Public Storage's Quarterly Results Beat Expectations

February 22 2017 - 8:14PM

Dow Jones News

By Maria Armental

Higher rents and foreign-currency gains helped Public Storage

beat Wall Street financial targets in the latest period.

The California-based real-estate investment trust, which built

its first self-storage facility in 1972, has more than 2,500

storage facilities in the U.S. and Europe.

In the latest period, the company recorded a $23 million

currency-translation gain from its euro-denominated debt.

Over all, Public Storage's fourth-quarter profit rose 14% to

$413.7 million, or $2.03 a share, while revenue rose 7% to $651.4

million.

Funds from operations, a key measure used by REITs to assess

performance, rose to $2.77 a share from $2.46.

Core FFO--which further excludes the effect of foreign currency

exchange rates and other items, such as legal settlements--rose to

$2.65 a share from $2.45 a share.

Analysts surveyed by Thomson Reuters had projected $1.89 a share

in profit and FFO of $2.64 on $619.1 million in revenue.

Shares closed Wednesday at $226.24, down 11% over the past 12

months.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 22, 2017 19:59 ET (00:59 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

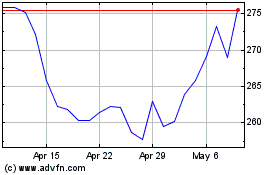

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024