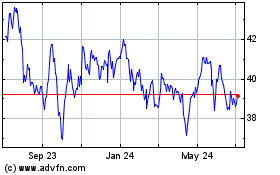

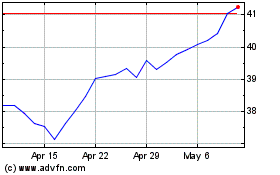

TRADING PRICES AND VOLUMES

The following table sets forth, for the periods indicated, the reported high and low daily trading prices and the aggregate volume of

trading of our Common Shares on the TSX and NYSE.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading of

Common Shares

|

|

Trading of

Common Shares

|

|

|

|

TSX

|

|

NYSE

|

|

|

|

High

|

|

Low

|

|

Volume

|

|

High

|

|

Low

|

|

Volume

|

|

|

|

($)

|

|

($)

|

|

(#)

|

|

(US$)

|

|

(US$)

|

|

(#)

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March

|

|

|

41.08

|

|

|

37.74

|

|

|

24,278,166

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

April

|

|

|

41.09

|

|

|

38.52

|

|

|

16,625,820

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

May

|

|

|

41.48

|

|

|

39.50

|

|

|

19,330,053

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

June

|

|

|

43.91

|

|

|

40.78

|

|

|

20,791,983

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

July

|

|

|

44.87

|

|

|

42.79

|

|

|

16,617,319

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

August

|

|

|

43.75

|

|

|

40.99

|

|

|

16,936,555

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

September

|

|

|

42.83

|

|

|

40.32

|

|

|

18,057,520

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

October

(1)

|

|

|

44.22

|

|

|

40.13

|

|

|

55,424,715

|

|

|

33.25

|

|

|

31.03

|

|

|

2,540,021

|

|

|

November

|

|

|

44.27

|

|

|

39.58

|

|

|

28,724,455

|

|

|

33.03

|

|

|

29.15

|

|

|

1,801,178

|

|

|

December

|

|

|

41.94

|

|

|

39.83

|

|

|

18,921,785

|

|

|

31.35

|

|

|

29.78

|

|

|

800,296

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January

|

|

|

41.91

|

|

|

40.59

|

|

|

15,832,581

|

|

|

32.18

|

|

|

30.53

|

|

|

1,001,095

|

|

|

February

|

|

|

43.50

|

|

|

41.35

|

|

|

20,223,622

|

|

|

33.06

|

|

|

31.61

|

|

|

900,395

|

|

|

March 1

|

|

|

42.49

|

|

|

41.95

|

|

|

1,164,421

|

|

|

31.85

|

|

|

31.50

|

|

|

63,179

|

|

-

(1)

-

The

Common Shares commenced trading on the NYSE on October 14, 2016.

CERTAIN CANADIAN AND U.S. FEDERAL INCOME TAX CONSIDERATIONS

The acquisition of the securities described herein may subject you to tax consequences in both the U.S. and Canada. This Prospectus

Supplement does not describe these tax consequences. Each Subscriber, in making this investment, has acknowledged that it has consulted, and is relying solely upon the advice of, such Subscriber's tax

advisors with respect to the Canadian and U.S. tax aspects of an investment in the Offered Shares, including with respect to Canadian withholding tax on dividends paid or credited

(or assumed to be paid or credited) on Offered Shares, and we have not made any representation regarding the tax consequences of an investment in the Offered Shares.

RISKS RELATED TO THE OFFERED SHARES

An investment in the Offered Shares offered hereby involves certain risks. You should carefully consider the risk factors described

under:

-

(a)

-

the

heading "Business Risk Management" found on pages 37 to 49 of the Annual MD&A;

-

(b)

-

note 32

"Financial Risk Management" found on pages 66 to 69 of the Annual Financial Statements;

-

(c)

-

the

heading "Risk Factors" found on pages D-14 to D-22 of the Management Information Circular, which include certain risks that relate to the

business and operations of ITC;

-

(d)

-

"Schedule G — Risk

Factors" to the Management Information Circular;

-

(e)

-

"Schedule A — Risk

Factors" to the ITC Business Acquisition Report;

-

(f)

-

the

heading "Item 1A. Risk Factors" found on pages 48 to 51 of "Schedule B — ITC Interim

Financial Statements and MD&A" to the ITC Business Acquisition Report, which include certain risks that relate to the business and operations of ITC; and

-

(g)

-

the

heading "Risk Factors" found on pages 23 to 25 of the accompanying Prospectus,

S-9

each

of which is incorporated by reference herein. In addition, you should carefully consider, in light of your own financial circumstances, the risk factors set out below which relate to the Offered

Shares, as well as the other information contained in this Prospectus Supplement, the Prospectus, the documents incorporated by reference herein and therein and in all subsequently filed documents

incorporated by reference, before making an investment decision.

The Common Shares are publicly traded and are subject to various factors that have historically made their market price volatile.

The market price of our Common Shares has in the past been, and may in the future be, subject to large fluctuations which may result in

losses for investors in our Common Shares. The market price of our Common Shares may increase or decrease in response to a number of events and factors,

including:

-

•

-

our operating performance and the performance of competitors and other similar companies;

-

•

-

the public's reaction to our press releases, other public announcements and our filings with the various securities

regulatory authorities;

-

•

-

changes in earnings estimates or recommendations by research analysts who track our securities;

-

•

-

the operating and share price performance of other companies that investors may deem comparable;

-

•

-

changes in general economic and/or political conditions;

-

•

-

the arrival or departure of key personnel; and

-

•

-

acquisitions, strategic alliances or joint ventures involving us or our competitors.

In

addition, the market price of our Common Shares is affected by many variables not directly related to our success and not within our control, including other developments that affect

the market for all utilities sector securities or the equity markets generally, the breadth of the public market for our Common Shares, and the attractiveness of alternative investments. These

variables may adversely affect the prices of our Common Shares regardless of our operating performance.

Our use of the net proceeds from the Offering may change.

We currently intend to apply the net proceeds we receive from the Offering as described under "Use of Proceeds" of this Prospectus

Supplement. However, management will have discretion in the actual application of those net proceeds, and may elect to apply them differently than is described under "Use of Proceeds" if management

believes it would be in our best interest to do so. The failure by management to apply the net proceeds effectively could have a material adverse effect on our business.

Future sales or issuances of securities of Fortis.

We may issue additional securities to finance future activities. We cannot predict the size of future issuances of securities or the

effect, if any, that future issuances and sales of securities will have on the market price of the Common Shares. Sales or issuances of substantial numbers of Common Shares, or the perception that

such sales could occur, may adversely affect prevailing market prices of the Common Shares. With any additional issuance of Common Shares, investors will suffer dilution to their voting power and we

may experience dilution in our earnings per share.

LEGAL MATTERS

Certain legal matters relating to this Offering will be passed upon on our behalf by Davies Ward Phillips & Vineberg LLP,

Toronto, Ontario and McInnes Cooper, St. John's. At the date hereof, partners and associates of each of Davies Ward Phillips & Vineberg LLP and McInnes Cooper own beneficially,

directly or indirectly, less than 1% of any of our securities or any securities of our associates or affiliates.

