SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2017

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant’s name into English)

Avenida

República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

Annual General Meeting and

Extraordinary General

Meeting

MANUAL FOR SHAREHOLDER`S PARTICIPATION

April 27th, 2017

INDEX

Comments from the Chairman, Board of

Directors 3

Comments from the CEO 6

Invitation 9

Notice of Meeting 13

Information to Vote by Power Attorney using Electronic Platform 18

Information to Vote by Distance Voting Form 20

Annex I – Distance Voting

Form 23

Public Power of Attorney Request 28

Assessment of the requirements

and legal and statutory impediments for nomination

of Petrobras’s fiscal council member

29

Annex I – Registration Form for Fiscal Council Board Member 30

Items to be discussed in the Ordinary General Meeting (OGM):

I. To analyze management

accounts, discuss and vote Report, Financial

Statements and Fiscal Board’s Report of Fiscal Year of 2016

Note: Annex 9.1-II of CVM Instruction 481/09 was not presented, in to calculate the loss in the fiscal year 2016.

37

II. Election of 5 Members to the Fiscal Council and their respective alternates 38

Appendix I - Information concerning the members nominated to the Fiscal

Council

39

Appendix II - Information concerning the members nominated by non- controlling shareholders to the Fiscal Council

44

III. Establishment of the Compensation of Management and Effective Members of the Fiscal

Council

54

Appendix I - Information on Item 13 of the “Formulário

de Referência”, complying with Art. 12 of the Brazilian Securities and Exchange Commission (“CVM”) Instruction Nº 481/09

55

Appendix II – Management comments about Petrobras financial position 87

Appendix III -

Information on Item 5.3 of the “Formulário de Referência” 171

Items to be discussed in the Extraordinary General Meeting (EGM):

I. Amendment proposal of Petrobras’s By-Law: 183

a. Annex I – Proposals of

Petrobras’s By-Law changes 187

b. Annex II – Proposals changes 207

II. Consolidation of Petrobras’s By-Law to reflect the approved changes; 223

a. Annex I – Petrobras’s By-Law after changes 224

III. Proposal for Inclusion, in

the Policy for Indication of Members of the Fiscal

Council, Board of Directors and Executive Board of Petrobras, of additional requirements for unblemished

reputation, in addition to those contained in

Law 13,303/16, and Decree 8.945/16, pursuant to Article 40, Item XIII of

Petrobras’ Bylaws. 245

Annex I - Additional requirements to be included in the policy of

members

of the fiscal council, board of directors and executive board.

246

MESSAGE FROM THE BOARD OF DIRECTORS CHAIRMAM

Dear

shareholders, employees and business partners of PETROBRAS This message has two major purposes.

The first is to be the first Message from the Board of Directors,

through its current

Chairmam, at the end of the first year of full term.

This

Chairmam was initially held throughout 2015 on an interim basis, subsequently replacing its full holder, who firstly took a leave and then resigned over the course of the term in duty.

Once this cycle of temporariness and replacement was completed in April 2016, the Board was mandated by shareholders for a full period of 02 (two) years, ending in April 2018, and

over the course of its first year in duty, it faced the replacement of the Chairman of the Executive Board.

As Mr. Pedro Parente was indicated to be the new

President by the controlling shareholder and was submitted to the same integrity background check, in which he was approved, he was nominated by the Board. Since then, a partnership was established with the presidency and the Executive Board, which

has undertaken a fruitful, constructive interaction, continuing the high-level work already developed under the presidency of Mr. Aldemir Bendine.

As soon as he

was sworn in, President Pedro Parente took among other initiatives the decision to carry out a cycle of debates focused on an in-depth review of the Strategic Planning of PETROBRAS; such initiative was fully supported by the Board of Directors,

which endorsed and supported the election of 2 (two) main goals under this new Plan, namely:

seek a considerable reduction of accidents in our facilities and our

activities – thus signaling the larger goal of preserving life and pursuing safe working conditions. Our targets in this regard are ambitious, seeking a dramatic reduction of personal incidents per million hours worked, what has been achieved

with much training, intensive improvement of process safety and awareness, and

to significantly reduce the company’s debt and the financial leveraging. We are

not proud to flaunt the largest corporate debt in the oil and gas sector on the planet.

Incidentally, it was recognized that the debt reached overly high levels

and repairing measures were required - such as envisaged in the Strategic Plan - to refocus them to a most suitable level to Petrobras’ businesses. As it has already been stated by President Pedro Parente, to achieve the commitment to invest in

our core business – oil extraction and fuel industrialization – disinvestment in activities that are not directly related to it is not a choice between valid alternatives, it is a necessity – it is one of the main ways to ensure

through active portfolio management the resources necessary to deliver the production curve we are capable – and obliged – to offer the market.

Another

key ingredient to ensure the cash flow that will enable us to invest in our core activities consists of technological, exploration, production, and/or financial partnerships.

The second main purpose of this message concerns the formal record of the changes in company Governance, of which the current Board is particularly proud. Let it be said first

that, since practically the creation of PETROBRAS in the 1950s, the current Board is the first

one composed SOLELY of Members with no relations to any government agencies.

Additionally, care has been taken in 2015, and the principle was preserved in 2016, to compose a multidisciplinary Board – legal operators are present, financial reporting

experts are present, accounting and auditing are present, investors are present, there is a

representative elected by the employees, there is an expert in oil,

gas, and deep water, all facets of the life of the company, ultimately, count on experts and representatives in the Board.

Immediately in 2015, once sworn in, the

Board incorporated or reinforced the mission and the Internal Rules of 5 (five) Advisory Committees to the Board itself:

an Auditing Committee, which over 2016

became Statutory, in compliance with the corresponding requirements from Comissão de Valores Mobiliários – CVM (the Securities and Exchange Commission of Brazil) and the Securities and Exchange Commission – SEC, USA;

a Strategic Affairs Committee;

a Finance Committee;

a Committee on Nomination, Compensation, and Succession; and a Health, Safety, and Environment Committee.

More recently, a Minority Shareholders Committee was incorporated, which has the duty and

prerogative to speak in advance on the care of company interests in the main transaction proposals with parties related to the Federal Government, its Autachies

and Foundations,

that are within the Board’s level of authority.

Each of

these Committees is headed by a member of the Board of Directors. The Statutory Audit Committee is composed only by members of the Board of Directors. In the other Committees, non-Board members who have knowledge and expertise in matters within the

scope of each Committee participate. To give an insight into the intensity of Committee operation, perhaps it should be said that in 2016 the Statutory Audit Committee met 29 (twenty-nine) times, the Committee on Nomination, Compensation, and

Succession met 32 (thirty-two) times, the Health, Safety, and Environment Committee met 13 (thirteen) times, the Finance Committee met 26 (twenty-six) times and the Strategic Committee met 21 (twenty-one) times. All this alongside 47 (forty-seven)

Board of Directors meetings, between Ordinary and Extraordinary meetings.

The Whistleblowing Channel was enormously improved, and background checks of suppliers

are in the thousands; both vetoes to the nomination of persons with inappropriate curricula for positions with decision-making authority, and suppliers from which we demand change in stances for a better governance, have been frequent.

It is our duty in rendering accounts of this nature to also face specific challenges. Two of them are worthy of record:

on the one hand, extended periods to operationalize divestments will be the direct effect of the vital decision to abide by the orders to improve transparency in the corresponding

processes, issued by competent authorities;

on the other hand, the discussions with the DoJ – the United States Department of Justice, later with the SEC and

our defense in Class Actions, in addition to several procedures before Brazilian authorities (CVM, TCU, Prosecutor’s Office, the Judiciary Branch) will only ensure final results once such cases are closed, although Petrobras is

a victim in this process and at no time benefited directly or indirectly from the illicit

acts.

As I said in the beginning, this is the start of an “accountability” report in

this first year of the current mandate.

And if we can summarize the understanding of our Mission beyond the safety of human life and the return to investment

grade, perhaps the best expression of our task is to contribute to recovering the self-esteem of employees, investors and Brazilians in their largest company, which we all want to be once again their best one.

