Sallie Mae and Chegg Partner on New Student Loan Benefit to Support Student Success

May 09 2017 - 9:03AM

Business Wire

Study Starter is a Unique and Exclusive

Benefit for Sallie Mae Student Loan Customers That Gives Students

Free Access to Online Tutoring and Studying Help from the Experts

at Chegg

Sallie Mae, the nation’s saving, planning, and paying for

college company, and Chegg (NYSE: CHGG), the Smarter Way to

Student, today announced a new and exclusive benefit available to

every student who takes out a new Sallie Mae Smart Option Student

Loan or Sallie Mae Smart Option Graduate Student Loan. Study

Starter gives Sallie Mae customers free access to online tutoring

and studying help from the experts at Chegg. Sallie Mae is the

first and only lender to offer this up-front, in-school benefit to

its customers.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170509005327/en/

Study Starter from Sallie Mae: an

exclusive new benefit focused on student success. (Graphic:

Business Wire)

Recent research from Chegg shows that more than half of students

entering college — 52 percent — are worried that difficult courses

and subjects could affect their ability to graduate. Even more — 74

percent — say they could benefit from extra help to get them

through challenging coursework.

Study Starter helps students jump-start their studies, expand

their learnings, and improve their grades —and it’s easy and

convenient to use. Students can get help answering study questions,

solving textbook problems, finishing homework, and prepping for

exams. The services are available online 24/7, so students can get

help quickly when they need it most.

Students can choose which Study Starter option best meets their

needs:

- The Chegg Tutors option features 120

minutes of free online access to tutors with expertise in more than

175 subjects who have been recruited from top universities and

vetted by Chegg.

- The Chegg Study option features four

months of free online access to step-by-step solutions to problems

in more than 26,000 college textbooks, and a database of more than

9 million study questions and answers.

- The combination option gives students

60 minutes of access to Chegg Tutors and two months of access to

Chegg Study.

“This partnership brings together two companies dedicated to

improving student outcomes, in and out of the classroom,” said

Nathan Schultz, chief learning officer, Chegg. “More than 1.5

million people subscribed to Chegg’s learning services last year,

and students credit Chegg Study and Chegg Tutors with actively

helping them to improve grades and comprehension. By making these

tools more accessible to their student customers, Sallie Mae is

taking a big step towards helping those students improve their

academic performance.”

Millions of students already take advantage of Chegg’s tutoring

and study services. In fact, 91 percent of Chegg Study users report

better grades on assignments or exams and 90 percent say Chegg

Tutors makes it easier to understand difficult material.

Additionally, nearly all — 94 percent — of Chegg Study users say it

helped them get homework done with less stress, a particularly

important factor for incoming freshmen who are just getting

acclimated to college coursework.

“Study Starter is a commitment to and investment in students’

success and helping them reach their potential and, frankly, that’s

what we are all about at Sallie Mae,” said Charlie Rocha, executive

vice president, Sallie Mae. “Our mission has always been to help

students and families save, plan, and pay for college, but that

also means helping students succeed at and ultimately complete

college. Study Starter will help them do just that, and with Chegg,

we’ve partnered with an industry leader who has a track record of

positive student outcomes.”

Study Starter is the latest benefit available for Sallie Mae

Smart Option Student Loan and Sallie Mae Smart Option Graduate

Student Loan customers. Customers who sign up to make monthly

payments via auto debit are also eligible to receive a 0.25

percentage-point interest rate reduction. Customers receive free

access to their FICO® Credit Score on a quarterly basis as well.

Additionally, Sallie Mae offers customers a Graduated Repayment

Period feature, a transitional repayment plan that offers customers

greater budget flexibility upon graduation and cosigner

release.

Sallie Mae recommends a 1-2-3 approach to paying for college:

first, maximize money that does not need to be repaid, such as

scholarships and grants; second, explore federal student loans;

and, third, consider a responsible private student loan.

As a result of this partnership, Chegg does not anticipate a

change to the 2017 annual guidance provided on its Q1 earnings

conference call on May 1, 2017.

For more information, visit SallieMae.com/StudyStarter.

About Sallie Mae

Sallie Mae (Nasdaq: SLM) is the nation’s saving,

planning, and paying for college company. Whether college is a long

way off or just around the corner, Sallie Mae offers products that

promote responsible personal finance, including private education

loans, Upromise rewards, scholarship search, college financial

planning tools, and online retail banking. Learn more at

SallieMae.com. Commonly known as Sallie Mae, SLM Corporation and

its subsidiaries are not sponsored by or agencies of the United

States of America.

About Chegg

Chegg puts students first. As the leading student-first

connected learning platform, Chegg strives to improve the overall

return on investment in education by helping students learn more in

less time and at a lower cost. Chegg is a publicly-held company

based in Santa Clara, California, and trades on the NYSE under the

symbol CHGG. For more information, visit www.chegg.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170509005327/en/

Sallie Mae:Rick Castellano,

302-451-2541Rick.Castellano@salliemae.comorChegg:Usher

Lieberman, 408-785-2028usher@chegg.com

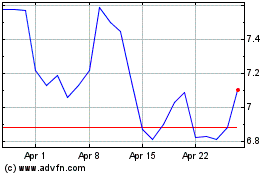

Chegg (NYSE:CHGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

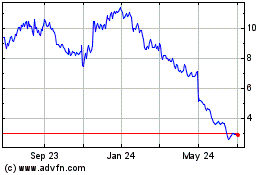

Chegg (NYSE:CHGG)

Historical Stock Chart

From Apr 2023 to Apr 2024