Orion Energy Systems, Inc. (NASDAQ: OESX) (Orion

Lighting), a leading designer and manufacturer of

high-performance, energy-efficient LED lighting products, today

announced preliminary, unaudited financial results for its fourth

quarter (Q4 ’17) and fiscal year ended March 31, 2017.

Preliminary, Unaudited Q4 & FY 2017

Performance

Orion CEO, John Scribante, commented, "Despite overall revenue

growth of 12% and a 27% increase in LED product sales in the first

nine months of fiscal 2017, both Orion and the lighting industry

hit an ‘air pocket’ of lower than anticipated order activity in

Orion’s fourth quarter ended March 31st. This slowdown limited our

FY 2017 revenue growth to 3.5%-4%, or approximately $70.0-$70.4

million, compared to revenue of $67.6 million in fiscal 2016, and

our previously communicated guidance of 10-15% growth.”

Orion’s Q4’17 preliminary, unaudited revenue declined 17-19% to

approximately $15.1-$15.5 million, compared to $18.6 million in Q4

’16. The Q4 ‘17 revenue shortfall was principally the result of the

far slower pace of lighting sales early during the period. Orion’s

FY 2017 performance reflected approximately 17% growth in

energy-saving LED lighting product sales. LED sales rose to

approximately 81% of total lighting product sales in FY 2017, up

from 71% in FY 2016 and increased to approximately 89% of total

lighting product sales in Q4’17, up from 76% in Q4’16.

Orion is not seeing any structural alterations or changes in the

competitive landscape within the industrial LED lighting retrofit

market. In fact, during fiscal 2017, Orion grew its new order

bookings by approximately 15% year over year. Orion’s fiscal 2017

revenue grew despite the expected ongoing decline in its legacy

fluorescent business, which contracted by approximately $6 million;

as well as a year-over-year decline in LED component pricing, which

negatively impacted average selling prices and Orion’s FY 2017

revenue. Looking past these factors, the solid underlying growth in

LED product sales underscores strong confidence in Orion’s market

position and growth prospects.

As others in the LED retrofit industry also experienced, new

order activity decelerated early in Orion’s fourth quarter, as many

customers reevaluated capital spending plans while they assessed

the economic, business, and market sentiment impact of the new U.S.

Government administration and its policies. Orion started to see

budgets begin to be released later in its fourth quarter, but the

pace of rebound proved more measured than expected, leading to the

Q4 ‘17 revenue shortfall. Fortunately, the market is moving towards

a more normal pace of business, and Orion continues to see its

energy-efficiency value proposition resonating with customers, as

confirmed by last week’s announcement of $1.9M in new orders with

the U.S. Navy.

Preliminary Addition to Inventory

Reserves

Given the heightened deceleration in fluorescent lighting and

prior generation LED product sales as a result of more energy

efficient and price-competitive LED alternatives, Orion plans to

record a reserve against its slower moving inventory of $1.5 – $2.0

million in Q4 ‘17. This additional reserve will be reflected as a

charge within cost of sales, reducing gross margin. In the future,

Orion will follow a “build-to-order” model for its fluorescent

products business, helping to insulate the Company from future

fluorescent inventory issues.

As a result of the addition to inventory reserves and lower than

anticipated production activity during the quarter, the gross

margin estimate for FY 2017 is expected to be approximately 25%

versus previous guidance of at or near 30%.

Preliminary Balance

Sheet

On a preliminary, unaudited basis, Orion ended FY 2017 with

approximately $17.3 million in cash and cash equivalents, compared

to $15.5 million at March 31, 2016. Long-term obligations under

Orion’s revolving credit facility were approximately $6.6 million

at March 31, 2017 as compared to $3.7 million at March 31,

2016.

Concluding Remarks

Mr. Scribante added, “Our LED product revenue has grown at a

130% compound annual growth rate to $53.3 million over four years.

That speaks to the strength of our product mix and the clear ROI

benefits of retrofitting to high quality, energy efficient, and

flexible Orion LED solutions. Further, this growth was achieved

amidst a restructuring of our agent network over the past year. We

believe the outlook for the LED lighting retrofit industry and

Orion remains strong, and we are committed to delivering

results.”

