Hudson Technologies, Inc. (NASDAQ:HDSN) announced results for

the fourth quarter ended December 31, 2016.

The Company reported revenues of $7.8 million, for the fourth

quarter ended December 31, 2016, an increase of 7% compared to $7.3

million in the comparable 2015 period. The revenue increase in the

quarter is primarily related to an increase in the volume of

certain refrigerants, offset by a reduction in service sales. Gross

margin in the fourth quarter of 2016 was 13% compared to 19% in the

prior year period primarily due to a change in sales mix in 2016

when compared to 2015. Net loss for the quarter was $1.9 million,

or ($0.05) per basic and diluted share, compared to a net loss of

$1.0 million, or ($0.03) per basic and diluted share, in the fourth

quarter of 2015.

In December 2016, the Company raised $48 million of net proceeds

through an underwritten public offering, which was partially

utilized to pay down all of its existing revolving credit facility,

resulting in a cash balance of $34 million as of December 31,

2016.

For the year ended December 31, 2016 Hudson achieved record

revenues of $105.5 million, a 32% increase compared to $79.7

million in the comparable 2015 period. The increase is primarily

related to a higher selling price of certain refrigerants and

higher volumes of certain refrigerants sold. Gross margin increased

to 29% for full year 2016 compared to 23% for 2015. Net income for

2016 was $10.6 million, or $0.31 per basic and $0.30 per diluted

share, compared to $4.8 million or $0.15 per basic and $0.14 per

diluted share in 2015.

Kevin J. Zugibe, Chairman and Chief Executive Officer of Hudson

Technologies commented, “2016 was another strong year for our

Company as demonstrated by record revenues, increased gross margins

and significantly improved profitability. Our full-year results are

reflective of our strong nine-month refrigerant season, during

which we continued to benefit from increases in the average selling

price of R-22 refrigerant. The fourth quarter is historically our

slowest portion of the year, as volume demand for refrigerants

falls off.”

Mr. Zugibe continued, “As a leading provider and reclaimer of

refrigerants, we believe we are well positioned to continue to

capitalize on the opportunities we’re seeing with the phase out of

R-22 and to take advantage of the industry dynamics that will

develop with the anticipated phase down of next generation HFC

compounds expected to begin in 2019. We, along with others in our

industry, believe a strong refrigerant reclamation program is

essential to fulfilling demand as production of legacy refrigerants

is phased out, but the equipment that requires these gases remains

in operation. With our long term experience in the industry,

proprietary technology and industry relationships, we are uniquely

positioned to assist customers as they adapt to the evolving

refrigerant marketplace.”

CONFERENCE CALL INFORMATION

The Company will host a conference call to discuss the fourth

quarter results today, March 1, 2017 at 5:00 P.M. Eastern Time.

To access the live webcast, log onto the Hudson Technologies

website at www.hudsontech.com, and click on “Investor Relations”.

To participate in the call by phone, dial (877) 407-9205

approximately five minutes prior to the scheduled start time.

International callers please dial (201) 689-8054.

A replay of the teleconference will be available until April 1,

2017 and may be accessed by dialing (877) 481-4010. International

callers may dial (919) 882-2331. Callers should use conference ID:

10262.

About Hudson Technologies

Hudson Technologies, Inc. is a leading provider of innovative

solutions to recurring problems within the refrigeration

industry. Hudson's proprietary RefrigerantSide® Services

increase operating efficiency and energy savings, and remove

moisture, oils and other contaminants frequently found in the

refrigeration circuits of large comfort cooling and process

refrigeration systems. Performed at a customer's site as an

integral part of an effective scheduled maintenance program or in

response to emergencies, RefrigerantSide® Services offer

significant savings to customers due to their ability to be

completed rapidly and at higher purity levels, and can be utilized

while the customer's system continues to operate. In addition, the

Company sells refrigerants and provides traditional reclamation

services to the commercial and industrial air conditioning and

refrigeration markets. For further information on Hudson,

please visit the Company's web site at www.hudsontech.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

Statements contained herein which are not historical facts

constitute forward-looking statements. Such forward-looking

statements involve a number of known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Such

factors include, but are not limited to, changes in the laws and

regulations affecting the industry, changes in the demand and price

for refrigerants (including unfavorable market conditions adversely

affecting the demand for, and the price of, refrigerants), the

Company's ability to source refrigerants, regulatory and economic

factors, seasonality, competition, litigation, the nature of

supplier or customer arrangements that become available to the

Company in the future, adverse weather conditions, possible

technological obsolescence of existing products and services,

possible reduction in the carrying value of long-lived assets,

estimates of the useful life of its assets, potential environmental

liability, customer concentration, the ability to obtain financing,

any delays or interruptions in bringing products and services to

market, the timely availability of any requisite permits and

authorizations from governmental entities and third parties as well

as factors relating to doing business outside the United States,

including changes in the laws, regulations, policies, and

political, financial and economic conditions, including inflation,

interest and currency exchange rates, of countries in which the

Company may seek to conduct business, the Company’s ability to

successfully integrate any assets it acquires from third parties

into its operations, and other risks detailed in the Company's 10-K

for the year ended December 31, 2015 and other subsequent filings

with the Securities and Exchange Commission. The words "believe",

"expect", "anticipate", "may", "plan", "should" and similar

expressions identify forward-looking statements. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date the statement was

made.

