UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2017

Commission File Number: 001-37915

Fortis Inc.

Fortis Place, Suite 1100

5 Springdale Street

St. John’s, Newfoundland and Labrador

Canada, A1E 0E4

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

EXHIBITS

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

Notice of Annual and Special Meeting May 4, 2017 and Management Information Circular |

|

99.2 |

|

Form of Proxy |

|

99.3 |

|

Notice of Availability of Proxy Materials for Fortis Inc. Annual and Special Meeting |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Fortis Inc. |

|

|

(Registrant) |

|

|

|

|

|

Date: March 28, 2017 |

/s/ David C. Bennett |

|

|

By: |

David C. Bennett |

|

|

Title: |

Executive Vice President, Chief Legal Officer and |

|

|

|

Corporate Secretary |

3

Exhibit 99.1

Notice of our 2017 annual and special meeting

|

When |

|

Where |

|

May 4, 2017

10:30 a.m. (Newfoundland Daylight Time) |

|

Holiday Inn St. John’s, Salon A

180 Portugal Cove Road

St. John’s, Newfoundland and Labrador |

What the meeting will cover

1. Receive the Fortis Inc. (Fortis) consolidated financial statements for the financial year ended December 31, 2016 and the auditors’ report

2. Elect the directors

3. Appoint the auditors and authorize the directors to fix the auditors’ remuneration

4. Have a say on executive pay

5. Vote on approving the amended and restated employee share purchase plan

6. Transact any other business that may properly come before the meeting

Your right to vote

You are entitled to receive notice of and vote at the shareholder meeting if you held Fortis common shares at the close of business on March 17, 2017. If you acquired your shares after this date, you can ask for your name to be included in the list of eligible shareholders until 10 days before the meeting, as long as you have proper proof that you own shares of Fortis.

The board of directors recommends that shareholders vote FOR all the resolutions. You can read more about these items in the attached management information circular.

Vote in person or by proxy

If you want to attend the meeting and vote your shares in person, you will need to register with our transfer agent, Computershare Trust Company of Canada, when you arrive. If you are appointing someone else to be your proxyholder or if you are a non-registered (beneficial) shareholder, please read the information beginning on

page 6 of the circular.

We’ll have a live webcast of the meeting on our website (www.fortisinc.com) if you are unable to attend in person.

The board of directors has approved the contents of the notice and authorized us to send this information to our shareholders, directors and our auditors.

By order of the board of directors,

David C. Bennett

Executive Vice President, Chief Legal Officer and Corporate Secretary

St. John’s, Newfoundland and Labrador

March 17, 2017

Message from the Chair of the Board and

the President and Chief Executive Officer

Dear fellow shareholders,

On behalf of the board and management of Fortis Inc., it is our pleasure to invite you to the 2017 annual and special meeting of shareholders on Thursday, May 4, 2017 in St. John’s, Newfoundland and Labrador. The meeting will be held in Salon A of the Holiday Inn St. John’s at 180 Portugal Cove Road, beginning at 10:30 a.m. local time.

The shareholder meeting is your opportunity to vote on specific items of business and meet members of the board and management. We will also present our results for the year, discuss our plans for the future and answer questions from shareholders.

The enclosed management information circular contains important information about the meeting and the items of business. Please take some time to read the circular before you vote your shares.

This year you will elect 12 directors to the board. Each is qualified and experienced and brings a strong mix of skills to the board. You can read about each nominee beginning on page 13.

You will also have a say on executive pay with our annual advisory vote on our approach to executive compensation. You can read more about executive compensation at Fortis in the message from the chair of the human resources committee beginning on page 44 and the detailed discussion of the program and decisions for the year beginning on page 47. At this year’s meeting you will also vote on approving an amendment to our employee share purchase plan which has been expanded to allow our United States (U.S.) employees to participate in the plan and become Fortis shareholders.

A year of strong growth

Fortis posted another year of strong results in 2016, highlighting the value of our low-risk and diversified portfolio of utilities.

On an adjusted basis, reported net earnings were $721 million or $2.33 per common share, 10% higher than our 2015 adjusted earnings per share (EPS) of $2.11. The most significant adjustments to earnings were to exclude utility acquisition-related expenses in 2016, and the gain on sales of non-core businesses in 2015.

We also achieved a number of other successes in 2016:

· We closed the acquisition of ITC Holdings Corp. (ITC) on October 14, 2016, two and half months earlier than expected, and fast for acquisitions in the utility sector

· We listed our common shares and began trading on the New York Stock Exchange (NYSE)

· We acquired Aitken Creek, the largest natural gas storage facility in British Columbia, which is uniquely positioned to benefit from the future development of natural gas resources in that province

· We also made significant progress on a number of key regulatory proceedings, resulting in reasonable regulatory stability for our utilities in the near term.

The acquisition of ITC, the largest independent electric transmission utility in the United States, is transformational and reinforces Fortis as a leader in the North American gas and electric utility industry.

ITC dramatically extends our reach in the United States to eight additional states and the NYSE listing increases liquidity for Fortis through access to a broader group of investors and trading activity for Fortis shares in the United States, all of which are critical to our growth strategy.

1

Delivering value to shareholders

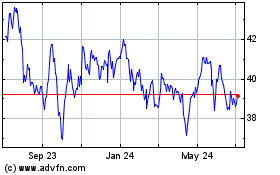

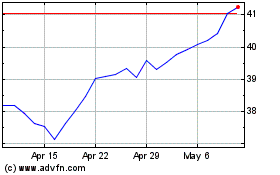

In 2016, Fortis continued to deliver value to shareholders with an annual dividend of $1.525 per common share and a one-year total shareholder return of 15.2%.

Since our initial push into the U.S. with the purchase of CH Energy Group, Inc. (CH Energy Group) in 2013, our adjusted EPS has grown at a compound annual growth rate of 11%, one of the highest in the industry for the three-year period through to 2016.

Over the past 10 years, Fortis has outperformed the market and delivered a compound annual dividend growth rate of 9% to shareholders. The increase in our dividend from $0.375 to $0.40 per share in the fourth quarter of 2016 marks 43 consecutive years of annual dividend increases — the longest record of any public corporation in Canada — and we have targeted average annual dividend growth of approximately 6% through 2021.

Pay aligned with performance

Strong corporate performance resulted in compensation for the five most senior executives above target, and up 5.7% from 2015.

Annual incentives were awarded at maximum for several executives, including the President and Chief Executive Officer, in recognition of the strong 2016 financial results and the successful and early closing of the ITC transaction.

Both the board and the human resources committee take great care to ensure compensation supports the business strategy, links to performance and aligns with shareholder interests.

Committed to strong governance

The board and management are committed to good governance and sound business practices. We are also committed to engaging more with our shareholders as we continue to grow and expand our investor base. Fortis continues to promote diversity and has committed to having a board where each gender represents at least one-third of the board’s independent directors — a level we currently meet.

Board changes

Ongoing board refreshment is also a key element of good governance, and we would like to thank David G. Norris and Peter E. Case for their valuable contributions and service on the Fortis board.

Mr. Norris stepped down from his role as Chair on September 1, 2016 and will retire from the board at the end of the 2017 shareholder meeting after completing the maximum 12-year tenure as a Fortis director. During his tenure, Mr. Norris also served as chair of the audit committee for five years. Mr. Norris provided outstanding board leadership through a very successful period in our history and we appreciate his efforts to ensure a timely and effective transition from his role as Chair.

