Walgreens CEO Says Rite Aid Deal Closing Soon -- Update

April 05 2017 - 10:47AM

Dow Jones News

By Sharon Terlep and Joshua Jamerson

Walgreens Boots Alliance Inc.'s chief executive said he expects

the drugstore chain's long-delayed tie-up with Rite Aid Corp. to

close in the coming weeks.

Antitrust regulators have been scrutinizing the deal, struck in

October 2015, and the companies have since agreed they would sell

hundreds of stores to Fred's Inc., a regional drugstore chain, to

allay concerns.

"I am still positive on this deal," Walgreens CEO Stefano

Pessina said in a call with analysts Wednesday. "I believe we have

a strong argument to defend this deal."

He said the merger is still expected to close by the end of

July, an extension of the initial January 2017 deadline. Investors

are anxious for it to be completed and have grown increasingly

uneasy that it could fall apart.

Among the antitrust concerns is that the resulting drugstore

giant -- which would challenge CVS Health Corp. -- would be able to

bully pharmacy-benefit managers steering corporate and government

drug plans.

For Fred's, the Rite Aid transaction would more than double the

size of the Memphis, Tenn., company, which has about 650 stores. It

had a market capitalization of about $400 million before it agreed

to borrow $1.65 billion to fund its Rite Aid deal. The chain has

pledged nearly all its assets as collateral for the loans.

Mr. Pessina said Wednesday he still thinks Fred's is the right

buyer for the divested stores. "We believe they are absolutely a

legitimate player in this industry," he said. "If for some reason

this won't be the case, we will review our options."

Walgreens and Rite Aid agreed in January to reduce the amount

Walgreens would pay by at least $2 billion. They also said they may

sell a few hundred additional Rite Aid stores. Under those new

terms, the deal would value Rite Aid from $6.8 billion to $7.4

billion, depending on how many stores the pair ends up

divesting.

Walgreens, which announced financial results for its quarter

ended Feb. 28, said its pharmacy business picked up in the U.S.

with the highest quarterly prescription growth in years.

Overall, Walgreens earned $1.06 billion, or 98 cents a share,

compared with $930 million, or 85 cents a share, in the year-ago

period, as sales fell 2.4% to $29.4 billion. Excluding certain

items, Walgreens said it earned $1.36 a share.

The company backed its fiscal 2017 outlook of adjusted per-share

earnings of $4.90 to $5.08. It also detailed a $1 billion share

buyback program and said it plans to close an additional 60 stores

than initially expected as part of a cost-reduction plan announced

in 2015.

Walgreens previously planned to close 200 stores. The additional

closures come as it opens stores in other locations. It had 8,175

stores in August 2016, compared with 8,232 a year earlier, it

said.

Walgreens stock, which has fallen 1% from over the past 12

months, fell another 1.7% to $81.10 in morning trading.

Write to Sharon Terlep at sharon.terlep@wsj.com and Joshua

Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

April 05, 2017 10:32 ET (14:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

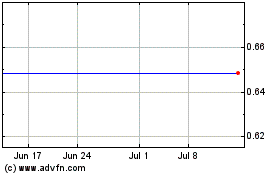

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024