UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section

14(a) of the Securities

Exchange Act of 1934 (Amendment No.

)

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary

Proxy Statement

|

|

|

¨

|

Confidential,

for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2))

|

|

|

x

|

Definitive

Proxy Statement

|

|

|

¨

|

Definitive

Additional Materials

|

|

|

¨

|

Soliciting

Material Pursuant to Rule 14a-12

|

ENERGOUS

CORPORATION

(Name of Registrant as Specified in

its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities

to which transaction applies: N/A

|

|

|

(2)

|

Aggregate number of securities to

which transaction applies: N/A

|

|

|

(3)

|

Per unit price or other underlying

value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount

on which the filing fee is calculated and state how it was determined): N/A

|

|

|

(4)

|

Proposed maximum aggregate value

of transaction: N/A

|

|

|

¨

|

Fee

paid previously with preliminary materials.

|

|

|

¨

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

(1)

|

Amount Previously Paid: N/A

|

|

|

(2)

|

Form, Schedule or Registration Statement

No.: N/A

|

3590 North First Street, Suite 210

San Jose, California 95134

April 14, 2017

Dear Stockholder:

You are cordially invited to attend the

annual meeting of stockholders of Energous Corporation to be held at 11:00 a.m., local time, on Thursday, May 18, 2017, at our

corporate headquarters located at 3590 North First Street, Suite 210, San Jose, California.

We look forward to your attendance either

in person or by proxy. Further details regarding the matters to be acted upon at this meeting appear in the accompanying Notice

of 2017 Annual Meeting of Stockholders and Proxy Statement. Please give this material your careful attention.

|

|

Very truly yours,

|

|

|

|

|

|

|

|

|

Stephen R. Rizzone

|

|

|

President and Chief Executive Officer

|

ENERGOUS CORPORATION

3590 North First Street, Suite 210

San Jose, California 95134

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 18, 2017

To the Stockholders of Energous Corporation:

NOTICE IS HEREBY GIVEN that the 2017

Annual Meeting of Stockholders of Energous Corporation, a Delaware corporation, will be held on Thursday, May 18, 2017 at 11:00

a.m., local time, at our corporate headquarters located at 3590 North First Street, Suite 210, San Jose, California, for the following

purposes:

|

|

1.

|

To elect six members of the Board of Directors.

|

|

|

2.

|

To ratify the appointment of Marcum LLP as our independent registered

public accounting firm for 2017.

|

|

|

3.

|

To transact such other business as may properly come before the

meeting and any adjournments or postponements thereof.

|

Only Energous stockholders of record

at the close of business on March 20, 2017, the record date of this meeting fixed by the Board of Directors, are entitled to notice

of and to vote at the meeting and any adjournment or postponement thereof. If you plan to attend the meeting and you require directions,

please call us at (408) 963-0200.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

Stephen R. Rizzone

|

|

|

President and Chief Executive Officer

|

San Jose, California

April 14, 2017

PROXY STATEMENT

TABLE OF

CONTENTS

3590 North First Street, Suite 210

San Jose, California 95134

INFORMATION ABOUT SOLICITATION AND VOTING

The Board of Directors (“Board”)

of Energous Corporation (“Company,” “Energous,” “we,” “us” or “our”)

is providing these materials to you in connection with our 2017 annual meeting of stockholders, which will take place on Thursday,

May 18, 2017, 11:00 a.m., local time, at our corporate headquarters located at 3590 North First Street, Suite 210, San Jose, California.

This proxy statement and the accompanying notice and form of proxy are expected to be first sent to stockholders on or about April

14, 2017.

GENERAL INFORMATION ABOUT THE ANNUAL

MEETING

Why am I receiving these materials?

You have received these proxy materials

because our Board of Directors is soliciting your proxy to vote your shares at the annual meeting. The proxy statement includes

information that we are required to provide you under Securities and Exchange Commission (“SEC”) rules and is designed

to assist you in voting your shares.

What is a proxy?

Our Board is asking for your proxy, meaning

that you authorize persons selected by the Board to vote your shares at the annual meeting in the way that you instruct. All shares

represented by valid proxies received before the annual meeting will be voted in accordance with the stockholder’s specific

voting instructions.

What is included in these materials?

These materials include:

|

|

·

|

this Proxy Statement

for the annual meeting;

|

|

|

·

|

a proxy card

for the annual meeting; and

|

|

|

·

|

the 2016 Annual

Report to Stockholders, which includes our 2016 Annual Report on Form 10-K.

|

What items will be voted on at the annual meeting?

There are two proposals scheduled to

be voted on at the annual meeting:

|

|

·

|

election of

director nominees nominated by our Board of Directors; and

|

|

|

·

|

ratification

of the appointment of Marcum LLP (“Marcum”) as our independent registered

public accounting firm for the fiscal year ending December 31, 2017.

|

The Board is not aware of any other matters

to be brought before the meeting. If other matters are properly raised at the meeting, the proxy holders may vote any shares represented

by proxy in their discretion.

What are the Board’s voting recommendations?

The Board recommends that you vote your

shares:

|

|

·

|

FOR

the

nominees to the Board of Directors presented in this proxy statement; and

|

|

|

·

|

FOR

the

ratification of the appointment of Marcum as our independent registered public accounting

firm for 2017.

|

Who can attend the annual meeting?

Admission to the annual meeting is limited

to:

|

|

·

|

Energous stockholders

as of the close of business on March 20, 2017;

|

|

|

·

|

holders of valid

proxies for the meeting; and

|

Each stockholder may be asked to present

valid picture identification such as a driver’s license or passport and proof of stock ownership as of the record date.

When is the record date and who is entitled to vote?

The Board of Directors set March 20,

2017 as the record date for the 2017 annual meeting. All record holders of Energous common stock as of the close of business on

that date are entitled to vote at the meeting. Each share of common stock is entitled to one vote. As of the record date, there

were 20,532,942 shares of common stock outstanding.

What is a stockholder of record?

A stockholder of record, or registered

stockholder, is a person whose ownership of Energous stock is reflected directly on the books and records of our transfer agent,

Wells Fargo Shareowner Services. If you hold stock through an account with a bank, broker or similar organization, you are considered

the beneficial owner of shares held in “street name” and are not a stockholder of record. For shares held in street

name, the stockholder of record is your bank, broker or similar organization. We only have access to ownership records for the

registered shares. If you are not a stockholder of record, we will require additional documentation to evidence your stock ownership

as of the record date, such as a copy of your brokerage account statement, a letter from your broker, bank or other nominee or

a copy of your notice or voting instruction card. As described below, if you are not a stockholder of record, you will not be

able to vote your shares unless you have a proxy from the stockholder of record authorizing you to vote your shares.

How do I vote?

You may vote by any of the following

methods:

|

|

·

|

In person

.

Stockholders of record and beneficial stockholders with shares held in street name may

vote in person at the meeting. If you hold shares in street name, you must also obtain

a proxy from the stockholder of record authorizing you to vote your shares.

|

|

|

·

|

By mail

.

Stockholders of record may vote by signing and returning the proxy card provided.

|

|

|

·

|

By phone

or via the Internet.