Nelson Carvalho

Chairman, Board of Directors

MESSAGE FROM THE CEO

Dear Shareholders and

investors,

I present my first message as CEO of Petrobras to our shareholders and investors with the sense of the immense responsibility of leading the Executive

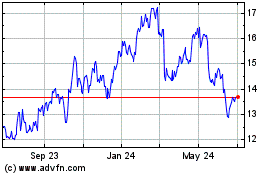

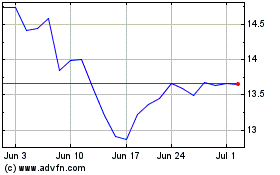

Board of the largest company in the heart of the Brazilians, and which today is among the four largest companies in Brazil in terms of market value, in full recovery.

The global oil and gas industry faced the second year of an extremely adverse context, which began with the abrupt drop in oil prices in the last quarter of 2014, when barrel price

departed from a US$ 100 level to a value lower than US$ 35 in early 2016. More recently, those prices fluctuate in a range between US$ 45 and US$ 55 per barrel. The industry had to adapt to this new reality of prices by selling assets and by

reducing investments and costs. An important aspect of this new competitive framework was the consolidation of the so- called unconventional oil and gas production (shale and tight oil/gas), which represents a disruptive change in the way to explore

and produce hydrocarbons and imposes great challenges to players of the so-called conventional production, including Petrobras.

This scenario, by itself is

challenging and found Petrobras in the midst of the biggest crisis in its history. The synthesis of these problems is the size of our gross debt, which reached the expressive amount of US$ 126 billion (R$ 493 billion) at the end of 2015. This is the

largest debt of non-financial entities in the country, except for the Federal Government’s debt. It is also the largest debt among global public companies operating in our industry. Those are not honorable positions and our strategic goal is to

reverse this situation.

Over 2016, we announced and implemented the necessary measures to deal with the numerous problems left as an inheritance of this crisis.

The Partnership and Divestment Program, which initiated a new cycle in 2015, had its pace accelerated in August. In September, we announced a new Strategic Plan and the corresponding Business and Management plan for the 2017 to 2021 period, with two

priority metrics. The first metric is related to safety, in which we defined that by 2018 we’ll limit our Recordable Injury Index (TAR) to 1.4 accidents per million hours worked. The second metric is related to our debt, as measured by the

ratio between net debt and EBITDA (a proxy of operating cash generation). This ratio has reached by the end of 2015 an index of 5.1 times, very high considering both the circumstances of the Brazilian market, and the comparison against large

international companies in the oil and gas sector. The strategic plan provides for the reduction of the net debt/EBITDA ratio to 2.5 times by the end of 2018.

In

our strategic plan, we clearly define the vision of the company we want to be: an integrated energy company, focusing on oil and gas, that evolves together with society, generates high value and has unique technical capability. We objectively

indicate with this vision and the 21 resulting strategies, where we’ll work and, with unprecedented clarity and transparency, where we’re not working.

The plan defined five levers to ensure we achieve our top metrics. The first is the “Commitment to Life” plan, which seeks to strengthen the behavioral

and safety aspects of processes to enable achieving our safety metric.

The four other pillars are integrated to allow the reduction of our debt: (1) a new pricing

policy for gasoline and diesel, based on international parity and the definition that at no time will we charge prices below international parity; (2) greater efficiency in our

investments (CAPEX), translating into a reduction in our investments with an increase in our

production; (3) reducing our costs, also without adversely affecting

our safety and our production goals; and (4) partnerships and divestments in transactions totaling US$21 billion in the 2017/18 biennium.

The 2016 results show

advances on all fronts. The number of recordable accidents per million man-hours was reduced by 24%, reaching the 1.63 index, which was only expected by the end of 2017. We generated positive free cash flow in every quarter of the year, totaling

7 consecutive quarters. Operating profit was R$17 billion in 2016, with an 16% increase in adjusted EBITDA, which represents the highest EBITDA margin among the

main players in the sector. The ration between our net debt and our adjusted EBITDA was reduced by 31%, from

5.11 times to 3.54 times.

We implemented the new pricing policy on October 2016. The company’s revenue began to follow international market dynamics, with revisions carried out at intervals no greater

than

30 days. Today there is growing naturalness in the way that markets and other external audiences receive these monthly revisions, consolidating the

implementation of this new policy.

Over 2016, we became more efficient in the production and exploration of oil and gas. For the second consecutive year, we were

able to achieve our oil production target, registering several records. Average production in Brazil reached the level of 2.144 million barrels per day. We highlight the 1.02 million barrels of oil per day mark in pre-salt layer-operated production,

where we prioritize our investments and gather knowledge and experience able to provide a relevant increase in productivity. When we include gas, our total production in Brazil and abroad reach the expressive mark of 2.79 million barrels of oil

equivalent per day.

Partnerships and divestments have gained new impulse, and the announced transactions reached an amount of US$ 13.6 billion in December 2016. In

addition to being essential for the financial recovery of the company, the strategic partnerships offer the opportunity of broad relationship with global companies, sharing risks, unburdening investments, promoting technological exchanges and

strengthening corporate governance. With partnerships, we are more competitive to cope with industry challenges.

The relationship between the Executive Board and

our Board of Directors merits special highlight. As an oversight body, the Board has diligently fulfilled its statutory duties, as presented in the message from its chairman. Together with the Board of Directors, we have enhanced the company’s

governance, improving internal controls, decision-making processes and the policy on management succession. With this cooperation, we are better qualified to deal with the challenge of getting Petrobras out of the financial and reputational crisis

in which it was placed in the recent past.

It is essential to register the contribution of our workforce for these progresses. The dedication and technical

competence of Petrobras employees have turned the company into a world reference, especially in deep-water exploration and production. These same attributes are needed now to overcome the challenges we face.

I send a special message to our shareholders. The company’s results in 2016 unfortunately

did not allow us to pay dividends as we’d like. But, under the concept of overall return to shareholders, which includes the variation in market value of our shares, we were

the company that offered highest returns in 2016 in the oil and gas sector. We know that this

result is due, to a large extent, to the confidence of our

shareholders and investors in our ability to deliver what we promised in our Strategic Plan. We’ll work in 2017 with redoubled force to match that trust.

Pedro Parente

CEO

INVITATION

Date: April 27, 2017

Time: 3 pm

Address: Auditorium of the Company’s headquarter at Avenida República do

Chile 65, 1st floor, in the city of Rio de Janeiro

Agenda items:

Annual General Meeting

|

I.

|

To analyze management accounts, examine, discuss and vote on the Management

Report and the Company’s Financial Statements, together with the report of the independent auditors and the Fiscal Council’s Report, for the fiscal year ended December 31, 2016;

|

II. Election of 5 (five) members for Fiscal Council, among which 1 (one) is

appointed

by the minority shareholders and one (1) by preferred shareholders, both through the separate election process, and their respective alternates; and

III.

Establishment of the financial compensation of Directors, members of the Fiscal Council and members of the Statutory Advisory Committees to the Board of Directors.

Extraordinary General Meeting

I. Proposal for the amendment of

Petrobras’ Bylaw, in order to:

|

(i)

|

Amend art. 14, to expressly provide for the possibility of incorporation of

a subsidiary whose object is solely to hold equity interests, as provided for in art. 8, paragraph 2 of Decree N. 8,945/16;

|

|

(ii)

|

Amend art. 16, to include the sole paragraph, in order to establish that,

notwithstanding the provisions set forth in articles

|

54 and 56 of Decree N. 8,945/16 for smaller companies (with gross annual revenues of

less than BRL 90 million), all the requirements and impediments applicable to the managers and members of the Fiscal Council shall be uniform and isonomic for

the selection and approval both within the holding company and

in the companies that are part of the Petrobras System;

(iii) Amend the main section of art.

18, to expressly provide that the term of management of the members of the Board of Directors will be unified, in compliance with art. 24, VII of Decree N.