Mr. Case is also completing 12 years on the Fortis board and therefore is also not standing for re-election. Mr. Case served as chair of the audit committee for six years and was a member of the governance and nominating committee for the past four years. He brought tremendous knowledge of the capital markets and insight to the energy sector.

2

Our tenure policy provides an effective way to build deep knowledge and expertise and an orderly process for board renewal.

This year two new director nominees are standing for election to the Fortis board.

Lawrence T. Borgard, an electrical engineer, brings extensive experience in the U.S. energy sector as a former President and Chief Operating Officer of Integrys Energy Group, a diversified energy holding company that was recently bought by another investor-owned utility.

Joseph L. Welch, an electrical engineer, is Chairman of the Board of ITC and also served as its President and Chief Executive Officer until October 31, 2016. Mr. Welch brings deep experience in the U.S. utility business and led ITC’s growth as it became the largest independent electric transmission company in the U.S.

Looking ahead

Today Fortis serves over three million gas and electricity customers across North America and the Caribbean. We are the largest investor-owned, electric and gas utility in Canada and one of the top 15 in North America when measured by enterprise value. We are confident about a bright future for Fortis and our prospects for long-term, profitable growth.

We thank you for your continued interest in Fortis and please remember to vote your shares. We look forward to seeing you on May 4, 2017.

Sincerely,

|

|

|

|

Douglas J. Haughey |

Barry V. Perry |

|

Chair, Board of Directors |

President and Chief Executive Officer |

3

What’s inside

|

Notice of our 2017 annual and special meeting |

IFC |

|

|

|

|

Message to shareholders |

1 |

|

|

|

|

Management information circular |

5 |

|

1. ABOUT THE SHAREHOLDER MEETING |

6 |

|

· Voting |

6 |

|

· What the meeting will cover |

8 |

|

· About the nominated directors |

12 |

|

2. GOVERNANCE |

30 |

|

· Our governance policies and practices |

30 |

|

· About the Fortis board |

31 |

|

· Serving as a director |

40 |

|

3. EXECUTIVE COMPENSATION |

43 |

|

Letter from the chair of the human resources committee |

44 |

|

Compensation discussion and analysis |

47 |

|

· Compensation strategy |

47 |

|

· Compensation governance |

47 |

|

· Compensation design and decision-making |

52 |

|

· 2016 Executive compensation |

56 |

|

· Share performance and cost of management |

74 |

|

2016 Compensation details |

76 |

|

4. OTHER INFORMATION |

84 |

|

APPENDICES |

86 |

|

A — Change of external auditors documentation |

86 |

|

B — Second amended and restated 2012 employee share purchase plan |

89 |

|

C — Statement of corporate governance practices |

101 |

|

D — Board mandate |

111 |

About forward-looking information

Fortis includes forward-looking information in this circular within the meaning of applicable securities laws including the Private Securities Litigation Reform Act of 1995. Forward-looking statements included in this circular reflect expectations of Fortis management regarding future growth, results of operations, performance, business prospects and opportunities. Wherever possible, words such as anticipates, believes, budgets, could, estimates, expects, forecasts, intends, may, might, plans, projects, schedule, should, target, will, would and the negative of these terms and other similar terminology or expressions have been used to identify the forward-looking statements, which include, without limitation: the expectation of regulatory stability for Fortis’ utilities in the near term, target average annual dividend growth through 2021, and the nature, timing, expected costs and impacts of certain capital projects including, without limitation, community-scale solar projects in Arizona and utility-scale solar projects in the Turks and Caicos Islands.

Forward looking statements involve significant risks, uncertainties and assumptions. Certain material factors or assumptions have been applied in drawing the conclusions contained in the forward-looking statements, including, without limitation: the receipt of applicable regulatory approvals and requested rate orders, no material adverse regulatory decisions being received, and the expectation of regulatory stability; no material capital project and financing cost overrun related to any of Fortis’ capital projects, the board of directors exercising its discretion to declare dividends, taking into account the business performance and financial conditions of Fortis, no significant variability in interest rates, no significant operational disruptions or environmental liability due to a catastrophic event or environmental upset caused by severe weather, other acts of nature or other major events; no severe and prolonged downturn in economic conditions, no significant decline in capital spending, sufficient liquidity and capital resources; no significant changes in government energy plans, environmental laws and regulations that may materially negatively affect Fortis and its subsidiaries, the ability to obtain and maintain licences and permits, retention of existing service areas, no significant changes in tax laws, favourable labour relations, and sufficient human resources to deliver service and execute the capital program.

Fortis cautions readers that a number of factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and undue reliance should not be placed on the forward-looking statements. For additional information with respect to certain of these risks or factors, refer to the continuous disclosure materials filed from time to time by Fortis with Canadian securities regulatory authorities and the Securities and Exchange Commission (SEC).

All forward-looking information in this circular is qualified in its entirety by the above cautionary statements and, except as required by law, Fortis undertakes no obligation to revise or update any forward-looking information as a result of new information, future events or otherwise.

4

Management information circular

You have received this management information circular because you owned common shares of Fortis Inc. as of the close of business on March 17, 2017 (the record date) and are entitled to receive notice of and vote at our annual and special meeting of shareholders at the Holiday Inn St. John’s on May 4, 2017 (or a reconvened meeting if the meeting is postponed or adjourned).

Management is soliciting your proxy for the meeting. Solicitation is mainly by mail, but you may also be contacted by phone, e-mail, internet or facsimile by a Fortis director, officer or employee or our proxy solicitation agent, Kingsdale Advisors (Kingsdale).

We pay for the costs of preparing and distributing the meeting materials, including reimbursing brokers and other entities for mailing the materials to our beneficial shareholders. We have retained Kingsdale as our proxy solicitation agent at a cost of $30,000 for their services and will reimburse them for any related expenses.

Your vote is important. Please read this circular carefully and then vote your shares (see page 6 for details).

The board of directors of Fortis has approved the contents of the circular and authorized us to send it to all shareholders of record.

David C. Bennett

Executive Vice President, Chief Legal Officer and Corporate Secretary

St. John’s, Newfoundland and Labrador

March 17, 2017

In this document:

· we, us, our and Fortis means Fortis Inc.

· you, your and shareholder refer to holders of Fortis common shares

· shares and Fortis shares mean common shares of Fortis, unless indicated otherwise

· all dollar amounts are in Canadian dollars, unless indicated otherwise

· information is as of March 17, 2017 unless indicated otherwise.

About notice and access

Fortis is using Notice and Access rules adopted by Canadian securities regulators to reduce the volume of paper in the materials distributed for the 2017 annual and special meeting of shareholders. Instead of receiving this circular with the proxy form or voting information form, shareholders received a notice of the meeting with instructions for accessing the remaining materials online.

We have sent the notice of the meeting and proxy form directly to registered shareholders, and the notice of the meeting and voting instruction form directly to non-objecting beneficial owners. If you are a non-registered shareholder, and Fortis or its agent has sent the notice of meeting and voting instruction form directly to you, your name and address and information about your holdings of Fortis shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding them on your behalf. We plan to pay the cost for intermediaries to deliver the notice of meeting, voting instruction form and other materials to objecting beneficial owners.