You may vote by proxy, by phone or by Internet, by following

the instructions provided in the accompanying proxy card or the voting instruction card

provided.

|

|

|

·

|

Beneficial

owners of shares held in “street name.”

You may vote by following the

voting instructions provided to you by your bank or broker.

|

For questions regarding your stock ownership

or the annual meeting, you may contact us through our website at http://www.energous.com/contact/ or, if you are a registered

holder, our transfer agent, Computershare Trust Company, N.A., by email through the Wells Fargo Shareowner Services website

at

https://www.shareowneronline.com/UserManagement/ContactUs.aspx

or by phone at www.computershare.com/contactus or toll

free at (800) 401-1957.

How can I change or revoke my vote?

You may change or revoke your vote as

follows:

|

|

·

|

Stockholders

of record.

You may change or revoke your vote by submitting a written notice of revocation

to Energous Corporation c/o Secretary at 3590 North First Street, Suite 210, San Jose,

California 95134 or by submitting another vote on or before May 18, 2017.

|

|

|

·

|

Beneficial

owners of shares held in “street name.”

You may change or revoke your

voting instructions by following the specific directions provided to you by your bank

or broker.

|

What happens if I do not give specific voting instructions?

Stockholders of record.

If you

are a stockholder of record and you sign and return a proxy card without giving specific voting instructions then the proxy holders

will vote your shares in the manner recommended by the Board of Directors on all matters presented in this proxy statement and

as the proxy holders may determine in their discretion for any other matters properly presented for a vote at the meeting.

Beneficial owners of shares held in

“street name.”

If you are a beneficial owner of shares held in street name and do not provide the organization

that holds your shares with specific voting instructions, the organization that holds your shares may generally vote in its discretion

on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions

from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the inspector

of election that it does not have the authority to vote on this matter with respect to your shares. This is referred to as a “broker

non-vote.”

Which ballot measures are considered “routine”

or “non-routine”?

The election of directors (“Proposal

1”) is considered to be a non-routine matter under applicable rules. A broker or other nominee cannot vote without instructions

on non-routine matters, and therefore there may be broker non-votes on Proposal 1.

The ratification of the appointment of

Marcum as our independent registered public accounting firm for 2017 (“Proposal 2”) is considered to be a routine

matter under applicable rules. A broker or other nominee may generally vote on routine matters, and we do not expect there to

be any broker non-votes with respect to Proposal 2.

What is the quorum for the annual meeting?

The presence, in person or by proxy,

of the holders of a majority of the shares entitled to vote is necessary for the transaction of business at the annual meeting.

This is called a quorum.

What is the voting requirement to approve each of the proposals?

The following are the voting requirements

for each proposal:

|

|

·

|

Proposal

1, Election of Directors

. The nominees receiving the highest number of votes will

be elected as members of our Board of Directors.

|

|

|

·

|

Proposal

2, Ratification of Appointment of Independent Registered Public Accounting Firm

.

The ratification of the Audit Committee’s appointment of Marcum as our independent

registered public accounting firm for 2017 will be approved if the number of votes cast

“FOR” the proposal at the annual meeting exceeds the number of votes cast

“AGAINST” the proposal.

|

How are abstentions and broker non-votes treated?

Broker non-votes and abstentions are

counted for purposes of determining whether a quorum is present. Broker non-votes and abstentions are not counted as votes cast

on any proposal considered at the annual meeting and, therefore, will have no effect on the proposals regarding the election of

directors. We expect no broker non-votes on the appointment of Marcum as our independent registered public accounting firm for

2017, and abstentions will have no effect on this proposal.

Who pays for solicitation of proxies?

We are paying the cost of soliciting

proxies. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses

for sending proxy materials to stockholders and obtaining their votes. In addition to soliciting the proxies by mail, certain

of our directors, officers and regular employees, without compensation, may solicit proxies personally or by telephone, facsimile

and email.

Where can I find the voting results of the annual meeting?

We will announce voting results in a

Form 8-K filed with the SEC within four business days following the meeting.

What is the deadline to propose actions for consideration

or to nominate individuals to serve as directors at the 2018 annual meeting of stockholders?

Requirements for Stockholder Proposals

to Be Considered for Inclusion in these Proxy Materials.

Stockholder proposals to be considered for inclusion in the proxy

statement and form of proxy relating to the 2018 annual meeting of stockholders must be received no later than December 15, 2017.

In addition, all proposals will need to comply with Rule 14a-8 of the Securities Exchange Act of 1934, as amended (“Exchange

Act”), which lists the requirements for the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder

proposals must be delivered to the Company’s Secretary at 3590 North First Street, Suite 210, San Jose, California 95134.

Requirements for Stockholder Proposals

to Be Brought Before the 2018 Annual Meeting of Stockholders.

Notice of any director nomination or other proposal that you

intend to present at the 2018 annual meeting of stockholders, but do not intend to have included in the proxy statement and form

of proxy relating to the 2018 annual meeting, must be delivered to the Company’s Secretary at 3590 North First Street, Suite

210, San Jose, California 95134 not earlier than the close of business on January 18, 2018 and not later than the close of business

on February 17, 2018. In addition, your notice must set forth the information required by our bylaws with respect to each director

nomination or other proposal that you intend to present at the 2018 annual meeting of stockholders.

CORPORATE GOVERNANCE

PRINCIPLES AND BOARD MATTERS

Board Independence

The Board of Directors has determined

that each of Mr. Cooper, Mr. Gaulding, Mr. Griffin and Mr. Jackson is an independent director within the meaning of the director

independence standards of The NASDAQ Stock Market (“NASDAQ”). Furthermore, the Board has determined that all of the

members of the Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee are independent directors

within the meaning of the applicable NASDAQ and SEC rules.

Executive Sessions of Independent Directors

Executive sessions of our independent

directors are generally scheduled following each regularly scheduled in-person meeting of the Board. Executive sessions do not

include any non-independent directors and are led by the Chairman of the Board.

Board Leadership Structure

The Board does not have a general policy

regarding the separation of the roles of Chairman and Chief Executive Officer. The Board believes that it should have the flexibility

to make these determinations at any given time in the way that it believes best to provide appropriate leadership for the Company

at that time. The Board has reviewed our current Board leadership structure in light of the composition of the Board, the size

of our company, the nature of the Energous business and other relevant factors. We currently have a Chief Executive Officer and

a separate Chairman of the Board. The Board believes that having an independent Chairman enhances the opportunity that management

is subject to independent and objective oversight and the independent directors have an active voice in the governance of the

Company. Mr. Rizzone serves as our Chief Executive Officer and Mr. Gaulding serves as the Chairman of the Board.

Security Holder Communications with the Board of Directors

Security holders who wish to communicate

directly with the Board, the independent directors of the Board or any individual member of the Board may do so by sending such

communication by certified mail addressed to the Chairman of the Board, as a representative of the entire Board of Directors or

to the individual director or directors, in each case, c/o Secretary, Energous Corporation, 3590 North First Street, Suite 210,

San Jose, California 95134. The Secretary reviews any such security holder communication and forwards relevant communications

to the addressee.