8,945/16;

|

(iv)

|

Amend art. 18, to insert paragraph 6, which prohibits the renewal of the

member of the Board of Directors who does not participate in any annual training provided by the Company in the last 2 years, in compliance with art. 42, sole paragraph of Decree N. 8,945/16;

|

|

(v)

|

Amend art. 18, to insert Paragraph 7, which provides that in any event, the

return of a former Board Member to the Company may only occur after a period equivalent to a term of management, in compliance with Art. 24, paragraph 4 of Decree N. 8,945/16;

|

|

(vi)

|

Amend the main section of art. 20, to expressly provide that the term of

management of the members of the Executive Board shall be unified, in compliance with art. 24, VII of Decree N.

|

8,945/16;

(vii) Amend art. 20, to insert Paragraph 3, which brings the additional requirement for the position of Executive Officer, in relation to the requirements for Directors, in

compliance with art. 24, II of Decree N. 8,945/16;

(viii) Amend art. 20, to insert Paragraph 4, which prohibits the renewal of the Executive Board member who does

not participate in any annual training provided by the Company in the last 2 years, in compliance with art. Art. 42, sole paragraph of Decree N. 8,945/16;

|

(ix)

|

Amend art. 20, to insert paragraph 5, which provides that, in any event,

the return of a former member of the Executive Board to the Company may only occur after a period equivalent to a term of management, in compliance with art. 24, paragraph 4 of Decree N. 8,945/16;

|

|

(x)

|

Amend the main section of art. 21 to provide for the express submission of

the Company’s managers to the conditions set forth in Decree No. 8,945/16, in addition to those provided for in Act

|

6,404/76 in Act

13,303/16 and in the Nomination Policy;

(xi) Amend art. 21, to include Paragraphs 1 and 2, which determine the application, to all administrators, of the

additional

conditions of unblemished reputation described and to be

detailed in the Nomination Policy;

(xii) Amend art. 21, to include Paragraph 3, which provides

for the attribution of the Nomination, Compensation and Succession Committee (“CIRS”) to analyze the additional conditions of unapproved reputation, within a maximum period of 8 business days from the delivery of information regarding the

nominee, and may be extended for up to the same period, or suspended, as the case may be;

(xiii) Amend art. 21, paragraph 2, which, after renumbering, shall become

Paragraph 5, in order to establish the equality of requirements and criteria for all members of the Board of Directors, including the employees’ representative;

(xiv) Amend art. 21, to include paragraph 7, to provide for the possibility of the candidate providing clarifications, at the request of the CIRS;

|

(xv)

|

Change art. 29 to insert, in items II, IV, VII and XIII, the competences

provided in arts. 9º, §1º; 24, III; 32, II and 37, §3º of Decree n. 8,945/16;

|

(xvi) Amend art. 30 to insert, in

items VI and VIII, the competences provided for in arts. 8, paragraph 2 and 32, I of Decree N.

8,945/16, As well as to promote editorial adjustments;

(xvii) Amend art. 30, items II, IV, IX, XIV and XV, to promote text adjustments;

(xviii)

Change art. 30, paragraph 1, former single paragraph, to provide for the Minority Committee as a statutory committee to support the Board of Directors;

(xix) Amend

art. 30, to include Paragraph 2, which provides that the

CIRS shall comply with the duties set forth in art. 21 of Decree N.

8,945/16, also analyzing the criteria of unblemished reputation foreseen in the proposed amendment of art. 21 of the Bylaw;

(xx) Amend art. 30 to include Paragraphs 3 and 4, which provide for the possibility of convening the Minority Committee, as a measure of good governance in the prior evaluation of

transactions involving the Union, its local authorities and foundations and federal state-owned enterprises, since outside the normal course of business of the Company, as well as discipline the composition of the Committee;

(xxi) Amend art. 32 for the inclusion of Paragraph 5, which provides

that the transactions with the Federal Government, its municipalities and foundations, shall be approved by the vote of

2/3 (two thirds) of the Directors present;

(xxii) Amend art. 34 to include clause

“l”, item II, which expressly provides for the Executive Board’s competence to approve collective labor agreements or agreements, as well as the filing of collective bargaining agreements;

(xxiii) Amend art. 35, paragraph 2 to improve the wording, using the terminology adopted for the functions directly linked to the Executive Officers, according to the need verified

by the Company;

(xxiv) Amend the main section of art. 43 to provide for the express submission of the Company’s Fiscal Counselors to the conditions set forth

in Decree N. 8,945/16, in the Nomination Policy, and to the criteria of unblemished reputation provided for in art. 21 of the Bylaw;

(xxv) Change art. 43,

paragraph 2, for text adjustment;

(xxvi) Amend art. 44 to include Paragraph 1, which prohibits the reappointment of Fiscal Council Members who do not participate

in any annual training provided by the Company in the last 2 years, in compliance with art. 42, sole paragraph of Decree N.

8,945/16, and;

(xxvii) Amend art. 44 to include Paragraph 2, which establishes that, in any event, the return of a former Fiscal Counselor to the Company may only occur after a period equivalent

to a term of performance, in compliance with art. 24, §4 of Decree N.

8,945/16.

II. Consolidation of the Bylaw to reflect the approved amendments, and;

III. Proposed

inclusion of additional requirements for unimpeachable reputation, in addition to those contained in Act 13,303, dated June 30,

2016, and of Decree 8,945, of the

Petrobras Board of Directors and Board of Executive Officers of December 27, 2016, in compliance with art. 40, item XIII of Petrobras’ Bylaw.

ANNUAL AND EXTRAORDINARY GENERAL MEETINGS CALL NOTICE

The Board of Directors of Petróleo Brasileiro SA - Petrobras convenes the Company’s shareholders to meet at Annual and Extraordinary General Meetings on April 27, 2017,

at

3:00 p.m., in the auditorium of the Headquarters Building, Avenida República do Chile 65,

1st floor, in the city of Rio de Janeiro (RJ), in order to deliberate on the following matters:

Annual General Meeting

|

I.

|

To analyze management accounts, examine, discuss and vote on the Management

Report and the Company’s Financial Statements, together with the report of the independent auditors and the Fiscal Council’s Report, for the fiscal year ended December 31, 2016;

|

II. Election of 5 (five) members for Fiscal Council, among which 1 (one) is appointed by the minority shareholders and one (1) by preferred shareholders, both through the

separate election process, and their respective alternates; and

III. Establishment of the financial compensation of Directors, members of the Fiscal Council and

members of the Statutory Advisory Committees to the Board of Directors.

Extraordinary General Meeting

I. Proposal for the amendment of Petrobras’ Bylaw, in order to:

|

(i)

|

Amend art. 14, to expressly provide for the possibility of incorporation of

a subsidiary whose object is solely to hold equity interests, as provided for in art. 8, paragraph 2 of Decree N. 8,945/16;

|

|

(ii)

|

Amend art. 16, to include the sole paragraph, in order to establish that,

notwithstanding the provisions set forth in articles 54 and 56 of Decree N.

|

8,945/16 for smaller companies (with gross annual revenues of

less than BRL

90 million), all the requirements and impediments applicable to the managers and members of the Fiscal Council shall be uniform and isonomic for the

selection and approval both within the holding company and in the companies that are part of the Petrobras System;

(iii) Amend the main section of art. 18, to expressly provide that the term of management of the members of the Board of Directors will

be unified, in compliance with art. 24, VI of Decree N. 8,945/16;

|

(iv)

|

Amend art. 18, to insert paragraph 6, which prohibits the renewal of the

member of the Board of Directors who does not participate in any annual training provided by the Company in the last 2 years, in compliance with art.

|

42, sole paragraph of Decree N. 8,945/16;

|

(v)

|

Amend art. 18, to insert Paragraph 7, which provides that in any event, the

return of a former Board Member to the Company may only occur after a period equivalent to a term of management, in compliance with Art. 24, paragraph 4 of Decree N. 8,945/16;

|

|

(vi)

|

Amend the main section of art. 20, to expressly provide that the term of

management of the members of the Executive Board shall be unified, in compliance with art. 24, VII of Decree N. 8,945/16;

|

(vii) Amend art.