This circular and the proxy form can be viewed online at www.envisionreports.com/fortis2017, under our SEDAR profile at www.sedar.com, under our EDGAR profile at www.sec.gov or on our website at www.fortisinc.com.

5

1. ABOUT THE SHAREHOLDER MEETING

Voting

Who can vote

You are entitled to receive notice of and vote at the meeting if you held common shares of Fortis at the close of business on March 17, 2017, the record date. Shareholders will vote on four items of business and any other matters that may properly come before the meeting (see page 8).

If you acquired your shares after this date, you can ask for your name to be included in the list of eligible shareholders up until 10 days before the meeting if you have proper proof that you own the shares. Contact our transfer agent, Computershare Trust Company of Canada (Computershare), right away (see below).

As of the record date, we had 415,519,809 common shares issued and outstanding. Each share entitles the holder to one vote on the items to be voted on.

How to vote

The voting process is different depending on whether you’re a registered or non-registered shareholder:

|

Registered shareholders

Your shares are registered in your name |

|

Non-registered (beneficial) shareholders Your shares are held in the name of your nominee

(usually a bank, trust company, securities dealer or

other financial institution) and you are the

beneficial owner of the shares |

|

Voting by proxy is the easiest way to vote. This means you have the right to appoint someone else (your proxyholder) to attend the meeting and vote your shares for you. Your proxyholder does not need to be a shareholder, but this person or company must attend the meeting and vote on your behalf. |

|

By choosing to send these materials to you directly, Fortis (and not the intermediary holding on your behalf) has assumed responsibility for delivering these materials to you, and executing your proper voting instructions. Please return your voting instructions as specified in the voting instruction form. |

|

|

|

|

|

Print the name of the person or company you’re appointing in the space provided on the proxy form in your package of materials. Then complete your voting instructions, date and sign the form and return it to Computershare right away. |

|

You can vote your shares in one of two ways: |

|

|

|

|

|

If you do not appoint your own proxyholder, the Fortis representatives named on the proxy form will act as your proxyholder, and will vote your shares according to your instructions. |

|

Submit your voting instructions

Use one of the methods provided on the voting instruction form (phone, fax or over the internet), or simply complete the form and mail it to the address provided on the form. |

|

|

|

|

|

If you sign and return the form but do not give your voting instructions or specify that you want your shares withheld, the Fortis representatives will vote FOR the items of business: |

|

Vote in person

Print your name in the space provided on the voting instruction form to appoint yourself as proxyholder, and follow the instructions from your nominee. |

|

· FOR the nominated directors |

|

|

|

· FOR the appointment of Deloitte LLP as our auditors

· FOR our approach to executive compensation

· FOR the amendment of the existing amended and restated employee share purchase plan |

|

Check in with a Computershare representative when you arrive at the meeting. Do not submit your vote using your voting instruction form because your vote will be taken at the meeting. |

|

|

|

|

|

Vote by proxy |

|

|

|

Internet |

Go to www.investorvote.com. Enter the 15-digit control number printed on the form and follow the instructions on screen. |

|

|

|

|

|

|

|

|

Phone |

1.866.732.8683 (toll-free in North America) and enter the 15-digit control number printed on the form. Follow the interactive voice recording instructions to submit your vote. |

|

|

|

|

|

|

|

|

Mail |

Enter your voting instructions on the proxy form, sign and date it, and send the completed form to:

Computershare Trust Company of Canada

Attention: Proxy Department

100 University Avenue, 8th Floor

Toronto, Ontario M5J 2Y1 |

|

|

6

|

Vote in person |

|

|

Check in with a Computershare representative when you arrive at the meeting. Do not fill out the proxy form because you will be casting your vote at the meeting. |

|

Send your voting instructions right away

Take some time to read this circular and then vote your shares right away. We must receive your voting instructions by 10:30 a.m. (Newfoundland Daylight time) on May 2, 2017 to ensure your shares are voted at the meeting.

If you are a non-registered shareholder, you will need to allow enough time for your nominee (or their representative) to receive your voting instructions and then submit them to Computershare.

If the meeting is postponed or adjourned, you must send your voting instructions at least 48 hours (not including Saturdays, Sundays and holidays) before the time the meeting is reconvened. The proxy cut-off may be waived or extended by the Chair of the meeting at his discretion, without notice.

Questions?

Call Kingsdale at:

· 1.888.518.6828 (toll-free within North America) or

· 416.867.2272 (collect call outside North America)

Or send an email to:

contactus@kingsdaleadvisors.com

Changing your vote

If you change your mind about how you want to vote your shares, you can revoke your proxy in one of the following ways, or by any other means permitted by law.

If you are a registered shareholder:

· vote again on the internet or by phone before 10:30 a.m. (Newfoundland Daylight time) on May 2, 2017

· complete a proxy form with a later date than the form you originally submitted, and mail it as soon as possible so that it is received before 10:30 a.m. (Newfoundland Daylight time) on May 2, 2017

· send a written notice from you or your authorized attorney to our Corporate Secretary so that it is received before 10:30 a.m. (Newfoundland Daylight time) on May 2, 2017.

If you are a non-registered shareholder, follow the instructions provided by your nominee.

Confidentiality and voting results

Proxy votes are tabulated by our transfer agent so individual shareholder votes are kept confidential.

If you do not attend the meeting, the voting results will be available on our website after the meeting (www.fortisinc.com) and on SEDAR (www.sedar.com) and EDGAR at (www.sec.gov).

How to obtain paper copies of our meeting materials

Registered and non-registered (beneficial) shareholders can ask for free paper copies of this circular and the proxy form or voting information form to be sent to them by mail. Requests can be made up to one year from the date the meeting materials are posted on our website. If you have questions about notice and access or want to order paper copies of our meeting materials, please contact Kingsdale (see above).

Or request free paper copies from our Corporate Secretary:

Fortis Inc.

Fortis Place, Suite 1100

5 Springdale Street

P. O. Box 8837

St. John’s, NL

A1B 3T2

7

What the meeting will cover

You will receive an update on our 2016 performance and vote on at least four items of business. An item is approved if a simple majority of shareholders represented in person or by proxy at the meeting vote FOR a resolution, except for the election of directors (see the note below about our majority voting policy for electing directors).

Quorum

We must have a quorum at the beginning of the meeting for it to proceed and to transact business. This means we must have two people present who together hold, or represent by proxy, at least 25% of our common shares issued and outstanding as of the record date.

1. Receive the financial statements (www.fortisinc.com)

We will present our consolidated financial statements for the year ended December 31, 2016 together with the auditors’ report. We mailed our consolidated financial statements to all registered shareholders and the beneficial shareholders who requested to receive a copy. You can also find a copy in our annual report, on our website (www.fortisinc.com), and on SEDAR (www.sedar.com) and EDGAR (www.sec.gov).

