By Jacquie McNish and Joann S. Lublin

Hunter Harrison is frustrated that "chest pounding" between his

activist investment partner and directors of CSX Corp. contributed

to a breakdown in negotiations for him to take the helm of the

railroad.

"I wish the two sides would get together and allow for this

value creation for the shareholders instead of going through these

games which create nothing but further anxiety for the

shareholders," Mr. Harrison said in an interview with The Wall

Street Journal.

CSX privately offered the chief executive position to the

72-year-old railroad veteran last week, but negotiations broke down

when Paul Hilal, Mr. Harrison's activist partner, refused to back

away from some compensation and governance demands.

Mr. Harrison said although he is "disappointed" that Mr. Hilal

was unable to reach an agreement with CSX, "I am not trying to

abandon anyone."

Mr. Hilal has conducted most of the discussions with CSX since

the Journal first broke the news last month that he had teamed up

with Mr. Harrison to shake up the Jacksonville, Fla.-based

railroad's management.

In a letter sent Thursday to the CSX board, Mr. Hilal urged the

company to resume negotiations, rather than wait for a shareholder

vote. The investor said he was willing to change five directors,

instead of six, if CSX agreed to give Mr. Harrison a four-year

employment contract instead of a two-year deal. CSX told Mr. Hilal

in a letter last week that would accept the nomination of five new

directors.

Mr. Hilal, whose hedge fund Mantle Ridge LP has invested in CSX,

is seeking to add six directors to a board that will eventually

shrink to 12 members. Mr. Hilal has also asked the railroad to

approve a compensation plan for Mr. Harrison that CSX estimated

could cost $300 million. The package includes a large stock award

and $89 million that Mantle Ridge had previously promised to pay

Mr. Harrison.

CSX said its board has concerns about giving so many board seats

to a shareholder with less than a 5% stake and that the cost of the

proposed compensation package is "extraordinary in scope and

structured largely as an upfront payment" with few performance

requirements.

About 50 CSX investors met with Mr. Hilal at a Manhattan

restaurant Wednesday night. They heard him defend his drive for six

board seats and Mr. Harrison's proposed pay package, according to

two shareholders.

"There was pushback" from investors on several issues, but their

greatest concern was over the number of seats sought, said one CSX

investor, who supports bringing in Mr. Harrison.

At Wednesday evening's gathering, Mr. Hilal said he needed the

five seats besides Mr. Harrison's so the expected new CSX chief

"has control and can execute his plan," according to this CSX

investor.

The standoff with Mr. Hilal prompted CSX to take the unusual

step Tuesday of calling for a special shareholder vote on Mantle

Ridge's demands, at a date to be determined.

CSX's decision to let shareholders vote on the activist's

demands "is a pretty smart move," said Charles Elson, head of the

Weinberg Center for Corporate Governance at University of

Delaware's business school.

The large pay package "casts a bit of a cloud on the activists,"

Mr. Elson said. "If you're running on a governance platform, this

kind of package would seem to be counter to a good governance

platform because of its significant size."

Mr. Harrison said he was willing to meet with CSX directors to

reconsider the terms of his compensation package, though CSX's

calculation is based on the assumption that its stock price would

improve significantly, "which would benefit all shareholders," he

said. Mr. Harrison declined to discuss what concessions he would

consider. "If [they] don't like this package, tell me how you would

like to bundle it and I'll take it under advisement," he said.

CSX did offer a counterproposal on compensation that would have

paid Mr. Harrison between $15 million and $20 million a year, well

above the current pay plan for its executives, people familiar with

the matter said. It didn't want to take on Mr. Hilal's commitment

to pay Mr. Harrison what he left on the table at Canadian Pacific

Railway, where Mr. Harrison was chief executive until last

month.

CSX said in a statement Tuesday night it would be

"inappropriate" to pay Mr. Hilal's commitment to compensate Mr.

Harrison for the $89 million he surrendered at CP.

At the Wednesday dinner, Mr. Hilal said the pay package is worth

$200 million and includes $120 million of stock options, about half

of which are tied to "very real" performance measures, according to

the CSX investor.

This CSX shareholder said the $200 million figure "is still a

lot of money." The investor also remains concerned over Mr.

Harrison's refusal to be examined by an independent physician,

saying "that's a big issue."

The activist proposal to CSX is similar to the compensation plan

Mr. Harrison was granted when he was named chief executive of CP in

2012. The plan was approved with little complaint after Bill

Ackman's Pershing Square Capital Management LP won a proxy battle

that handed the hedge fund a majority of directors on the

railroad's board. During Mr. Harrison's tenure, CP's stock price

more than doubled in value.

CSX's proposal exceeds the amounts paid to the company's current

chief executive, Michael Ward, who in the three years ended in 2015

earned a total of $31.6 million in salary, stock awards and other

benefits, according to a company filing. At CP, Mr. Harrison was

paid $18.7 million in salary, bonuses and stock awards last

year.

--Paul Ziobro and David Benoit contributed to this article.

Write to Jacquie McNish at Jacquie.McNish@wsj.com and Joann S.

Lublin at joann.lublin@wsj.com

(END) Dow Jones Newswires

February 16, 2017 18:56 ET (23:56 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

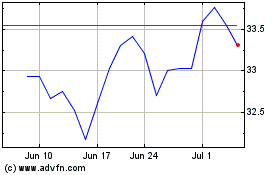

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024