Hudson Technologies, Inc. and

SubsidiariesConsolidated Statements of

Operations(unaudited)(Amounts in thousands, except for

share and per share amounts)

Three Months EndedDecember

31,

Year EndedDecember 31,

2016 2015 2016

2015 Revenues $ 7,779 $ 7,301 $ 105,481 $

79,722

Cost of sales 6,746 5,933

74,395 61,233

Gross profit

1,033 1,368 31,086

18,489

Operating expenses: Selling and

marketing 1,273 1,207 4,310 4,179 General and administrative

2,588 1,913 7,829 6,129

Total operating expenses 3,861

3,120 12,139 10,308

Operating income (loss) (2,828 ) (1,752 ) 18,947 8,181

Other income (expense): Interest expense (199 ) (176

) (1,118 ) (776 ) Other income (expense) 31

302 (564 ) 302 Total other income

(expense) (168 ) 126 (1,682 )

(474 )

Income (loss) before income taxes (2,996 )

(1,626 ) 17,265 7,707

Income tax expense (benefit)

(1,071 ) (603 ) 6,628 2,944

Net income (loss) $

(1,925 )

$ (1,023 )

$ 10,637 $

4,763 Net income (loss) per common share

– Basic

$ (0.05 )

$

(0.03 )

$ 0.31

$ 0.15 Net income (loss) per

common share – Diluted

$ (0.05 )

$ (0.03 )

$

0.30 $ 0.14

Weighted average number of shares outstanding - Basic

36,527,250

32,715,802

34,104,476

32,546,840

Weighted average number of shares outstanding - Diluted

36,527,250

32,715,802

35,416,910

33,936,099

Hudson Technologies, Inc. and

SubsidiariesConsolidated Balance Sheets(Amounts in

thousands, except for share and par value amounts)

December

31,

2016

2015

Assets

Current assets: Cash and cash equivalents $ 33,931 $ 1,258

Trade accounts receivable - net 4,797 4,414 Inventories 68,601

61,897 Deferred tax asset - 376 Prepaid expenses and other current

assets

847 1,524

Total current assets 108,176 69,469 Property,

plant and equipment, less accumulated depreciation 7,532 7,536

Other assets 75 76 Deferred tax asset 2,532 3,287 Goodwill 856 856

Intangible assets, less accumulated amortization

3,299

3,787 Total Assets

$ 122,470 $

85,011

Liabilities and

Stockholders' Equity

Current liabilities: Trade accounts payable $ 5,110 $ 5,792

Accrued expenses and other current liabilities 2,888 3,018 Accrued

payroll 1,782 1,577 Income taxes payable 322 -- Short-term debt and

current maturities of long-term debt

199

20,573 Total current liabilities

10,301 30,960 Other liabilities - 333 Long-term debt, less current

maturities

152 4,293

Total Liabilities 10,453

35,586 Commitments and

contingencies Stockholders' equity: Preferred

stock, shares authorized 5,000,000: Series A Convertible preferred

stock, $0.01 par value ($100 liquidation preference value); shares

authorized 150,000; none issued or outstanding

--

--

Common stock, $0.01 par value; shares authorized 100,000,000;

issued and outstanding 41,465,820 and 32,804,617 415 328 Additional

paid-in capital 114,032 62,163 Accumulated deficit

(2,430 ) (13,066

) Total Stockholders' Equity

112,017 49,425

Total Liabilities and Stockholders' Equity

$ 122,470 $

85,011

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170301006396/en/

Investor Relations:Institutional Marketing Services

(IMS)John Nesbett/Jennifer

Belodeau203-972-9200jnesbett@institutionalms.comorCompany:Hudson

Technologies, Inc.Brian F. Coleman, 845-735-6000President &

COObcoleman@hudsontech.com

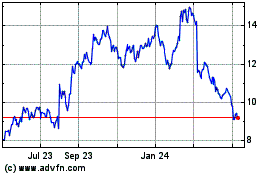

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Sep 2023 to Sep 2024