2. Elect directors (see page 12)

You will elect 12 directors to the board this year:

Tracey C. Ball

Pierre J. Blouin

Lawrence T. Borgard

Maura J. Clark

Margarita K. Dilley

Ida J. Goodreau

Douglas J. Haughey

R. Harry McWatters

Ronald D. Munkley

Barry V. Perry

Joseph L. Welch

Jo Mark Zurel

Ten directors are standing for re-election and Lawrence T. Borgard and Joseph L. Welch have been nominated as directors of the Fortis board for the first time. Peter E. Case and David G. Norris are not standing for re-election because they will have each served the maximum of 12 years on the board as of the date of the meeting. You can read about the nominated directors beginning on page 12 and our policy on director tenure on page 42.

If for any reason any of the proposed nominees are unable to serve as a director of Fortis, the persons named in the enclosed proxy form reserve the right to nominate and vote for another nominee at their discretion unless the shareholder has specified in its proxy that their shares are to be withheld from voting for the election of directors.

Majority voting policy

A nominee must receive more FOR than WITHHOLD votes to serve as a director on our board (see page 12).

The board and management recommend that you vote FOR the nominated directors.

3. Appoint the auditors (see page 86)

The board, on the recommendation of the audit committee, proposes that shareholders appoint Deloitte LLP as our auditors to hold office until the close of the next annual meeting of shareholders.

In keeping with our commitment to best practices in corporate governance, earlier this year the audit committee completed a comprehensive tender process for the 2017 external audit engagement. After careful consideration and subject to the approval of our shareholders, the audit committee selected Deloitte LLP based on the qualifications of its audit team, technology and independence. Additional documents related to the change of auditors (Change of auditors notice and acknowledgements by Ernst & Young LLP and Deloitte LLP) are set out in Appendix A.

The board negotiates the fees to be paid to the auditors. Fees are based on the complexity of the matters and the auditors’ time. Management believes the fees negotiated in the past have been reasonable and are comparable to fees charged by other auditors providing similar services.

8

The table below shows the fees paid to Ernst & Young LLP in the last two years:

|

|

|

2016 |

|

2015 |

|

|

Audit fees |

|

$ |

5,884,000 |

|

$ |

5,223,000 |

|

|

Audit-related fees |

|

$ |

1,727,000 |

|

$ |

870,000 |

|

|

Tax fees |

|

$ |

332,000 |

|

$ |

475,000 |

|

|

Non-audit fees |

|

— |

|

— |

|

|

Total |

|

$ |

7,943,000 |

|

$ |

6,568,000 |

|

Total fees were higher than in 2015, mainly due to the assurance services provided for readiness assessment of the Sarbanes Oxley Act of 2002 (SOX), registration with the SEC and the acquisition of ITC and related financings.

The board and management recommend that you vote FOR the appointment of Deloitte LLP as our auditors and FOR the authorization of the board to set the auditors’ remuneration for 2017.

4. Have a say on executive pay (see page 47)

As part of our commitment to strong corporate governance, the board is holding an advisory vote on our approach to executive compensation. While the results of the vote are not binding on the board, the board will take the results into account when considering compensation policies, practices and decisions and topics to be discussed as part of its engagement with shareholders on compensation and related matters.

The board believes our executive compensation policies and practices closely align the interests of executives and shareholders and are consistent with corporate governance best practices in Canada. Last year 97.49% of the votes were cast in favour of our approach to executive compensation.

You can vote FOR or AGAINST the resolution:

RESOLVED THAT:

On an advisory basis and not to diminish the role and responsibilities of the board of directors of Fortis, the shareholders of Fortis accept the approach to executive compensation as described in the compensation discussion and analysis section of this circular.

The board and management recommend that you vote FOR the advisory and non-binding vote on our approach to executive compensation as described in this circular.

5. Vote on the amended and restated 2012 employee share purchase plan (see page 71)

Our amended and restated 2012 employee share purchase plan (the 2012 ESPP) gives full-time and part-time employees, including executives, a convenient way to become Fortis shareholders and build their equity ownership. It is also an effective way for us to attract, retain and motivate employees. The plan is open to Canadian and U.S. residents and employees in other countries where they are allowed to participate.

On February 15, 2017, the board approved an amendment to the 2012 ESPP (the Plan Amendment) to increase the share reserve under the 2012 ESPP by 2,000,000 shares. As there are currently 286,166 shares available for issuance under the 2012 ESPP, implementing the amendment will result in a total of 2,286,166 shares available for issuance under the plan, representing 0.55% of the total number of shares issued and outstanding as of the date of this circular.

The Plan Amendment must be approved by a majority of votes cast in person or by proxy by shareholders at the meeting for it to take effect. The Plan Amendment was conditionally accepted by the Toronto Stock Exchange (TSX) on March 14, 2017, provided that we receive the approval of shareholders and satisfy certain conditions imposed by the TSX, including the filing of evidence of shareholder approval.

9

You can vote FOR or AGAINST the resolution:

RESOLVED THAT:

1. The amendment of the existing amended and restated 2012 employee share purchase plan of Fortis, be and is hereby approved;

2. Fortis is hereby authorized to issue an additional 2,000,000 shares under the plan, which, when combined with the 286,166 shares currently available for issuance, will permit the issuance of a maximum aggregate of 2,286,166 common shares from treasury in accordance with the terms of the second amended and restated 2012 employee share purchase plan, which common shares will be issued as fully paid and non-assessable common shares in the capital of Fortis; and

3. Any officer of Fortis be and is hereby authorized, for and in the name of and on behalf of Fortis, to execute and deliver all such further agreements, instruments, amendments, certificates and other documents and to do all such other acts or things as such officer may determine to be necessary or advisable for the purpose of giving full force and effect to the provisions of this resolution, the execution by such officer and delivery of any such agreement, instrument, amendment, certificate or other document or the doing of any such other act or things being conclusive evidence of such determination.

The board and management recommend that you vote FOR the resolution to approve the amendment of the amended and restated 2012 employee share purchase plan.

Background

Shareholders first approved an employee share purchase plan in 1987, and an amended and restated plan in 1994.

In May 2010, the board adopted an employee share purchase plan that allowed the plan administrator to purchase Fortis common shares on the open market rather than obtaining all the shares from treasury. In 2012, shareholders approved the 2012 ESPP in substantially the current form, subject to certain amendments approved by the board on December 6, 2016 and subsequently accepted by the TSX (the 2016 Plan Amendments). The 2016 Plan Amendments were implemented to facilitate participation by U.S. resident employees of Fortis and its subsidiaries in the plan and did not require the approval of Fortis shareholders under the terms of the 2012 ESPP or the applicable rules of the TSX. See 2016 Amendments to the 2012 ESPP on page 11 for a description of the 2016 Plan Amendments.

