UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March, 2017

Commission File Number:

001-36000

XTL Biopharmaceuticals Ltd.

(Translation of registrant’s name

into English)

5 Hacharoshet St.

PO Box 4423

Raanana 4365603, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F.

Form

20-F

x

Form

40-F

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Incorporation by Reference: This Form

6-K of XTL Biopharmaceuticals Ltd. is hereby incorporated by reference into the registration statements on Form S-8 (File No. 333-148085,

File No. 333-148754 and File No. 333-154795) and Form F-3 (File No. 333-194338).

xtl

biopharmaceuticals REPORTS 2016 FINANCIAL RESULTS & PROVIDES CLINIcAL and Operational UPDATE

RAANANA,

Israel

- (March 30, 2017) –

XTL Biopharmaceuticals

Ltd.

(NASDAQ: XTLB, TASE: XTLB.TA)

(“XTL” or the “Company”),

a clinical-stage biopharmaceutical company developing

treatments for autoimmune diseases

,

today announced financial results for the year ended December 31, 2016 and provided an update on the development program for its

lead drug candidate hCDR1.

“2016

was an important year for us, as we continued to lay the foundation for the advancement of hCDR1 towards a global Phase 2 trial

designed to have a high likelihood of success based on prior clinical study findings in lupus (SLE)" said Josh Levine, CEO

of XTL. In addition, we strengthened the intellectual property of our lead asset, hCDR1, by filing patents on the dosing of our

drug for lupus and identifying a potential second indication for our lead asset by filing a use patent for the treatment of

Sjögren’s

syndrome (SS) based on pre-clinical in vitro data. This new data has the potential to significantly increase the market size for

hCDR1 in a second indication and further supports the findings found in previous clinical studies performed on lupus.

”.

Clinical and Operational Update

|

|

·

|

The Company raised a net total of approximately

$5 million in February and March 2017 in a public offering to institutional investors and a private placement with existing investors.

The transactions included the issuance of ADSs and unregistered warrants to purchase ADSs.

|

|

|

·

|

XTL generated new in-vitro data from studies

evaluating cells obtained from serum samples of patients with SS demonstrating that incubation with hCDR1 resulted in a significant

reduction of gene expression of several cytokines considered to be pathogenic in SS. These data correspond to some of the in vitro

data obtained in studies testing serum samples from patients with SLE. SS impacts more than twice the number of people as SLE does

in the U.S. and represents a significant unmet therapeutic need. A patent application has been filed with the U.S. Patent and Trademark

Office for hCDR1 in the treatment of SS.

|

|

|

·

|

We added two leading experts in rheumatology,

Robert Fox, MD and Simon Bowman, MD, to the Company’s clinical advisory board to help guide a planned Phase II trial to evaluate

hCDR1 for the treatment of SS.

|

|

|

·

|

Dr. Daphna Paran, a world renowned expert

in the treatment of lupus and an internal medicine and rheumatology specialist, was appointed as Medical Director.

|

|

|

XTL Biopharmaceuticals Ltd.

5 Hacharoshet Street, Raanana, 43656, Israel

Tel: +972 9 955 7080; email:

ir@xtlbio.com

|

Page

1

|

|

|

·

|

The Company received very encouraging

feedback from the U.S. Food and Drug Administration (FDA) in response to its pre-investigational new drug (IND) meeting package

for hCDR1. This successful outcome included BILAG, a measure of lupus disease activity, as the primary efficacy endpoint. Based

on prior positive efficacy data using BILAG as the measure, XTL believes the FDA’s guidance will improve the likelihood of

a successful trial. The FDA’s guidance also included parameters on patient inclusion criteria and patient population for

safety requirements for marketing approval.

|

|

|

·

|

We completed the Phase 2 clinical trial

design for hCDR1 in the treatment of SLE, in consultation with its world renowned Clinical Advisory Board The trial design includes

a treatment arm dosing weekly at 0.5 mg hCDR1 and BILAG as the measure for the primary efficacy endpoint. Data from the prior Phase

2 study showed a statistically significant effect of a 0.5 mg dose of hCDR1 on the BILAG index.

|

Financial Overview

XTL reported $2.0 million in cash and cash

equivalents as of December 31, 2016. These funds, together with the approximately $5 million raised to date in 2017, will be used

to advance the hCDR1 clinical program for the treatment of SLE and SS and to identify additional assets to add to the XTL portfolio.