S-10

AUDITORS

Ernst & Young LLP, Chartered Professional Accountants, Fortis Place, 5 Springdale Street, Suite 800,

St. John's, Newfoundland and Labrador A1E 0E4, have audited the Annual Financial Statements incorporated by reference in this Prospectus Supplement. Ernst & Young LLP

report that they are independent of us in accordance with the Rules of Professional Conduct of the Association of Chartered Professional Accountants of Newfoundland and Labrador and in accordance with

the applicable rules and regulations of the SEC and the Public Company Accounting Oversight Board. On February 15, 2017, following a comprehensive request for proposals, assessment and

evaluation process, the Board of Directors determined that it would not propose Ernst & Young LLP for re-appointment as the auditors of Fortis at the upcoming meeting of Fortis

shareholders expected to be held on May 4, 2017. The Board has determined it will recommend the appointment of Deloitte LLP, 5 Springdale Street, Suite 1000,

St. John's, Newfoundland and Labrador A1E 0E4 as auditors of Fortis. Deloitte LLP has not prepared any report, valuation, statement or opinion included or incorporated by

reference in this Prospectus Supplement.

The

auditors of ITC are Deloitte & Touche LLP, located in Detroit, Michigan. Deloitte & Touche LLP has audited the consolidated financial statements and

financial statement schedule of ITC as at December 31, 2015 and December 31, 2014 and for the years ended December 31, 2015, 2014 and 2013 together with the notes thereto and the

auditor's report thereon dated February 25, 2016, which are included in the ITC Business Acquisition Report and the Management Information Circular incorporated by reference in this Prospectus

Supplement. Deloitte & Touche LLP, certified public accountants, are independent with respect to ITC within the meaning of the Securities Act, and the applicable rules and regulations

thereunder adopted by the SEC and the Public Company Accounting Oversight Board.

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under the laws of the Province of Newfoundland and Labrador, Canada. The majority of our directors and officers,

and some of the experts named in this Prospectus, are residents of Canada, and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the

U.S. We have appointed an agent for service of process in the U.S., but it may be difficult for holders of Common Shares who reside in the U.S. to effect service within the

U.S. upon those directors, officers and experts who are not residents of the U.S. It may also be difficult for holders of the Common Shares who reside in the U.S. to realize in

the U.S. upon judgments of courts of the U.S. predicated upon our civil liability and the civil liability of our directors and officers and experts under U.S. federal

securities laws.

We

have filed with the SEC an appointment of agent for service of process on Form F-X. Under the Form F-X, we have appointed CT Corporation System, 111 Eighth

Avenue, New York, New York 10011, as our agent for service of process in the U.S. in connection with any investigation or administrative proceeding conducted by the SEC, and any

civil suit or action brought against us in a U.S. court arising out of or related to or concerning the offering of securities under the registration statement of which this Prospectus

Supplement forms a part.

We

have been advised by our Canadian counsel, Davies Ward Phillips & Vineberg LLP, that a judgment of a U.S. court predicated solely upon civil liability under

U.S. federal securities laws would probably be enforceable in Canada if the U.S. court in which the judgment was obtained has a basis for jurisdiction in the matter that would be

recognized by a Canadian court for the same purposes. We have also been advised by Davies Ward Phillips & Vineberg LLP, however, that there is real doubt whether an action could be

brought in Canada in the first instance on the basis of liability predicated solely upon U.S. federal securities laws.

Two

of our directors, Ms. Maura J. Clark and Ms. Margarita K. Dilley, reside outside of Canada and each has appointed Fortis Inc., Suite 1100,

5 Springdale Street, P.O. Box 8837, St. John's, Newfoundland and Labrador A1B 3T2 as agent for service of process. You are advised that it may not be possible

to enforce judgments obtained in Canada against any person that resides outside of Canada, even if such person has appointed an agent for service of process.

S-11

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with securities commissions or similar

authorities in each of the provinces of Canada.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary

of Fortis at Suite 1100, 5 Springdale Street, P.O. Box 8837, St. John's, Newfoundland and Labrador A1B 3T2 (telephone (709) 737-2800) and

are also available electronically at

www.sedar.com

.

SHORT FORM BASE SHELF PROSPECTUS

|

|

|

|

|

New Issue and/or Secondary Offering

|

|

November 30, 2016

|

FORTIS INC.

$5,000,000,000

COMMON SHARES

FIRST PREFERENCE SHARES

SECOND PREFERENCE SHARES

SUBSCRIPTION RECEIPTS

DEBT SECURITIES

We may from time to time offer and issue common shares, or Common Shares, first preference shares, or First Preference Shares, second preference shares, or Second Preference

Shares, subscription receipts, or Subscription Receipts, and/or unsecured debt securities, or Debt Securities, and together with the Common Shares, First Preference Shares, Second Preference Shares

and Subscription Receipts, the Securities, having an aggregate offering price of up to $5,000,000,000 (or the equivalent in U.S. dollars or other currencies), during the 25 month

period that this short form base shelf prospectus, or the Prospectus, including any amendments hereto, remains valid. Securities may be offered separately or together, in amounts, at prices and on

terms to be determined based on market conditions at the time of sale and set forth in an accompanying prospectus supplement, or a Prospectus Supplement.

We are permitted, under the multi-jurisdictional disclosure system adopted by the United States, or the U.S., and Canada, to prepare this Prospectus in accordance with

Canadian disclosure requirements. You should be aware that such requirements are different from those of the U.S.

Financial statements incorporated by reference herein have been prepared in accordance with U.S. generally accepted accounting principles, or

U.S. GAAP.

Prospective investors should be aware that the acquisition of Securities may subject you to tax consequences in both the U.S. and Canada. This Prospectus may not describe these

tax consequences fully. You should read the tax discussion contained in any applicable Prospectus Supplement.

Your ability to enforce civil liabilities under U.S. federal securities laws may be affected adversely because our company is incorporated under the laws of the Province

of Newfoundland and Labrador, Canada, some of our officers and directors and some of the experts named in this Prospectus are non-U.S. residents, and some of our assets and some of the assets

of those officers, directors and experts may be located outside of the U.S.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION, OR THE SEC, NOR HAS THE SEC PASSED UPON THE ADEQUACY OR ACCURACY

OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

No underwriter or dealer has been involved in the preparation of, or has performed any review of, this Prospectus.

The

specific variable terms of any offering of Securities will be set out in the applicable Prospectus Supplement including, where applicable: (a) in the case of Common Shares, the number of

shares offered and the offering price (or the manner of determination thereof if offered on a non-fixed price basis); (b) in the case of First Preference Shares and Second Preference

Shares, the designation of the particular series, the number of shares offered, the offering price (or the manner of determination thereof if offered on a non-fixed price basis), the currency

or currency unit for which such shares may be purchased, any voting rights, any rights to receive dividends, any terms of redemption, any

conversion

or exchange rights and any other specific terms; (c) in the case of Subscription Receipts, the offering price (or the manner of determination thereof if offered on a non-fixed

price basis), the procedures for the exchange of Subscription Receipts for Common Shares, First Preference Shares, Second Preference Shares or Debt Securities, as the case may be, and any other

specific terms; and (d) in the case of Debt Securities, the designation of the Debt Securities, the aggregate principal amount of the Debt Securities being offered, the currency or currency

unit in which the Debt Securities may be purchased, authorized denominations, any limit on the aggregate principal amount of the Debt Securities of the series being offered, the issue and delivery

date, the maturity date, the offering price (at par, at a discount or at a premium), the interest rate or method of determining the interest rate, the interest payment date(s), any conversion

or exchange rights that are attached to the Debt Securities, any redemption provisions, any repayment provisions and any other specific terms. A Prospectus Supplement may include other specific

variable terms pertaining to the Securities that are not within the alternatives and parameters described in this Prospectus.