Plan status

The table below provides details of the share activity under the plans at the end of 2016:

|

(as at December 31, 2016) |

|

|

|

|

Total number of common shares outstanding under the 2012 ESPP |

|

3,084,063 |

|

|

As a % of the total number of shares issued and outstanding |

|

0.768 |

% |

|

Total number of common shares allocated for issue from treasury under the 2012 ESPP |

|

|

|

|

(while retaining the flexibility to acquire shares in the open market) |

|

2,044,664 |

|

|

Number of shares remaining in the 2012 ESPP reserve |

|

426,526 |

|

The next table provides details of the share activity under the plan as at March 17, 2017:

|

(as at March 17, 2017) |

|

|

|

|

Total number of common shares that have been issued from treasury to employees of Fortis and its subsidiaries |

|

1,758,498 |

|

|

As a percentage of the total number of shares issued and outstanding |

|

0.423 |

% |

|

Total number of common shares available for future issue |

|

286,166 |

|

|

As a percentage of the total number of shares issued and outstanding |

|

0.069 |

% |

|

Number of employees and retirees who are participants in the predecessor plans |

|

3,627 |

|

10

2016 Amendments to the 2012 ESPP

On December 6, 2016 the Board approved the 2016 Plan Amendments to incorporate the following changes to the 2012 ESPP:

· amendments incorporated to limit the ability of certain participants in the 2012 ESPP to receive loans under the plan, reflecting prohibitions imposed by applicable U.S. laws on the ability of Fortis to make loans to certain officers

· amendments to incorporate references to the U.S. Securities Act of 1933, as amended (U.S. Securities Act), as being applicable to the 2012 ESPP in connection with issuances to U.S. residents

· the addition of a new suspension event definition to clarify that the 2012 ESPP may be suspended if required under certain applicable U.S. laws

· a clarification that the rules of a stock exchange other than the TSX could apply to future amendments to the 2012 ESPP

· amendments to reflect the fact that retirees who are U.S. residents are not entitled to continue to participate in the 2012 ESPP following their retirement, and

· the incorporation of certain provisions confirming the tax treatment for participants who are U.S. residents under the U.S. Internal Revenue Code of 1986.

All of these amendments were implemented in compliance with section 19.2 of the plan which permits amendments to be made without shareholder approval. Only the Plan Amendment providing for the issuance of up to an additional 2,000,000 common shares under the 2012 ESPP, and not the 2016 Plan Amendments, requires the approval of shareholders at the meeting. See employee share purchase plan on page 71 for more information and see Appendix B for the complete text of the 2012 Plan, including the proposed amendment and the 2016 Plan Amendments.

6. Other business

We did not receive any shareholder proposals by the deadline of February 4, 2017 and management is not aware of any other matters that may come before the meeting. If an item is properly brought before the meeting, you or your proxyholder can vote on the item as you see fit.

Shareholders who are entitled to vote at the 2018 annual meeting and wish to submit a proposal must make sure that we receive the proposal by February 2, 2018, in accordance with the provisions of the Corporations Act (Newfoundland and Labrador).

11

About the nominated directors

This year 12 people have been nominated to serve on the board. You can read about the nominated directors in the profiles that follow.

Ten of the nominees currently serve on the board, and two have been nominated for the first time: Joseph L. Welch who serves as Chairman of the Board of ITC, which Fortis acquired in October 2016, and Lawrence T. Borgard who was President and Chief Operating Officer of Integrys Energy Group.

All but two of the nominated directors are independent. Mr. Perry is not independent because he is our President and Chief Executive Officer. Mr. Welch is not considered independent under Canadian securities laws because he was President and Chief Executive Officer of ITC until October 31, 2016. He will be considered independent on November 1, 2019.

None of the nominated directors serve together on another unrelated public company board, and none of the nominations involves a contract, arrangement or understanding between a Fortis director or executive officer or any other individual.

None of the nominated directors, or their associates or affiliates, has a direct or indirect material interest (as a beneficial shareholder or in any other way) in any item of business other than the election of directors. As part of the merger agreement between Fortis and ITC, Fortis agreed to nominate Mr. Welch as a director of Fortis for the two annual general meetings following the closing of the acquisition.

A strong and diverse board

100% are financially literate

10 of 12 directors are independent

average tenure 3.9 years

4 directors are female

8 have utility/energy experience

10 have governance and risk management experience

7 have executive compensation experience

100% have senior executive experience

About majority voting

Our majority voting policy requires a nominated director who receives more WITHHELD than FOR votes to tender his or her resignation to the Chair of the board. The governance and nominating committee will consider the offer and make a recommendation to the board.

The board will accept the resignation if there are no exceptional circumstances that would warrant the director continuing to serve on the board as part of its fiduciary duties to Fortis and its shareholders. The director will not participate in the committee’s or the board’s deliberations. The board will make its decision within 90 days of the shareholder meeting and announce it in a media release with an explanation of the reasons for the decision.

The policy does not apply to a contested election of directors, where the number of nominees exceeds the number of directors to be elected, or where proxy materials have been circulated in support of the election of one or more nominees who are not included among the nominees supported by the board.

The board updated the majority voting policy in January 2016.

12

Director profiles

The nominated directors have provided the information below about the Fortis shares or deferred share units (DSUs) they own, or exercise control or direction over, directly or indirectly. You can read more about their equity ownership on page 40. We calculated the market value of their holdings using the closing price of our common shares on the TSX: $39.01 on March 18, 2016 and $42.84 on March 17, 2017.

Douglas J. Haughey

Calgary, Alberta, Canada

Corporate director

Chair of the board since September 2016

Director since May 2009

Age 60

Independent

Skills and experience

· Finance / Accounting

· Utility / Energy

· Senior executive

· Executive compensation

· Governance and risk management

· Mergers and acquisitions

From August 2012 through May 2013, Mr. Haughey was Chief Executive Officer of The Churchill Corporation, a commercial construction and industrial services company focused on the western Canadian market. From 2010 through its successful sale to Pembina Pipeline in April 2012, he served as President and Chief Executive Officer of Provident Energy Ltd., an owner/operator of natural gas liquids midstream facilities. From 1999 through 2008, Mr. Haughey held several executive roles with Spectra Energy and predecessor companies. He had overall responsibility for its western Canadian natural gas midstream business, was President and Chief Executive Officer of Spectra Energy Income Fund and also led Spectra’s strategic development and mergers and acquisitions teams based in Houston, Texas.

Mr. Haughey graduated from the University of Regina with a Bachelor of Administration and from the University of Calgary with an MBA. He holds an ICD.D designation from the Institute of Corporate Directors.

Mr. Haughey was appointed Chair of the board in September 2016 and serves on all board committees. He served as chair of the human resources committee from March 2, 2015 through September 1, 2016. He served on the board of directors of FortisAlberta and served as its Chair from 2013 to February 2016.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.57% votes for |

|

Board of directors (Chair) |

|

16 of 16 |

|

100 |

% |

|

0.43% votes withheld |

|

Audit |

|

12 of 12 |

|

100 |

% |

|

|

|

Human resources |

|

7 of 7 |

|

100 |

% |

|

|

|

Governance and nominating |

|

3 of 3 |

(1) |

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

10,000 |

|

20,550 |

|

$ |

1,308,762 |

|

yes (3.6x) |

|

|

2016 |

|

10,000 |

|

16,559 |

|

$ |

1,036,067 |

|

|

|

|

Change |

|

— |

|

3,991 |

|

$ |

272,695 |

|

|

|

Other unrelated public company directorships during the last five years

Keyera Corporation (Lead Director, Compensation and Governance)

(1) Mr. Haughey attended all committee meetings since joining the committee in September 2016.

13

Tracey C. Ball

Edmonton, Alberta, Canada

Corporate director

Director since May 2014

Age 59

Independent

Skills and experience

· Finance / Accounting

· Capital markets

· Senior executive

· Governance and risk management

· Legal / Regulatory

Ms. Ball retired in September 2014 as Executive Vice President and Chief Financial Officer of Canadian Western Bank Group. Prior to joining a predecessor to Canadian Western Bank Group in 1987, she worked in public accounting and consulting. Ms. Ball has served on several private and public sector boards, including the Province of Alberta Audit Committee and the Financial Executives Institute of Canada.