Policies Regarding Director Nominations

The Board has adopted a policy concerning

director nominations, available at

www.energous.com

and summarized below.

Director Qualifications

The Corporate Governance and Nominating

Committee is responsible for identifying the appropriate qualifications, skills and characteristics desired of members of the

Board in the context of the needs of the business and the current composition and needs of the Board.

Director candidates are considered based

upon a variety of criteria, including demonstrated business and professional skills and experiences relevant to our business and

strategic direction, concern for long-term stockholder interests, personal integrity and sound business judgment. The Board of

Directors seeks members from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic

experience and expertise that, in concert, offer us and our stockholders diversity of opinion and insight in the areas most important

to us and our corporate mission. In addition, nominees for director are selected to have complementary, rather than overlapping,

skill sets. However, the Corporate Governance and Nominating Committee does not have a formal policy concerning the diversity

of the Board of Directors. All candidates for director nominee must have time available to devote to the activities of the Board

of Directors. The Corporate Governance and Nominating Committee also considers the independence of candidates for director nominee,

including the appearance of any conflict in serving as a director. Candidates for director nominees who do not meet all of these

criteria may still be considered for nomination to the Board of Directors, if the Corporate Governance and Nominating Committee

believes that the candidate will make an exceptional contribution to us and our stockholders.

Process for Identifying and Evaluating

Director Nominees

The Board of Directors is responsible

for selecting nominees for election to the Board of Directors by the stockholders. The Board of Directors delegates the selection

process to the Corporate Governance and Nominating Committee, with the expectation that other members of the Board of Directors,

and of management, may be requested to take part in the process as appropriate. Generally, the Corporate Governance and Nominating

Committee identifies candidates for director nominees in consultation with management, through the use of search firms or other

advisers, through the recommendations submitted by other directors or stockholders or through such other methods as the Corporate

Governance and Nominating Committee deems appropriate. Once candidates have been identified, the Corporate Governance and Nominating

Committee confirms that the candidates meet the qualifications for director nominees established by the Corporate Governance and

Nominating Committee. The Corporate Governance and Nominating Committee may gather information about the candidates through interviews,

detailed questionnaires, comprehensive background checks, or any other means that the Corporate Governance and Nominating Committee

deems to be helpful in the evaluation process. The Corporate Governance and Nominating Committee then meets as a group to discuss

and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition

and needs of the Board of Directors. Based on the results of the evaluation process, the Corporate Governance and Nominating Committee

recommends candidates for the Board of Directors’ approval as director nominees for election to the Board of Directors.

The Corporate Governance and Nominating Committee also recommends candidates for the Board of Directors’ appointments to

the standing committees of the Board of Directors.

Procedures for Recommendation of Director

Nominees by Stockholders

The policy of the Corporate Governance

and Nominating Committee is to consider properly submitted stockholder recommendations for director candidates. To submit a recommendation

to the Corporate Governance and Nominating Committee for director nominee candidates, a stockholder must make such recommendation

in writing and include:

|

|

·

|

the name and

address of the stockholder making the recommendation, as they appear on our books and

records, and of such record holder’s beneficial owner, if any;

|

|

|

·

|

the class and

number of shares of our equity securities that are owned beneficially and held of record

by such stockholder and such beneficial owner including all “synthetic equity instruments”

(e.g., derivatives, swaps, hedges, etc.), voting rights, rights to fees, dividends, or

other material rights;

|

|

|

·

|

a description

of the material terms of any agreements, arrangements or understandings (whether or not

in writing) entered into between such stockholder or such beneficial owner and any other

person for the purpose of acquiring, holding, disposing or voting of any shares of any

class of our equity;

|

|

|

·

|

the name of

the individual recommended for consideration as a director nominee;

|

|

|

·

|

why such recommended

candidate meets our criteria and would be able to fulfill the duties of a director;

|

|

|

·

|

how the recommended

candidate meets applicable independence requirements established by the SEC and NASDAQ;

|

|

|

·

|

the recommended

candidate’s beneficial ownership in our securities;

|

|

|

·

|

any relationships

between the recommended candidate and us which may constitute a conflict of interest;

and

|

|

|

·

|

all other information

relating to the recommended candidate that would be required to be disclosed in solicitations

of proxies for the election of directors or is otherwise required, in each case pursuant

to Regulation 14A under the Exchange Act, including the recommended candidate’s

written consent to being named in the proxy statement as a nominee and to serving as

a director if approved by the Board of Directors and elected.

|

Recommendations must be sent to the Chairperson

of the Corporate Governance and Nominating Committee, c/o Secretary, Energous Corporation, 3590 North First Street, Suite 210,

San Jose, California 95134. The Secretary must receive any such recommendation for nomination not later than the close of business

on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the date of the proxy

statement delivered to stockholders in connection with the preceding year’s annual meeting of stockholders; provided, however,

that with respect to a special meeting of stockholders called by us for the purpose of electing directors to the Board of Directors,

the Secretary must receive any such recommendation not earlier than the 90th day prior to such special meeting nor later than

the later of (1) the close of business on the 60th day prior to such special meeting or (2) the close of business on the 10th

day following the day on which a public announcement is first made regarding such special meeting. We will promptly forward any

such nominations to the Corporate Governance and Nominating Committee. Once the Corporate Governance and Nominating Committee

receives a recommendation for a director candidate, such candidate will be evaluated in the same manner as other candidates and

a recommendation with respect to such candidate will be delivered to the Board of Directors.

Policy Governing Director Attendance

at Annual Meetings of Stockholders

While we do not have a formal policy

governing director attendance at our annual meeting of stockholders, we do encourage our directors to attend. All of our directors

then serving on the Board of Directors attended our 2016 annual meeting of stockholders.

Code of Business Conduct and Ethics

We have in place a Code of Business Conduct

and Ethics (“Code of Ethics”) that applies to all of our directors, officers and employees. The code of ethics is

designed to deter wrongdoing and promote:

|

|

·

|

honest and ethical

conduct, including the ethical handling of actual or apparent conflicts of interest between

personal and professional relationships;

|

|

|

·

|

full, fair,

accurate, timely and understandable disclosure in reports and documents that we file

with, or submit to, the SEC and in other public communications that we make;

|

|

|

·

|

compliance with

applicable governmental laws, rules and regulations;

|

|

|

·

|

the prompt internal

reporting of violations of the Code of Ethics to an appropriate person identified in

the Code of Ethics; and

|

|

|

·

|

accountability

for adherence to the Code of Ethics.

|

A current copy of the Code of Ethics

is available at www.energous.com. A copy may also be obtained, free of charge, from us upon a request directed to Energous Corporation,

3590 North First Street, Suite 210, San Jose, California 95134, attention: Investor Relations. We intend to disclose any amendments

to or waivers of a provision of the Code of Ethics by posting such information on our website available at www.energous.com and/or

in our public filings with the SEC.

The Board of Directors and its Committees

Board of Directors

Our bylaws state that the number of directors

constituting the entire Board of Directors shall be determined by resolution of the Board, and that the Board has the authority

to increase the number of directors, fill any vacancies on the Board and to decrease the number of directors to eliminate any

vacancies. The number of directors currently fixed by our Board of Directors is six.

