Additional Proxy Soliciting Materials (definitive) (defa14a)

April 24 2017 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment

No. )

|

|

|

|

|

Filed by the Registrant ☒

|

|

Filed by a Party other than the Registrant ☐

|

|

Check the appropriate box:

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

|

|

☐

|

|

Definitive Proxy Statement

|

|

☒

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material under

§240.14a-12

|

|

|

|

Air Lease Corporation

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act

Rules 14a-6(i)(1)

and

0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was

determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

Air Lease Corporation Spring 2017

Stockholder Engagement

Air Lease: Consistent Growth and Strong

Financial Performance Consistent growth under the leadership of our management team Asset Growth ($ in billions) Revenue Growth ($ in billions) 18% CAGR 21% CAGR 1 As of December 31, 2016 Air Lease Corporation is a leading aircraft leasing company

We purchase new commercial jet transport aircraft directly from aircraft manufacturers and lease those aircraft to airlines throughout the world We have a diversified, global customer base with 85 airlines across 51 countries as of December 31, 2016

2010 - Founded 2011 - IPO 76 - Employees1 237 - Owned aircraft1 30 - Managed aircraft1 363 - Aircraft on order1

Leadership Transition Positions Us for the

Future Mr. Udvar-Házy founded Air Lease in February 2010, serving as CEO & Chairman He is a pioneer in the aircraft leasing industry, and co-founded the business that became International Lease Finance Corporation (ILFC) in 1973,

serving as CEO & Chairman Steven Udvar-Házy Executive Chairman John L. Plueger Chief Executive Officer & President Mr. Plueger joined Air Lease as its President, COO, and Board member in March 2010, shortly after the Company was formed

He has more than 30 years of aviation industry and aircraft leasing experience, 24 of which were with ILFC, where he served on its Board, and as President and COO In his full-time Executive Chairman role, Mr. Udvar-Házy leverages his

long-standing industry relationships to work closely with our airline customers, OEMs and financiers to modernize and grow airline fleets Mr. Udvar-Házy and Mr. Plueger have worked together for over 30 years, first building ILFC into one of the

largest aircraft leasing companies in the world, and now establishing Air Lease as a market leader. We believe that their partnership, experience, and knowledge are unmatched in the industry In his role as CEO & President, Mr. Plueger drives our

strategic business priorities and is responsible for growing our business across all constituencies and continuing to build stockholder value Recent leadership transition positions Air Lease to benefit from the deep knowledge, relationships and

operational experience of the Executive Chairman and CEO as the Company continues to grow Successful 30-year partnership

Air Lease Executive Compensation Program 1

Target Dollar Value of Aircraft Added to our Fleet decreased year-over-year as discussed on pages 38-39 of our March 2017 Proxy Statement 2 As reported in March 2017 Proxy Statement 3 CEO and Chairman are no longer eligible to receive a deferred

bonus beginning in FY2017 Executive Compensation Program Reflects Our Unique Business and Leadership Team 2016 Executive Compensation Highlights 2016 CEO Pay Mix at Target 2017 CEO Pay Mix at Target3 High Levels of Stock Ownership Demonstrate

Alignment with Stockholders 73% At Risk 86% At Risk Significant management stock ownership Mr. Udvar-Házy: 114x base salary2 Mr. Plueger: 29x base salary2 Stock ownership creates strong alignment between our executives and our stockholders We

require a small number of extraordinary, talented individuals with industry experience to manage and lead a capital-intensive and global business – 2016 Revenue / Employee = $18.7M We are one of only four US listed public aircraft leasing

companies Rigorous annual incentive program financial targets set above 2015 target and actual performance (on three of four financial metrics)1 Core long-term incentive (“LTI”) is 100% performance based 50% of core LTI is tied to

relative total shareholder return (“TSR”) and requires above-median performance for target payout 2016 program changes resulted in increased weight of LTI and higher proportion of CEO pay at risk

