By Erin Ailworth

MIDLAND, Texas -- Using a proprietary app called iSteer, Brian

Tapp, a geologist for EOG Resources Inc., dashed off instructions

to a drilling rig 100 miles away. This tool is among the reasons

the little-known Texas company says it pumps more oil from the

continental U.S. than Exxon Mobil Corp. -- or any other

producer.

A rig worker received Mr. Tapp's iPhone alert and tweaked the

trajectory of a drill bit thousands of feet underground, to land

more squarely in a sweet spot of rock filled with West Texas

crude.

U.S. shale drillers transformed the energy industry over the

past decade with hydraulic fracturing and horizontal drilling, in

the early days using brute force to unleash a torrent of oil and

gas that altered the balance of power among oil-producing nations

and triggered a global glut.

Now, with oil currently trading near $50 a barrel, these

producers are trying to unleash fracking 2.0, the next step in the

technological transformation of the sector that is aimed at

extracting oil even faster and less expensively to eke out profits

at that level.

The promise of this new phase is potentially as significant as

the original revolution. If more producers can follow EOG's lead

and profitably ramp up output from shale drilling even at lower

prices, the sector could become a lasting force that challenges

OPEC's ability to control market prices.

For a sector in which the previous era's success was tied to the

rapid expansion of output, the shift toward finding more

cost-effective ways to get to that oil and gas is full of

challenges. When oil prices dropped, critics wondered if the shale

industry -- rife with heavily indebted companies that had never

turned a profit -- would collapse.

EOG, with its longtime focus on low-cost production, is the

producer many hope to emulate, thanks to the iSteer app and dozens

of other homegrown innovations. Dubbed the "Apple of oil" by one

analyst, EOG made its name as a pioneer in horizontal drilling and

in finding ways to get oil out of shale -- often dense layers of

rock that hold oil and gas in tiny pores -- a feat many once

believed impossible.

Competitors such as Chesapeake Energy Corp. and Pioneer Natural

Resources Co. also are finding new ways to profit amid low energy

prices. Many are experimenting with longer, supersize wells, and

fracking them with millions of pounds of sand. Other producers,

however, have said the industry needs oil prices of at least $55 to

$60 to truly rebound.

The price of oil plunged about 75% from its peak of more than

$100 a barrel in mid-2014, and the natural-gas price sank by half

in the same period. More than 420,000 oil and gas jobs world-wide

have been lost, according to energy consulting firm Graves &

Co., and, since the start of 2015, over 200 U.S. energy companies

have filed for bankruptcy, according to law firm Haynes & Boone

LLP.

EOG, part of Enron Corp. until 1999, now drills horizontal wells

in West Texas more than a mile long in 20 days, down from 38 days

in 2014. It has done it in as few as 10 1/2 days. It estimates it

can get at least a 30% rate of return on wells at $40 a barrel, and

that at $50 it can boost oil production at least 15% a year through

2020.

The company said it produced roughly the same amount of oil last

year as it did in 2014 with a budget that was 67% smaller.

The iSteer app and other proprietary programs EOG designed are

partly why.

EOG uses iSteer to help navigate through rock thousands of feet

underground, landing in identified layers with more precision. A

device behind the drill bit underground transmits information --

including depth and direction but also readings to identify types

of rock and the presence of gas -- to a geologist at the office.

The numbers are crunched, using EOG's databases on the location's

rock layers and on previous wells, and course corrections are sent

to the driller on the rig.

EOG said adjustments can happen in minutes, instead of a process

that in the past took at least 30 minutes. The quick modifications

keep the drill in a 10-to-15 foot window, which EOG said improves

the output and consistency of a well.

The apps help employees work at the "speed of thought," said

Sandeep Bhakhri, EOG's chief information officer.

The company now uses 65 apps it designed after realizing it

needed tools with capabilities it couldn't find off the shelf.

Along the way, it boosted its staff of data scientists, and over

the past three years has hired recent computer-science graduates

from the University of Texas at Austin.

The apps help EOG answer a range of questions, such as how much

pressure to use to crack a particular geologic stratum, to

identifying ideal trajectories for drills, to more mundane queries,

such as the fastest route to drive from one drilling site to the

next.

"I look at [the apps] first thing in the morning, on the

exercise bike or during breakfast -- it gives me a head start on

the day," said Ezra Yacob, general manager of EOG's Midland

operations.

Tinkering, core to the company's culture, was evident on a

recent visit to the division office in Midland, a city of about

124,000 at the heart of the oil-rich Permian Basin in West

Texas.

There, geologists, engineers and technicians could be found

constantly on their computers and iPhones using EOG's apps. The

company says all workers are encouraged to fiddle and find novel

solutions to problems.