20, to insert Paragraph 3, which brings the additional requirement for the position of Executive Officer, in relation to the requirements for Directors, in compliance with art. 24, II of Decree N.

8,945/16;

(viii) Amend art. 20, to insert Paragraph 4, which prohibits the renewal of the

Executive Board member who does not participate in any annual training provided by the Company in the last 2 years, in compliance with art. Art. 42, sole paragraph of Decree N. 8,945/16;

|

(ix)

|

Amend art. 20, to insert paragraph 5, which provides that, in any event,

the return of a former member of the Executive Board to the Company may only occur after a period equivalent to a term of management, in compliance with art. 24, paragraph 4 of Decree N. 8,945/16;

|

|

(x)

|

Amend the main section of art. 21 to provide for the express submission of

the Company’s managers to the conditions set forth in Decree No. 8,945/16, in addition to those provided for in Act 6,404/76 in Act 13,303/16 and in the Nomination Policy;

|

|

(xi)

|

Amend art. 21, to include Paragraphs 1 2 and 3, which determine the

application, to all administrators, of the additional conditions of unblemished reputation described and to be detailed in the Nomination Policy;

|

(xii) Amend art. 21, to include Paragraph 3, which provides for the attribution of the Nomination, Compensation and Succession Committee (“CIRS”) to analyze the additional conditions of unapproved reputation, within a

maximum period of 8 business days from the delivery of information regarding the nominee, and may be extended for up to the same period, or suspended, as the case may be;

(xiii) Amend art. 21, paragraph 2, which, after renumbering, shall become Paragraph 6, in order to establish the equality of

requirements and criteria for all members of the Board of Directors, including the employees’ representative;

(xiv) Amend art. 21, to include paragraph 7, to

provide for the possibility of the candidate providing clarifications, at the request of the CIRS;

|

(xv)

|

Change art. 29 to insert, in items II, IV, VII and XIII, the competences

provided in arts. 9º, §1º; 24, III; 32, II and 37, §3º of Decree n. 8,945/16;

|

(xvi) Amend art. 30 to insert, in

items VI and VIII, the competences provided for in arts. 8, paragraph 2 and 32, I of Decree N. 8,945/16, As well as to promote editorial adjustments;

(xvii) Amend

art. 30, items II, IV, IX , XIV and XV, to promote text adjustments;

(xviii) Change art. 30, paragraph 1, former single paragraph, to provide for the Minority

Committee as a statutory committee to support the Board of Directors;

(xix) Amend art. 30, to include Paragraph 2, which provides that the CIRS shall comply with

the duties set forth in art. 21 of Decree N. 8,945/16, also analyzing the criteria of unblemished reputation foreseen in the proposed amendment of art. 21 of the Bylaw;

|

(xx)

|

Amend art. 30 to include Paragraphs 3 and 4, which provide for the

possibility of convening the Minority Committee, as a measure of good governance in the prior evaluation of transactions involving the Union, its local authorities and foundations and federal state-owned enterprises, since outside the normal course

of business of the Company, as well as discipline the composition of the Committee;

|

(xxi) Amend art. 32 for the inclusion of Paragraph 5,

which provides that the transactions with the Federal Government, its municipalities and foundations, shall be approved by the vote of 2/3 (two thirds) of the Directors present;

(xxii) Amend art. 34 to include clause “l”, item II, which expressly provides for the Executive Board’s competence to approve collective labor agreements or

agreements, as well as the filing of collective bargaining agreements;

(xxiii) Amend art. 35, paragraph 2 to improve the wording, using the terminology adopted for

the functions directly linked to the Executive Officers, according to the need verified by the Company;

(xxiv) Amend the main section of art. 43 to provide for the

express submission of the Company’s Fiscal Counselors to the conditions set forth in Decree N.

8,945/16, in the Nomination Policy, and to the criteria of unblemished reputation provided for in art. 21 of the Bylaw;

(xxv) Change art. 43, paragraph 2, for text adjustment;

(xxvi) Amend art. 44 to include

Paragraph 1, which prohibits the reappointment of Fiscal Council Members who do not participate in any annual training provided by the Company in the last 2 years, in compliance with art. 42, sole paragraph of Decree N. 8,945/16, and;

(xxvii) Amend art. 44 to include Paragraph 2, which establishes that, in any event, the return of a former Fiscal Counselor to the Company may only occur after a period equivalent

to a term of performance, in compliance with art.

24, §4 of Decree N. 8,945/16.

II. Consolidation of the Bylaw to reflect the approved amendments, and;

III. Proposed

inclusion of additional requirements for unimpeachable reputation, in addition to those contained in Act 13,303, dated June 30, 2016, and of Decree 8,945, of the Petrobras Board of Directors and Board of Executive Officers of December 27,

2016, in compliance with art. 40, item XIII of Petrobras’ Bylaw.

The

person present at the Meeting shall prove his or her shareholder status, pursuant to article 126 of Act 6,404, dated 12.15.1976. In order to be represented, the shareholder must comply with the provisions of paragraph 1 of article 126 of said Act

and article 13 of Petrobras’ Bylaw, showing the following documents:

i) Representative’s identity document;

ii) Power of Attorney with special powers of the represented with notarized signature

(original or authenticated copy);

iii) Copy of the agreement or Bylaw of the

fund’s representative or regulation, if applicable;

iv) Copy of the instrument of investiture or equivalent document proving the powers of the grantor of the

power of attorney, if applicable.

The shareholders represented by attorneys-in-fact are requested to file, at least three business days in advance, the documents

listed above in room 1002 (Attendance to Shareholders) of the Headquarters Building. For those who will submit the documentation on the day of the Meetings, the Company informs that it will be able to receive it from

11 am, at the place where the meetings will be held.

The exercise of the right to vote in the

case of the loan of shares shall be borne by the borrower of the loan, except if the agreement signed between the parties provides for otherwise.

In addition, shareholders may also elect to vote on the matters set forth in this Notice through the use of the public request for power

of attorney, pursuant to CVM Instruction

481, of December 17, 2009.

The

receipt of electronic powers of attorney shall be available at the Company’s site, (http://www.petrobras.com.br/ir) from the beginning of April 2017.

The

Company informs that the instructions for distance voting, which is dealt with in CVM Instruction 561, dated April 7, 2015, are included in the Handbook for Meeting (Manual da Assembleia).

Likewise, the requirements, impediments, as well as the documentation that must be presented for the appointment of members of the Fiscal Council are included in the Handbook for

Meeting (Manual da Assembleia).

All the documentation pertinent to the matters that will be resolved in these Annual and Extraordinary General Meetings, in

accordance with the Instruction CVM 481, of December 17, 2009 is available to shareholders in Room 1002 (Shareholders Service) of the Company’s Headquarters Building, and at the Company’s electronic addresses

(http://www.petrobras.com.br/ri) and the Brazilian Securities Commission - CVM (http://www.cvm.gov.br).

Rio de Janeiro, March 24th, 2017.

Luiz Nelson Guedes de Carvalho

Chairman of the Board of Directors

USER GUIDE TO THE ELETRONIC PLATFORM SYSTEM

Step 1

– Request password for validation of the shareholder

a) Access the address https://petrobras.infoinvest.com.br/assembleias/2017-04-27, click “Click here

to request remittance of the password” and fill in the data of the form to receive the vote validation password by regular mail.

b) An email is sent to the

requestor of the password with the identifier of each fund.

c) The shareholder will receive at his registered address the password for voting remotely at the

General Meeting. Make sure your registry is up to date.

Step 2 – Send shareholder’s identification documents

All the documents must be sent within a single envelope and delivered no later than April

19,

2017 at the address indicated below:

Donnelley Financial Solutions Rua Dom Gerardo 46, 4º andar CEP [ZIP CODE] 20090-030

Rio de Janeiro, RJ

The shareholder’s ID documents are as follows:

a) Natural Persons

notarized copy of the taxpayer identification number - CPF;

notarized copy of ID (RG, CNH [National Driver’s License] or passport);

notarized copy of

residence proof;

power of attorney with signature notarized at registry office for granting the voting powers to the attorney who will attend the meeting.

b) Legal Entities

notarized copy of corporate taxpayer identification number

– CNPJ;

notarized copy of the Bylaws or internal regulation;

identification documents of the natural person with powers of representation to the CNPJ (in accordance with the list of documents for Natural Persons listed

above); notarized copy of the documents evidencing powers of representation of the relevant natural person (Bylaws or power of attorney issued by the legal representative of the CNPJ).