All

shelf information permitted under applicable laws to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this

Prospectus. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the

purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

We

may sell the Securities to or through underwriters or dealers purchasing as principals and may also sell the Securities to one or more purchasers directly subject to obtaining any required

exemptive relief or through agents. The Prospectus Supplement relating to a particular offering of Securities will identify each underwriter, dealer or agent, if any, engaged by us in connection with

the offering and sale of Securities and will set forth the terms of the offering of such Securities, the method of distribution of such Securities including, to the extent applicable, the proceeds to

us, and any fees, discounts or any other compensation payable to underwriters, dealers or agents and any other material terms of the plan of distribution. Securities may be sold from time to time in

one or more transactions at a fixed price or fixed prices, or at non-fixed prices. If offered on a non-fixed price basis, Securities may be offered at market prices prevailing at the time of sale or

at prices to be negotiated with purchasers at the time of sale, which prices may vary between purchasers and during the period of distribution. If Securities are offered on a non-fixed price basis,

the underwriters', dealers' or agents' compensation will be increased or decreased by the amount by which the aggregate price paid for Securities by the purchasers exceeds or is less than the gross

proceeds paid by the underwriters, dealers or agents to us. See "Plan of Distribution".

This

Prospectus also qualifies the distribution of Securities by certain of our securityholders, including one or more of our wholly owned subsidiaries, or each a Selling Securityholder. One or more

Selling Securityholders may sell Securities to or through underwriters or dealers purchasing as principals and may also sell the Securities to one or more purchasers directly, through statutory

exemptions, or through agents designated from time to time. See "Plan of Distribution" and "Selling Securityholders".

Our

Common Shares, First Preference Shares, Series F, First Preference Shares, Series G, First Preference Shares, Series H, First Preference Shares, Series I, First

Preference Shares, Series J, First Preference Shares,

Series K and First Preference Shares, Series M are listed on the Toronto Stock Exchange, or TSX, under the symbols "FTS", "FTS.PR.F", "FTS.PR.G", "FTS.PR.H", "FTS.PR.I",

"FTS.PR.J", "FTS.PR.K" and "FTS.PR.M", respectively. Our Common Shares are listed on the New York Stock Exchange, or NYSE, under the symbol "FTS".

There is currently no

market through which the First Preference Shares, Second Preference Shares, Subscription Receipts or Debt Securities may be sold and purchasers may not be able to resell any First Preference Shares,

Second Preference Shares, Subscription Receipts or Debt Securities purchased under this Prospectus. This may affect the pricing of such Securities in the secondary market, the transparency and

availability of trading prices, the liquidity of such Securities and the extent of issuer regulation. See the "Risk Factors" section of the applicable Prospectus Supplement.

This

Prospectus does not qualify for issuance Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to one or more

underlying interests including, for example, an equity or debt security, a statistical measure of economic or financial performance including, but not limited to, any currency, consumer price or

mortgage index, or the price or value of one or more commodities, indices or other items, or any other item or formula, or any combination or basket of the foregoing items. For greater certainty, this

Prospectus may qualify for issuance Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to published rates of a central

banking authority or one or more financial institutions, such as a prime rate or bankers' acceptance rate, or to recognized market benchmark interest rates such as LIBOR, EURIBOR or a

U.S. federal funds rate.

Subject

to applicable laws, in connection with any offering of Securities, the underwriters, dealers or agents may over-allot or effect transactions which stabilize or maintain the market price of the

Securities at levels other than those which may prevail on the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See "Plan of Distribution".

TABLE OF CONTENTS

Table of Contents

NOTICE TO READERS

Investors should rely only on the information contained in or incorporated by reference in this Prospectus or any applicable Prospectus

Supplement. We have not authorized anyone to provide investors with different or additional information. We are not making an offer of Securities in any jurisdiction where the offer is not permitted

by law. Prospective investors should not assume that the information contained in or incorporated by reference in this Prospectus or any applicable Prospectus Supplement is accurate as of any date

other than the date on the front of the applicable Prospectus Supplement.

Unless

we have indicated otherwise, or the context otherwise requires, references in this Prospectus to "Fortis", "we", "us" and "our" refer to Fortis Inc. and our consolidated

subsidiaries.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Capitalized terms used but not otherwise defined in this "Special Note Regarding Forward-Looking Statements"

have the meanings ascribed thereto under the heading "Glossary".

This

Prospectus, including the documents incorporated herein by reference, contains "forward-looking information" within the meaning of applicable Canadian securities laws and

"forward-looking statements" within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995

(collectively referred to herein as

"forward-looking information" or "forward-looking statements"). The forward-looking information reflects our current expectations regarding our future growth, results of operations, performance,

business prospects and opportunities, based on information currently available. These expectations may not be appropriate for other purposes. All forward-looking information is given pursuant to the

"safe harbour" provisions of applicable Canadian securities legislation. The words "anticipates", "assumes", "believes", "budgets", "can", "could", "estimates", "expects", "forecasts", "intends",

"may", "might", "opportunity", "plans", "projects", "seeks", "schedule", "should", "target", "will", "would" and similar expressions are often intended to identify forward-looking information,

although not all forward-looking information contains these identifying words. The forward-looking information reflects management's current beliefs and is based on information currently available

to us.

The

forward-looking information in this Prospectus, including the documents incorporated herein by reference, includes, but is not limited to, statements regarding: the expectation that

the acquisition of ITC will be accretive to earnings per Common Share in the first full year following closing, excluding one-time acquisition-related expenses; the expectation that we will recognize

additional acquisition-related expenses in the fourth quarter of 2016; targeted average annual dividend growth through 2021; the expected timing of filing of regulatory applications and receipt and

outcome of regulatory decisions; our forecast midyear rate base for 2017 and the expectation that midyear rate base will increase from 2016 to 2021; forecast gross consolidated capital expenditures

for 2016 and total capital spending through 2021; forecast gross consolidated capital expenditures for 2016 for certain of our subsidiaries, including ITC, FortisAlberta and UNS Energy; the nature,

timing and expected costs of certain capital projects including, without limitation, expansion of the Tilbury LNG facility, including Tilbury 1A, the pipeline expansion to the Woodfibre LNG site, and

additional opportunities including electric transmission, LNG and renewable-related infrastructure and generation; the expectation that our significant capital expenditure program will support

continuing growth in earnings and dividends; the expectation that the acquisition of ITC will increase total capitalization, but will not have a significant impact on the percentage breakdown of our

capital structure; the expectation that cash required to complete subsidiary capital expenditure programs will be sourced from a combination of cash from operations, borrowings under credit

facilities, equity injections from us and long-term debt offerings; the expectation that maintaining the targeted capital structure of our regulated operating subsidiaries will not have an impact on

its ability to pay dividends in the foreseeable future; the expectation that our subsidiaries will be able to source the cash required to fund our 2016 capital expenditure programs; the expected

consolidated fixed-term debt maturities and repayments over the next five years, including at ITC; the expectation that the combination of available credit facilities and relatively low annual debt

maturities and repayments will provide us with flexibility in the timing of access to capital markets; the expectation that we will remain compliant with debt covenants throughout 2016; the intent of

management to hedge future exchange rate fluctuations and monitor our foreign currency exposure; the expectation that FortisAlberta will recognize capital tracker revenue in 2016; Tucson Electric

2

Table of Contents

Power

Company's expected share of mine reclamation costs; Central Hudson's estimated total remediation costs for manufactured gas plant sites; the estimated range of return on common shareholder's

equity refunds and associated regulatory liabilities at ITC; the expectation that any liability from current legal proceedings will not have a material adverse effect on our consolidated financial

position and results of operations; and the expectation that the adoption of certain future accounting pronouncements will not have a material impact on our consolidated financial statements.