Ms. Ball graduated from Simon Fraser University with a Bachelor of Arts (Commerce). She is a member of the Canadian Chartered Professional Accountants of Canada, the Institute of Chartered Accountants of Alberta, and the Association of Chartered Professional Accountants of British Columbia. Ms. Ball was elected as a Fellow of the Institute of Chartered Accountants of Alberta in 2007. She holds an ICD.D designation from the Institute of Corporate Directors.

Ms. Ball was appointed to the audit committee on May 14, 2014. Ms. Ball serves as Chair of the board of FortisAlberta.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.82% votes for |

|

Board of directors |

|

15 of 16 |

(1) |

94 |

% |

|

0.18% votes withheld |

|

Audit |

|

12 of 12 |

|

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

4,950 |

|

10,227 |

|

$ |

650,183 |

|

yes (3.9x) |

|

|

2016 |

|

4,950 |

|

7,284 |

|

$ |

477,248 |

|

|

|

|

Change |

|

— |

|

2,943 |

|

$ |

172,935 |

|

|

|

Other unrelated public company directorships during the last five years

—

(1) Ms. Ball was unable to attend one board meeting by teleconference because of technical difficulties.

14

Pierre J. Blouin

Ile Bizard, Quebec, Canada

Corporate director

Director since May 2015

Age 59

Independent

Skills and experience

· Finance / Accounting

· Capital markets

· Utility / Energy

· Public policy and government relations

· Senior executive

· Executive compensation

· Governance and risk management

· Legal / Regulatory

· Mergers and acquisitions

· Technology

Mr. Blouin served as the Chief Executive Officer of Manitoba Telecom Services, Inc. until his retirement in December 2014. Prior to joining Manitoba Telecom Services, Inc. as its Chief Executive Officer in 2005, Mr. Blouin held various executive positions in the Bell Canada Enterprises group of companies, including Group President, Consumer Markets for Bell Canada, Chief Executive Officer of BCE Emergis, Inc. and Chief Executive Officer of Bell Mobility.

Mr. Blouin graduated from Hautes Etudes Commerciales with a Bachelor of Commerce in Business Administration. He is a Fellow of the Purchasing Management Association of Canada.

Mr. Blouin was appointed to the human resources committee on May 7, 2015 and the governance and nominating committee on May 5, 2016.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.51%votes for |

|

Board of directors |

|

16 of 16 |

|

100 |

% |

|

0.49%votes withheld |

|

Human resources |

|

7 of 7 |

|

100 |

% |

|

|

|

Governance and nominating |

|

4 of 4 |

(1) |

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

2,380 |

|

7,192 |

|

$ |

410,064 |

|

Has until May 2020 to meet the guideline |

|

|

2016 |

|

2,380 |

|

3,294 |

|

$ |

221,343 |

|

|

|

Change |

|

— |

|

3,899 |

|

$ |

188,721 |

|

|

Other unrelated public company directorships during the last five years

National Bank of Canada (Human Resources Committee)

Manitoba Telecom Services Inc.

(1) Mr. Blouin attended all committee meetings since joining the committee in May 2016.

15

Lawrence T. Borgard

Naples, Florida, USA

Corporate director

New nominee

Age 55

Independent

Skills and experience

· Capital markets

· Utility / Energy

· Senior executive

· Executive compensation

· International business

· Mergers and acquisitions

Mr. Borgard is the former President and Chief Operating Officer of Integrys Energy Group and the Chief Executive Officer of each of Integrys’ six regulated electric and natural gas utilities. Mr. Borgard retired in 2015, following the successful sale of Integrys. Prior to serving as President at Integrys, Mr. Borgard served in a variety of executive roles.

Mr. Borgard graduated from Michigan State University with a Bachelor of Science (Electrical Engineering) and the University of Wisconsin-Oshkosh with an MBA. He also attended the Advanced Management Program at Harvard University Business School.

2016 Board and committee attendance

Fortis securities held (as at March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

— |

|

— |

|

— |

|

If elected, will have until May 2022 to meet the guideline |

|

Other unrelated public company directorships during the last five years

—

16

Maura J. Clark

New York, New York, USA

Corporate director

Director since May 2015

Age 58

Independent

Skills and experience

· Finance / Accounting

· Capital markets

· Utility / Energy

· Senior executive

· Governance and risk management

· International business

· Legal / Regulatory

· Mergers and acquisitions

Ms. Clark retired from Direct Energy, a subsidiary of Centrica plc, in March 2014 where she was President of Direct Energy Business, a leading energy retailer in Canada and the United States. Previously, Ms. Clark was Executive Vice President of North American Strategy and Mergers and Acquisitions for Direct Energy. Ms. Clark’s prior experience includes investment banking and serving as Chief Financial Officer of an independent oil refining and marketing company.

Ms. Clark graduated from Queen’s University with a Bachelor of Arts in Economics. She is a member of the Association of Chartered Professional Accountants of Ontario.

Ms. Clark was appointed to the audit committee on May 7, 2015 and the governance and nominating committee on May 5, 2016.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.76% votes for |

|

Board of directors |

|

16 of 16 |

|

100 |

% |

|

0.24% votes withheld |

|

Audit |

|

12 of 12 |

|

100 |

% |

|

|

|

Governance and nominating |

|

4 of 4 |

(1) |

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

— |

|

4,862 |

|

$ |

208,288 |

|

Has until May 2020 to meet the guideline |

|

|

2016 |

|

— |

|

2,115 |

|

$ |

82,506 |

|

|

|

Change |

|

— |

|

2,747 |

|

$ |

125,782 |

|

|

Other unrelated public company directorships during the last five years

Elizabeth Arden, Inc. (Audit (Chair), Nominating and Corporate Governance)

Agrium Inc.

(1) Ms. Clark attended all committee meetings since joining the committee in May 2016.

17

Margarita K. Dilley

Washington, D.C., USA

Corporate director

Director since May 2016

Age 59

Independent

Skills and experience

· Finance / Accounting

· Capital markets

· Utility / Energy

· Senior executive

· Governance and risk management

· International business

· Mergers and acquisitions

· Technology

Ms. Dilley retired from ASTROLINK International LLC in 2004, an international wireless broadband telecommunications company, where she was Vice President and Chief Financial Officer. Ms. Dilley’s prior experience includes serving as Director, Strategy & Corporate Development and Treasurer for Intelsat.

Ms. Dilley graduated from Cornell University with a Bachelor of Arts, from Columbia University with a Master of Arts and from Wharton Graduate School, University of Pennsylvania with an MBA.

Ms. Dilley serves as the Chair of the board of CH Energy Group. Ms. Dilley was appointed to the audit committee on May 5, 2016.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.76% votes for |

|

Board of directors |

|

9 of 9 |

(1) |

100 |

% |

|

0.24% votes withheld |

|

Audit |

|

8 of 8 |

(2) |

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

— |

|

2,712 |

|

$ |

116,182 |

|

Has until May 2021 to meet the guideline |

|

|

2016 |

|

— |

|

— |

|

— |

|

|

|

Change |

|

— |

|

2,712 |

|

$ |

116,182 |

|

|

Other unrelated public company directorships during the last five years

—

(1) Ms. Dilley attended all of the board meetings since joining the board in May 2016.

