Additional Proxy Soliciting Materials (definitive) (defa14a)

April 21 2017 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material under Rule 14a-12

|

Tenet Healthcare

Corporation

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

April 21, 2017

|

Re:

|

Supplemental information relating to the Tenet Healthcare Corporation 2017 Annual Meeting of Shareholders: Proposal 2 – Advisory Vote to Approve Executive Compensation

|

Dear Fellow Tenet Shareholder:

Tenet’s 2017 Proxy

Statement was filed with the SEC on March 24, 2017, and is available at

https://tenethealth.investorhq.

businesswire.com/sites/tenethealth.investorhq.businesswire.com/files/doc_library/file/2017_Tenet_Healthcare_Proxy_Statement.PDF

. We are writing for your

continued support on Proposal 2 – Advisory Vote to Approve Executive Compensation (referred to as the “say-on-pay proposal”), which was supported by approximately 90% of the votes cast last year.

Glass, Lewis & Co., LLC has recommended that shareholders vote in accordance with the recommendations of our Board of Directors on

all

of the

proposals included in the Proxy Statement. In contrast, Institutional Shareholder Services Inc. has recommended that shareholders vote in accordance with the Board’s recommendations on four of the five proposals, but not with respect to the

say-on-pay proposal.

The Human Resources Committee of Tenet’s Board of Directors believes there is a strong business rationale for executive

compensation decisions made during 2016 and early 2017, which serve shareholders’ long-term interests and deserve your support. The highlights of the Committee’s executive compensation decisions are reiterated below to help establish a

common understanding, while readers should reference the Proxy Statement for definitions and other details.

Business Considerations

Tenet has an unwavering commitment to provide high quality healthcare services that produce attractive long-term returns for shareholders. Following are three

major business-related considerations that influenced executive compensation decisions in 2016 and 2017:

|

|

•

|

|

Operating financial performance remains relatively strong

.

Despite stock price declines, our recent financial and operating results have been stronger. For example, same-hospital patient revenue

grew 5.5% and 4.8% in 2015 and 2016, respectively, and Adjusted EBITDA increased by 17% and 6% in each of these years. Adjusted Free Cash Flow also improved meaningfully as compared to past years.

|

|

|

•

|

|

Stock price is significantly impacted by uncertainties regarding healthcare policy

.

Beginning in the second half of 2015, Tenet’s stock price began a decline that continued through the fall of

2016 and then accelerated following the November 2016 elections. We believe that uncertainty regarding the future of the Affordable Care Act, risks in hospital reimbursement models and other regulatory and macroeconomic changes have contributed to

the decline in stock price unrelated to the fundamental performance of the business.

|

|

|

•

|

|

Realized compensation is highly dependent on stock price performance and achievement of operating goals

.

Management has established a number of initiatives designed to strengthen the operating and

financial performance of the business. Two-thirds of the long-term incentive awards made in 2017 are directly dependent upon achievement of related goals before pay will be delivered. Examples of previously disclosed initiatives, which support

achievement of these goals, include completing hospital divestitures, expanding our ambulatory platform, and improving Adjusted Free Cash Flow. The Human Resources Committee of the Tenet Board of Directors approved the aggressive goals and related

compensation opportunities in order to focus this experienced management team and directly align pay with company performance.

|

Compensation Decisions

Strengthening the

alignment between real pay delivery and performance has been a major objective of the Committee in 2016-17. Decisions regarding Tenet’s proxy officer pay levels and pay structure reflect this objective, as highlighted below:

|

|

•

|

|

Base salaries and target annual incentive opportunities for the CEO remain unchanged since 2015

.

Current levels were regarded as reasonable for the current business environment. Meanwhile, the

CEO’s last salary increase was in 2015.

|

|

|

•

|

|

2016 annual incentives were earned at 67% of target

.

Rigorous financial, operating, and strategic goals are set at the beginning of each year. For 2016, the target financial goals were not met,

resulting in below-target earned awards, demonstrating clear pay-for-performance alignment.

|

|

|

•

|

|

2016 long-term incentive grants had moderate downside risk to balance performance and retention, and were discounted from our traditional median-targeting grant values

.