Research and development expenses for the

year ended December 31, 2016 were $443,000 compared with $578,000 for 2015. Expenses incurred in 2016 include, among other things,

chemistry, manufacturing and control (CMC) costs for production of the drug product, pre-clinical experiments on the use of hCDR1

for the treatment of SS patients, as well as clinical and regulatory consulting fees. The decrease in expenses in 2016 compared

to 2015 is mainly due to professional consulting expenses in 2015 related to the preparation and submission to the FDA of our pre-IND

meeting package for our planned clinical study of the hCDR1 drug for the treatment of SLE patients.

XTL reported an operating loss for the

year ended December 31, 2016 of $2.6 million compared with $3.6 million for 2015. The 2016 loss includes $0.8 million for the full

impairment in the Company's intangible asset related to its secondary clinical asset as it focuses its efforts and resources on

the development of its lead asset, hCDR1 for the treatment of SLE. The Company reported a total net loss for the year ended December

31, 2016 of $2.5 million or 0.009 per share, compared to $4.3 million or 0.017 per share in 2015.

|

|

XTL Biopharmaceuticals Ltd.

Hacharoshet Street, Raanana, 43656, Israel

Tel: +972 9 955 7080; email:

ir@xtlbio.com

|

Page

2

|

XTL Biopharmaceuticals, Ltd. and Subsidiaries

(USD in thousands)

Consolidated Statements of Financial Position - Selected Data

|

|

|

As of

|

|

|

|

|

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Cash, Cash Equivalents

|

|

|

2,019

|

|

|

|

3,817

|

|

|

Other current assets

|

|

|

735

|

|

|

|

448

|

|

|

Non-current assets

|

|

|

263

|

|

|

|

1,058

|

|

|

Total assets

|

|

|

3,017

|

|

|

|

5,323

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

330

|

|

|

|

436

|

|

|

Total shareholders’ equity

|

|

|

2,687

|

|

|

|

4,887

|

|

XTL Biopharmaceuticals, Ltd. and Subsidiaries

(USD in thousands, except per share amounts)

Consolidated Statements of Comprehensive Income - Selected Data

|

|

|

Year ended

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

|

|

Audited

|

|

|

Research and development expenses

|

|

|

(443

|

)

|

|

|

(578

|

)

|

|

General and administrative expenses

|

|

|

(1,270

|

)

|

|

|

(1,419

|

)

|

|

Impairment of intangible assets

|

|

|

(848

|

)

|

|

|

(1,604

|

)

|

|

Other gains (losses), net

|

|

|

-

|

|

|

|

(10

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(2,561

|

)

|

|

|

(3,611

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Finance income (expenses), net

|

|

|

16

|

|

|

|

(11

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

|

(2,545

|

)

|

|

|

(3,622

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations

|

|

|

-

|

|

|

|

(689

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total loss for the period

|

|

|

(2,545

|

)

|

|

|

(4,311

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the period attributable to:

|

|

|

|

|

|

|

|

|

|

Equity holders of the Company

|

|

|

(2,545

|

)

|

|

|

(4,313

|

)

|

|

Non-controlling interests from discontinued operations

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2,545

|

)

|

|

|

(4,311

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share (in U.S. dollars):

|

|

|

|

|

|

|

|

|

|

From continuing operations

|

|

|

(0.009

|

)

|

|

|

(0.014

|

)

|

|

From discontinued operations

|

|

|

-

|

|

|

|

(0.003

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share for the period

|

|

$

|

(0.009

|

)

|

|

$

|

(0.017

|

)

|

|

|

XTL Biopharmaceuticals Ltd.

