Report of Foreign Issuer (6-k)

February 16 2017 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report Of Foreign Private Issuer

Pursuant To Rule 13a-16 Or 15d-16 Of

The Securities

Exchange Act Of 1934

For the month of February 2017

Commission File Number: 000-54290

Grupo Aval Acciones y Valores S.A.

(Exact name of registrant as specified

in its charter)

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO AVAL ACCIONES Y VALORES S.A.

TABLE OF CONTENTS

|

ITEM

|

|

|

1.

|

Transcript of Conference Call – Proyecto Ruta del Sol Tramo 2

|

Item 1

GRUPO AVAL ACCIONES Y

VALORES S.A.

CONFERENCE CALL

PROYECTO RUTA DEL SOL

TRAMO 2

FEBRUARY 15TH, 2017

Operator

Welcome to Grupo Aval’s

conference call regarding “Proyecto Ruta del Sol Tramo 2”. My name is Hilda and I will be your operator for today’s

call.

Grupo Aval is an issuer

of securities in Colombia and in the United States, registered with the Colombia’s National Registry of Shares and Issuers,

RNVE, and the United States Securities and Exchange Commission. As such, it is subject to the control of the Superintendency of

Finance and Compliance with the applicable US securities regulation as a foreign private issuer under Rule 405 of the US Securities

Act of 1933.

The information provided

in this call includes forward-looking statements by the Company which are based on facts and circumstances as currently known.

Actual results may vary from those stated in this call as a consequence of developments in the investigations and the decisions

of any governmental, judicial or arbitral authority involved in this matter and the final agreement reached with respect to the

Proyecto Ruta del Sol Tramo 2, among others.

Grupo Aval shall not

be responsible for any decision taken by investors in connection with this call. Grupo Aval expressly disclaims any obligation

to review, update or correct the information provided in this call. The call is not intended to provide full disclosure on the

subject discussed.

Today’s call will

be conducted by Mr. Luis Carlos Sarmiento, President and CEO of Grupo Aval.

I will now turn the call

over to Mr. Luis Carlos Sarmiento. Mr. Sarmiento, you may begin.

Luis Carlos Sarmiento

Gutiérrez

Grupo Aval Acciones

y Valores S.A.

Chief Executive Officer

Good afternoon everyone

and thank you for joining this call. We decided to hold this call given the vast amount of questions and inquiries that we have

received from investors, analysts and other interested parties with regard to the series of events and news related to Odebrecht’s

transnational bribery scandal and its possible effects on Proyecto Ruta del Sol Tramo 2, Corficolombiana and Grupo Aval. I hope

to cover all of the questions you might have; if I do leave some unanswered, chances are that we do not have the information ourselves.

In any case, if after the call there are other topics you would like to discuss with us, please do contact us and we will try to

clarify all of your doubts. There are several events in motion as we speak. The moment we have additional information relevant

to the market we will make sure to inform you of any new developments.

I would like to break

this call in three main topics: First, I will share with you facts that I consider relevant and that I believe serve to add context

to the extent of our involvement in this project. Secondly, I will review for you chronologically all the events that have transgressed

since the LavaJato scandal erupted in Brazil. And finally, I will try to answer other specific questions that we have received

in the past few days from the investor and analyst communities. To begin,

1. The

facts:

|

|

·

|

Grupo Aval owns approximately 10% of Corficolombiana directly, and indirectly, through three of

the banks that Aval controls, an additional 48%, for a total combined 58% stake in this affiliate. Aval receives 44% of the economics

of Corficolombiana on its own financial statement.

|

|

|

·

|

Corficolombiana is by nature an investment/merchant bank that generates revenues through three

main lines of business: treasury, investment banking advisory and investments in financial and non-financial operating companies.

|

|

|

·

|

Corficolombiana’s investments in non-financial companies are concentrated in four industries:

energy, infrastructure, hotels and agroindustry.

|

|

|

·

|

Corficolombiana is an industry leader in infrastructure as reflected by the fact that it is the

country’s largest toll road builder and operator. Corficolombiana is the majority shareholder in all but one of the infrastructure

projects in which it participates – Ruta del Sol 2.

|

|

|

·

|

The reason that Corficolombiana is not a majority shareholder in Ruta del Sol 2 is that Corficolombiana

did not have the road building experience required by the Government when this toll road was put up for bid back in 2009.

|

|

|

·

|

Consequently, Corficolombiana sought partnerships with the then leading infrastructure companies

in the world and after a thorough selection process decided to partner with Odebrecht S.A., Latin America’s largest engineering

and construction company.

|

|

|

·

|

Odebrecht’s main requirement was to be given operating control of the company that ultimately

won the auction in late December, 2009. This company is known today as Concesionaria Ruta del Sol 2, “CRDS”.

|

|

|

·

|

Corficolombiana participated in CRDS through a wholly-owned affiliate, EPISOL, with a 33% stake,

Odebrecht with 62% and the Solarte group with 5%.

