Comcast Results Top Expectations as Cable Giant Preps for Wireless Entry

April 27 2017 - 7:42AM

Dow Jones News

By Shalini Ramachandran

Comcast Corp.'s first-quarter results offer a glimpse into why

the cable giant is jumping into the cutthroat wireless business:

Consumers don't want a landline phone anymore, limiting the appeal

of its lucrative "triple play" bundles.

The company lost 5,000 voice customers in the quarter, compared

with an addition of 102,000 in the year-ago quarter. Among just

residential voice customers, the decline was even more stark with a

loss of 27,000.

Offering wireless service will present a new way for Comcast to

encourage package upgrades and further diversify its business.

Earlier this month, Comcast unveiled a mobile offering for any

customer that subscribes to at least its internet service, debuting

unlimited data plans that in some cases undercut rivals.

While many investors have been focused on the company's upcoming

entry into the wireless business, Comcast still reported

better-than-expected financial results in the first quarter. Its

NBCUniversal arm posted strong earnings buoyed by its filmed

entertainment unit.

On the cable side, Comcast added video and high-speed internet

customers, though additions slowed from the prior-year quarter. The

cable company added 42,000 residential and business video

customers, compared with the 53,000 it added in the prior-year

quarter. It added 429,000 broadband customers in the quarter

compared with 438,000 a year earlier.

Overall, net income rose to $2.6 billion, or 53 cents a share,

up from about $2.1 billion, or 43 cents a share, a year ago.

Revenue grew 8.9% to $20.5 billion.

Revenue and profit exceeded estimates from analysts, who were

projecting earnings of 44 cents a share on $20.1 billion in

revenue, according to Thomson Reuters.

As it seeks to highlight new lines of business, Comcast broke

out for the first time the number of customers who subscribe to its

security and home automation services: 957,000. In the quarter,

Comcast added 66,000 new home automation customers, up from 56,000

in the year-ago quarter.

The cable giant's broadband and business services divisions

posted strong sales growth in the first quarter, lifting overall

revenue at the cable business -- which accounts for the bulk of

Comcast's top line -- by 5.8% to $12.9 billion.

Broadband revenue increased 10% to $3.6 billion, while

business-services revenue jumped almost 14% to $1.5 billion.

Landline voice revenue fell 3.6% to $863 million.

At NBCUniversal, revenue rose 15% to $7.9 billion, helped by

strong growth at the filmed entertainment division, thanks to new

movies like "Fifty Shades Darker" and "Get Out." Filmed

entertainment brought in $1.98 billion in revenue, compared with

$1.38 billion in the year-ago quarter.

While the cable networks and broadcast TV units grew revenue and

earnings due to new carriage contracts and streaming content

licensing deals, they both continued to see lackluster ad sales

because of ratings softness. Cable networks' ad revenues declined

2.9% to $826 million, while broadcast TV ad revenue was essentially

flat at $1.3 billion.

Regarding Comcast's dive into the wireless business, many Wall

Street analysts and investors have been skeptical because its

service will rely on a five-year-old reseller agreement with rival

Verizon Communications, raising the prospect that it isn't a stable

long-term solution. Wall Street was also taken by surprise when

Comcast meaningfully underspent analyst estimates in a recent

government auction of airwaves -- a sign that it is remaining

cautious.

With the auction closing, investors are gaming out whether

Comcast ends up buying a wireless company instead. So far, company

executives have signaled that they are happy with their current

approach and don't think they need to buy a wireless carrier.

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

April 27, 2017 07:27 ET (11:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

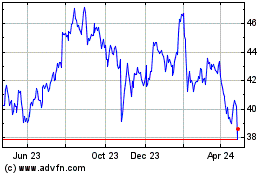

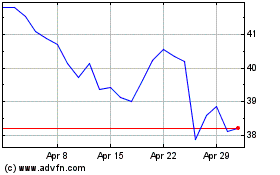

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Sep 2023 to Sep 2024