Our Board met nine times during 2016.

All directors attended at least 75% of the aggregate of all meetin

g

s

of the Board and meetings of committees of the Board on which he served during 2016.

The Board currently has standing Compensation,

Audit and Corporate Governance and Nominating Committees. The Board of Directors and each standing committee retains the authority

to engage its own advisors and consultants. Each standing committee has a charter that has been approved by the Board of Directors.

A copy of each committee charter is available at www.energous.com. Each committee reviews the appropriateness of its charter annually

or at such other intervals as each committee determines.

The following table sets forth the current members of each

standing committee of the Board:

|

Name

|

|

Audit

|

|

Compensation

|

|

Corporate

Governance

and

Nominating

|

|

John R. Gaulding

|

|

x

|

|

Chair

|

|

|

|

Robert J. Griffin

|

|

x

|

|

x

|

|

Chair

|

|

Rex S. Jackson

|

|

Chair

|

|

|

|

x

|

Committees

Audit Committee

. Our Audit Committee

consists of Mr. Gaulding, Mr. Griffin and Mr. Jackson. The Board has determined that each member of the Audit Committee is independent

within the meaning of the NASDAQ director independence standards and applicable rules of the SEC for audit committee members.

The Board has appointed Mr. Jackson as Chairperson of the Audit Committee and has determined that he qualifies as an “audit

committee financial expert” under the rules of the SEC. The Audit Committee is responsible for assisting the Board in fulfilling

its oversight responsibilities with respect to financial reports and other financial information. The Audit Committee (1) reviews,

monitors and reports to the Board of Directors on the adequacy of our financial reporting process and system of internal control

over financial reporting, (2) has the ultimate authority to select, evaluate and replace the independent auditor and is the ultimate

authority to which the independent auditors are accountable, (3) in consultation with management, periodically reviews the adequacy

of the Company’s disclosure controls and procedures and approves any significant changes thereto, (4) provides the audit

committee report for inclusion in our proxy statement for our annual meeting of stockholders, and (5) recommends, establishes

and monitors procedures for the receipt, retention and treatment of complaints relating to accounting, internal accounting controls

or auditing matters and the receipt of confidential, anonymous submissions by employees of concerns regarding questionable accounting

or auditing matters. The Audit Committee met four times in 2016.

Compensation Committee

. Our Compensation

Committee consists of Mr. Gaulding (who serves as its Chairperson) and Mr. Griffin, each of whom is a non-employee director as

defined in Rule 16b-3 under the Exchange Act. The Board has determined that each member of the Compensation Committee is an independent

director within the meaning of NASDAQ’s director independence standards.The Compensation Committee (1) discharges the responsibilities

of the Board relating to the compensation of our directors and executive officers, (2) oversees our procedures for consideration

and determination of executive and director compensation, and reviews and approves all executive compensation, and (3) administers

and implements our incentive compensation plans and equity-based plans. The Compensation Committee met three times in 2016.

The Compensation Committee engaged Compensia,

Inc., a nationally recognized independent compensation consultant, to provide competitive benchmarking and recommendations regarding

the design, form and amount of our compensation arrangements with our Chief Executive Officer. At the Compensation Committee’s

request, the consultant does not provide any services to us other than the assistance it provides to the Compensation Committee.

The consultant reports directly to the Compensation Committee on all work assignments from the Committee. The Compensation Committee

has assessed the independence of Compensia, Inc. pursuant to SEC rules and concluded that no conflict of interest exists that

would prevent Compensia from serving as an independent consultant to the committee.

Corporate Governance and Nominating

Committee

. Our Corporate Governance and Nominating Committee consists of Mr. Griffin (who serves as its Chairperson) and Mr.

Jackson. The Board has determined that each member of the Corporate Governance and Nominating Committee is an independent director

within the meaning of the NASDAQ director independence standards. The Corporate Governance and Nominating Committee (1) recommends

to the Board persons to serve as members of the Board of Directors and as members of and chairpersons for Board committees, (2)

considers the recommendation of candidates to serve as directors submitted from Company stockholders, (3) assists the Board in

evaluating the performance of directors and Board committees, (4) advises the Board regarding the appropriate board leadership

structure for us, (5) reviews and makes recommendations to the Board on corporate governance and (6) reviews Board size and composition

and recommends to the Board any changes it deems advisable. The Corporate Governance and Nominating Committee did not meet in

2016, and its functions were performed by the Board as a whole.

Compensation Committee Interlocks and

Insider Participation

None of the directors who served on the

Compensation Committee in 2016 served as one of our employees in 2016 or has ever served as one of our officers. During 2016,

none of our executive officers served as a director or member of the Compensation Committee (or other committee performing similar

functions) of any other entity of which an executive officer served on our Board of Directors or Compensation Committee.

Role of the Board of Directors in Risk

Oversight

The Board of Directors administers its

risk oversight function directly and through the Audit Committee. The Board and Audit Committee regularly discuss with management

our major risk exposures, their potential financial impact on us, and steps to monitor and control those risks.

PROPOSAL 1

—

ELECTION

OF DIRECTORS

Our Board of Directors currently consists

of six members. Upon the recommendation of the Corporate Governance and Nominating Committee, the Board has nominated the six

current directors for election at the annual meeting, to hold office until the next annual meeting of stockholders and the election

of their successors.

Shares represented by all proxies received

by the Board and not marked to withhold authority to vote for any individual nominee will be voted FOR the election of the nominees

named below. Each nominee has agreed to serve if elected and the Board knows of no reason why any nominee would be unable to serve,

but if such should be the case, proxies may be voted for the election of some other person nominated by the Board of Directors.

Nominees to the Board of Directors

The following table sets forth the nominees

to be elected at the 2017 annual meeting, the year such director was first elected as a member of our Board of Directors, and

the positions currently held by each director with us.

|

Name

|

|

Year

First

Became

Director

|

|

Position

with Energous

|

|

Stephen R. Rizzone

|

|

2013

|

|

President, Chief Executive Officer, Director

|

|

Michael Leabman

|

|

2012

|

|

Chief Technology Officer, Director

|

|

Martin Cooper

|

|

2015

|

|

Director

|

|

John R. Gaulding

|

|

2014

|

|

Chairman of the Board of Directors

|

|

Robert J. Griffin

|

|

2014

|

|

Director

|

|

Rex S. Jackson

|

|

2014

|

|

Director

|

Information about Director Nominees

Set forth below is background information

for each current director and director nominee, as well as information about the experience, qualifications, attributes or skills

that led the Board to conclude that such person should serve on the Board.

Stephen R. Rizzone

, age

68, joined Energous as President, Chief Executive Officer and Director in October 2013. Mr. Rizzone also served as Chairman of

the Board from October 2013 to February 2015. Mr. Rizzone has more than 40 years of executive management, marketing, sales and

entrepreneurial experience in the data communications hardware, networking hardware and software, and silicon and optical components

markets. Prior to joining us, Mr. Rizzone served as Chief Executive Officer and chairman of the board of Active Storage, Inc.,

a data storage company, from 2011 until December 2012 and as the Chief Executive Officer and chairman of the board of directors

of Communicado, Inc., a voice and data communications networking company, from 2006 to 2009. Mr. Rizzone previously served as

member of the board of directors of Katzkin Leather, an automotive interiors company from 2011 to November 2013 and the Los Angeles

Regional Technology Alliance (LARTA), an entrepreneur and technology non-profit from 2009 to 2011. Mr. Rizzone holds a B.A. in

Public Administration from California State University at Fullerton. Our Board of Directors believes that Mr. Rizzone’s

extensive industry, executive and board experience, as well as his service as our Chief Executive Officer, qualify him to serve

as a member of our Board of Directors.