The

forecasts and projections that make up the forward-looking information included in this Prospectus are based on assumptions which include, but are not limited to: the realization of

the anticipated benefits of the acquisition of ITC; our ability to successfully integrate the business and operations of ITC into our group of companies; our ability to retain key employees of ITC;

the absence of undisclosed liabilities of ITC; the receipt of applicable regulatory approvals and requested rate orders, no material adverse regulatory decisions being received, and the expectation of

regulatory stability; no material capital project and financing cost overrun related to any of our capital projects; the realization of additional opportunities including natural gas related

infrastructure and generation; our Board of Directors exercising its discretion to declare dividends, taking into account our business performance and financial conditions; no significant variability

in interest rates; no significant operational disruptions or environmental liability due to a catastrophic event or environmental upset caused by severe weather, other acts of nature or other major

events; the continued ability to maintain the electricity and gas systems to ensure their continued performance; no severe and prolonged downturn in economic conditions; no significant decline in

capital spending; sufficient liquidity and capital resources; the continuation of regulator-approved mechanisms to flow through the cost of natural gas and energy supply costs in customer rates; the

ability to hedge exposures to fluctuations in foreign exchange rates, natural gas prices and electricity prices; no significant counterparty defaults; the continued competitiveness of natural gas

pricing when compared with electricity and other alternative sources of energy; the continued availability of natural gas, fuel, coal and electricity supply; continuation and regulatory approval of

power supply and capacity purchase contracts; the ability to fund defined benefit pension plans, earn the assumed long-term rates of return on the related assets and recover net pension costs in

customer rates; no significant changes in government energy plans, environmental laws and regulations that may materially negatively affect our operations and cash flows; no material change in public

policies and directions by governments that could materially negatively affect us and our subsidiaries; maintenance of adequate insurance coverage; the ability to obtain and maintain licences and

permits; retention of existing service areas; the continued tax-deferred treatment of earnings from our Caribbean operations; continued maintenance of information technology infrastructure; continued

favourable relations with First Nations; favourable labour relations; that we can reasonably assess the merit of and potential liability attributable to ongoing legal proceedings; and sufficient human

resources to deliver service and execute the capital program.

The

forward-looking information is subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical results or results anticipated

by the forward-looking information. Factors which could cause results or events to differ from current expectations include, but are not limited to: regulatory risk, including risks relating to

pending and future changes in environmental regulations; interest rate risk, including the uncertainty of the impact that a continuation of a low interest rate environment may have on the ROE of our

regulated utilities; the impact of fluctuations in foreign exchange rates; risk associated with the impact of less favorable economic conditions on our results of operations; risks associated with the

continuation, renewal, replacement and/or regulatory approval of power supply and capacity purchase contracts; risks relating to energy prices; provincial, state and federal regulatory legislative

decisions and actions; uncertainty related to the realization of some or all of the expected benefits of the acquisition of ITC; uncertainty regarding the outcome of regulatory proceedings of our

utilities; risks relating to any potential downgrade of our credit ratings; risks relating to the Base Rate Complaints; risks relating to

potential additional FERC challenges and FERC orders that could result in the ITC Regulated Operating Subsidiaries continuing to take Bonus Depreciation; operating and maintenance risks, including our

limited experience in the independent FERC-regulated transmission industry; the risk that ITC will not be integrated successfully; risks relating to our ability to access capital markets on favourable

terms or at all; the cost of debt and equity capital; risks associated with changes in economic conditions; changes in regional economic and market conditions which could affect customer growth and

energy usage; risks relating to the impact of actual loads, forecasted loads, regional economic conditions, weather conditions, union strikes, labour shortages, material and equipment prices and

3

Table of Contents

availability;

the performance of the stock market and changing interest rate environment; risks from regulatory approvals for reasons relating to rate construct, environmental, siting, regional

planning, cost recovery or other issues or as a result of legal proceedings; risks arising from variances between estimated and actual costs of construction contracts awarded and the potential for

greater competition; insurance coverage risk; risk of loss of licences and permits; risk of loss of service area; risks relating to derivatives; the continued ability to hedge foreign exchange risk;

counterparty risk; environmental risks; competitiveness of natural gas; natural gas, fuel, coal and electricity supply risk; risks relating to human resources and labour relations; risk of unexpected

outcomes of legal proceedings currently against us; risk of not being able to access First Nations lands; weather and seasonality risk; commodity price risk; capital resources and liquidity risks;

changes in critical accounting estimates; risks related to changes in tax legislation; the ongoing restructuring of the electric industry; changes to long-term contracts; risk of failure of

information technology infrastructure and cyber-attacks or challenges to our information security; and certain presently unknown or unforeseen risks, including, but not limited to, acts of terrorism.

For additional information with respect to our risk factors and risk factors relating to ITC, the acquisition of ITC and our post-acquisition business and operations, reference should be made to the

section of this Prospectus entitled "Risk Factors", to the documents incorporated herein by reference and to our continuous disclosure materials filed from time to time with Canadian and

U.S. securities regulatory authorities.

All

forward-looking information in this Prospectus and in the documents incorporated herein by reference is qualified in its entirety by the above cautionary statements and, except as

required by law, we undertake no obligation to revise or update any forward-looking information as a result of new information, future events or otherwise.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been filed with the SEC as part of our registration statement: (a) the documents referred to under

the heading "Documents Incorporated by Reference"; (b) the consent of Ernst & Young LLP; (c) the consent of Deloitte & Touche LLP; (d) the consent of

Davies Ward Phillips & Vineberg LLP; (e) the power of attorney of the directors and officers of Fortis; and (f) the Statement of Eligibility on Form T-1 under the

U.S. Trust Indenture Act of

1939

of The Bank of New York Mellon.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed by us with securities

commissions or similar authorities in Canada.