Step 3 – Remote voting

To vote remotely at

the General Meeting, access https://petrobras.infoinvest.com.br/assembleias/2017-04-27and click the “Click here to vote” option. It will be necessary to inform the CPF / CNPJ (punctuation is required), the fund identifier (informed by

e-mail) and the password (sent by regular mail) for each of the funds on the login screen.

The voting service will be available from April 10th through April 26th,

2017. The shareholder will receive the voting confirmation by e-mail.

The voting service will not be available for ADR holders.

DISTANCE VOTING BALLOT FORM

The form must be

completed if shareholders choose to exercise their right to use the distance voting remotely, per CVM Instruction no. 481/09.

In this case, it is imperative to

complete the file with the full name (or corporate name) of the shareholder and the Registration number in the Ministry of Finance, whether a legal entity (CNPJ) or natural person (CPF), as well as an email address for contact.

In addition, in order for the ballot to be considered valid and the votes therein delivered be recorded in the General Meeting quorum, the following instructions shall be observed:

i. ballot fields shall be duly completed, according to the shareholder’s class of shares. To better identify each item, voting fields will be presented as

follows:

a) [ON only]: Only holders of common shares (PETR3) shall vote;

b)

[PN only]: Only holders of preferred shares (PETR4) shall vote;

c) [ON and PN]: Holder of common and preferred shares (PETR3) and (PETR4) shall vote.

ii. at the end, the shareholder or its legal proxy(ies), as appropriate and pursuant to current legislation, shall sign the ballot form; and

iii. signature certification will be required for all signatures included in the ballot form and, in the case of foreigners, their corresponding consular validation and the sworn

translation of documents.

Guidelines for sending the form

Shareholders who

choose to exercise their right to use the distance voting may: (i) fill in and send this form directly to the Company; or

(ii) relay completion instructions to

suitable service providers, according to the

following guidelines:

Exercise

of distance voting rights using a custodian

Shareholders who choose to exercise their right to vote via their custodian agent shall relay their voting instructions

according to the rules defined by the sub-custodian, which forwards said voting manifestations to the BM&FBOVESPA Central Depository. For such, shareholders shall contact their custody agents to check the proper procedures.

According to CVM Instruction no. 481/09, shareholders shall relay ballot form completion instructions to their custody agents up to seven days before the date on which the

Shareholders’ Meeting will be held, namely, until 04/20/2017 (inclusive), except if a different term is defined by their custody agents.

Petrobras has up to

three days from ballot form receipt to inform shareholders that submitted documents are eligible for the vote to be considered valid, or to warn of the

need for correction and resubmission of the ballot form or accompanying documents, stating their period of receipt within up to seven

days before the Shareholders’ Meeting.

It is therefore recommended that shareholders send the ballot form, which will be available at least one month prior to

the Shareholders’ Meeting, plus related documents as early as possible, so there is enough time for evaluation by Petrobras and eventual return with reasons for correction, correction, and resubmission.

It should be noted that, as ordered by CVM Instruction no. 481/09, upon receiving shareholder voting instructions through their respective custody agents, the BM&FBOVESPA

Central Depository shall disregard any conflicting instructions in connection to the same deliberation that were issued by the same enrollment number in CPF (natural persons) or CNPJ (legal entities).

Exercise of distance voting rights using a book-entry share administrator

In addition to the

previous options, shareholders holding book-entry shares can exercise their right to vote using Banco do Brasil, which is the managing institution for Petrobras’ Book-Entry Shares system. In this case, the shareholder/proxy shall deliver the

duly completed distance voting ballot form at any Banco do Brasil branch.

Exercise of distance voting via direct remittance of ballot form by shareholders to

Petrobras

Shareholders who choose to exercise their right to use the distance

voting may, alternatively, do it directly to the Company, for which end the following documents are to be remitted to Av. República do Chile, 65, 10º andar – sala 1002, Centro, CEP: 20031-912, Rio de Janeiro/RJ - Brasil, care of the

Department of Individual Investor Relations – Shareholder Support:

(i) physical copy of this ballot form, duly completed, signed, and with each page

initialed;

(ii) certified copy of the following documents: (a) for natural persons:

• valid photo ID and CPF number;

• in the case of proxy (engaged less than one year

from the date of the Annual and Extraordinary General Meetings) forward documentation with certified signature and the proxy’s identity.

(b) for legal

persons:

• latest bylaws or consolidated social contract and the corporate documents proving the legal representation of shareholder;

• CNPJ; and

• photo ID document of the legal proxy. (c) for investment funds:

• last consolidated fund rules with CNPJ;

• bylaws or social

contract of its administrator or manager, as appropriate, in compliance with the fund’s voting policy and corporate documents proving the powers of representation; and

• photo ID document of the legal proxy.

Once the ballot form and corresponding required documentation are received, the Company will notify shareholders of their acceptance or

need for rectification, pursuant to CVM Instruction nº 481.

If the ballot form is forwarded directly to the Company and is not properly completed or is not

accompanied by the supporting documents, it may be disregarded and shareholders will be notified at the email address informed.

The ballot form and other

supporting documents shall be recorded at the company within seven days prior to the date of the General Shareholders’ Meeting, namely, by 04/20/2017 (inclusive). Any ballot forms received by the Company after that date shall also be

disregarded.

DISTANCE VOTING FORM - 04/27/2017

A&EGM OF

PETRÓLEO BRASILEIRO S.A.(PETROBRAS)

1. Shareholder name and e-mail:

Name:

E-mail:

Confirm e-mail:

2. Shareholder CNPJ or CPF:

3. Instructions for completion

This ballot form is to be completed in case shareholders choose

to exercise their right to use the distance voting, per CVM Instruction no. 481/09.

In this case, it is imperative that previous fields are completed with the full

name (or corporate name) of the shareholder and the Registration number inh the Ministry of Finance, whether a legal entity (CNPJ) or natural person (CPF), as well as an email address for contact.

In addition, in order for the ballot to be considered valid and the votes herein delivered be recorded in the General Meeting quorum, the following instructions shall be observed:

|

i.

|

ballot fields shall be duly completed, according to the shareholder’s

class of shares. To better identify each item, voting fields will be presented as follows:

|

a) [ON only]: Only holders of common shares

(PETR3) shall vote;

b) [PN only]: Only holders of preferred shares (PETR4) shall vote;

c) [ON and PN]: Holder of common and preferred shares (PETR3) and

(PETR4) shall vote.

ii. shareholders or their legal proxy(ies), as appropriate and pursuant to current legislation, shall sign the ballot form; and

iii. certification of signatures included in the ballot form shall be required and, in the case of foreigners, their corresponding consular

validation and the sworn translation of documents.

4. Guidelines for sending the form

Shareholders

who choose to exercise their right to use the distance voting may:

(i) fill in and send this form directly to the Company; or

|

(ii)

|

relay completion instructions to suitable service providers, according to

the following guidelines:

|

4.1 Exercise of distance voting rights using a custodian

Shareholders who choose to exercise their right to use de distance voting via their custodian agent shall relay their voting instructions according to the rules defined by the

sub-custodian, which forwards said voting manifestations to the BM&FBOVESPA Central Depository. For such, shareholders shall contact their custody agents to check the proper procedures.

According to CVM Instruction no. 481/09, shareholders shall relay ballot form completion instructions to their custody agents up to seven days before the date on which the

Shareholders’ Meeting will be held, namely, until 04/20/2017 (inclusive), except if a different term is defined by their custody agents.

Petrobras has up to

three days from ballot form receipt to inform shareholders that submitted documents are eligible for the vote to be considered valid, or to warn of the need for correction and resubmission of the ballot form or accompanying documents, stating their

period of receipt within up to seven days before the Shareholders’ Meeting.