Michael Leabman

, age 44,

founded Energous in October 2012 and became our Chief Technology Officer in October 2013. Mr. Leabman has been a member of our

Board of Directors since its founding and served as our President, Chief Financial Officer, Treasurer and Secretary until October

2013. From 2010 to September 2013, Mr. Leabman served as President of TruePath Wireless, a service provider and equipment provider

in the broadband communications industry. Mr. Leabman served on the board of directors of TruePath Holdings from 2010 to 2013.

From 2008 to 2010, Mr. Leabman served as Chief Technology Officer for DataRunway Inc., a wireless communication company providing

broadband internet to airlines. Mr. Leabman received both his B.S and M.S. in electrical engineering from the Massachusetts Institute

of Technology. Our Board of Directors believes that Mr. Leabman’s extensive knowledge of Energous, its technology and the

consumer and commercial electronics industry, qualify him to serve as a member of our Board of Directors.

Martin Cooper

, age 88,

joined our Board of Directors in 2015. Since 2008, Mr. Cooper has served as Chairman of Dyna, LLC, a new business incubator and

developer located in Del Mar, California. Mr. Cooper has over 60 years of experience in the wireless business in which time he

has served on numerous boards of directors, participated in the creation of the cellular industry, and contributed to the technology

of radio spectrum management. Mr. Cooper previously served as Corporate Director of Research and Development at Motorola, Inc.,

a telecommunications company and led a team credited with having conceived and created the first portable cellular telephone.

Mr. Cooper also previously founded ArrayComm, Inc., a software firm specializing in antenna technologies for mobile phones and

wireless Internet connectivity. Mr. Cooper is a member of the National Academy of Engineering and serves on the Federal Communications

Commission Technology Advisory Council and the United States Department of Commerce Spectrum Management Advisory Committee. Mr.

Cooper has been awarded the National Academy of Engineering’s Draper Prize, the Marconi Prize, and is an Institute of Electrical

and Electronics Engineers (IEEE) Centennial Medal awardee and Prince of Asturias Laureate awardee. Mr. Cooper holds a B.S. and

M.S. in Electrical Engineering from the Illinois Institute of Technology. Our Board of Directors believes that Mr. Cooper’s

extensive historical engagement in the formation and development of the cellular industry and his scientific and managerial background

qualify him to serve as a member of our Board of Directors.

John R. Gaulding

, age

71, joined our Board of Directors in 2014 and became chairman of the Board in February 2016. Since 1996, Mr. Gaulding has

been a private investor and business consultant in the fields of strategy and organization. Mr. Gaulding is a Co-Founder and

Director Emeritus of Sage Partners, an advisory firm providing counsel on strategy and corporate governance issues. He is

also Chairman Emeritus of Dominican University of California where he served for 7 years as Chairman and 16 years as a

Trustee. From 1996 to 1999 and again from 2001 to 2016, Mr. Gaulding was an independent director of Monster Worldwide, Inc.,

an employment website company, where he chaired the Corporate Governance and Nominating Committee for ten years and also

chaired the Audit Committee. From 2002 to 2012, he served as a Director for Yellow Media, Inc. where he also chaired

the Corporate Governance and Nominating Committee and the Compensation Committee. Mr. Gaulding’s extensive corporate

board experience includes ANTs Software, Inc., an enterprise business management company, where he was lead director and

Chairman of the Audit Committee, and ORTEL, a high–technology manufacturer of electro-optical devices used in the

telecommunications industry. In addition, he served as the executive Chairman and Chief Executive Officer of National

Insurance Group, Inc., an insurance company. Mr. Gaulding has also served as non-executive Chairman of Novo Media, Inc., one

of the first digital agencies. Finally, he was a founding director of Vino Volo, an airline terminal wine lounge company. Mr.

Gaulding’s industry experience includes 15 years as a corporate officer, serving as Vice-President for Corporate

Strategy and Development, for Pacific Telesis Group, President and Chief Executive Officer for Pacific Bell Yellow Pages, an

advertising and publishing company, and President and Chief Executive Officer for ADP Claims Solutions Group, a

claims solutions and information services company. Mr. Gaulding holds a B.S in Engineering from University of California, Los

Angeles, an M.B.A. from the University of Southern California and an honorary Doctor of Laws from Dominican University of

California. Our Board of Directors believes that Mr. Gaulding’s extensive executive and managerial experience qualify

him to serve as a member of our Board of Directors.

Robert J. Griffin

, age 50,

joined the Company’s Board of Directors in February 2014. Mr. Griffin currently serves as Chief Business Officer of Cities

Market Studios, a Minneapolis-based sales and marketing company he joined in 2016. Mr. Griffin previously was the Founder and

Chief Executive Officer of Griffin International Companies, a Minneapolis-based retail sales and marketing firm. After founding

Griffin International Companies in 1997, Mr. Griffin

led the expansion of the company’s

business across three continents and secured the license of brands and technologies from a number of large, well-known companies.

Prior to founding Griffin International Companies, Mr. Griffin spent 6 years at Best Buy Co. in various management roles. Mr.

Griffin holds a BA in Economics from Gustavus Adolphus College. Mr. Griffin’s extensive executive leadership experience

and his in-depth knowledge of the retail industry and technology licensing make him well qualified to serve on our board of directors.

Rex S. Jackson

, age 57,

joined the Company's board of directors in March 2014. Mr. Jackson currently serves as Chief Financial Officer of Gigamon Inc.,

a provider of active visibility into data-in-motion network traffic, enabling stronger security and superior performance. Mr.

Jackson previously served as Chief Financial Officer of Rocket Fuel Inc., an advertising technology company, from March 2016 to

October 2016. Prior to Rocket Fuel, Mr. Jackson served as Chief Financial Officer of JDS Uniphase Corporation, a provider of network

and service enablement solutions and optical products for telecommunications service providers, cable operators and network equipment

manufacturers, from January 2013 through September 2015, and drove the separation of JDSU into two independent public companies

in August 2015. Mr. Jackson joined JDSU in January 2011 as Senior Vice President, Business Services, with responsibility for Corporate

Development, Legal, Corporate Marketing and Information Technology. Prior to JDSU, Mr. Jackson served as Chief Financial Officer

of Symyx Technologies from 2007 to 2010, where he led the company's acquisition of MDL Information Systems and subsequent merger

of equals with another public company. Mr. Jackson also previously served as acting Chief Financial Officer at Synopsys and held

executive positions with Avago, AdForce and Read-Rite. Mr. Jackson holds a B.A. degree from Duke University and a J.D. from Stanford

University. Mr. Jackson also currently serves on the board of directors of EMCORE Corporation, a provider of advanced, mixed-signal

optical products. Our Board of Directors believes that Mr. Jackson's accounting and financial expertise, general business acumen

and significant executive leadership experience qualify him to serve as a member of our Board of Directors.