Our disclosure documents listed below and filed with the appropriate securities commissions or similar regulatory authorities in

each of the provinces of Canada are specifically incorporated by reference into and form an integral part of this Prospectus:

-

(a)

-

our

Annual Information Form dated February 17, 2016, for the fiscal year ended December 31, 2015;

-

(b)

-

our

audited comparative consolidated financial statements as at December 31, 2015 and December 31, 2014 and for the fiscal years ended

December 31, 2015 and 2014, together with the notes thereto, or the Annual Financial Statements, and the auditors' report thereon dated February 17, 2016;

-

(c)

-

our

Management Discussion and Analysis of financial condition and results of operations dated February 17, 2016 for the fiscal year ended

December 31, 2015, or the Annual MD&A;

-

(d)

-

our

Management Information Circular dated March 18, 2016 prepared in connection with our annual and special meeting of shareholders held on

May 5, 2016, or the Management Information Circular; provided, however, that the following sections or subsections of the Management Information Circular are hereby excluded from this

Prospectus in accordance with Item 11.1(3) of Form 44-101F1 —

Short Form Prospectus

as the

acquisition of ITC Holdings Corp., or ITC, has been completed:

-

(i)

-

"Questions

and Answers About the Meeting and Acquisition — Did the Board of Directors of Fortis receive a fairness

opinion in connection with the Acquisition?" at pages 3-4 of the Management Information Circular;

-

(ii)

-

the

references to Goldman, Sachs & Co. and the opinion of Goldman, Sachs & Co. under the headings "Special

Business — The Acquisition of ITC Holdings Corp. — Background and

4

Table of Contents

-

(e)

-

our

unaudited comparative interim consolidated financial statements as at September 30, 2016 and for the three and nine months ended

September 30, 2016 and 2015, together with the notes thereon, or the Interim Financial Statements;

-

(f)

-

our

Management Discussion and Analysis of financial condition and results of operations for the three and nine months ended September 30, 2016, or

the Interim MD&A;

-

(g)

-

our

material change report dated February 11, 2016 relating to the announcement of the acquisition of ITC;

-

(h)

-

our

material change report dated October 24, 2016 relating to the announcement of the completion of the acquisition of ITC; and

-

(i)

-

our

business acquisition report dated November 23, 2016 with respect to the acquisition of ITC completed on October 14, 2016, or the ITC

Business Acquisition Report.

Any

document of the type referred to above, including any material change report (other than any confidential material change report), any business acquisition report, any Prospectus

Supplements disclosing additional or updated information, and any "template version" of "marketing materials" (each as defined in National

Instrument 41-101 —

General Prospectus Requirements

) subsequently filed by us with such securities

commissions or regulatory authorities in Canada after the date of this Prospectus, and prior to the termination of the distribution under this Prospectus, shall be deemed to be incorporated by

reference into this Prospectus.

Documents

filed by us with the SEC or similar authorities in Canada which are in our current reports on Form 6-K or annual reports on Form 40-F under the

U.S. Securities Exchange Act of 1934

,

as amended, or the Exchange Act, in each case after the date of this Prospectus, shall be deemed to be

incorporated by reference as exhibits to the registration statement of which this Prospectus forms a part and, in addition, any other report on Form 6-K and the exhibits thereto

shall be deemed to be incorporated by reference into this Prospectus or as exhibits to the registration statement, if and to the extent expressly provided in such reports. Our current reports on

Form 6-K and our annual reports on Form 40-F are available on the SEC's Electronic Data Gathering and Retrieval, or EDGAR, website

at

www.sec.gov

.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this Prospectus shall be deemed to be modified or superseded for

purposes of this Prospectus to the extent that a statement contained herein, or in any other subsequently filed document which also is incorporated or is deemed to be incorporated by reference herein,

modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the

document that it modifies or supersedes. The making of a modifying or superseding statement will not be deemed an admission for any purpose that the modified or superseded statement, when made,

constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in

light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this

Prospectus.

When

we file a new annual information form and audited consolidated financial statements and related management discussion and analysis with, and where required, they are accepted

by, the applicable securities regulatory authorities during the time that this Prospectus is valid, the previous annual information form, the previous audited consolidated financial statements and

related management discussion and analysis and all unaudited interim consolidated financial statements and related management discussion and analysis for such periods, all material change reports and

any information circular and business acquisition report filed prior to

5

Table of Contents

the

commencement of our financial year in which the new annual information form is filed will be deemed no longer to be incorporated by reference in this Prospectus for purposes of future offers and

sales of Securities under this Prospectus. Upon new interim financial statements and the accompanying management discussion and analysis being filed by us with the applicable securities regulatory

authorities during the term of this Prospectus, all interim financial statements and accompanying management's discussion and analysis filed prior to the filing of the new interim financial statements

shall be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities hereunder.

Copies

of the documents incorporated herein by reference may be obtained on request without charge from our Corporate Secretary at Suite 1100, 5 Springdale Street,

P.O. Box 8837, St. John's, Newfoundland and Labrador A1B 3T2 (telephone (709) 737-2800). These documents are also available through the Internet on our

website at

www.fortisinc.com

or on SEDAR, which can be accessed at

www.sedar.com

. The information contained on, or accessible through, any of

these websites is not incorporated by reference into this Prospectus and is not, and should not be considered to be, a part of this Prospectus, unless it is explicitly so incorporated.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

In addition to our continuous disclosure obligations under the securities laws of the provinces of Canada, we are subject to the

informational requirements of the Exchange Act and in accordance therewith file reports and other information with the SEC. Under the multi-jurisdictional disclosure system adopted by the U.S., or

MJDS, such reports and other information may be prepared in accordance with the disclosure requirements of Canada, which requirements are different from those of the U.S. Any information filed

with the SEC can be read and copied at prescribed rates at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public

Reference Room may be obtained by calling the SEC at 1-800-SEC-0330 or by accessing its website at

www.sec.gov

. Some of the documents that we file with or furnish to the

SEC are electronically available from the SEC's Electronic Document Gathering and Retrieval System, which is commonly known by the acronym "EDGAR", and may be accessed

at

www.sec.gov

.

We

have filed with the SEC a registration statement on Form F-10 under the

U.S. Securities Act of 1933

, as amended, or the

Securities Act, with respect to the Securities offered by this Prospectus as supplemented by a Prospectus Supplement. This Prospectus, which forms a part of the registration statement, does not

contain all of the information set forth in the registration statement, certain parts of which have been omitted in accordance with the rules and regulations of the SEC. For further information with

respect to us and the Securities offered in this Prospectus, reference is made to the registration statement and to the schedules and exhibits filed therewith. Statements contained in this Prospectus

as to the contents of certain documents are not necessarily complete and, in each instance, reference is made to the copy of the document filed as an exhibit to the registration statement. Each such

statement is qualified in its entirety by such reference.

PRESENTATION OF FINANCIAL INFORMATION

Financial statements incorporated by reference herein have been prepared in accordance with U.S. GAAP.

All

financial information of ITC and the historical financial statements of ITC incorporated by reference in this Prospectus are reported in U.S. dollars and have been prepared in

accordance with U.S. GAAP. Our unaudited pro forma condensed consolidated financial information included in the ITC Business Acquisition Report incorporated by reference in this

Prospectus are reported in Canadian dollars and have been prepared in accordance with applicable Canadian rules. The assets and liabilities of ITC shown in our unaudited pro forma condensed

consolidated balance sheet as at September 30, 2016 included in the ITC Business Acquisition Report are reported in Canadian dollars and reflect the U.S.-to-Canadian dollar period-end closing

exchange rate. The revenues and expenses of ITC shown in our unaudited pro forma condensed consolidated statement of earnings for the year ended December 31, 2015 and for the nine months

ended September 30, 2016, included in the ITC Business Acquisition Report, are reported in Canadian dollars and reflect the average U.S.-to-Canadian dollar exchange rates for such periods.