(2) Ms. Dilley attended all committee meetings since joining the committee in May 2016.

18

Ida J. Goodreau

Vancouver, British Columbia, Canada

Corporate director

Director since May 2009

Age 65

Independent

Skills and experience

· Finance / Accounting

· Utility / Energy

· Senior executive

· Executive compensation

· Governance and risk management

· International business

· Mergers and acquisitions

Ms. Goodreau is past President and Chief Executive Officer of LifeLabs. Prior to joining LifeLabs in March 2009, Ms. Goodreau served as President and Chief Executive Officer of the Vancouver Coastal Health Authority from 2002. She has held senior leadership roles in several Canadian and international pulp and paper and natural gas companies.

Ms. Goodreau graduated from the University of Windsor with a Bachelor of Commerce, Honours, and an MBA, and from the University of Western Ontario with a Bachelor of Arts (English and Economics).

Ms. Goodreau was appointed chair of the human resources committee on September 1, 2016 and serves on the governance and nominating committee. She serves as a director of FortisBC Energy and FortisBC and will serve as Chair of those companies beginning April 1, 2017.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.47% votes for |

|

Board of directors |

|

16 of 16 |

|

100 |

% |

|

0.53% votes withheld |

|

Human resources (Chair) |

|

7 of 7 |

|

100 |

% |

|

|

|

Governance and nominating |

|

5 of 5 |

|

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

— |

|

28,684 |

|

$ |

1,228,823 |

|

yes (6.8x) |

|

|

2016 |

|

— |

|

25,068 |

|

$ |

977,903 |

|

|

|

|

Change |

|

— |

|

3,616 |

|

$ |

250,920 |

|

|

|

Other unrelated public company directorships during the last five years

—

19

R. Harry McWatters

Summerland, British Columbia, Canada

President, Vintage Consulting Group Inc.

Director since May 2007

Age 71

Independent

Skills and experience

· Public policy and government relations

· Senior executive

· Governance and risk management

Mr. McWatters is President of Vintage Consulting Group Inc., Harry McWatters Inc. and Encore Vineyards Ltd., all of which are engaged in various aspects of the British Columbia wine industry. He is the founder and past President of Sumac Ridge Estate Wine Group.

Mr. McWatters serves on the governance and nominating committee. He is a former director of FortisBC Holdings and FortisBC, where he served as Chair from 2006 through 2010.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.62% votes for |

|

Board of directors |

|

16 of 16 |

|

100 |

% |

|

0.38% votes withheld |

|

Governance and nominating |

|

5 of 5 |

|

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

1,100 |

|

33,146 |

|

$ |

1,467,099 |

|

yes (8.9x) |

|

|

2016 |

|

1,100 |

|

29,367 |

|

$ |

1,188,518 |

|

|

|

|

Change |

|

— |

|

3,779 |

|

$ |

278,581 |

|

|

|

Other unrelated public company directorships during the last five years

—

20

Ronald D. Munkley

Mississauga, Ontario, Canada

Corporate director

Director since May 2009

Age 71

Independent

Skills and experience

· Finance / Accounting

· Capital markets

· Utility / Energy

· Senior executive

· Executive compensation

· Governance and risk management

· Legal / Regulatory

· Mergers and acquisitions

Mr. Munkley retired in April 2009 as Vice Chairman and Head of the Power and Utility Business of CIBC World Markets. While there he acted as lead advisor on over 175 capital markets and strategic and advisory assignments for North American Utility clients. Prior to that he was Chief Operating Officer at Enbridge Inc. and Chairman of Enbridge Consumer Gas. Previously he was President and CEO of Consumer Gas where he led the company through deregulation and restructuring in the 1990s.

Mr. Munkley graduated from Queen’s University with a Bachelor of Science (Chemical Engineering), Honours. He is a professional engineer and has completed the Executive and Senior Executive Programs of the University of Western Ontario and the Partners, Directors and Senior Officers Certificate of the Canadian Securities Institute.

Mr. Munkley was appointed chair of the governance and nominating committee in May 2014 and also serves on the human resources committee.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.51% votes for |

|

Board of directors |

|

16 of 16 |

|

100 |

% |

|

0.49% votes withheld |

|

Human resources |

|

7 of 7 |

|

100 |

% |

|

|

|

Governance and nominating (Chair) |

|

5 of 5 |

|

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

12,000 |

|

19,853 |

|

$ |

1,364,583 |

|

yes (7.6x) |

|

|

2016 |

|

12,000 |

|

16,559 |

|

$ |

1,114,087 |

|

|

|

|

Change |

|

— |

|

3,294 |

|

$ |

250,496 |

|

|

|

Other unrelated public company directorships during the last five years

Bird Construction Inc. (Audit, Personnel and Safety)

21

Barry V. Perry

St. John’s, Newfoundland and Labrador, Canada

President and Chief Executive Officer, Fortis Inc.

Director since January 2015

Age 52

Not independent

Mr. Perry is President and Chief Executive Officer of Fortis. Prior to his current position at Fortis, Mr. Perry served as President from June 30, 2014 to December 31, 2014 and prior to that served as Vice President, Finance and Chief Financial Officer since 2004. Mr. Perry joined the Fortis organization in 2000 as Vice President, Finance and Chief Financial Officer of Newfoundland Power.

He graduated from Memorial University with a Bachelor of Commerce and is a member of the Association of Chartered Professional Accountants of Newfoundland and Labrador.

Mr. Perry serves as a director of Fortis utility subsidiaries FortisBC Energy, FortisBC, UNS Energy and ITC.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.80% votes for |

|

Board of directors |

|

16 of 16 |

|

100 |

% |

|

0.20% votes withheld |

|

|

|

|

|

|

|

Fortis securities held (as at March 18, 2016 and March 17, 2017)(1)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets executive share

ownership target |

|

|

2017 |

|

245,223 |

|

— |

|

$ |

10,505,353 |

|

yes (9.6x) |

|

|

2016 |

|

191,122 |

|

— |

|

$ |

7,455,669 |

|

|

|

|

Change |

|

54,101 |

|

— |

|

$ |

3,049,684 |

|

|

|

Other unrelated public company directorships during the last five years

—

(1) Options are granted to Mr. Perry as part of his compensation as President and Chief Executive Officer of Fortis (see page 79). Mr. Perry does not receive director compensation as a member of the Fortis board.

22

Joseph L. Welch

Long Beach Key, Florida, USA

Corporate director

New nominee

Age 68

Not independent

Skills and experience

· Capital markets

· Utility / Energy

· Public policy and government relations

· Senior executive

· Executive compensation

· Governance and risk management

· International business

· Mergers and acquisitions

· Technology

Mr. Welch serves as Chairman of the Board of ITC. He retired as President and Chief Executive Officer of ITC effective October 31, 2016 following its acquisition by Fortis.

He began his career in the utility business in 1971, established ITCTransmission in Michigan as a stand-alone entity from its parent corporation in 2003, and subsequently led ITC’s growth into the largest independent electric transmission company in the United States.

Mr. Welch graduated from the University of Kansas with a Bachelor of Science (Electrical Engineering). He is a licensed professional engineer in the state of Michigan.

