Manhattan Bridge Capital, Inc. Reports First Quarter Results - Record Revenue and Net Earnings

April 25 2017 - 7:15AM

Manhattan Bridge Capital, Inc. (NASDAQ:LOAN) announced today that

total revenue for the three month period ended March 31, 2017 was

approximately $1,330,000 compared to approximately $1,105,000 for

the three month period ended March 31, 2016, an increase of

$225,000, or 20.4%. The increase in revenue represents an increase

in lending operations. In 2017, approximately $1,106,000 of the

Company’s revenue represents interest income on secured, commercial

loans that it offers to small businesses compared to approximately

$914,000 for the same period in 2016, and approximately $223,000

represents origination fees on such loans compared to approximately

$190,000 for the same period in 2016. The loans are principally

secured by collateral consisting of real estate and, generally,

accompanied by personal guarantees from the principals of the

businesses.

Net income for the three month period ended

March 31, 2017 was approximately $791,000, or $0.10 per basic and

diluted share (based on approximately 8.1 million and 8.2 million

weighted-average outstanding common shares, respectively), versus

approximately $695,000, or $0.10 per basic and diluted share (based

on approximately 7.3 million weighted-average outstanding common

shares). This increase is primarily attributable to the increase in

revenue, offset by an increase in operating expenses.

As of March 31, 2017, total stockholders' equity

was approximately $23,108,000 compared to approximately $22,314,000

as of December 31, 2016, an increase of $794,000.

On March 14, 2017, the Company’s Board of

Directors authorized a common stock repurchase allowing the buyback

of up to 100,000 shares of the company’s common stock in market or

off-market transactions at prevailing prices over the next twelve

months. The manner, timing and number of shares purchased will be

at the Company’s discretion. As of March 31, 2017, the Company had

not yet repurchased any shares.

Assaf Ran, Chairman of the Board and CEO,

stated, “As we present another quarter of record high revenue and

net earnings, the Company once again demonstrates strength,

stability and, most importantly, responsibility. The numbers speak

for themselves. As a CEO with unprecedented personal commitment and

a major shareholder of the Company, I am proud of our achievements

to date, and am determined to achieve continued success,” added Mr.

Ran.

About Manhattan Bridge Capital, Inc. Manhattan

Bridge Capital, Inc. offers short-term secured, non–banking loans

(sometimes referred to as ‘‘hard money’’ loans) to real estate

investors to fund their acquisition, renovation, rehabilitation or

improvement of properties located in the New York metropolitan

area. We operate the web site:

http://www.manhattanbridgecapital.com

| MANHATTAN BRIDGE CAPITAL, INC. AND

SUBSIDIARIES |

|

| CONSOLIDATED BALANCE SHEETS |

|

| |

|

|

Assets |

March 31, 2017 (unaudited) |

|

December 31, 2016 (audited) |

|

| Current assets: |

|

|

|

|

| Cash and cash

equivalents |

$ |

120,659 |

|

|

$ |

96,299 |

|

|

| Cash - restricted |

|

202,061 |

|

|

|

--- |

|

|

| Short term loans

receivable |

|

26,699,500 |

|

|

|

27,495,500 |

|

|

| Interest receivable on

loans |

|

385,166 |

|

|

|

346,519 |

|

|

| Other current

assets |

|

49,991 |

|

|

|

29,397 |

|

|

| Total

current assets |

|

27,457,377 |

|

|

|

27,967,715 |

|

|

| |

|

|

|

|

| Long term loans

receivable |

|

8,504,820 |

|

|

|

7,259,820 |

|

|

| Property and equipment,

net Security deposit |

|

6,922 6,816 |

|

|

|

7,980 6,816 |

|

|

| Investment in privately

held company |

|

35,000 |

|

|

|

35,000 |

|

|

| Deferred financing

costs |

|

44,151 |

|

|

|

56,193 |

|

|

| Total

assets |

$ |

36,055,086 |

|

|

$ |

35,333,524 |

|

|

| |

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Line of credit |

$ |

7,217,047 |

|

|

$ |

6,482,848 |

|

|

| Accounts payable and

accrued expenses |

|

82,614 |

|

|

|

105,541 |

|

|

| Deferred origination

fees |

|

326,018 |

|

|

|

315,411 |

|

|

| Dividends payable |

|

--- |

|

|

|

813,503 |

|

|

| Total

current liabilities |

|

7,625,679 |

|

|

|

7,717,303 |

|

|

| Long term

liabilities: |

|

|

|

|

| Senior secured notes

(net of deferred financing costs of $678,898 and $697,669,

respectively) |

|

5,321,102 |

|

|

|

5,302,331 |

|

|

| Total

liabilities |

|

12,946,781 |

|

|

|

13,019,634 |

|

|

| Commitments and

contingencies |

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

| Preferred shares - $.01

par value; 5,000,000 shares authorized; no shares issued |

|

--- |

|

|

|

--- |

|

|

| Common shares - $.001

par value; 25,000,000 authorized; 8,312,036 issued; 8,135,036

outstanding |

|

8,312 |

|

|

|

8,312 |

|

|

| Additional paid-in

capital |

|

23,137,279 |

|

|

|

23,134,013 |

|

|

| Treasury stock, at cost

- 177,000 |

|

(369,335 |

) |

|

|

(369,335 |

) |

|

| Retained earnings

(Accumulated deficit) |

|

332,049 |

|

|

|

(459,100 |

) |

|

| Total stockholders'