It is therefore recommended that shareholders send the ballot form, which will be

available at least one month prior to the Shareholders’ Meeting, plus related documents as early as possible, so there is enough time for evaluation by Petrobras and eventual return with reasons for correction, correction, and resubmission.

It should be noted that, as ordered by CVM Instruction no. 481/09, upon receiving shareholder voting instructions through their respective custody agents, the

BM&FBOVESPA Central Depository shall disregard any conflicting instructions in connection to the same deliberation that were issued by the same enrollment number in CPF (natural persons) or CNPJ (legal entities).

4.2. Exercise of distance voting rights using a book-entry share administrator

In addition to

the previous options, shareholders holding book-entry shares can exercise their right to vote using Banco do Brasil, which is the managing institution for Petrobras’ Book-Entry Shares system. In this case, the shareholder/proxy shall deliver

the duly completed distance voting ballot form at any Banco do Brasil branch.

4.3. Exercise of distance voting via direct remittance of ballot form by

shareholders to Petrobras

Shareholders who choose

to exercise their right to vote use the distance voting may, alternatively, do it directly to the Company, for which end the following documents are to be remitted to Av. República do Chile, 65, 10º andar – sala 1002, Centro, CEP:

20031-912, Rio de Janeiro/RJ - Brasil, care of the Department of Individual Investor Relations – Shareholder Support:

(i) physical copy of this ballot form,

duly completed, signed, and

with each page initialed;

|

(ii)

|

certified copy of the following documents: (a) for natural persons:

|

valid photo ID and CPF number;

in the case of proxy

(engaged less than one year from the date of the Ordinary and Extraordinary GSM) forward documentation with certified signature and the proxy’s identity.

(b)

for legal persons:

latest bylaws or consolidated social contract and the corporate documents proving the legal representation of shareholder;

CNPJ; and

photo ID document of the legal proxy. (c) for investment funds:

last consolidated fund rules with CNPJ;

bylaws or social contract of its administrator or

manager, as appropriate, in compliance with the fund’s voting policy and corporate documents proving the powers of representation; and

photo ID document of

the legal proxy.

Once the ballot form and corresponding required documentation are received, the Company will notify shareholders of their acceptance or need for

rectification, pursuant to CVM Instruction no. 481/09.

If the ballot form is forwarded directly to the Company and is not properly completed or is not accompanied

by the supporting documents described in item (4.3 - ii), it may be disregarded and shareholders will be notified at the email address informed in item 1.

The

ballot form and other supporting documents shall be recorded at the company within up to seven days prior to the date of the General Shareholders’ Meeting, namely, by 04/20/2017 (inclusive). Any ballot forms received by the Company after that

date shall also be disregarded.

VOTING MANIFESTATION - Please mark your choice of vote with an “X”.

5. ANNUAL GENERAL MEETING

5.1. [Only ON] To analyze management accounts, examine, discuss and

vote on the Management Report and the Company’s Financial Statements, together with the report of the independent auditors and the Fiscal

Council’s

Report, for the fiscal year ended December 31, 2016

[ ] Approve [ ] Reject [ ] Abstain

5.2. Election of 5 (five) members for Fiscal Council, among which 1 (one) is appointed by the minority shareholders and one (1) by preferred shareholders, both through the separate

election process, and their respective alternates.

5.2.1 [Only ON] Candidates indicated by the Controlling Shareholder:

1. Principal: Adriano Pereira de Paula

Alternate: Paulo José dos Reis Souza

2. Principal: Marisete Fatima Dadald Pereira

Alternate: Agnes Maria de Aragão Costa

3. Principal: Luiz Augusto Fraga Navarro de Britto Filho

Alternate: Maurycio

José Andrade Correia

[ ] Approve [ ] Reject [ ] Abstain

5.2.2 [Only ON]

If one of the candidates that compose voting plate fails to integrate it to accommodate the separate election dealt with in arts. 161,

§4, and 240 of Law No.

6,404 of 1976, can the votes corresponding to their shares continue to be conferred on the chosen voting plate?

[ ] Yes [ ] No

5.2.3 [Only PN] Candidate indicated by the preferred shareholders: Principal: Walter Luis Bernardes Albertoni

Alternate: José Pais Rangel

[ ] Approve [ ] Reject [ ] Abstain

5.3 [Only ON] Establishment of the financial compensation of Directors, members of the Fiscal Council and members of the Statutory Advisory Committees to the Board of Directors.

[ ] Approve [ ] Reject [ ] Abstain

6. Second Call of Meeting [ON] and [PN]

In the

event of a second call of this General Meeting, may the voting

instructions included in this ballot form be considered also for the second call of Meeting?

[ ] Yes [ ] No

7. EXTRAORDINARY GENERAL MEETING [ON only]

7.1. [ON Only] Amendment proposal of Petrobras’s By-Law: [ ] Approve [ ] Reject [ ] Abstain

7.2. [ON Only] Consolidation of Petrobras’s By-Law to reflect the approved changes

[ ] Approve [ ] Reject [ ] Abstain

7.3. [ON Only] Proposed inclusion of additional

requirements for unimpeachable reputation, in addition to those contained in Act 13,303, dated June 30, 2016, and of Decree 8,945, of the Petrobras Board of Directors and Board of Executive Officers of December 27, 2016, in compliance with art. 40,

item XIII of Petrobras’ Bylaw.

[ ] Approve [ ] Reject [ ] Abstain

8.

Second Call of Meeting [ON Only]

In the event of a second call of this General Meeting, may the voting

instructions included in this ballot form be considered also for the second call of Meeting?

[

] Yes [ ] No

[City], [month] [day], 2017.

Shareholder’s Name (certified

signature) CPF / CNPJ:

PUBLIC REQUEST FOR PROXY

Rio de Janeiro, March 27,

2017, Petróleo Brasileiro S.A. – Petrobras invites its shareholders to attend the Annual and Extraordinary General Meetings to be held on April 27, 2017, at 3 PM, to deliberate on the agenda included in the Notice of Meeting.

To facilitate and encourage the participation of shareholders with voting rights, the Company will make it available to shareholders to vote through the world-wide web on the

agenda included in the Notice of Meeting by using a public request for proxy, pursuant to CVM Instruction no. 481, published on December 17, 2009.

Electronic

voting will take place through the electronic address voting platform at https://petrobras.infoinvest.com.br/assembleias/2017-04-27. For such, shareholders need to request the validation password for remote voting as soon as possible. The

shareholder’s voting intention must be sent through the system between April 10 and 26,

2017.

Electronic participation in the Annual and Extraordinary General Meetings is not available for our ADR holders.

Consult item “Manual on Electronic Platform System voting”, included in this Handbook for Meeting (Manual da Assembleia), for more details.

By providing this alternative, Petrobras seeks to reinforce its commitment to the adoption of the best practices in Corporate Governance and transparency.

ASSESSMENT OF THE REQUIREMENTS AND LEGAL AND STATUTORY IMPEDMENTS FOR NOMINATION OF PETROBRAS’S FISCAL COUNCIL MEMBER

The appointment of a member of the Fiscal Council of Petrobras, whether by the controlling shareholder, the minority shareholder or the holders of preferred shares, shall fully

comply with the requirements and prohibitions imposed by the Brazilian Corporation Law, as well as those in Law No. 13,303/16 and Decree No. 8.945/16, under consequence of not being granted their nomination.

Shareholders who wish to nominate candidates must deliver the completed Form, as well as the attached documentation, within 8 business days from the date of the Annual

Shareholders’ Meeting, that is, until 04/13/2017, In order to meet the requirements.

Once all documentation has been received, the Temporary Eligibility

Committee, created in compliance with art. 64, paragraph 1 of Decree 8.945/2016, will analyze the information provided by the nominee, according to the Form and supporting documentation, advising shareholders on compliance with the requirements and

innocence of the prohibitions established in Law 13.303/16, Decree No. 8.945/16 and in the Bylaws.