Financial information in this Prospectus that has been derived from such unaudited pro forma condensed consolidated financial information has been translated to Canadian dollars on the

same basis.

6

Table of Contents

Certain

calculations included in tables and other figures in this Prospectus have been rounded for clarity of presentation.

CURRENCY AND EXCHANGE RATE INFORMATION

This Prospectus contains references to U.S. dollars and Canadian dollars. All dollar amounts referenced, unless otherwise

indicated, are expressed in Canadian dollars. References to "$" or "C$" are to Canadian dollars and references to "US$" are to U.S. dollars. The following table shows, for the years and dates

indicated, certain information regarding the Canadian dollar/U.S. dollar exchange rate. The information is based on the noon exchange rate as reported by the Bank of Canada. Such exchange rate

on November 28, 2016 was C$1.3401 = US$1.00.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period End

|

|

Average

(1)

|

|

Low

|

|

High

|

|

|

|

|

|

(C$ per US$)

|

|

|

|

|

Year ended December 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

1.3840

|

|

|

1.2788

|

|

|

1.1728

|

|

|

1.3990

|

|

|

2014

|

|

|

1.1601

|

|

|

1.1045

|

|

|

1.0614

|

|

|

1.1643

|

|

|

2013

|

|

|

1.0636

|

|

|

1.0299

|

|

|

0.9839

|

|

|

1.0697

|

|

|

Quarter ended,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2016

|

|

|

|

|

|

|

|

|

1.2775

|

|

|

1.3248

|

|

|

June 30, 2016

|

|

|

|

|

|

|

|

|

1.2544

|

|

|

1.3170

|

|

|

March 31, 2016

|

|

|

|

|

|

|

|

|

1.2962

|

|

|

1.4589

|

|

-

(1)

-

The

average of the noon buying rates during the relevant period.

FORTIS

We are an international electric and gas utility holding company, with total assets of approximately $47 billion, on a

pro forma basis as at September 30, 2016 including the acquisition of ITC, and revenue totaling approximately $8.1 billion and $5.8 billion for the year ended

December 31, 2015 and the nine months ended September 30, 2016, respectively, in each case on a pro forma basis including the acquisition of ITC. In 2015, our electricity

distribution systems met a combined peak demand of 9,705 megawatts, or MW, and our gas distribution systems met a peak day demand of 1,323 terajoules, or TJ. For the nine months ended

September 30, 2016, our electricity distribution systems met a combined peak demand of 9,590 MW and our gas distribution system met a peak day demand of 1,335 TJ. In addition,

ITC's electricity transmission system serves a combined peak load exceeding 26,000 MW. Our 8,000 employees serve customers at utility operations in five Canadian provinces, nine

U.S. states and three Caribbean countries.

Our

business segments are:

-

(a)

-

Regulated

Independent Transmission — United States: consisting of the electric transmission operations of ITC,

acquired by us and GIC Pte Ltd, or GIC, on October 14, 2016. ITC is now our indirect subsidiary, with Eiffel Investment Pte Ltd (an affiliate of GIC) owning a 19.9%

interest in ITC. ITC's business consists primarily of the electric transmission operations of ITC's regulated operating subsidiaries, which include International Transmission Company, Michigan

Electric Transmission Company, LLC, ITC Midwest LLC, ITC Great Plains, LLC and ITC Interconnection LLC. ITC owns and operates high-voltage transmission facilities in

Michigan, Iowa, Minnesota, Illinois, Missouri, Kansas and Oklahoma, and is a public utility and independent transmission owner in Wisconsin;

-

(b)

-

Regulated

Electric & Gas Utilities — United States: consisting of vertically integrated electrical and

gas utilities in the state of Arizona: Tucson Electric Power Company, UNS Electric, Inc. and UNS Gas, Inc., each a subsidiary of UNS Energy Corporation, acquired by us in 2014; together

with Central Hudson Gas & Electric Corporation, a regulated transmission and distribution utility located in New York State's Mid-Hudson River Valley, acquired by us in 2013;

-

(c)

-

Regulated

Gas Utility — Canadian: consisting of FortisBC Energy Inc., a regulated gas utility serving the Lower

Mainland, Vancouver Island and Whistler regions of British Columbia;

7

Table of Contents

-

(d)

-

Regulated

Electric Utilities — Canadian: consisting of (i) FortisAlberta, a regulated electric distribution

utility serving a substantial portion of southern and central Alberta; (ii) FortisBC Inc., an integrated, regulated electric utility serving the southern interior of British Columbia;

(iii) Newfoundland Power Inc., a regulated electric utility that operates throughout the island portion of the Province of Newfoundland and Labrador; (iv) Maritime Electric

Company, Limited, a regulated electric utility on Prince Edward Island; and (v) FortisOntario Inc., which provides regulated, integrated electric utility service in Fort Erie, Cornwall,

Gananoque and Port Colborne and distributes electricity in the District of Algoma in Ontario;

-

(e)

-

Regulated

Electric Utilities — Caribbean: consisting of (i) an indirect approximate 60% controlling ownership

interest in Caribbean Utilities Company, Ltd., an integrated electric utility in Grand Cayman, Cayman Islands, the Class A Ordinary Shares of which are listed on the TSX under the symbol

CUP.U; (ii) FortisTCI Limited and Turks and Caicos Utilities Limited, integrated electric utilities on the Turks and Caicos Islands; and (iii) an approximate 33% equity investment in

Belize Electricity Limited, an integrated electric utility in Belize;

-

(f)

-

Non-Regulated — Energy

Infrastructure: consisting of (i) our 51% controlling ownership interest in the Waneta

expansion hydroelectric generating facility in British Columbia; (ii) the Aitken Creek gas storage facility in British Columbia, acquired by us on April 1, 2016 for

US$266 million; and (iii) the 25-MW Mollejon, 7-MW Chalillo and 19-MW Vaca hydroelectric generating facilities in Belize; and

-

(g)

-

Corporate

and Other: captures expense and revenue items not specifically related to any reportable segment and those business operations that are below the

required threshold for reporting as separate segments.

SHARE CAPITAL OF FORTIS

Our authorized share capital consists of an unlimited number of Common Shares, an unlimited number of First Preference Shares issuable

in series and an unlimited number of Second Preference Shares issuable in series, in each case without nominal or par value. As at November 28, 2016, 399,833,460 Common Shares,

5,000,000 Cumulative Redeemable First Preference Shares, Series F, or the First Preference Shares, Series F, 9,200,000 Cumulative Redeemable Five-Year Fixed Rate Reset

First Preference Shares, Series G, or the First Preference Shares, Series G, 7,024,846 Cumulative Redeemable Five-Year Fixed Rate Reset First Preference Shares, Series H,

or the First Preference Shares, Series H, 2,975,154 Cumulative Redeemable Floating Rate First Preference Shares, Series I, or the First Preference Shares, Series I,

8,000,000 Cumulative Redeemable First Preference Shares, Series J, or the First Preference Shares, Series J, 10,000,000 Cumulative Redeemable Fixed Rate Reset First

Preference Shares, Series K, or the First Preference Shares, Series K, and 24,000,000 Cumulative Redeemable Fixed Rate Reset First Preference Shares, Series M, or the First

Preference Shares, Series M, were issued and outstanding. Our Common Shares, First Preference Shares, Series F, First Preference Shares, Series G, First Preference Shares,

Series H, First Preference Shares, Series I, First Preference Shares, Series J, First Preference Shares, Series K and First Preference Shares, Series M are

listed on the TSX under the symbols "FTS", "FTS.PR.F", "FTS.PR.G", "FTS.PR.H", "FTS.PR.I", "FTS.PR.J", "FTS.PR.K" and "FTS.PR.M", respectively. Our Common Shares are listed on the NYSE under the

symbol "FTS".