equity |

|

23,108,305 |

|

|

|

22,313,890 |

|

|

| Total

liabilities and stockholders' equity |

$ |

36,055,086 |

|

|

$ |

35,333,524 |

|

|

| MANHATTAN BRIDGE CAPITAL, INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (unaudited) |

| |

| |

Three Months Ended March

31, |

| |

2017 |

2016 |

| |

|

|

| Interest income from

loans |

$ |

1,106,180 |

$ |

914,309 |

|

| Origination fees |

|

223,425 |

|

190,281 |

|

| Total

revenue |

|

1,329,605 |

|

1,104,590 |

|

| Operating costs and

expenses: |

|

|

| Interest and

amortization of deferred financing costs |

|

231,582 |

|

179,550 |

|

| Referral fees |

|

1,360 |

|

1,369 |

|

| General and

administrative expenses |

|

305,514 |

|

227,839 |

|

| Total

operating costs and expenses |

|

538,456 |

|

408,758 |

|

| |

|

|

| Income from operations

before income tax expense |

|

791,149 |

|

695,832 |

|

| Income tax expense |

|

--- |

|

(508 |

) |

| Net income |

$ |

791,149 |

$ |

695,324 |

|

| |

|

|

| Basic and diluted net

income per common share outstanding: |

|

|

| --Basic |

$ |

0.10 |

$ |

0.10 |

|

| --Diluted |

$ |

0.10 |

$ |

0.10 |

|

| |

|

|

| Weighted average number

of common shares outstanding: |

|

|

| --Basic |

|

8,135,036 |

|

7,264,039 |

|

| --Diluted |

|

8,158,316 |

|

7,292,372 |

|

| MANHATTAN BRIDGE CAPITAL, INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (unaudited) |

| |

| |

|

Three Months Ended March

31, |

| |

|

2017 |

|

2016 |

| |

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

| Net

income |

|

$ |

791,149 |

|

|

$ |

695,324 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities - |

|

|

|

|

|

Amortization of deferred financing costs |

|

|

30,813 |

|

|

|

12,041 |

|

|

Depreciation |

|

|

1,058 |

|

|

|

862 |

|

| Non cash

compensation expense |

|

|

3,266 |

|

|

|

3,397 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

| Interest

receivable on loans |

|

|

(38,647 |

) |

|

|

17,764 |

|

| Other

current and non current assets |

|

|

(20,594 |

) |

|

|

(16,063 |

) |

| Accounts

payable and accrued expenses |

|

|

(22,927 |

) |

|

|

28,135 |

|

| Deferred

origination fees |

|

|

10,607 |

|

|

|

(30,424 |

) |

| Net cash

provided by operating activities |

|

|

754,725 |

|

|

|

711,036 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

| Issuance

of short term loans |

|

|

(9,556,000 |

) |

|

|

(5,913,500 |

) |

|

Collections received from loans |

|

|

9,107,000 |

|

|

|

7,808,990 |

|

| Purchase

of fixed assets |

|

|

--- |

|

|

|

(1,038 |

) |

| Net cash

(used in) provided by investing activities |

|

|

(449,000 |

) |

|

|

1,894,452 |

|

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

| Proceeds

from (repayment of) line of credit |

|

|

734,199 |

|

|

|

(1,170,601 |

) |

| Cash

restricted for reduction of line of credit |

|

|

(202,061 |

) |

|

|

(464,889 |

) |

| Repayment

of short-term loan |

|

|

--- |

|

|

|

(235,000 |

) |

| Deferred

financing costs |

|

|

--- |

|

|

|

(163,112 |

) |

| Dividend

paid |

|

|

(813,503 |

) |

|

|

(617,443 |

) |

| Net cash

used in financing activities |

|

|

(281,365 |

) |

|

|

(2,651,045 |

) |

| |

|

|

|

|

| Net increase (decrease)

in cash and cash equivalents |

|

|

24,360 |

|

|

|

(45,557 |

) |

| Cash and cash

equivalents, beginning of period |

|

|

96,299 |

|

|

|

106,836 |

|

| Cash and cash

equivalents, end of period |

|

$ |

120,659 |

|

|

$ |

61,279 |

|

| |

|

|

|

|

| Supplemental Cash Flow

Information: |

|

|

|

|

| Taxes paid during the

period |

|

$ |

--- |

|

|

$ |

508 |

|

| Interest paid during

the period |

|

$ |

192,231 |

|

|

$ |

176,799 |

|

Contact:

Assaf Ran, CEO

Vanessa Kao, CFO

(516) 444-3400

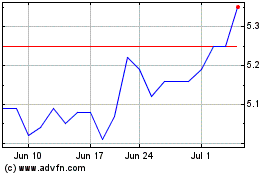

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

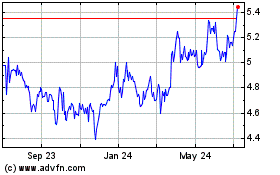

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024