,475 Income from Operations 485 323

1,140 950 Other (Expenses) Income Interest expense (43 ) (47 ) (149

) (151 ) Other income (expenses), net 45 (97 )

358 129 Total other income (expenses)

2 (144 ) 209 (22 ) Income

from Continuing Operations before Income Taxes 487 179 1,349 928

Income Tax Expenses (106 ) (15 ) (256 )

(168 )

Income from Continuing Operations before

Non-controlling Interest, net of tax

381 164 1,093 760 Loss from Discontinued Operations, net of tax

(1 ) (1 ) (4 ) (5 ) NET INCOME

$

380

$

163 1,089 $ 755 Less: Net Income Attributable to Non-controlling

Interest 30 13 126

156 Net Income Attributable to Trio-Tech International 350

150 963 599 Net Income Attributable to Trio-Tech International:

Income from Continuing Operations, net of tax 351 155 970 607 Loss

from Discontinued Operations, net of tax (1 ) (5 )

(7 ) (8 ) Net Income Attributable to Trio-Tech

International $ 350 $ 150 $ 963 $ 599

Basic Earnings Per Share $ 0.10 $ 0.04 $ 0.28

$ 0.17 Diluted Earnings per Share $ 0.10 $

0.04 $ 0.27 $ 0.17 Weighted Average

Shares Outstanding - Basic 3,523 3,563 3,523 3,563 Weighted Average

Shares Outstanding - Diluted 3,639 3,576 3,577 3,575

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME UNAUDITED (IN

THOUSANDS) Three Months Ended

Nine Months Ended March 31, March 31, 2017

2016 2017 2016 Comprehensive

Income (Loss)

Attributable to Trio-Tech

International:

Net income $ 380 $ 163 $ 1,089 $ 755 Foreign Currency

Translation, net of tax 290 779 (1,087

) (624 ) Comprehensive Income (Loss) 670 942 2 131

Less: Comprehensive Income (loss) Attributable to

Non-controlling Interest (38 ) 170 (75 )

32 Comprehensive Income (Loss) Attributable to

Trio-Tech International $ 708 $ 772 $ 77 $ 99

TRIO-TECH INTERNATIONAL AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (IN

THOUSANDS, EXCEPT NUMBER OF SHARES)

Mar. 31,

Jun. 30, 2017 2016

ASSETS (Unaudited) CURRENT ASSETS:

Cash and cash equivalents $ 4,009 $ 3,807 Short-term deposits 536

295 Trade accounts receivable, net 8,350 8,826 Other receivables

321 596 Inventories, net 2,172 1,460 Prepaid expenses and other

current assets 308 264 Assets held for sale 83 92

Total current assets 15,779 15,340 Deferred tax

assets 376 401 Investment properties, net 1,221 1,340 Property,

plant and equipment, net 10,694 11,283 Other assets 1,836 1,788

Restricted term deposits 1,629 2,067 Total

non-current assets 15,756 16,879 TOTAL ASSETS $

31,535 $ 32,219

LIABILITIES AND SHAREHOLDER'S EQUITY

CURRENT LIABILITIES: Lines of credit $ 2,107 $ 2,491 Accounts

payable 3,379 2,921 Accrued expenses 2,574 2,642 Income taxes

payable 213 230 Current portion of bank loans payable 199 342

Current portion of capital leases 196 235 Total

current liabilities 8,668 8,861 Bank loans payable, net of

current portion 1,428 1,725 Capital leases, net of current portion

366 503 Deferred tax liabilities 279 216 Other non-current

liabilities 43 43 Total non-current liabilities

2,116 2,487 TOTAL LIABILITIES 10,784

11,348 COMMITMENTS AND CONTINGENCIES -- -- EQUITY

TRIO-TECH INTERNATIONAL'S SHAREHOLDERS' EQUITY:

Common stock, no par value, 15,000,000

shares authorized; 3,523,055 and 3,513,055 issued and outstanding

at March 31, 2017 and June 30, 2016, respectively

10,921 10,882 Paid-in capital 3,204 3,188 Accumulated retained

earnings 3,988 3,025 Accumulated other comprehensive

gain-translation adjustments 1,276 2,162 Total

Trio-Tech International shareholders' equity 19,389 19,257

Non-controlling interest 1,362 1,614 TOTAL EQUITY

20,751 20,871 TOTAL LIABILITIES AND EQUITY $ 31,535 $

32,219

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170511005045/en/

Company Contact:A. Charles WilsonChairman(818)

787-7000orInvestor Contact:Berkman Associates(310)

477-3118info@BerkmanAssociates.com

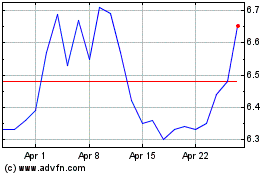

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Aug 2024 to Sep 2024

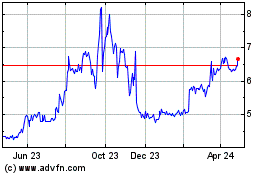

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Sep 2023 to Sep 2024