It's an outgrowth of the company's habit of ignoring

conventional wisdom as it looks for ways to become a better

producer.

In the early 2000s, EOG was determined to show that vast

supplies of natural gas could be unlocked by drilling horizontally

through shale. It drilled 15 uneconomic wells in the Dallas-Fort

Worth-area field known as the Barnett, while its employees

experimented to find better techniques, according to former CEO

Mark Papa. It succeeded on the 16th.

As the shale boom took off, scores of producers borrowed heavily

to lease land for drilling. EOG moved in the opposite direction,

keeping debt low and favoring technological innovation and returns

over rapid growth.

When Mr. Papa in 2007 realized gas prices were headed for a

drop, he said the company started shifting to oil. At the time, few

in the industry thought oil could be economically extracted from

shale formations.

A bespectacled EOG geologist named Bill Thomas, then the head of

the company's Fort Worth office, was among those who did.

He became CEO in 2013, and now can often be found in his

35th-floor office at EOG's headquarters in Houston scrutinizing

data about well productivity. Instead of a secretary, the assistant

outside his office is one of the company's top geo-technicians,

responsible for analyzing information.

The company's market cap is now $55 billion. Shares closed at

$97 Wednesday, down 18% from their price at oil's mid-2014 peak,

beating the SPDR S&P Oil and Gas Exploration and Production

ETF, a common industry benchmark, which dropped 55% in that

time.

EOG regularly solves problems in-house. When, in the early days

of drilling for crude in North Dakota's Bakken Shale, the company

hit logistical problems getting its oil to market, it built a rail

terminal and pipeline to help move it from North Dakota to the

trading hub near Cushing, Okla.

These days, it designs its own motors to power drill bits,

allowing its engineers to constantly incorporate fixes that improve

performance. Oil is pumped into olive-green storage tanks made to

EOG's specifications, cutting down costs and the number of tanks it

needs in the field.

It often works with smaller services contractors, instead of

giants such as Schlumberger Ltd. and Halliburton Co., so it can

negotiate costs and find expertise tailored to its needs. The

partnerships save it money and give it more control over the

logistics and supplies needed for any given project, EOG said.

For example, a larger services company might ask EOG to use a

particular sand supplier or employ a standard mix of sand, water

and chemicals when fracking a well. With a smaller services

company, EOG can potentially use sand from a company-owned mine --

it bought one in 2008 when the specialized grains started becoming

hard to find -- and design fracks to meet specific needs.

Heath Work, an EOG drilling manager in Midland, compared the way

the company operates to a championship Nascar driver and crew, who

make small adjustments that add up over time. "Jimmie Johnson has

won seven times and he does it with the same engine as his

competitors; he just figures out how to change tires faster," Mr.

Work said.

Competitors are innovating too, as producing oil for less

becomes more important than merely finding and pumping new

supplies.

Chesapeake Energy recently used a record 50 million pounds of

sand to frack a megawell in Louisiana, reaping cost savings via

economies of scale. Chesapeake, which some believed was close to

bankruptcy in early 2016, said the giant wells are part of its

turnaround strategy.

Pioneer Natural Resources said it saves money by mining some of

its own sand and has been building its own system to transport the

water it needs. Chief Executive Tim Dove said those operations are

integral to the company's goal of producing one million barrels of

oil equivalent a day by 2026 while still having cash to cover

expenditures.

Critics have questioned EOG's habit of quickly ramping up

production from individual wells, arguing that can cause wells to

peter out prematurely. The company used the strategy to supercharge

returns in the Eagle Ford, an oil-rich region of South Texas where

it was ahead of the pack in leasing more than 500,000 acres for a

tiny percentage of what others would pay later.

Mr. Thomas, the CEO, said trial and error has proven its Eagle

Ford wells aren't damaged when allowed to flow aggressively. "You

increase your returns because the wells pay out so much quicker,"

he said. "If you get a higher return and it doesn't damage the

well, then why not do it?"

EOG expanded in the Permian region by 310,000 acres in October

when it acquired Yates Petroleum Corp. for $2.4 billion. Swallowing

an entire company was an uncharacteristic move for EOG that will

test whether it can export its corporate culture.

A day after the deal closed, EOG was already using its apps and

data to steer a Yates well.

"The whole industry has gotten better, but we've gotten better a

bit faster," Mr. Thomas said.

(END) Dow Jones Newswires

March 30, 2017 13:36 ET (17:36 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

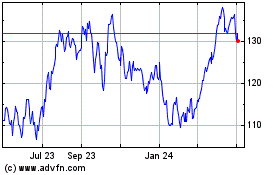

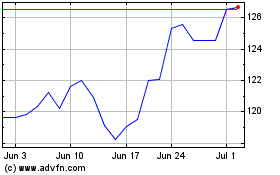

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024