Director Compensation

In December 2015, we adopted a non-employee

director compensation policy pursuant to which our non-employee directors receive on an annual basis a $50,000 retainer paid in

cash and an annual equity award with a value of $75,000. The equity award consists of a restricted stock unit grant made on the

first trading day following December 31 of each year covering a number of shares of common stock equal to $75,000 divided by the

closing price of our common stock on such date that vests in full on the one year anniversary of grant. The Chairman of the Board,

if independent, is granted an additional 25,000 restricted stock units on the first trading day following December 31 of each

year that vests in full on the one year anniversary of grant. The Chairman of the Board, lead independent director (if the Chairman

of the Board is not independent) and committee members receive additional annual cash compensation as follows:

|

Chairman of the Board

|

|

$

|

50,000

|

|

|

Lead Independent Director:

|

|

$

|

25,000

|

|

|

Audit Committee Chair:

|

|

$

|

20,000

|

|

|

Audit Committee Member:

|

|

$

|

10,000

|

|

|

Compensation Committee Chair:

|

|

$

|

15,000

|

|

|

Compensation Committee Member:

|

|

$

|

5,000

|

|

|

Corporate Governance and Nominating Committee Chair:

|

|

$

|

10,000

|

|

|

Corporate Governance and Nominating Committee Member:

|

|

$

|

5,000

|

|

A director may elect to receive all or

any portion of the cash consideration or restricted stock units payable under the non-employee director compensation policy in

deferred stock units.

Grants made under the non-employee director

compensation policy are made pursuant to the 2016 Amended and Restated Non-Employee Equity Compensation Plan. Mr. Rizzone and

Mr. Leabman receive no compensation for their service on our Board or Directors.

The following table sets forth information

with respect to compensation earned by or awarded to each of the non-employee members of our Board of Directors who served on

our Board during 2016:

|

Name

|

|

Fees Earned

or Paid in

Cash ($)

|

|

|

Stock

Awards ($)(1)

|

|

|

All Other

Compensation

($)(2)

|

|

|

Total ($)

|

|

|

John R. Gaulding

|

|

|

75,000

|

|

|

|

559,011

|

|

|

|

–

|

|

|

|

634,011

|

|

|

Martin Cooper

|

|

|

50,000

|

|

|

|

300,010

|

|

|

|

40,000

|

|

|

|

390,010

|

|

|

Robert J. Griffin

|

|

|

75,000

|

|

|

|

300,010

|

|

|

|

–

|

|

|

|

375,010

|

|

|

Rex S. Jackson

|

|

|

75,000

|

|

|

|

300,010

|

|

|

|

–

|

|

|

|

375,010

|

|

_______________________

|

|

(1)

|

The amounts shown in this column indicate the grant date fair

value of stock awards granted in the subject year computed in accordance with FASB ASC

Topic 718. For additional information regarding the assumptions made in calculating these

amounts, see the Notes to our audited financial statements included in our Annual Report

on Form 10-K. The amounts in this column include amounts attributable to grants of restricted

stock units.

|

|

|

(2)

|

The amount in this column represents additional fees for consulting

services performed by Mr. Cooper.

|

The following table shows the

number of shares subject to outstanding option awards, shares subject to outstanding time-based restricted stock unit awards and

shares subject to outstanding performance-based restricted stock unit awards held by each non-employee director as of December

31, 2016:

|

Name

|

|

Shares Subject to

Outstanding Stock

Awards (#)

|

|

|

Shares Subject to

Outstanding Stock

Option Awards (#)

|

|

|

John R. Gaulding

|

|

|

85,453

|

|

|

|

–

|

|

|

Martin Cooper

|

|

|

54,472

|

|

|

|

–

|

|

|

Robert J. Griffin

|

|

|

54,472

|

|

|

|

25,979

|

|

|

Rex S. Jackson

|

|

|

54,472

|

|

|

|

15,768

|

|

OUR BOARD OF DIRECTORS

RECOMMENDS A VOTE

“

FOR

”

ELECTION OF EACH OF THE SIX NOMINATED DIRECTORS

PROPOSAL 2 — RATIFICATION OF

APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors

has appointed Marcum LLP (“Marcum”) as our independent registered public accounting firm for the fiscal year ending

December 31, 2017

and recommends that stockholders vote for ratification

of such selection

. We are presenting this selection to our stockholders for ratification at the annual meeting.

Marcum audited our financial statements

for 2016. No representative of Marcum is expected to be present at the 2017 annual meeting.

Vote Required for Approval

Ratification of the appointment of our

independent registered public accounting firm requires the affirmative vote of a majority of the shares present or represented

at the 2017 annual meeting, in person or by proxy, and voting on such ratification. If our stockholders fail to ratify the selection

of Marcum as the independent registered public accounting firm for 2017, the Audit Committee will reconsider whether to retain

that firm. Even if the selection is ratified, the Audit Committee may, in its discretion, direct the appointment of a different

independent registered public accounting firm at any time during the year.

Independent Registered Public Accounting Firm Fees and

Services

We regularly review the services and

fees from our independent registered public accounting firm. These services and fees are also reviewed with our audit committee

annually. In accordance with standard policy, Marcum periodically rotates the individuals who are responsible for the Energous audit.

The following table sets forth the aggregate

fees billed or expected to be billed by Marcum for 2016 for audit and non-audit services, including “out-of-pocket”

expenses incurred in rendering these services. The nature of the services provided for each category is described following the

table.

|

Fee Category

|

|

2016

|

|

|

2015

|

|

|

Audit Fees

(1)

|

|

$

|

167,349

|

|

|

$

|

162,731

|

|

|

Audit-Related Fees

(2)

|

|

|

–

|

|

|

|

11,639

|

|

|

Tax Fees

|

|

|

–

|

|

|

|

–

|

|

|

All Other Fees

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

$

|

167,349

|

|

|

$

|

174,370

|

|

___________________

|

|

(1)

|

Audit fees include fees for professional services rendered for

the audit of our annual statements, quarterly reviews, consents and assistance with and

review of documents filed with the SEC.

|

|

|

(2)

|

Audit-related fees include fees for additional accounting consultations

related to revenue recognition and the Company’s Employee Stock Purchase Plan.

|

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy

that requires that all services to be provided by the Company’s independent public accounting firm, including audit services

and permitted non-audit services, to be pre-approved by the Audit Committee. All audit and permitted non-audit services provided

by Marcum during 2016 were pre-approved by the Audit Committee.

OUR BOARD OF DIRECTORS

RECOMMENDS A VOTE

“

FOR

”

APPROVAL OF PROPOSAL NO. 2

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth certain

information regarding beneficial ownership of our common stock as of April 7, 2017 by:

|

|

·

|

each

person or group of affiliated persons known by us to be the beneficial owner of more

than 5% of our common stock;

|

|

|

·

|

each

member of our Board of Directors, and each nominee for election to our Board;

|

|

|

·

|

each

executive officer named in the Summary Compensation Table below;

|

|

|

·

|

all

of our executive officers and directors as a group.

|

Unless otherwise noted below, the address

of each person listed on the table is c/o Energous Corporation at 3590 North First Street, Suite 210, San Jose, California 95134.

