AIG CEO Peter Hancock's Total Pay Fell 23% in 2016 -- Update

April 13 2017 - 5:16PM

Dow Jones News

By Leslie Scism

American International Group Inc. Chief Executive Peter

Hancock's total compensation fell 23% to $9.58 million last year as

the global insurance conglomerate suffered setbacks in its

profit-improvement plan.

Mr. Hancock has since resigned from the firm but remains at the

helm until a successor is named. He came under pressure from the

board as it feared a potential fight with billionaire investor Carl

Icahn if he wasn't replaced.

In a regulatory filing Thursday, AIG's board also disclosed that

hedge-fund manager and large shareholder John Paulson is leaving

the board "due to his other time commitments," while Samuel

Merksamer, a representative for Mr. Icahn, is standing for

re-election.

Both men joined the board last spring as AIG sought to avert a

public fight with the activist investors over ways to boost

shareholder returns. Mr. Paulson's Paulson & Co. hedge fund

sold nearly half its shares in the fourth quarter but still owned

4.55 million shares as of March 15, according to the AIG

filing.

For much of last year, AIG was making headway in improving its

profit margins, but the insurer closed the year with one of its

biggest quarterly losses since the financial crisis.

Mr. Hancock earned a base salary of $1.6 million, the same as in

2015, though the year-earlier compensation included an extra

payroll period to make it $1.66 million.

The CEO received no short-term-incentive pay compared with

year-earlier short-term incentive pay of $2.5 million. Mr. Hancock

did earn a long-term stock award, which is based primarily on share

performance compared with peers as measured over a three-year

period. Granted in March 2016, it totaled $7.85 million, down 4.6%

from the year before.

As previously reported, the board agreed to pay Mr. Hancock $5

million for his services during the transition period this year and

an additional $9.53 million as severance, on top of his regular

salary and incentive pay for 2017. The executive also will exit

with an estimated $38.3 million in unvested stock awards, which

were awarded between 2013 and 2016.

The exact amount payable from those stock awards depends on

AIG's share performance versus peers over the next several years.

That means Mr. Hancock's financial payout is tied partly to how

well his successor handles the job.

In a recent shareholder letter, nonexecutive Chairman Douglas

Steenland said the board "is actively engaged in the process of

identifying the right individual to serve as CEO."

AIG's board will shrink to 13 directors from the current 16, as

two other directors also won't stand for re-election: George L.

Miles Jr. and Robert S. Miller, both in connection with reaching

the board's general retirement age of 75. Mr. Miller, who joined

AIG's board in 2009 when it was struggling to repay a nearly $185

billion U.S.-taxpayer bailout, served as AIG's nonexecutive

chairman from 2010 through mid-2015.

While Mr. Hancock received no short-term incentive pay, the

board awarded more than $680,000 each to four top lieutenants. The

board cited the company's success in cutting costs and generating

more than $10 billion in planned or completed transactions to help

fund share buybacks.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

April 13, 2017 17:01 ET (21:01 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

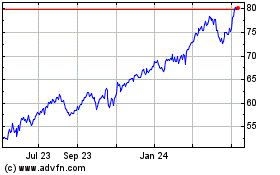

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

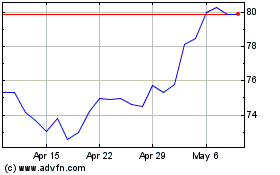

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024