About Orion Energy Systems

Orion is a leading designer and producer of energy efficient

lighting and retrofit lighting solutions for commercial and

industrial buildings. Orion manufactures and markets connected

lighting systems encompassing LED solid-state lighting and

intelligent controls. Orion systems incorporate patented

design elements that deliver significant energy, efficiency,

optical and thermal performance that drive financial,

environmental, and work-space benefits for a wide variety of

customers, including nearly 40% of the Fortune 500.

Safe Harbor Statement

Certain matters discussed in this press release, are

"forward-looking statements" intended to qualify for the safe

harbor from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may

generally be identified as such because the context of such

statements will include words such as "anticipate," "believe,"

"could," "estimate," "expect," "intend," "may," "plan,"

"potential," "predict," "project," "should," "will," "would" or

words of similar import. Similarly, statements that describe the

Company's future plans, objectives or goals are also

forward-looking statements. Such forward-looking statements are

subject to certain risks and uncertainties that could cause results

to differ materially from those expected, including, but not

limited to, the following: (i) our ability to achieve our expected

revenue, gross margin, net income and EBITDA objectives in fiscal

2017 and beyond; (ii) our ability to achieve and sustain

profitability and positive cash flows; (iii) the availability of

additional debt financing and/or equity capital, and our limited

borrowing capacity under our bank line of credit; (iv) our

development of, and participation in, new product and technology

offerings or applications, including customer acceptance of our new

light emitting diode product lines; (v) deterioration of market

conditions, including our dependence on customers' capital budgets

for sales of products and services and continuing decreases in

prices of LED products; (vi) our ability to compete and execute our

strategy in a highly competitive and rapidly changing LED market

and our ability to respond successfully to market competition;

(vii) our ability to successfully implement our strategy of

focusing on lighting solutions using new LED technologies in lieu

of traditional HIF lighting upon which our business has

historically relied; (viii) adverse developments with respect to

litigation and other legal matters to which we are subject; (ix)

our failure to comply with the covenants in our revolving credit

agreement; (x) increasing duration of customer sales cycles; (xi)

fluctuating quarterly results of operations as we focus on new LED

technologies; (xii) the market acceptance of our products and

services; (xiii) our ability to recruit and hire sales talent to

increase our in-market sales and our ability to pursue an expanded

third-party sales channel through distribution and sales agents;

(xiv) price fluctuations, shortages or interruptions of component

supplies and raw materials used to manufacture our products; (xv)

loss of one or more key customers or suppliers, including key

contacts at such customers; (xvi) our ability to effectively manage

our product inventory to provide our products to customers on a

timely basis; (xvii) a reduction in the price of electricity;

(xviii) the cost to comply with, and the effects of, any current

and future government regulations, laws and policies; (xix)

increased competition from government subsidies and utility

incentive programs; (xx) potential warranty claims; and (xxi) the

other risks described in our filings with the SEC. Shareholders,

potential investors and other readers are urged to consider these

factors carefully in evaluating the forward-looking statements and

are cautioned not to place undue reliance on such forward-looking

statements. The forward-looking statements made herein are made

only as of the date of this press release and the Company

undertakes no obligation to publicly update any forward-looking

statements, whether as a result of new information, future events

or otherwise. More detailed information about factors that may

affect our performance may be found in our filings with the

Securities and Exchange Commission, which are available at

http://www.sec.gov or

at http://www.orionlighting.com in the Investor Relations

section of the Company's Web site.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170425006934/en/

Investor Relations Contacts:Bill Hull, CFOOrion Energy

Systems, Inc.(312) 660-3575orWilliam Jones; David CollinsCatalyst

Global(212) 924-9800oesx@catalyst-ir.com

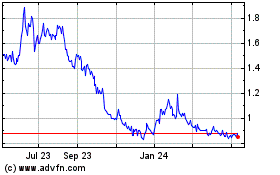

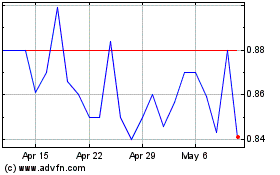

Orion Energy Systems (NASDAQ:OESX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orion Energy Systems (NASDAQ:OESX)

Historical Stock Chart

From Apr 2023 to Apr 2024