To our knowledge, each person listed below has sole voting and investment power over the shares shown as beneficially owned, except

to the extent jointly owned with spouses or otherwise noted below.

Beneficial ownership is determined in

accordance with SEC rules. The information does not necessarily indicate ownership for any other purpose. Under these rules, shares

of common stock issuable by us to a person pursuant to stock options that may be exercised and restricted stock units that may

vest within 60 days after April 7, 2017 are deemed to be beneficially owned and outstanding for purposes of calculating the number

of shares and the percentage of shares beneficially owned by that person. However, these shares are not deemed to be beneficially

owned and outstanding for purposes of computing the percentage beneficially owned by any other person. Percentages of common stock

outstanding as of April 7, 2017 are calculated based upon 20,589,103 shares outstanding on that date, including unissued but

vested restricted stock deemed to be outstanding pursuant to Rule 13d-3 of the Exchange Act.

|

Name and Address of Beneficial Owner

|

|

Number of

Shares

Beneficially

Owned

|

|

|

|

Percentage

of Class

|

|

|

|

|

|

|

|

|

|

|

|

Directors and Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin Cooper

|

|

|

23,270

|

|

|

|

|

*

|

|

|

John R. Gaulding

|

|

|

46,504

|

|

|

|

|

*

|

|

|

Robert J. Griffin

|

|

|

43,209

|

(1)

|

|

|

|

*

|

|

|

Rex S. Jackson

|

|

|

33,098

|

(2)

|

|

|

|

*

|

|

|

Cesar Johnston

|

|

|

4,383

|

|

|

|

|

*

|

|

|

Michael Leabman

|

|

|

298,481

|

(3)

|

|

|

|

1.4

|

%

|

|

Stephen R. Rizzone

|

|

|

1,053,564

|

(4)

|

|

|

|

4.9

|

%

|

|

Brian Sereda

|

|

|

27,022

|

|

|

|

|

*

|

|

|

Directors and executive officers as a group (10 persons)

|

|

|

1,546,816

|

(5)

|

|

|

|

6.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

Five Percent Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entities affiliated with Ascend Capital LLC

.(6)

|

|

|

3,913,930

|

|

|

|

|

17.6

|

%

|

|

DvineWave Holdings LLC

(7)

|

|

|

1,649,812

|

|

|

|

|

8.0

|

%

|

_____________________

Less than one percent.

|

|

(1)

|

Includes 25,979 shares of common stock issuable upon

the exercise of stock options.

|

|

|

(2)

|

Includes 15,768 shares of common stock issuable upon

the exercise of stock options.

|

|

|

(3)

|

Includes 283,357 shares of common stock issuable upon

the exercise of stock options.

|

|

|

(4)

|

Includes (i) 713,625 shares of common stock issuable

upon the exercise of stock options; (ii) 123,113 shares of common stock issuable upon the settlement of restricted stock units

(“RSUs”); and (iii) 60,000 shares of common stock issuable upon the settlement of performance stock units (“PSUs”).

|

|

|

(5)

|

Includes (i) 123,113 shares issuable upon the settlement

of RSUs; (ii) 60,000 shares issuable upon the settlement of PSUs; and (ii) 1,038,729 shares of common stock issuable upon the

exercise of stock options.

|

|

|

(6)

|

Consists of (i) 1,618,123 shares held by Ascend Legend Master

Fund, Ltd. and its affiliates (“Ascend”), (ii) (x) 81,667 shares and (y) 822,951 shares issuable upon exercise of warrants

held by Emily Fairbairn, (iii) 809,062 shares issuable upon exercise of warrants held by Malcolm Fairbairn, (iv) 315,462 shares

held by Valley High Limited Partnership, (v) 133,333 shares held by Grant Fairbairn Irrevocable Trust September 30, 2011 and (vi)

133,333 shares held by Nina Fairbairn Irrevocable Trust September 30, 2011 (collectively, the “Ascend Shares”). Emily

Fairbairn beneficially owns 1,486,746 Ascend Shares; Malcom Fairbairn beneficially owns 3,009,312 Ascend Shares; Valley High Limited

Partnership and Valley High Capital LLC beneficially own and have shared voting and dispositive power over 315,462 Ascend Shares;

the Grant Fairbairn Irrevocable Trust September 30, 2011 beneficially owns and has shared voting and dispositive power over 133,333

Ascend Shares; the Nina Fairbairn Irrevocable Trust September 30, 2011 beneficially owns and has shared voting and dispositive

power over 133,333 Ascend Shares; and Ascend Legend Master Fund, Ltd., Ascend Legend Fund, Ltd., Ascend Partners Fund

I, Ltd., Ascend Capital Limited Partnership and Ascend Capital, LLC beneficially own and have shared voting and dispositive

power over 1,618,123 Ascend Shares. The principal business address of Ascend Legend Master Fund, Ltd., Ascend Legend Fund, Ltd.

and Ascend Partners Fund I, Ltd. is c/o dms Corporate Services Ltd., P.O. Box 1344, dms House, 20 Genesis Close, Grand

Cayman, Cayman Islands KY1-1108. The principal business address of Ascend Capital, LLC and Ascend Capital Limited Partnership

is 4 Orinda Way, Suite 200-C, Orinda, CA 94563. This information has been obtained from the Schedule 13D filed by Ascend with

the SEC on August 19, 2016.

|

|

|

(7)

|

DvineWave Irrevocable Trust dated December 12, 2012 is

the manager of DvineWave Holdings LLC. Gregory Tamkin, the trustee of the DvineWave Irrevocable Trust, has sole voting and investment

power with respect to the entity’s shares of Energous common stock. The address is for DvineWave Holdings LLC is 1400 Wewatta

Street, Suite 400, Denver, CO 80202. This information has been obtained from Amendment No. 1 to Schedule 13G filed by Gregory

Tamkin with the SEC on February 12, 2016.

|

EXECUTIVE OFFICERS

Set forth below is background information

relating to our executive officers, other than those discussed under Information About Director Nominees:

|

Name

|

|

Age

|

|

Position

|

|

Stephen R. Rizzone

|

|

68

|

|

President, Chief Executive Officer, Director

|

|

Michael Leabman

|

|

44

|

|

Chief Technology Officer, Director

|

|

Brian Sereda

|

|

56

|

|

Senior Vice President and Chief Financial Officer

|

|

Cesar Johnston

|

|

53

|

|

Senior Vice President of Engineering

|

|

Neeraj Sahejpal

|

|

47

|

|

Senior Vice President of Product Marketing

|

Brian Sereda

joined Energous in

July 2015 and currently serves as Senior Vice President and Chief Financial Officer. His prior experience includes senior finance

positions in leading technology companies, including semiconductor equipment, software and consumer electronics companies, with

extensive experience in corporate finance, capital markets and merger and acquisition transactions. From 2011 through April 2015

he was Chief Financial Officer of ActiveVideo, a developer of a software platform for managed service operators such as cable

companies and telecommunication companies. Previously, Mr. Sereda was Chief Financial Officer for Virage Logic, a NASDAQ-listed

company that was a provider of semiconductor intellectual property, from 2008 to its acquisition by Synopsys in 2010. He also

served as Chief Financial Officer of Proxim Wireless, a wireless networking company, from 2006 to 2008. Mr. Sereda received his

M.B.A. from St. Mary's College of California and a B.S. and B.A. from Simon Fraser University in Vancouver, B.C., Canada.

