UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of

March, 2017

Commission File Number:

001-36532

SPHERE 3D CORP.

240 Matheson Blvd. East

Mississauga, Ontario,

Canada, L4Z 1X1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F.

[X] Form 20-F [

] Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes [ ]

No [X]

If "Yes" is marked, indicate below the file number assigned to

the registrant in connection with Rule 12g3-2(b):

The information contained in this Form 6-K is incorporated by

reference into, or as additional exhibits to, as applicable, the registrant's

outstanding registration statements.

Consent, Waiver, Reaffirmation and Amendment Number One

to Credit Agreement

As previously disclosed, on April 6, 2016, Overland Storage, Inc., a California

corporation (“Overland”) and wholly owned subsidiary of Sphere 3D Corp. (the

“Company”), Tandberg Data GmbH, a limited liability company organized under the

laws of Germany (“Tandberg” and, together with Overland, collectively the

“Borrowers”), and Opus Bank, a California commercial bank, as Lender (“Lender”),

entered into a Credit Agreement (the “Credit Agreement”) pursuant to which the

Lender provided the Borrowers a $10 Million revolving credit facility and

Overland $10 Million term loan facility. On December 30, 2016, the Borrowers and

Lender entered into a Consent, Waiver, Reaffirmation and Amendment Number One to

Credit Agreement (the “First Amendment”) pursuant to which (i) the maturity date

for the revolving and term loan credit facilities were amended to be the earlier

of the maturity date in the 8% Senior Secured Convertible Debenture, dated

December 1, 2014, issued to FBC Holdings S.a r.l. (the “Debenture”), or March

31, 2017, (ii) the Lender granted a waiver of specified defaults under the

Credit Agreement relating to a minimum asset coverage ratio, (iii) the Lender

provided its consent to the consummation of the acquisition of equity interests

of certain target companies, and (iv) certain other terms of the Credit

Agreement were amended, including but not limited to terms related to collateral

coverage, milestone deliverables, and financial covenants.

Further, as a condition of the entry into the First Amendment, the Company (i)

cancelled the warrant issued to Lender for the purchase of 1,541,768 common

shares at an exercise price of $1.30 per common share and (ii) issued to the

Lender a warrant (the “Replacement Warrant”) for the purchase of up to 862,068

common shares at an exercise price of $0.01 per common share. The Replacement

Warrant provides for “piggyback” registration rights.

The foregoing descriptions of the First Amendment and the Replacement Warrant do

not purport to be complete and are qualified in their entirety by reference to

each of the First Amendment and the Replacement Warrant, attached hereto as

Exhibits 99.1 and 99.2, respectively, and incorporated herein by reference.

Portions of the First Amendment have been redacted based upon a request for

confidential treatment filed with the Securities and Exchange Commission

pursuant to Rule 24b-2 under the Securities Exchange Act of 1934, as amended.

Amendments Number Two and Three to Credit Agreement,

Amendment Number One to Amendment

Number 1, Waiver and

Reaffirmation

On March 12, 2017, the Borrowers and Lender entered into an Amendment Number Two

to Credit Agreement, Amendment Number One to Amendment Number 1, Waiver and

Reaffirmation (the “Second Amendment”). On March 22, 2017, the Borrowers and

Lender entered into an Amendment Number Three to Credit Agreement (the “Third

Amendment”) further amending the Second Amendment. Under the terms of the Second

Amendment, as modified by the Third Amendment, (i) the maturity date for the

revolving and term loan credit facilities were amended to be the earlier of (a)

the maturity date in the Debenture or (b) (x) June 30, 2017 if the Maturity

Extension Trigger Date (as defined below) occurs on or before March 31, 2017 or

(y) if the Maturity Extension Trigger Date has not occurred by such date, March

31, 2017, (ii) the Lender granted a waiver of specified defaults under the

Credit Agreement relating to obligations to deliver to the Lender an executed

letter of intent with respect to refinancing the credit facility, and (iii)

certain other terms of the Credit Agreement were amended, including but not

limited to terms related to collateral coverage, milestone deliverables, and

financial covenants. The Maturity Extension Trigger Date is the date upon which

both of the following conditions have been satisfied: (a) the Company shall have

received gross cash proceeds of at least $3,000,000 from the issuance of the

common shares and related warrants and (b) the Company shall have deposited at

least $2,500,000 of the funds raised in an equity offering into the primary

operating account that Overland maintains at Opus Bank. In the event of certain

specified events of default, including failure to meet certain monthly revenue

and EBITDA targets, to enter into a term sheet with a new lender by April 28,

2017, or to enter into a letter of intent with respect to a financing or retain

a financial advisor with respect to a sale of a significant portion of the

company's assets, all amounts under the Credit Agreement may be accelerated and

become immediately payable.

Further, as a condition of the entry into the Second Amendment, the Company

issued to the Lender (i) a warrant (the “First Additional Warrant”), exercisable

in the event that the Company has not repaid all outstanding amounts due under

the Credit Agreement on or prior to April 17, 2017, for the purchase of the

number of common shares determined by dividing (i) 75,000 by (ii) the difference

between the market price of our common shares on April 17, 2017 and $0.01, at an exercise price of $0.01 per

common share and (ii) a warrant (the “Second Additional Warrant”), exercisable

in the event that the Company has not repaid all outstanding amounts due under

the Credit Agreement on or prior to May 31, 2017, for the purchase of the number

of common shares determined by dividing (i) 100,000 by (ii) the difference

between the market price of our common shares on May 31, 2017 and $0.01, at an

exercise price of $0.01 per common share. In addition, the warrants provide for

“piggyback” registration rights.

The foregoing descriptions of the Second Amendment, the First Additional

Warrant, the Second Additional Warrant and the Third Amendment do not purport to

be complete and are qualified in their entirety by reference to each of the

Amendments and the Warrants, attached hereto as Exhibits 99.3, 99.4, 99.5 and

99.6, respectively, and incorporated herein by reference. Portions of the Second

Amendment and Third Amendment have been redacted based upon a request for

confidential treatment filed with the Securities and Exchange Commission

pursuant to Rule 24b-2 under the Securities Exchange Act of 1934, as amended.

Term Loan Agreement

The Company and FBC Holdings S.a r.l. (“FBC”), a company organized under the

laws of Luxembourg, entered into a Term Loan Agreement, dated as of September

16, 2016, pursuant to which FBC provided a term loan to the Company in the

principal amount of $2,500,000. The loan bears an interest rate of 20% per annum

and is repayable in equal monthly installments with the first such payment paid

in January 2017. The Term Loan Agreement contains customary covenants, and is

secured by substantially all assets of the Company. The foregoing description of

the Term Loan Agreement does not purport to be complete and is qualified in its

entirety by reference to the Term Loan Agreement attached hereto as Exhibit 99.7

and incorporated herein by reference.

SUBMITTED HEREWITH

Exhibits

* Portions of this exhibit have been omitted pursuant to a

request for confidential treatment.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

SPHERE 3D CORP.

|

Date: March 23, 2017

|

/s/

Kurt Kalbfleisch

|

|

|

Name: Kurt Kalbfleisch

|

|

|

Title: Chief Financial Officer

|

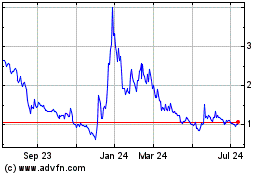

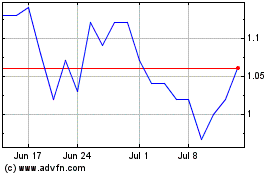

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Apr 2023 to Apr 2024