Current Report Filing (8-k)

April 03 2017 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): April 1, 2017

GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-33958

|

|

20-8099512

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583

|

|

|

|

|

|

(Address of Principal Executive Offices) (Zip Code)

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (855) 855-4253

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

Item 1.01

|

Entry Into A Material Definitive Agreement

|

On April 1, 2017, the Company and JGB Newton Ltd., a Cayman Islands exempted company (the “Investor”) entered into a waiver (the “Waiver”) that amended the Securities Purchase Agreement dated May 10, 2016 between the Company and the Investor, as amended on August 22, 2016 (the “SPA”). Under the terms of the SPA the Company sold to the Investor a secured convertible debenture (the “Debenture”), in the principal amount of $25,350,000. The Waiver provides that solely with respect to the calendar months of April 2017, May 2017, June 2017, July 2017, August 2017 and September 2017 (collectively, the “Specified Months”), the Investor waives, subject to certain delineated exceptions, the requirement of paragraph (i) of the definition of “Equity Conditions” set forth in Section 1 of the Debenture, thereby continuing to allow the Company to deliver shares of its Common Stock in respect to a portion of its amortization obligation under the Debenture. The Waiver also continues the requirement that the cash and/or cash equivalents in excess of remaining outstanding balance of the Debenture be withdrawn from certain accounts and deposited into an agreed to Company account and the Investor special redemptions rights granted on December 14, 2016 as reported on the Current Report on Form 8-K dated February 7, 2017.

The foregoing description of the material terms of the Waiver are qualified in their entirety by the Waiver, copies of which are filed as Exhibit 10.1 on this Current Report on Form 8-K and are incorporated herein by reference.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

|

|

|

|

|

|

10.1

|

Waiver dated April 1, 2017 to the Securities Purchase Agreement, dated as of May 10, 2016 by and between Galena Biopharma Inc. and JGB Newton, Ltd.

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GALENA BIOPHARMA, INC.

|

|

|

|

|

|

|

|

Date:

|

|

April 3, 2017

|

|

|

|

By:

|

|

/s/ Thomas J. Knapp

|

|

|

|

|

|

|

|

|

|

Thomas J. Knapp

Interim General Counsel and Corporate Secretary

|

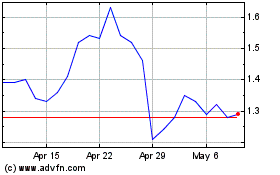

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

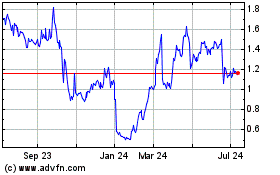

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024