Stockholder Engagement In 2016 and early

2017, members of our management team and Board – including an independent director – conducted an extensive stockholder engagement program to better understand our stockholders’ viewpoints Our engagement team met with stockholders

holding 48% of outstanding shares The invaluable feedback we heard from our stockholders throughout our engagement meetings was shared with the compensation committee and entire Board, and was incorporated into 2016 compensation decisions,

leadership changes in July 2016 and our 2017 compensation program Responsiveness to Stockholder Feedback on Compensation Program CEO compensation program changes reflect both our Compensation Committee’s decision to increase emphasis on

at-risk compensation and feedback received from stockholders What We Heard What We Did Better align executive compensation with Company performance Decreased proportion of fixed compensation by decreasing our new CEO’s salary from $1.5 million

to $1 million Greater percentage of pay should be “at risk” and in the form of equity Total target cash compensation for CEO decreased by 17%, and percentage of cash at risk increased by 10% Greater percentage of pay should be in the

form of performance-based equity with multi-year vesting 2017 target performance based equity for Chief Executive Officer is 63.5% of total compensation compared to 48% in 2016 Eliminate participation in deferred bonus program Discontinued

CEO’s participation in deferred bonus program Better explain lack of peer group and use of benchmarking data in setting compensation Improved disclosure on use of benchmarking data in setting compensation amounts Preference for eliminating

employment agreements Eliminated CEO and Executive Chairman employment agreements

Limited Direct Public Company Peers

Limited direct company peers Only one files a full suite of SEC disclosures, including a proxy statement Companies in the aircraft leasing business include: Privately owned companies Subsidiaries of larger companies, including aircraft

manufacturers, banks, financial institutions, other leasing companies, aircraft brokers and airlines Of the over one hundred companies in the aircraft leasing business… … only 4 are stand-alone public companies listed in the US …

We do not disclose a peer group because we have very limited direct public company peers Over the past year, Air Lease’s TSR has outperformed its three publicly-listed peers1 1 Source: CapitalIQ, Dividend Adjusted Share Pricing measured from

April 20, 2016 to April 20, 2017 Air Lease: 16.6% AerCap: 10.3% Aircastle: 10.8% Fly Leasing: 10.6%

Small, Talented Team Responsible for

Managing Complex Business Company/Industry Revenue / Employee (mm) Total Assets / Employee (mm) Net Income / Employee (mm) Air Lease Corporation1 $18.67 $183.89 $4.93 Diversified Financial Companies2 (Capitalization between $1bn and $10bn) $0.97

$6.86 $0.22 Sub-Industry: Asset Management and Custody Banks2 $1.18 $6.28 $0.22 1 As of December 31, 2016 2Source: Capital IQ (Year End 2016 Figures) and most recent Company 10-Ks Compared to other capital intensive businesses such as diversified

financial companies, our employees are responsible for significantly more revenue, income and assets Managing this level of assets with a small number of employees requires extraordinarily talented individuals with deep industry experience, and our

compensation program is designed to reward these special employees for continuing to create and deliver long-term shareholder value Annual incentive bonus is highly performance-based with metrics closely tied to our strategic and operating goals

Significant portion of LTI payout ties to relative TSR outperformance of the market (as measured by S&P 400)

Financial Performance Measures 2016 Target

Change versus 2015 Target 2016 Actual Performance Achievement Level Overall Revenue $1,387 17.7% $1,419 170% Pre-Tax Operating Margin 39.0% 12.1% 40.9% 179% Pre-Tax Return on Equity 17.0% 20.6% 18.1% 177% Dollar Value of Aircraft Added to our Fleet