|

|

|

·

|

Concesionaria Ruta del Sol 2 is the only partnership we have with Odebrecht. We are not associated

with them in the Navelena project nor in any other project.

|

|

|

·

|

Episol’s cash investment in CRDS amounts to approximately Ps$86 billion, approximately US$29

million.

|

|

|

·

|

However, through retained earnings, the investment of Episol in CRDS has grown to Ps$0.35 trillion

(approx. US$117 million), which is equivalent to 1.7% of the total assets of Corficolombiana and to 0.2% of Grupo Aval’s

total consolidated assets.

|

|

|

·

|

Corficolombiana’s share of CRDS’ net income for 2016 was PS$95 billion, approximately

US$30 million, and given our stake in Corficolombiana, this figure accounted for less than 2% of Grupo Aval’s net income

for the year.

|

|

|

·

|

As mentioned by us in previous statements, since 2009, the company has contributed with approximately

6% of the total net income of Corficolombiana, and less than 1% of the total net income of Grupo Aval.

|

|

|

·

|

CRDS has not distributed cash dividends to Corficolombiana and was not expected to do so in the

next decade as it first needed to finish the construction of the road and then it had to meet its obligations with the banks.

|

|

|

·

|

The financial obligations of CRDS, the most relevant liability of the company, as of December 31,

2016 was PS$2.4 trillion (approximately US$800 million). 50% of such loans were granted by banks owned by Grupo Aval in both a

revolving facility which funded working capital requirements and a long term facility which funded part of the construction.

|

|

|

·

|

The loans are, as of January 30th, 2017 Past Due 30 days + and as a consequence banks have begun

to constitute loan loss reserves.

|

|

|

·

|

These loss reserves are not material as of January 31st, and if they continue to be past due as

of the end of this month the additional amount required to be provisioned will not be material either. If by the end of 1Q2017

this matter has not been resolved, which is not our expectation, but if it has not been resolved, our banks would have to constitute

additional provisions to reach a total of PS$120 billion (approximately USD 40 million).

|

|

|

·

|

The loan loss reserves are tax deductible at a 40% rate this year. After such tax impact is deducted

and minority interest is calculated, the provisions required in 1Q2017 would have a negative impact in Aval’s Net Income

of approximately US$ 18 million; a non-material figure if we compare it with the net income we consistently generate.

|

2. Now,

let me address a chronology of events related to the Odebrecht scandal:

|

|

·

|

On June 12, 2015 Brazilian police arrested Marcelo Odebrecht, the head of Odebrecht S.A. Mr. Odebrecht

was accused of spearheading a $2.1 billion bribery scheme at state-run oil firm Petrobras. The investigation looked into whether

subcontractors may have colluded with top Petrobras executives to overbill the company and pay bribes.

|

|

|

·

|

That same month we requested that senior Odebrecht executives came to Colombia to explain what

had happened and to reassure us that the charges were contained to Brazil and would not contaminate our partnership and/or the

Ruta del Sol project. Senior executives visited with us later on that month and gave us all sort of plausible reassurances. There

were no suspicions in anybody’s mind that the corruption at Odebrecht would spill into Colombia.

|

|

|

·

|

On December 21, 2016 we found out through press reports that Odebrecht had reached a Plea Agreement

with the US Department of Justice in which Odebrecht confessed to several acts of corruption in several countries, including Colombia,

where the company confessed to offering bribes for US$11 million in order to obtain infrastructure contracts. In the first few

days of January, 2017 we found out that bribes were paid in connection with the contracts associated with CRDS.

|

|

|

·

|

Since the very first few days in January we have been in close touch with Government officials,

with the Agencia Nacional de Infraestructura (ANI) and with the Attorney General’s office (Fiscalía) to offer any

assistance whatsoever that could be required from us.

|

|

|

·

|

Because we had absolutely no knowledge of our partner’s illegal actions, we officially requested

to be made part of the case as victims of the actions of Odebrecht.

|

|

|

·

|

On January 18, we were informed that the ANI had requested that an arbitration proceeding ruled

the Ruta del Sol 2 contract null and void. The forum of the arbitration had been in place for about 2 years and had been considering

a different matter between CRDS and the ANI. The ANI based its request solely on the base of Odebrecht’s confession to bribery

and not on the state of the construction project itself, which is deemed to be acceptable.

|

|

|

·

|

We have presented a motion of opposition to the ANI’s request arguing that the non-culprit

shareholders of CRDS would be unjustly affected by its nullity.

|

|

|

·

|

By procedure, our opposition should motivate a conciliation hearing in which the parties should

try to reach an agreement. We are very confident that in such hearing we will reach a mutual agreement to terminate and liquidate

the contract. We are also confident that a formula for the liquidation of the contract will be agreed upon. And finally, we are

confident that as a result of such formula the financial system will be paid in full for the loans that are currently owed by CRDS.