In the case of the documentation is sent later, as not to permit

the analysis of the Temporary Eligibility Committee in time for the Annual General Meeting, it will be analyzed during the Annual General Meeting, by the Secretary of the Board, in the form of art. 22, paragraph 4 of Decree No. 8.945/16.

ANNEX I

Registration Form for Fiscal Council Board

Member

Personal Data and Contact

Full name:

Date of birth:

Gender:

Profession:

(Taxpayer identification number - TIN) - CPF:

Identity card #:

Issued by:

Issue Date:

Birth Place:

Address: professional and personal:

Professional and personal phone number:

Professional and personal e-mail address:

Professional Information

Current Professional

Position (main):

Total time experience in Fiscal Council (years):

Total time

of professional experience (years):

Areas of academic training (undergraduate and graduate):

Minimum Requirements for Fiscal Council Board Member

I – University level diploma; and

( ) Yes ( ) No

II - 03 years of experience as Fiscal Council Board Member

or Administrator or Management position or Public

Administration Advisory,

Direct or Indirect.

( ) Yes ( ) No

Impediments for nomination of Fiscal

Council Member

Article 1 of complementary law No. 64/1990 (Ficha Limpa)

I

– Illiterate person or cannot voting person;

( ) Yes ( ) No

II - Is a

member of the National Congress, the Legislative Assemblies, the Legislative Chamber and the Municipal Councils, which has lost its mandate for breach of the provisions of items I and II of art. 55 of the Federal Constitution, equivalent provisions

on loss of mandate of the State Constitutions and Organic Laws of the Municipalities and the Federal District, for the elections held during the remaining term of the mandate for which he was elected and for the subsequent eight (8) years at the end

of the legislature;

( ) Yes ( ) No

III - Was Governor or Deputy Governor of State and of the

Federal District, Mayor or Deputy Mayor who lost his elective office for violation of the provisions of the State Constitution, of the Organic Law of the Federal District or of the

Organic Law of the Municipality, for the elections

that took place during the remaining term and within 8 (eight) years following the end of the term for which he

was elected;

( ) Yes ( ) No

IV - Has against his person a decision deemed

appropriate by the Electoral Court, in a final decision or rendered by a collegiate body, in the process of verifying abuse of economic or political power, for the election in which he competes or has been elected, as well as for those who took

place in the following 8 (eight) years;

( ) Yes ( ) No

V - Was convicted of a

criminal offense, in a final decision

or handed down by a collegiate judicial body, from the conviction until the expiration of eight (8) years after serving the

sentence, for crimes: against the popular economy, public faith, administration and public assets; against the private equity, the financial system, the

capital

market and those provided for in the law that governs bankruptcy; against the environment and public health; electoral law, for which the law contains a custodial sentence; of abuse of authority, in cases in which there is condemnation to the loss

of the position or to the disqualification for the exercise of public function; of washing or hiding of goods, rights and values; trafficking in narcotics and related drugs, racism, torture, terrorism and heinous; of reduction to the condition

analogous to that of slave; against sexual life and dignity; practiced by criminal organization or gang;

( ) Yes ( ) No

VI - Was declared unworthy of the officialdom or with him incompatible, for the term of 8 (eight) years;

( ) Yes ( ) No

VII - Had its accounts relating to the exercise of public offices or functions

rejected by an insurmountable irregularity that constitutes an intentional act of administrative impropriety, and by an irreversible decision of the competent organ, unless it has been suspended or annulled by the Judiciary, for the elections that

took place in the Eight (8) years from the date of the decision;

( ) Yes ( ) No

VIII - Has held a position in the direct, indirect or foundational

public administration that has benefited either himself or third parties for the abuse of economic or political power, convicted in a final decision or rendered by a collegiate judicial body, for the election in which he concurred or been elected,

as well as those that took place in the next 8 (eight) years;

( ) Yes ( ) No

IX - in a credit, financing or insurance establishment, has

been or is the

subject of a judicial or extrajudicial liquidation proceeding, has exercised, in the twelve (12) months prior to the respective decision, a position or function of management, administration or representation, until such time as exonerated of any

liability;

( ) Yes ( ) No

X - has been convicted of electoral corruption, of

unlawful collection of votes, of donation, of illegal appropriation or expenditure of campaign funds, or of prohibited conduct to public officials in election campaigns that imply the annulment of the registration or the diploma, for a period of

eight (8) years from the election;

( ) Yes ( ) No

XI - was President of the

Republic, Governor of State and Federal District, Mayor, member of the National Congress, Legislative Assemblies, Legislative Chamber, Municipal Councils, who resigned from his mandate from offering representation or petition capable of authorizing

process for breach of the provisions of the Federal Constitution, the State Constitution, the Organic Law of the Federal District or the Organic Law of the Municipality, for the elections held during the remainder of the term for which he was

elected and in the eight years following the end of the legislature;

( ) Yes ( ) No

XII - was condemned to the suspension of political rights,

in a final decision or rendered by

a collegiate judicial body, for an intentional act of administrative impropriety

that impairs the public patrimony and illicit enrichment, from the condemnation or

with a sentence transited in rem judicatum until the course of the within eight (8) years after serving the sentence;

( ) Yes ( ) No

XIII - was excluded from the exercise of the profession by a

sanctioning decision of the competent professional body, as a result of ethical and professional infraction, for a

period of 8 (eight) years, unless the act has been annulled

or suspended by the Judiciary;

( ) Yes ( ) No

XIV - was convicted, in a final decision or rendered by a

collegiate judicial body, by reason of having undone or simulated to undo a conjugal bond or stable union to avoid characterization of ineligibility, for a term of eight (8) years after the decision that recognizes fraud;

( ) Yes ( ) No

XVI - was dismissed from the public service as a result of

an administrative or judicial process, for a period of eight (8) years, counted from the decision, unless the act has been suspended or annulled by the Judiciary;

( ) Yes ( ) No

XVII - is a natural person or officer of a legal person

responsible for electoral donations considered illegal by a final decision or rendered by a collegiate body of the Electoral Court, for a period of eight (8) years after the

decision, subject to the procedure Art. 22 complementary law No. 64/90

( ) Yes ( ) No

XVIII - is a magistrate or member of the Public Prosecution

Service who is compulsorily

retired by a sanctioning decision, who has lost the position by sentence or who has asked for exemption or voluntary retirement pending a disciplinary administrative process, for a term of 8 (eight) years.

( ) Yes ( ) No

Articles 162 and 147 of Law 6,404/76

XIX - is a member of the board of directors and employee of the company or a subsidiary or the same group;

( ) Yes ( ) No

X - is a spouse or relative, up to third degree, of

administrator of the company;

( ) Yes ( ) No

XXI - is a person barred by a special law, or convicted of

bankruptcy, prevarication, bribery,

concussion, embezzlement, against the popular economy, public faith or property, or criminal penalty that, although temporarily, access to public office;

( ) Yes (

) No

XXII - is a person declared unencumbered by an act of the

Brazilian

Securities and Exchange Commission;

( ) Yes ( ) No

XXIII - holds a position in a company that can be

considered a competitor in the market, especially in advisory, administrative or fiscal councils;

( ) Yes ( ) No

XXIV - has conflicting interests with society(a).

( ) Yes ( ) No

Article 1 of Law 12,813/13

XXV - discloses or makes use of privileged information, for

its own or third party’s

benefit, obtained by reason of the activities performed;

( ) Yes ( ) No

XXVI

- carries on an activity that implies the rendering of

services or the maintenance of a business relationship with a natural or legal person that has an interest

in a decision

of the public agent or collegiate in which it participates;

( )

Yes ( ) No

XXVII - carries out, directly or indirectly, an activity that

by

reason of its nature is incompatible with the attributions of the position or employment, considering as such, including, the activity developed in related areas or

matters;

( ) Yes ( ) No

XXVIII - acts, albeit informally, as attorney, consultant,

advisor or intermediary of private

interests in the organs or entities of the direct or indirect public administration of any of the Powers of the Union, the States, the Federal District and the Municipalities;

( ) Yes ( ) No

XXIX - performs an act in the interest of a juridical person

of which his or her spouse, companion or relatives, consanguineous or related, in a direct or collateral manner, up to the third degree, and who may benefit or influence his or her

management acts;

( ) Yes ( ) No

XXX - receives a gift from anyone who has an

interest in a

decision of the public agent or collegiate of which he participates outside the limits and conditions established in regulation; and

( ) Yes ( ) No

XXXI - provides services, although occasional, the company

whose activity is controlled, supervised or regulated by the entity to which it is linked.