Mr. Welch has served as Chairman of the Board of ITC since 2008.

2016 Board and committee attendance

Fortis securities held (as at March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

1,712,392 |

|

— |

|

$ |

73,358,873 |

|

yes (444.6x) |

|

|

|

|

|

|

|

|

|

|

|

|

Other unrelated public company directorships during the last five years

—

23

Jo Mark Zurel

St. John’s, Newfoundland and Labrador, Canada

President, Stonebridge Capital Inc.

Director since May 2016

Age 53

Independent

Skills and experience

· Finance / Accounting

· Capital markets

· Senior executive

· Executive compensation

· Governance and risk management

· International business

· Mergers and acquisitions

Mr. Zurel is President of Stonebridge Capital Inc., a private investment company, and a corporate director. From 1998 to 2006, Mr. Zurel was Senior Vice-President and Chief Financial Officer of CHC Helicopter Corporation. Mr. Zurel has served on several private and public sector boards, including Major Drilling Group International Inc., the Canada Pension Plan Investment Board and Fronteer Gold Inc. He also serves on the boards of a private company and several not-for-profit organizations.

Mr. Zurel graduated from Dalhousie University with a Bachelor of Commerce. He is a Fellow of the Association of Chartered Professional Accountants of Newfoundland and Labrador. He holds an ICD.D designation from the Institute

of Corporate Directors.

Mr. Zurel was appointed to the human resources committee on May 5, 2016. He has served as a director of Newfoundland Power Inc. since 2008 and served as Chair of that board from 2012 until July 2016.

|

2016 Voting results |

|

2016 Board and committee attendance |

|

|

99.70% votes for |

|

Board of directors |

|

9 of 9 |

(1) |

100 |

% |

|

0.30% votes withheld |

|

Human resources |

|

3 of 3 |

(2) |

100 |

% |

Fortis securities held (as at March 18, 2016 and March 17, 2017)

|

Year |

|

Common

shares (#) |

|

Deferred share

units (DSUs) (#) |

|

Market

value ($) |

|

Meets share

ownership target |

|

|

2017 |

|

9,949 |

|

1,991 |

|

$ |

511,509 |

|

yes (3.1x) |

|

|

2016 |

|

9,949 |

|

— |

|

$ |

388,110 |

|

|

|

|

Change |

|

— |

|

1,991 |

|

$ |

123,399 |

|

|

|

Other unrelated public company directorships during the last five years

Highland Copper Company Inc. (Audit (Chair), Compensation)

Major Drilling Group International Inc. (Audit (Chair), Compensation)

(1) Mr. Zurel attended all board meetings since joining the board in May 2016.

(2) Mr. Zurel attended all committee meetings since joining the committee in May 2016.

24

Additional information about the directors

2016 Meeting attendance

We expect directors to attend all of the regularly scheduled board and committee meetings and the annual meeting of shareholders, and ideally any special meetings. Directors can attend by teleconference if they are unable to attend in person.

The table below is a summary of the 2016 meeting attendance.

|

|

|

Number of meetings |

|

Overall meeting attendance |

|

|

Board |

|

16 |

|

97 |

% |

|

Audit committee |

|

12 |

|

100 |

% |

|

Human resources committee |

|

7 |

|

100 |

% |

|

Governance and nominating committee |

|

5 |

|

100 |

% |

|

Total number of meetings held |

|

40 |

|

98 |

% |

In 2016 there were more audit committee and board meetings than usual, largely related to the acquisition of ITC and related financing.

The next table summarizes the number of board and committee meetings attended by each non-executive director in 2016. You can see each director’s individual attendance record in the profiles beginning on page 13.

|

|

|

Board meetings |

|

Committee meetings |

|

Total board and committee meetings |

|

|

Tracey C. Ball |

|

15 of 16 |

|

94 |

% |

12 of 12 |

|

100 |

% |

27 of 28 |

|

96 |

% |

|

Pierre J. Blouin |

|

16 of 16 |

|

100 |

% |

11 of 11 |

|

100 |

% |

27 of 27 |

|

100 |

% |

|

Maura J. Clark |

|

16 of 16 |

|

100 |

% |

16 of 16 |

|

100 |

% |

32 of 32 |

|

100 |

% |

|

Margarita K. Dilley |

|

9 of 9 |

|

100 |

% |

8 of 8 |

|

100 |

% |

17 of 17 |

|

100 |

% |

|

Ida J. Goodreau |

|

16 of 16 |

|

100 |

% |

12 of 12 |

|

100 |

% |

28 of 28 |

|

100 |

% |

|

Douglas J. Haughey |

|

16 of 16 |

|

100 |

% |

22 of 22 |

|

100 |

% |

38 of 38 |

|

100 |

% |

|

R. Harry McWatters |

|

16 of 16 |

|

100 |

% |

5 of 5 |

|

100 |

% |

21 of 21 |

|

100 |

% |

|

Ronald D. Munkley |

|

16 of 16 |

|

100 |

% |

12 of 12 |

|

100 |

% |

28 of 28 |

|

100 |

% |

|

Jo Mark Zurel |

|

9 of 9 |

|

100 |

% |

3 of 3 |

|

100 |

% |

12 of 12 |

|

100 |

% |

|

Directors not standing for re-election |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paul J. Bonavia (1) |

|

0 of 4 |

|

— |

|

— |

|

— |

|

0 of 4 |

|

— |

|

|

Peter E. Case |

|

16 of 16 |

|

100 |

% |

17 of 17 |

|

100 |

% |

33 of 33 |

|

100 |

% |

|

David G. Norris |

|

16 of 16 |

|

100 |

% |

24 of 24 |

|

100 |

% |

40 of 40 |

|

100 |

% |

(1) Mr. Bonavia did not attend meetings in January and February 2016 to avoid a potential conflict of interest regarding the ITC acquisition and another entity of which he was a member of the board of directors. He resigned from our board on February 8, 2016 to remain in compliance with the rules of the other entity. He was not a member of any board committee because he was not considered independent.

25

2016 Director compensation

|

|

|

Fees earned (1) |

|

Share-based awards

(DSUs) (2) |

|

All other

compensation (3) |

|

Total |

|

|

Tracey C. Ball (includes FortisAlberta) |

|

$ |

100,500 |

|

$ |

105,000 |

|

$ |

83,210 |

|

$ |

288,710 |

|

|

Pierre J. Blouin |

|

$ |

40,500 |

|

$ |

165,000 |

|

$ |

7,532 |

|

$ |

213,032 |

|

|

Paul J. Bonavia |

|

— |

|

$ |

41,250 |

|

$ |

5,186 |

|

$ |

46,436 |

|

|

Peter E. Case |

|

$ |

129,500 |

|

$ |

105,000 |

|

$ |

36,006 |

|

$ |

270,506 |

|

|

Maura J. Clark |

|

$ |

143,382 |

|

$ |

105,000 |

|

$ |

4,823 |

|

$ |

253,205 |

|

|

Margarita K. Dilley (includes CH Energy Group) |

|

$ |

43,732 |

|

$ |

82,500 |

|

$ |

107,134 |

|

$ |

233,366 |

|

|

Ida J. Goodreau (includes FortisBC) |

|

$ |

106,973 |

|

$ |