$2,373 (13.7%) $2,754 200% Annual Incentives Reward Financial Performance and Strategic Achievements Performance-Based Annual Cash Incentives Strategic Objectives Expand our aircraft management business Add new airline customers 3. Continue to

optimize specified internal processes Performance Against Strategic Goals We expanded our fee-based aircraft management business and currently provide fee-based management services for 4 additional aircraft for a total of 30 but did not reach our

maximum goal We added 11 new airline customers, but we did not meet our maximum goal We continued to optimize internal processes, including implementing a treasury management system, a mobile device management platform and hard drive encryption and

obtained an investment grade rating, exceeding our target goal 146% Total (Company Performance Factor) 174% 80% 20% We set rigorous targets under our annual incentive program, which is structured to measure both the financial and strategic

achievements that we believe underpin long-term value creation

Long-Term Incentives Aligned with

Performance Long-Term Incentive Plan Equity Mix Key Elements Performance Link Payout of 2014 – 2016 LTI Awards Book Value RSUs (50%) Book value is a key value driver of our Company 3-year performance period, measured annually Target awards

vest if target book value is achieved If target is not attained in a given year, RSUs do not vest and expire Book value targets increase year-over-year Book Value Appreciation Book value RSUs paid out at target In each of 2014, 2015 and 2016, the

Compensation Committee approved book value RSU grants that vest annually over three years Each year, the targets increased requiring steady increases in book value in order to vest Each year, we exceeded the increasingly challenging targets TSR RSUs

(50%) Focuses executives on actions that will generate sustainable value creation 3-year performance measurement period TSR measured against S&P 400 MidCap Index Target payout requires 55th percentile achievement Relative TSR TSR RSUs paid out

at 43% of target 100% of CEO’s and Named Executive Officers’ normal course equity awards consist of performance-based shares Our core long-term incentive program consists entirely of performance-based shares, and is highly aligned with

our performance

*A holding company for Air Canada

Highly Engaged Board with Extensive Industry Relevant Experience Steven F. Udvar-Házy Exec. Chairman John L. Plueger CEO Robert Milton LID Matthew J. Hart Cheryl Gordon Krongard Marshall O. Larsen Ian M. Saines Ronald D.

Sugar Former Chairman & CEO, Air Lease Former President & COO, Air Lease Former Chairman & CEO, Ace Aviation Holdings* Retired President & COO, Hilton Hotels Corporation Retired Senior Partner, Apollo Management Retired Chairman,

President & CEO, Goodrich Corporation Chief Executive, Funds Management Challenger Limited Retired Chairman & CEO, Northrop Grumman Corporation Joined Board 2010 2010 2010 2010 2013 2014 2010 2010 Executive Leadership ✔ ✔

✔ ✔ ✔ ✔ ✔ ✔ Financial Expertise ✔ ✔ ✔ ✔ ✔ ✔ Capital Allocation Expertise ✔ ✔ ✔ ✔ ✔ ✔ Airline Industry Expertise ✔

✔ ✔ ✔ ✔ Aviation Expertise ✔ ✔ ✔ ✔ ✔ International Experience ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔

Other Public Company Board SkyWest Spirit AeroSystems Holdings United Continental Holdings (Non-Executive Chairman) American Airlines Group American Homes 4 Rent Xerox US Airways (formerly) Becton, Dickinson and Company Lowe's Companies United

Technologies Amgen Apple Chevron Strong Board evaluation and succession processes ensure the Board is comprised of Directors with the necessary skills and balance of perspectives to oversee our unique business Denotes

independent directors 75% Independent

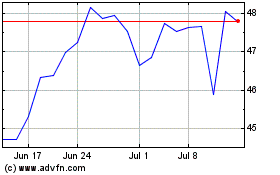

Air Lease (NYSE:AL)

Historical Stock Chart

From Mar 2024 to Apr 2024

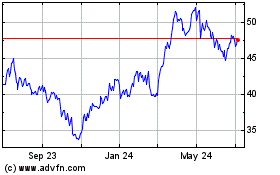

Air Lease (NYSE:AL)

Historical Stock Chart

From Apr 2023 to Apr 2024