Half of the 2016 grants were

in performance-based restricted stock units (performance shares) and the other half were in time-based restricted stock units (restricted shares). The performance shares shifted from a one-year performance period in prior years to a three-year

period and will be earned if pre-established financial goals are achieved for Adjusted EPS, Adjusted ROIC, and Adjusted Free Cash Flow less Cash to Non-Controlling Interests, assuming continued employment. Additionally, there is a goal for relative

total shareholder return (TSR) compared to Tenet’s direct peers (HCA Holdings, Community Health Systems, Universal Health Services, and LifePoint Health), who are the closest benchmarks for performance comparisons. Meanwhile, the remaining

restricted shares will be earned over three years only if employment is continued. This combination of grant types provided moderate potential upside in realizable pay, and dampened the downside risk from healthcare sector-related uncertainties to

encourage retention. In making the 2016 grants, regular median grant values were reduced by approximately 20%. For example, the CEO’s 2016 grant value was reduced from a median competitive target of $9 million to roughly the 25

th

percentile of $7.2 million, and grants to his direct reports (including the other proxy officers) were similarly reduced.

|

2

|

|

•

|

|

2017 long-term incentives were designed with higher performance-risk tied to stock-price recovery and were based upon the long-standing practice of establishing value relative to market peer group median

values

.

One-third of the 2017 target grants are in performance-based awards and one-third are in restricted shares with both structured much like the 2016 grants, except the performance awards are denominated and paid in cash to conserve

shares and Adjusted ROIC was dropped as a measure for the purpose of simplification. The remaining one-third of the grants is in performance-based stock options. These options have an exercise price of $18.99 (closing price on grant date), but are

forfeited unless the average closing price is equal to or greater than $23.74 (25% premium over strike price; 58% premium over the closing price on April 20, 2017) for at least 20 consecutive trading days within the three year performance

period, also subject to continued employment. With two-thirds of the grant value now at risk for achieving rigorous performance goals over a three year period with cliff vesting, the Committee believed it was appropriate to once again provide

executives with the opportunity to earn compensation at median competitive values.

|

|

|

•

|

|

Rigorous goals are in place for earning performance-based incentives

.

Consistent with the practices of many other public companies, the company has concluded that pre-disclosure of these long-term

financial performance goals could cause competitive harm to the company and may be interpreted as guidance by some investors. Consistent with Tenet’s past practice, specific financial goals will be disclosed after the performance period is

completed and the information is no longer sensitive from a competitive perspective. Tenet will disclose goal achievement or not, relative to these goals in order to inform pay delivered or forfeited at the end of the respective Plan performance

period. In establishing financial goals, the Committee considers annual and longer-term growth rates that the company does disclose to investors, as well as the consensus of analyst estimates and business-planning projections. Evidence of

goal-setting rigor is apparent in the below-target annual incentive earnouts for 2016. Further evidence is in the chart from the proxy statement (page 34) showing the “realizable value” of the compensation granted to our CEO in recent

years. Taking 2016 as an illustration, our CEO had proxy-reported “target” compensation value of approximately $10.5 million, while the relevant performance-based “realizable” value had declined to $6.8 million (-35%) as of

year-end, due to below-target performance under the annual incentive plan and the decline in the stock price from the time of grant.

|

In

closing, please recognize the Committee’s serious commitment to pay for performance, as indicated by the alignment of actual pay delivery with performance that benefits Tenet’s shareholders and continuing to increase the proportion of

executive pay tied directly to performance achievement. We strongly believe that Tenet’s executive compensation program is designed in the best interests of the company’s shareholders, and that the support of shareholders for Tenet’s

prior say-on-pay proposals and our responsiveness to shareholder concerns supports this belief.

We encourage you to vote “FOR” Proposal 2 – the say-on-pay proposal

.

Sincerely,

Ronald Rittenmeyer

Lead Director and Chair of the Human Resources Committee

Tenet Healthcare Corporation

3

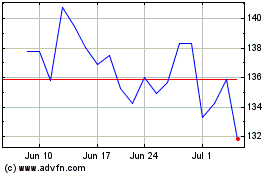

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Aug 2024 to Sep 2024

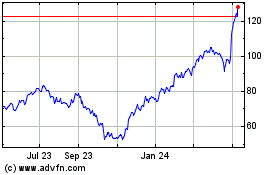

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Sep 2023 to Sep 2024