Cesar Johnston

joined Energous

as Senior Vice President of Engineering in July 2014, after holding various management roles at Marvell Semiconductor, a semiconductor

company, from 2006 until September 2013, including Vice President of Engineering for Wireless Connectivity since 2010. Mr. Johnston

was the Senior Director Engineering for Wi-Fi VLSI and Hardware development at Broadcom from 2004 until 2006. Mr. Johnston is

a recognized pioneer in the development of wireless technologies, and he has been responsible for the introduction of multiple

first-of generations of SISO and MIMO wireless products. Mr. Johnston is a Senior Member of the IEEE. Mr. Johnston received both

a B.S. and M.S.E.E. from NYU Tandon School of Engineering and is listed as either inventor or co-inventor on 20 issued patents.

Neeraj Sahejpal

joined Energous

in November 2014 and currently serves as Senior Vice President of Product Marketing. From 2009 to November 2014, he held various

positions at Broadcom, most recently as Director, Product Marketing, Wireless Entertainment Connectivity. From 2005 to 2009, Mr.

Sahejpal held a senior marketing position at PMC Sierra. Prior to that, Mr. Sahejpal co-founded Conifer Networks from 2004 to

2005 and held senior positions in ASIC design while working for Inkra Networks, NVIDIA and Oak Technology (now Zoran). Mr. Sahejpal

received a B.E. in Electronics and Communication from National Institute of Technology, Allahabad, India and a MSCE and M.B.A.

in Entrepreneurship and Finance from Santa Clara University. Mr. Sahejpal has also completed the Executive Program in Strategic

Marketing at the Stanford Graduate Business School.

EXECUTIVE COMPENSATION

Our compensation philosophy is to offer

our executive officers compensation and benefits that are competitive and meet our goals of attracting, retaining and motivating

highly skilled management, which is necessary to achieve our financial and strategic objectives and create long-term value for

our stockholders. We believe the levels of compensation we provide should be competitive, reasonable and appropriate for our business

needs and circumstances. The principal elements of our executive compensation program have to date included base salary, incentive

quarterly performance bonuses and long-term equity compensation in the form of stock options and restricted stock units. We believe

successful long-term Company performance is more critical to enhancing stockholder value than short-term results. For this reason

and to conserve cash and better align the interests of management and our stockholders, we emphasize long-term performance-based

equity compensation over base annual salaries.

The following table sets forth information

concerning the compensation earned by the individual that served as our Principal Executive Officer during 2016 and our two most

highly compensated executive officers other than the individual who served as our Principal Executive Officer during 2016 (collectively,

the “named executive officers”):

Summary Compensation Table for 2016

Name and

Principal Position

|

|

Year

|

|

|

Salary($)

|

|

|

Non-Equity

Incentive

Plan($)

|

|

|

Stock

Awards($)(1)

|

|

|

Option

Awards ($)

|

|

|

All Other

Compensation

($)

|

|

|

TOTAL ($)

|

|

|

Stephen R. Rizzone

|

|

|

2016

|

|

|

|

365,000

|

|

|

|

311,163

|

|

|

|

4,691,500

|

(2)

|

|

|

-

|

|

|

|

-

|

|

|

|

5,367,663

|

|

|

Chief Executive Officer

|

|

|

2015

|

|

|

|

365,000

|

|

|

|

322,140

|

|

|

|

4,102,165

|

(3)

|

|

|

-

|

|

|

|

-

|

|

|

|

4,789,305

|

|

|

Michael Leabman

|

|

|

2016

|

|

|

|

250,000

|

|

|

|

213,125

|

|

|

|

1,573,0004

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

2,036,125

|

|

|

Chief Technology Officer

|

|

|

2015

|

|

|

|

250,000

|

|

|

|

220,644

|

|

|

|

261,439

|

(5)

|

|

|

-

|

|

|

|

-

|

|

|

|

732,083

|

|

|

Cesar Johnston

|

|

|

2016

|

|

|

|

300,000

|

|

|

|

235,068

|

|

|

|

1,337,050

|

(6)

|

|

|

-

|

|

|

|

-

|

|

|

|

1,872,118

|

|

|

Senior Vice President of Engineering

|

|

|

2015

|

|

|

|

250,000

|

|

|

|

175,483

|

|

|

|

440,785

|

(7)

|

|

|

-

|

|

|

|

-

|

|

|

|

886,268

|

|

__________________

|

|

(1)

|

The amounts shown in this column indicate the grant date fair

value of RSUs granted in the subject year computed in accordance with FASB ASC Topic

718. For additional information regarding the assumptions made in calculating these amounts,

see the Notes to our audited financial statements included in our Annual Report on Form

10-K.

|

|

|

(2)

|

Of this amount, $2,359,500 is attributable to a grant of RSUs

and $2,332,000 is attributable to performance share units.

|

|

|

(3)

|

Of this amount, $2,427,788 is attributable to grants of RSUs

and $1,674,377 is attributable to a grant of PSUIs under our 2015 Performance Share Unit

Plan (“Performance Share Plan”) that only become earned upon achievement

of pre-specified levels of market capitalization during the applicable performance period.

See “Performance Share Unit Awards”.

|

|

|

(4)

|

This amount is attributable to grants of RSUs.

|

|

|

(5)

|

Of this amount, $94,000 is attributable to grants of RSUs and

$167,439 is attributable to a grant of PSUs under the Performance Share Plan that only

become earned upon achievement of pre-specified levels of market capitalization during

the applicable performance period. See “Performance Share Unit Awards”.

|

|

|

(6)

|

This amount is attributable to grants of RSUs.

|

|

|

(7)

|

Of this amount, $105,910 is attributable to a grant of RSUs

and $334,875 is attributable to a grant of PSUs under the Performance Share Plan that

only become earned upon achievement of pre-specified levels of market capitalization

during the applicable performance period. See “Performance Share Unit Awards”.

|

Outstanding Equity Awards at December

31, 2016

The following table provides information

regarding equity awards held by the named executive officers as of December 31, 2016.

|

|

|

Options Awards

|

|

Stock Awards

|

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

|

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

|

|

|

Option

Exercise

Price ($)

|

|

|

Option

Expiration

Date

|

|

Number of

Shares or

Units of

Stock that

Have Not

Vested (#)

|

|

|

Market

Value of

Shares or

Units of

Stock that

Have Not

Vested ($)(1)

|

|

|

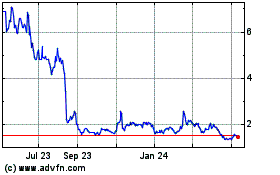

Equity