Today's Top Supply Chain and Logistics News From WSJ

March 06 2017 - 6:55AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Trucking fleet owners are starting to show modest confidence in

the U.S. economy. Orders for new heavy-duty trucks rose in February

for the fourth month in a row, WSJ Logistics Report's Jennifer

Smith writes. The overall order count of 22,900 Class 8 tractors

remains relatively light, but the steady upturn has pushed the

backlog past 100,000 trucks, bringing some relief to a troubled

truck manufacturing sector. The 5% increase over January reflects

rosier reports in the industrial sector, where factory orders and

manufacturing activity have been turning upward. The consumer trade

has been rockier, but truckers serving that business are seeing

solid demand to start 2017. Old Dominion Freight Line Inc. says its

shipment count edged up in February, and competitor Saia Inc. says

its demand accelerated from January to February. With pricing

holding firm in both the LTL and truckload arenas, carriers may

have the financial footing to speed up truck orders even more later

this year.

Alibaba Group Holding Ltd.'s new stake in India is a big bet on

consolidation in the country's fractured and hotly-contested

e-commerce market. The Chinese e-commerce giant is putting another

$177 million behind Paytm, the WSJ's Newley Purnel reports, leading

a new funding round with backing that gives Aibaba a controlling

stake in the Indian online payment and commerce business. The

funding values Paytm's new e-commerce platform at $1 billion. The

money is pouring into India's raucously competitive e-commerce

field even though the densely-populated country has big gaps in

online service. Credit Suisse estimates India has only 40 million

online shoppers in a population of 1.2 billion people. Alibaba,

Amazon.com Inc. and others expect the market will blossom as

internet infrastructure improves, and there are signs of big

nascent demand. Paytm recently saw a huge influx of users to its

mobile-wallet service after the Indian government voided the

country's highest-denomination bank notes.

China may be ready to rein back the relentless growth in its

industrial sector that's roiled world commodity markets. China's

government is pledging to dramatically slow a coal-power building

binge, the WSJ's Brian Spegele reports, saying it will shut down

dozens of coal-power plants and stop some new construction as the

country weans itself off a heavy reliance on coal and shifts to

cleaner sources of energy. The power sector is a stark example in

China of supply outstripping demand, but Beijing has moved recently

to cut overcapacity. The country's economic planning agency says it

aims to reduce steel production by some 50 million metric tons and

coal by at least 150 million tons this year. That could boost

prices for steel and the bulk-carrier shipping rates that are

closely tied to the value of the goods.

E-COMMERCE

Small businesses are looking at Alibaba chief Jack Ma's promise

to President Donald Trump to create 1 million U.S. jobs with heavy

skepticism. Small businesses such as those that place goods on

Alibaba's marketplaces have been fighting an uphill battle to get

counterfeit goods removed from the platforms, the WSJ's Kathy Chu

and Liza Lin report, undermining their own sales while creating a

big hurdle to Alibaba's international expansion plans. Big brands

have complained that Alibaba is slow to fight fakes, but small

businesses face particular problems because they have fewer

resources to track and report counterfeits. The U.S. Trade

Representative cited the problems faced by small businesses when it

reinstated Alibaba's Chinese-language Taobao site to a list of

notorious marketplaces that it says pose a risk to tens of millions

of American jobs. U.S. sellers want to reach Alibaba's big

audience, but small operators say the risks of appearing alongside

fakes and the costs of fighting counterfeits are daunting.

QUOTABLE

IN OTHER NEWS

A U.S. bankruptcy court approved a reorganization plan for

International Shipholding Corp. that will leave the bulk carrier in

the hands of SEACOR Holdings Inc. (WSJ)

General Motors Co. will sell its European business for $2.33

billion, with the Opel and Vauxhall brands going to Peugeot SA.

(WSJ)

Developers are preparing to open a free trade zone in New York

City for storage of fine art in the specialized global market.

(WSJ)

U.S. service providers posted their highest level of activity in

more than a year in February. (WSJ)

Delays in sending U.S. tax refunds may crimp consumer spending

in February. (WSJ)

The U.S. Environmental Protection Agency is close to reversing

an Obama administration decision to lock in stringent automobile

fuel-economy and emission standards. (WSJ)

Retailer Hhgregg, Inc. will close 88 stores and three

distribution centers as it adjusts to a steep downturn in sales.

(WSJ)

Finish Line Inc. sold its 65-store JackRabbit sporting-goods

chain and the inventories to affiliates of a private investment

firm for no payment. (WSJ)

A bankruptcy judge signed off on Gordon Brothers' $3 million

purchase of teen retailer Wet Seal LLC's brand name. (WSJ)

Currency investors are moving from stakes in the commodity

rebound toward increasing bets that industrial demand is set to

grow. (WSJ)

Big Lots Inc.'s comparable-store sales increased modestly in its

most recent quarter. (WSJ)

Wal-Mart Stores Inc., Maersk Line and International Business

Machines Inc. are undertaking ambitious tests of blockchain

technology for ocean shipments and sourcing. ( New York Times)

Georgia officials are pushing their $706 million Port of

Savannah upgrade as a "dredge-ready" project for Trump

administration infrastructure plans. (Atlanta

Journal-Constitution)

Aerospace components workers are uneasy about the impact Trump

administration trade policies may have on jobs. (Charleston Post

and Courier)

Iran and Azerbaijan agreed to work towards completing their

portion of a planned freight railway from Europe to South Asia.

(Reuters)

BNSF Railway will clean up coal and petroleum coke spilled from

open-top freight cars and will study covering loads under a consent

decree filed in federal court. (Seattle Times)

USA Truck Inc. set up an office in central Mexico for its

freight broker unit, USAT Logistics. (Fort Smith Times Record)

Canadian trucker Kenz Transportation LLC will establish its

first U.S. hub in Pennsylvania's Lehigh Valley. (Allentown Morning

Call)

American Outdoor Brands Inc., owners of gun maker Smith &

Wesson, will consolidate its U.S. logistics at a single

distribution center in central Missouri. (Columbia Daily

Tribune)

Authorities say gangs have repeatedly broken into railcars at

lightly-guarded yards outside Chicago and stolen firearms.

(WBBM)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

March 06, 2017 06:40 ET (11:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

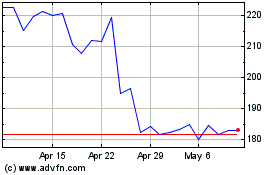

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

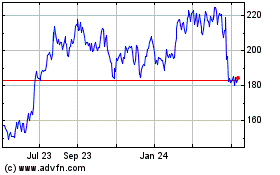

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Apr 2023 to Apr 2024