( )

Yes ( ) No

Article 44 of Petrobras’ By-Laws

XXXII - It is being

nominated for the 3rd consecutive

reelection to the Fiscal Council of Petrobras.

( ) Yes ( ) No

Court of Auditors of the Union (TCU)

XXXIII - is includes in the file of restricted person by the TCU

for public function that appears in the website of the institution(b).

( ) Yes ( ) No

(a) For the purposes of this subsection, CVM Instruction 367 presumes that there is a conflict of interest with the Company, a person who, cumulatively: I - has been elected by a

shareholder who has also elected as a board member in a competing company; and II - maintain a tie of subordination with the shareholder who elected him.

(b) List

of restricted person: options - Services and Queries - Registry of Irregularities - Disabled for the public function - list of disabled

Attached documents to prove

the minimum requirements:

Requirement

Means of verification

Diploma at University level

Copy of the graduation diploma

Copy of the postgraduate certificate

03 years of experience as Administrator or Fiscal

Counselor or Management position or Public Administration Advisory, Direct or Indirect.

Appointment and exoneration, if any

Company / Organ Statement

Registered Work Contract

Under consequence of the law, I declare that the information provided herein is accurate and true without any kind of erasures.

Place and Date

Signature of Nominee

ANNUAL GENERAL MEETING PRESENTATION TO SHAREHOLDERS ITEM I

TO ANALYZE MANAGEMENT ACCOUNTS, EXAMINE, DISCUSS AND VOTE ON THE MANAGEMENT REPORT AND THE COMPANY’S FINANCIAL STATEMENTS, TOGETHER WITH THE REPORT OF THE INDEPENDENT AUDITORS

AND THE FISCAL COUNCIL’S REPORT, FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

Dear Shareholders,

The Management Report, Financial Statements and Fiscal Council’s Report of fiscal year of 2016 is available in Petrobras website:

http://www.investidorpetrobras.com.br/en/financial-results

Rio de Janeiro, March 27th 2017.

Pedro Parente

CEO

ANNUAL GENERAL MEETING PRESENTATION TO SHAREHOLDERS ITEM II

ELECTION OF MEMBERS TO THE FISCAL COUNCIL AND THEIR RESPECTIVE ALTERNATES

Dear Shareholders,

The election of members to the Fiscal Council and their respective alternates, according to what has been established in the Company’s Bylaws, will approved

in the course of the Annual General Meeting.

The controlling shareholder nominates the following names to compose the Fiscal Council and respective alternates:

Adriano Pereira de Paula (alternate: Paulo José dos Reis Souza); Marisete Fátima Dadald Pereira (alternate: Agnes Maria de Aragão da Costa); Luiz Augusto Fraga Navarro de Britto Filho (alternate: Maurycio José Andrade Correia).

As provided for in CVM Instruction under no. 481/2009, there might be nomination of candidates for filling the positions of non-controlling shareholders in the

Company’s Board of Directors, by means of public proxy solicitation.

Please find attached the Appendix I and II regarding the data referring to the persons

indicated above, following the items 12,5 to 12,10 of the Reference Form (Art. 10 of CVM

481 Instruction)

Rio de Janeiro, March 27th, 2017.

Pedro Parente

CEO

ANNEX I

INFORMATION CONCERNING THE MEMBER

NOMINATED

BY THE CONTROLLING SHAREHOLDER TO THE FISCAL COUNCIL

Name Indicated

by the controlling shareholder

Nane

Date of

Birth

Administration

Body

Mandate

Term number of Consecutive Mandates

TIF

Profession

Elective position to

occupy

Adriano Pereira de Paula

743.481.327-04

10/13/1963

Economist

Fiscal Council

Member of FC (full member)

Up to AGM of

2018

1

Paulo José dos Reis Souza

494.424.306-53

06/02/1962

Business

Manager

Fiscal Council

Member of FC (alternate)

até AGO de

2018

5

Marisete Fátima Dadald

Pereira

409.905.160-91

16/04/1955

Accountant

Fiscal Council

Membro do CF (full member)

Up to AGM of

2018

6

Agnes Maria de Aragão da

Costa

080.909.187-94

01/02/1979

Economist

Fiscal Council

Member of FC (alternate)

Up to AGM of

2018

2

Luiz Augusto Fraga

Navarro de Britto Filho

347.230.215-15

05/10/1965

Lawyer

Fiscal Council

Member of FC (full member)

Up to AGM of

2018

1

Maurycio José Andrade

Correia

719.201.104-53

12/06/1971

Lawyer

Fiscal Council

Member of FC (alternate)

Up to AGM of

2018

0

Adriano Pereira de Paula, Brazilian, economist and public servant. It was approved in the first selective process carried out for General Coordinator in the

Treasury (April 2010). He was the head of the General Coordination of Credit Operations, responsible for the budgetary, financial and accounting management of Official

Loan Operations - OOC, aimed at the promotion of agricultural,

agroindustrial and export activities. In addition, to manage the economic subsidies for programs to promote the productive infrastructure, industry, housing, individual productive credit related to the Financial Charges of the Union (EFU), and the

payments of indemnities and restitutions of the Program of Guarantee of the Agricultural Activity (PROAGRO).

In August 2016, he assumed the position of

Undersecretary of Fiscal Policy of the

National Treasury, having at his charge the planning and financial programming of the federal government, the management of

federal funds, risks and assets of the Union, control of Treasury participation in state companies Subsidies and subsidies directly responsible to the Treasury.

Paulo José dos Reis Souza, Brazilian, a business administrator. Director of Programs of the National Treasury Department (STN) of the Ministry of Finance

since August 2016. He held the following positions STN/MF: Undersecretary of Fiscal Policy; General Coordinator of Financial Programming; Coordinator of Financial Programming; and Manager. He joined the STN as Finance and Control Analyst in 1991,

current Federal Auditor of Finance and Control. He has a postgraduate degree in Administration in the following areas: Public Policies and Government Management (Public Administration) and Public Sector Economics (Economy). He was Fiscal Counselor

in the following companies: Infraero S / A (Airport Infrastructure); SERPRO (Technology and Information Systems); Eletropaulo S/A (Energy Distributor); Petrobras Distribuidora SA (Distribuidora de Combustĺveis); INB - Nuclear Industries of

Brazil S/A (Nuclear Fuel Production); Petrobras (Exploration and refining of Petroleum); and Banco do Brasil (Financial Sector). Currently, he is also Fiscal Council member of VALE. (Mining Sector).

Marisete Fátima Dadald Pereira. She has been a member of the Fiscal Council of Petrobras since 2011 and currently holds the position of head of the Special Advisory for

Economic Affairs of the Ministry of Mines and Energy, a governmental

entity, since August 2006, where she has held the position of

special adviser to the Minister of Mines and Energy from August 2005 to July 2006. Her main professional experiences include: (i) manager of the Economic and Financial Department of Eletrosul Centrais Elétricas SA from 1987 to 2005; And (ii)

Accounting and Fiscal Specialist of the Accounting and Fiscal Counsel David Rafael Blochtein, accounting advisory company, from 1973 to 1987. She is an accountant, graduated from Vale do Rio dos Sinos University, and holds a postgraduate degree in

Accounting University of Vale do Itajaĺ and post-graduate in Auditing and Economic Sciences by the Federal University of Santa Catarina.

Agnes Maria de

Aragão Da Costa. A Brazilian economist. She is a director and senior economist at the Ministry of Mines and Energy, with special emphasis on Energy and Mining Economies. She acts in the formulation of public policy recommendations and in the