Current Report Filing (8-k)

March 16 2017 - 4:24PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 14, 2017

BRIGHTCOVE INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE

|

|

001-35429

|

|

20-1579162

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

290 Congress Street, Boston, MA

|

|

02210

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

(888) 882-1880

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(d) On March 14, 2017, the Board of Directors (the “Board”) of Brightcove Inc. (the “Company”) appointed Diane Hessan to the Board to

fill a vacancy as a Class III director, to serve until the Company’s 2018 annual meeting of stockholders or until her successor is duly elected and qualified.

At the time of appointment, it was not determined whether Ms. Hessan would sit on any Board committee.

The Company expects to enter into an indemnification agreement with Ms. Hessan in connection with her appointment to the Board, which is

expected to be in substantially the same form as that entered into with the other directors of the Company.

There is no arrangement or

understanding pursuant to which Ms. Hessan was appointed to the Board. There are no family relationships between Ms. Hessan and any director or executive officer of the Company, and Ms. Hessan has no direct or indirect material

interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Ms. Hessan’s compensation

will be consistent with that provided to all of the Company’s non-employee directors. Under the Company’s current non-employee director compensation policy, Ms. Hessan will receive an annual cash retainer of $30,000 for general

availability and participation in meetings and conference calls of the Board. In connection with her initial election to the Board, Ms. Hessan will receive an initial equity award with an aggregate value of $130,000, split equally in value

between restricted stock units and options to purchase shares of common stock (issued with an exercise price equal to the fair market value of the Company’s common stock on the grant date), that each vest in equal quarterly installments over

three years, provided, however, that all vesting ceases if Ms. Hessan resigns from the Board or otherwise ceases to serve as a director, unless the Board determines that the circumstances warrant continuation of vesting. The shares underlying

the initial grant of restricted stock units and stock options may not be sold while Ms. Hessan remains a Board member. At each annual meeting of our stockholders, so long as she has served as a director for at least the six months prior to such

annual meeting of stockholders, Ms. Hessan will receive annual equity awards with an aggregate target value of $65,000, split equally in value between restricted stock units and options to purchase shares of common stock (issued with an

exercise price equal to the fair market value of the Company’s common stock on the grant date), that each vest in full after one year, provided, however, that all vesting ceases if Ms. Hessan resigns from the Board or otherwise ceases to

serve as a director, unless the Board determines that the circumstances warrant continuation of vesting.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On March 16, 2017, the Company issued a press release

announcing Ms. Hessan’s appointment to the Board as discussed in Item 5.02(d) of this Report on Form 8-K. The full text of the press release is furnished as Exhibit 99.1 hereto. The information in this Item 7.01 and Exhibit 99.1

attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release of Brightcove Inc. dated March 16, 2017.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BRIGHTCOVE INC.

|

|

|

|

|

|

|

Date: March 16, 2017

|

|

|

|

By:

|

|

/s/ Kevin Rhodes

|

|

|

|

|

|

|

|

|

|

Kevin Rhodes

Chief Financial

Officer

|

3

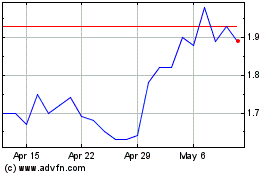

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

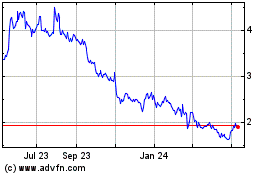

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Apr 2023 to Apr 2024