EARNINGS COVERAGE RATIOS

In accordance with the requirements of the Canadian securities regulatory authorities, the consolidated earnings coverage ratios set

out below have been calculated for the 12-month periods ended September 30, 2016 and December 31, 2015. Our interest requirements on all of our outstanding long-term debt amounted to

$622 million and $604 million for the 12 months ended September 30, 2016 and the 12 months ended December 31, 2015, respectively. Our dividend requirements on

all of our First Preference Shares for the 12 months ended September 30, 2016 and the 12 months ended December 31, 2015, adjusted to a before-tax equivalent, amounted to

$97 million using an effective income tax rate of 19.7% and $97 million using an effective income tax rate of 21.0%, respectively. Our earnings before interest and income tax for the

12 months ended September 30, 2016 and the 12 months ended December 31, 2015 were $1,335 million and $1,558 million,

8

Table of Contents

respectively,

which is 1.86 times and 2.22 times, respectively, our aggregate interest and dividend requirements for the periods.

Our

earnings coverage ratios, calculated on a pro forma basis after giving effect to the acquisition of ITC, including: (i) the amount of borrowings in connection with the

financing of the acquisition of ITC; and (ii) the indebtedness of ITC, on a consolidated basis, on closing of the acquisition, which was $5.9 billion as of September 30, 2016, are

calculated as follows: (a) our interest requirements on all of our outstanding long-term debt amounted to $932 million and $703 million for the 12 months ended

December 31, 2015 and the nine months ended September 30, 2016, respectively; (b) our dividend requirements on all of our First Preference Shares for the 12 months ended

December 31, 2015 and the nine months ended September 30, 2016, adjusted to a before-tax equivalent, amounted to $104 million using an effective income tax rate of 26.2% and

$80 million using an effective income tax rate of 26.0%, respectively; and (c) our earnings before interest and income tax for the 12 months ended December 31, 2015 and the

nine months ended September 30, 2016 were $2,234 million and $1,608 million, respectively, which is 2.16 times and 2.05 times, respectively, our aggregate interest

and dividend requirements for the periods after giving effect to the acquisition of ITC and the financing thereof as described above.

These

earnings coverage ratios do not purport to be indicative of earnings coverage ratios for any future periods. The earnings coverage ratios and dividend and interest requirements do

not give effect to the issuance of any Securities that may be issued pursuant to this Prospectus and any Prospectus Supplement, since the aggregate principal amounts and the terms of such Securities

are not currently known. If we offer First Preference Shares, Second Preference Shares or Debt Securities having a term to maturity in excess of one year under this Prospectus, the applicable

Prospectus Supplement will include earnings coverage ratios giving effect to the issuance of such Securities.

DIVIDEND POLICY

Dividends on the Common Shares are declared at the discretion of our board of directors, or the Board of Directors. We declared and

paid cumulative cash dividends on our Common Shares of $1.395 in 2015, $1.28 in 2014 and $1.24 in 2013. On December 16, 2015, our Board of Directors declared a first quarter dividend of $0.375

per Common Share, which was paid on March 1, 2016 to holders of record on February 17, 2016. On February 17, 2016, our Board of Directors declared a second quarter dividend of

$0.375 per Common Share, which was paid on June 1, 2016 to holders of record on May 18, 2016. On July 28, 2016, our Board of Directors declared a third quarter dividend of $0.375

per Common Share, which was paid on September 1, 2016 to holders of record on August 19, 2016. On September 27, 2016, our Board of Directors declared a fourth quarter dividend of

$0.40 per Common Share, which will be paid on December 1, 2016 to holders of record on November 18, 2016. We have increased our annual Common Share dividend payment for

43 consecutive years.

During

the third quarter of 2016, we provided dividend guidance targeting average annual dividend growth of 6% through 2021. This guidance takes into account many factors, including the

successful integration of ITC, the expectation of reasonable outcomes for regulatory proceedings at our utilities, the successful execution of our $13 billion five-year capital plan and

management's continued confidence in the strength of our diversified portfolio of assets and record of operational excellence.

Regular

quarterly dividends at the prescribed annual rate have been paid on all of the First Preference Shares, Series F; First Preference Shares, Series G; First

Preference Shares, Series H; First Preference Shares, Series I; First Preference Shares, Series J; First Preference Shares, Series K; and First Preference Shares,

Series M, or the Outstanding First Preference Shares, respectively. Our Board of Directors declared a first quarter dividend on the Outstanding First Preference Shares on December 16,

2015, in each case in accordance with the applicable prescribed annual rate or floating rate, as the case may be, which was paid on March 1, 2016 to holders of record on February 17,

2016. On February 17, 2016, our Board of Directors declared a second quarter dividend on the Outstanding First Preference Shares, in accordance with the applicable prescribed annual rate or

floating rate, as the case may be, in each case which was paid on June 1, 2016 to holders of record on May 18, 2016. On July 28, 2016 our Board of Directors declared a third

quarter dividend on the Outstanding First Preference Shares, in accordance with the applicable prescribed annual rate or floating rate, as the case may be, in each case which was paid on

September 1, 2016 to holders of record on August 19, 2016. On

9

Table of Contents

September 27,

2016 our Board of Directors declared a fourth quarter dividend on the Outstanding First Preference Shares, in accordance with the applicable prescribed annual rate or floating

rate, as the case may be, in each case to be paid on December 1, 2016 to holders of record on November 18, 2016.

DESCRIPTION OF SECURITIES OFFERED

Common Shares

Common Shares may be offered separately or together with First Preference Shares, Second Preference Shares, Subscription Receipts or

Debt Securities under this Prospectus. Common Shares may also be issuable on conversion or exchange of certain Debt Securities and Subscription Receipts qualified for issuance under this Prospectus.

Each Common Share offered hereunder will have the terms described below.

Dividends

Dividends on Common Shares are declared at the discretion of our Board of Directors. Holders of Common Shares are entitled to dividends

on a

pro rata

basis if, as and when declared by our Board of Directors. Subject to the rights of the holders of the First Preference Shares and

Second Preference Shares and any of our other classes of shares entitled to receive dividends in priority to or rateably with the holders of the Common Shares, our Board of Directors may declare

dividends on the Common Shares to the exclusion of any of our other classes of shares.

Liquidation, Dissolution or Winding-Up

On our liquidation, dissolution or winding-up, holders of Common Shares are entitled to participate rateably in any distribution of our

assets, subject to the rights of holders of First Preference Shares and Second Preference Shares and any of our other classes of shares entitled to receive our assets on such a distribution in

priority to or rateably with the holders of the Common Shares.

