Current Report Filing (8-k)

May 10 2017 - 7:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 8, 2017

Cannabics

Pharmaceuticals Inc

.

(Exact Name of Registrant as Specified in

Its Charter)

|

Nevada

|

000-52403

|

20-3373669

|

|

(State of incorporation)

|

(Commission File Number)

|

(IRS Employer No.)

|

#3 Bethesda Metro Center

Suite 700

Bethesda, MD 20814

(Address of principal executive offices

and Zip Code)

(877) 424-2429

(Registrant's telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: (see General Instruction

A.2. below):

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 8, 2017,

we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with D-Beta One EQ, Ltd., an affiliate of

YAII EQ, Ltd. ("D-Beta"), which provides that, upon the terms and subject to the conditions and limitations set forth

therein, D-Beta will purchase an aggregate of 3,000,000 shares of our Common Stock (the “Purchased Shares”) at a price

per share of $1.00 per share, for an aggregate purchase price of $3,000,000. In addition, for a period of one-year from May 8,

2017, D-Beta may from time to time purchase up to an additional 1,500,000 shares of our Common Stock (the "Additional Shares")

at a price per share of $2.00 per share, for an aggregate purchase price of $3,000,000 assuming the purchase of all of the Additional

Shares.

Pursuant to the Purchase Agreement, we

are required to register all shares previously acquired by D-Beta or its affiliates, the Purchased Shares, and the Additional Shares.

The Company will file with the Securities

and Exchange Commission a prospectus supplement to the Company's prospectus, dated April 21, 2017, filed as part of the Company's

effective shelf registration statement on Form S-3, File No. 333-216845, registering all of the shares of Common Stock that are

to be offered and sold to D-Beta pursuant to the Purchase Agreement.

Pursuant to the

Purchase Agreement, we shall use the net proceeds from the sale of the shares for working capital purposes and capital expenditures.

For 60 days from the effective date of the Purchase Agreement we may not sell shares of Common Stock that are freely tradable at

a price equal to or below $1.00 per share. There are no other restrictions on future financing transactions. The Purchase Agreement

does not contain any right of first refusal, participation rights, penalties or liquidated damages. We did not pay any additional

amounts to reimburse or otherwise compensate D-Beta in connection with the transaction.

The Purchase

Agreement shall terminate automatically on the one-year anniversary of the effective date of the Purchase Agreement.

D-Beta has agreed

that neither it nor any of its affiliates shall engage in any short-selling or hedging of our Common Stock during any time prior

to the public disclosure of the Purchase Agreement.

The foregoing

is a summary description of certain terms of the Purchase Agreement. For a full description of all terms, please refer to the copy

of the Purchase Agreement that is filed herewith as Exhibits 10.1 to this Current Report on Form 8-K and is incorporated herein

by reference. All readers are encouraged to read the entire text of the Purchase Agreement.

The Company’s

press release announcing its entry into the Purchase Agreement with D-Beta is furnished as Exhibit 99.1 to this current report

on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

The

following Exhibits are filed as part of this Report.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Securities Purchase Agreement, dated as of May 8, 2017, between Cannabics Pharmaceuticals Inc. and D-Beta One EQ, Ltd.

|

|

|

|

|

|

99.1

|

|

Press Release, dated May 9, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CANNABICS PHARMACEUTICALS INC.

|

|

|

|

|

|

By:

|

/s/

Itamar Borochov

|

|

|

|

Name: Itamar Borochov

Title: Chief Executive Officer

|

Date: May

9, 2017

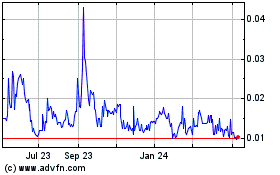

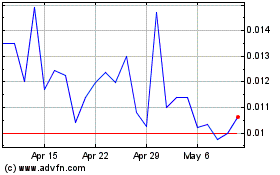

CNBX Pharmaceuticals (QB) (USOTC:CNBX)

Historical Stock Chart

From Aug 2024 to Sep 2024

CNBX Pharmaceuticals (QB) (USOTC:CNBX)

Historical Stock Chart

From Sep 2023 to Sep 2024