Hacharoshet Street, Raanana, 43656, Israel

Tel: +972 9 955 7080; email:

ir@xtlbio.com

|

Page

3

|

About hCDR1

hCDR1 is a novel compound with a unique

mechanism of action and clinical data on over 400 patients in three clinical studies. The drug has a favorable safety profile,

is well tolerated by patients and has demonstrated efficacy in at least one clinically meaningful endpoint. For more information

please see a peer reviewed article in Lupus Science and Medicine journal (

full article

).

About XTL Biopharmaceuticals Ltd.

(XTL)

XTL Biopharmaceuticals

Ltd., is a clinical-stage biotech company focused on the development of pharmaceutical products for the treatment of autoimmune

diseases. The Company’s lead drug candidate, hCDR1, is a world-class clinical asset for the treatment of autoimmune diseases

including systemic lupus erythematosus (SLE) and Sjögren’s Syndrome (SS). The few treatments currently on the market

for these diseases are not effective enough for most patients and some have significant side effects. hCDR1 has robust clinical

data in three clinical trials with 400 patients and over 200 preclinical studies with data published in more than 40 peer

reviewed scientific journals.

XTL is traded

on the Nasdaq Capital Market (NASDAQ: XTLB) and the Tel Aviv Stock Exchange (TASE: XTLB.TA). XTL shares are included in the following

indices: Tel-Aviv Biomed, Tel-Aviv MidCap, and Tel-Aviv Tech Index.

For further information, please contact:

Investor Relations, XTL Biopharmaceuticals

Ltd.

Tel: +972 9 955 7080

Email:

ir@xtlbio.com

www.xtlbio.com

===============================================================

|

|

XTL Biopharmaceuticals Ltd.

Hacharoshet Street, Raanana, 43656, Israel

Tel: +972 9 955 7080; email:

ir@xtlbio.com

|

Page

4

|

Cautionary Statement

This press release may contain forward-looking

statements, about XTL’s expectations, beliefs or intentions regarding, among other things, its product development efforts,

business, financial condition, results of operations, strategies or prospects. In addition, from time to time, XTL or its representatives

have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use

of forward-looking words such as "believe," "expect," "intend," "plan," "may,"

"should" or "anticipate" or their negatives or other variations of these words or other comparable words or

by the fact that these statements do not relate strictly to historical or current matters. These forward-looking statements may

be included in, but are not limited to, various filings made by XTL with the U.S. Securities and Exchange Commission, press releases

or oral statements made by or with the approval of one of XTL’s authorized executive officers. Forward-looking statements

relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking

statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that

could cause XTL’s actual results to differ materially from any future results expressed or implied by the forward-looking

statements. Many factors could cause XTL’s actual activities or results to differ materially from the activities and results

anticipated in such forward-looking statements, including, but not limited to, the factors summarized in XTL’s filings with

the SEC and in its periodic filings with the TASE. In addition, XTL operates in an industry sector where securities values are

highly volatile and may be influenced by economic and other factors beyond its control. XTL does not undertake any obligation

to publicly update these forward-looking statements, whether as a result of new information, future events or otherwise. Please

see the risk factors associated with an investment in our ADSs or ordinary shares which are included in our Form 20-F filed with

the U.S. Securities and Exchange Commission on March 30, 2017.

|

|

XTL Biopharmaceuticals Ltd.

Hacharoshet Street, Raanana, 43656, Israel

Tel: +972 9 955 7080; email:

ir@xtlbio.com

|

Page

5

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

XTL BIOPHARMACEUTICALS LTD.

|

|

|

|

|

|

Date: March 30, 2017

|

By:

|

/s/ Josh Levine

|

|

|

|

Josh Levine

|

|

|

|

Chief Executive Officer

|

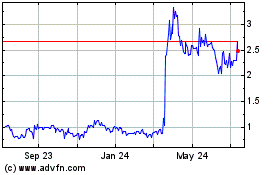

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

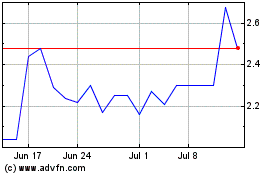

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Apr 2023 to Apr 2024