Voting Rights

Holders of the Common Shares are entitled to receive notice of and to attend all annual and special meetings of our shareholders, other

than separate meetings of holders of any other class or series of shares, and to one vote in respect of each Common Share held at such meetings.

First Preference Shares

The following is a summary of the material rights, privileges, conditions and restrictions attached to the First Preference Shares as a

class. The specific terms of the First Preference Shares, including the currency in which First Preference Shares may be purchased and redeemed and the currency in which any dividend is payable, if

other than Canadian dollars, and the extent to which the general terms described in this section apply to those First Preference Shares, will be set forth in the applicable Prospectus Supplement. One

or more series of First Preference Shares may be sold separately or together with Common Shares, Second Preference Shares, Subscription Receipts or Debt Securities under this Prospectus.

Issuance in Series

Our Board of Directors may from time to time issue First Preference Shares in one or more series. Prior to issuing shares in a series,

our Board of Directors is required to fix the number of shares in the series and determine the designation, rights, privileges, restrictions and conditions attaching to that series of First Preference

Shares.

Priority

The shares of each series of First Preference Shares rank on a parity with the First Preference Shares of every other series and in

priority to all of our other shares, including the Second Preference Shares, as to the payment of dividends, return of capital and the distribution of our assets in the event of a liquidation,

dissolution or winding-up, whether voluntary or involuntary, or any other distribution of our assets among our shareholders

10

Table of Contents

for

the purpose of winding-up our affairs. Each series of First Preference Shares participates rateably with every other series of First Preference Shares in respect of accumulated cumulative

dividends and returns of capital if any amount of cumulative dividends, whether or not declared, or amount payable on the return of capital in respect of a series of First Preference Shares, is not

paid in full.

Voting

The holders of the First Preference Shares are not entitled to any voting rights as a class except to the extent that voting rights may

from time to time be attached to any series of First Preference Shares, and except as provided by law or as described below under "— Modification". At any meeting of the

holders of First Preference Shares, each holder shall have one vote in respect of each First Preference Share held.

Redemption

Subject to the provisions of the

Corporations Act

(Newfoundland and Labrador) and any

provisions relating to any particular series, we, upon giving proper notice, may redeem out of capital or otherwise at any time, or from time to time, the whole or any part of the then outstanding

First Preference Shares of any one or more series on payment for each such First Preference Share of such price or prices as may be applicable to such series. Subject to the foregoing, if only a part

of the then outstanding First Preference Shares of any particular series is at any time redeemed, the shares to be redeemed will be selected by lot in such manner as our Board of Directors or the

transfer agent for the First Preference Shares, if any, decide, or if our Board of Directors so determine, may be redeemed

pro rata

disregarding

fractions.

Modification

The class provisions attached to the First Preference Shares may only be amended with the prior approval of the holders of the First

Preference Shares in addition to any other approvals required by the

Corporations Act

(Newfoundland and Labrador) or any other statutory provisions of

like or similar effect in force from time to time. The approval of the holders of the First Preference Shares with respect to any and all matters may be given by at least two-thirds of the votes cast

at a meeting of the holders of the First Preference Shares duly called for that purpose.

Second Preference Shares

The rights, privileges, conditions and restrictions attaching to the Second Preference Shares are substantially identical to those

attaching to the First Preference Shares, except that the Second Preference Shares are junior to the First Preference Shares with respect to the payment of dividends, repayment of capital and the

distribution of our assets in the event of a liquidation, dissolution or winding up.

The

specific terms of the Second Preference Shares, including the currency in which Second Preference Shares may be purchased and redeemed and the currency in which any dividend is

payable, if other than Canadian dollars, and the extent to which the general terms described in this Prospectus apply to those Second Preference Shares, will be set forth in the applicable Prospectus

Supplement. One or more series of Second Preference Shares may be sold separately or together with Common Shares, First Preference Shares, Subscription Receipts or Debt Securities under this

Prospectus.

Subscription Receipts

Subscription Receipts may be offered separately or together with Common Shares, First Preference Shares, Second Preference Shares or

Debt Securities, as the case may be. Subscription Receipts will be issued under a subscription receipt agreement, or the Subscription Receipt Agreement, that will be entered into between us and the

escrow agent, or the Escrow Agent, at the time of issuance of the Subscription Receipts. Each Escrow Agent will be a financial institution authorized to carry on business as a trustee. If underwriters

or agents are used in the sale of any Subscription Receipts, one or more of such underwriters or agents may also be a party to the Subscription Receipt Agreement governing the Subscription Receipts

sold to or through such underwriter or agent.

11

Table of Contents

The

Subscription Receipt Agreement will provide each initial purchaser of Subscription Receipts with a non-assignable contractual right of rescission following the issuance of any Common

Shares, First Preference Shares, Second Preference Shares or Debt Securities, as applicable, to such purchaser upon the exchange of the Subscription Receipts if this Prospectus, the Prospectus

Supplement under which the Subscription Receipts are offered, or any amendment hereto or thereto contains a misrepresentation, as such term is defined in the

Securities

Act

(Ontario). This contractual right of rescission will entitle such initial purchaser to receive the amount paid for the Subscription Receipts upon surrender of the

Securities issued in exchange therefor, provided that such remedy for rescission is exercised in the time stipulated in the Subscription Receipt Agreement. This right of rescission will not extend to

any holders of Subscription Receipts who acquire such Subscription Receipts from an initial purchaser on the open market or otherwise.

The

applicable Prospectus Supplement will include details of the Subscription Receipt Agreement covering the Subscription Receipts being offered. The specific terms of the Subscription

Receipts, and the extent to which the general terms described in this section apply to those Subscription Receipts, will be set forth in the applicable Prospectus Supplement. A copy of the

Subscription Receipt Agreement will be filed by us with securities regulatory authorities after it has been entered into by us and will be available on our SEDAR profile at

www.sedar.com

.

This

section describes the general terms that will apply to any Subscription Receipts being offered. The terms and provisions of any Subscription Receipts offered under a Prospectus

Supplement may differ from the terms described below, and may not be subject to or contain any or all of such terms. The particular terms of each issue of Subscription Receipts that will be described

in the related Prospectus Supplement will include, where applicable:

-

(a)

-

the

number of Subscription Receipts;

-

(b)

-

the

price at which the Subscription Receipts will be offered;

-

(c)

-

conditions,

or the Release Conditions, for the exchange of Subscription Receipts into Common Shares, First Preference Shares, Second Preference Shares or

Debt Securities, as the case may be, and the consequences of such conditions not being satisfied;

-

(d)

-

the

procedures for the exchange of the Subscription Receipts into Common Shares, First Preference Shares, Second Preference Shares or Debt Securities;

-

(e)

-

the

number of Common Shares, First Preference Shares, Second Preference Shares or Debt Securities to be exchanged for each Subscription Receipt;

-

(f)

-

the

aggregate principal amount, currency or currencies, denominations and terms of the series of Common Shares, First Preference Shares, Second Preference

Shares or Debt Securities that may be exchanged upon exercise of each Subscription Receipt;

-

(g)

-

the

designation and terms of any other Securities with which the Subscription Receipts will be offered, if any, and the number of Subscription Receipts that

will be offered with each Security;

-

(h)

-

the