Our expectation is also that at least the cash investments of the partners in the Concession will be recovered as a result of the

liquidation formula.

|

|

|

·

|

On January 23rd, the Country’s General Prosecutor (Procuraduría) filed a class action

suit against CRDS in a State Court (the Tribunal Administrativo de Cundinamarca). The Class Action Suit seeks that a Judge orders

the President of Colombia to choose and appoint a Governmental entity to take over the concession and related contracts and assets.

The President has not made public his determination on this matter yet.

|

|

|

·

|

On January 30th, Corficolombiana’s former President, Jose Elias Melo, who resigned of his

own accord approximately one year ago, was asked to go to the Fiscalia for questioning. We have no further information regarding

this procedure, nor knowledge of him being charged with any accusations.

|

|

|

·

|

Jose Elias was President of Corficolombiana for 10 years and left the company for personal reasons.

There is no association between his leaving the company and the Odebrecht crime.

|

|

|

·

|

On February 10, the Tribunal Administrativo de Cundinamarca, where the Class Action Suit had been

filed by the Procuraduría, agreed to issue a preventive injunction (Medidas Cautelares), including the following interim

measures:

|

|

|

•

|

The interim suspension of the effects of the concession contract until: (i) The current Arbitration

proceeding in which the ANI requested the nullification of the contract reaches a final decision, or (ii) The Tribunal Administrativo

de Cundinamarca reaches a final decision with respect to the class action initiated at the request of the Procuraduría.

|

|

|

•

|

To instruct the President of Colombia to appoint the governmental entity in charge of the administration

of Toll Road Project Ruta del Sol 2 during the suspension of the concession contract.

|

|

|

•

|

The seizure (freezing) of the bank accounts and dividends of the following companies with respect

to Proyecto Ruta del Sol 2:

|

|

|

-

|

Concesionaria Ruta del Sol S.A.S.

|

|

|

-

|

Construtora Norberto Odebrecht S.A. (Sucursal Colombia)

|

|

|

-

|

Odebrecht Latinvest Colombia S.A.S.

|

|

|

-

|

Estudios y Proyectos del Sol S.A.S.

|

|

|

•

|

The seizure (freezing) of the bank accounts of the following individuals:

|

|

|

-

|

Gabriel Ignacio García Morales, former Viceminister of Transportation, and Odebrecht’s

executives:

|

|

|

-

|

Luiz Antonio Bueno Júnior,

|

|

|

-

|

Luiz Antonio Mameri and

|

|

|

-

|

Luiz Eduardo Da Rocha Soares.

|

|

|

·

|

On February 10, we were informed that the arbitrators in the Arbitration proceeding considering

the ANI’s request to nullify the contract resigned their positions.

|

|

|

·

|

The reason behind their resignation was associated to the fact that the scope of the Arbitration

proceeding initially installed approximately two years ago, had been altered.

|

|

|

·

|

On February 13th the parties to the arbitration (the ANI and CRDS) met to try to come up with a

new list of arbitrators. An agreement was not reached and thus on February 14th the Bogotá Chamber of Commerce designated

new arbitrators who have the next few days to accept or reject their designation.

|

|

|

·

|

On February 14th media reports indicated that a Fiscalia confidential document had been leaked

and that on it one of the government officials who accepted Odebrecht’s bribe had stated that Mr. Melo knew about the bribes.

We have no further information regarding this allegation. In any case, we continue to support the Fiscalia’s efforts to get

to the bottom of this case and any actions that it might take to accelerate the case’s resolution.

|

|

|

·

|

We are also fairly confident that we can resolve the ANI’s and Procuraduria’s aspirations

with the same agreement to terminate and liquidate the contract. Our aspiration is that the same agreement to terminate the contract

can be considered and accepted by the newly appointed arbitrators or by the Tribunal de Cundinamarca. We expect this to happen

within the first quarter of this year.

|

|

|

·

|

Before the contract is terminated, the road built should continue to be maintained, tolls should

continue to be collected and to the best of the Concession’s cash resources, its obligations with employees and suppliers

should be met. As no other sources of income are going to flow into the concession, we believe it is imperative that a termination

is reached in a short period of time. From our conversation with Government officials, we believe that they agree on this point.

|

|

|

3.

|

Finally, I will refer to other specific inquiries that we have received over the past few days:

|

|

|

·

|

The laws that rule the repercussions for shareholders in the Ruta del Sol 2 concession project

are: Law 80 of 1993, Law 1150 of 2007 and for a part of the project, specifically an addition granted in 2014, Law 1474 of 2011.

|

|

|

·

|

Consequently, the nullity of the Ruta del Sol 2 Contract has no implications on Episol as a Concessionaire

or builder of toll roads.

|

|

|

·

|

Furthermore, the nullity of the Contract has no repercussions on the FOUR infrastructure projects

that were awarded to Corficolombiana of the 4th generation concessions.

|

|

|

·

|

Of those four projects, two are wholly owned by Corficolombiana, and two will be controlled by

Corficolombiana and have Iridium of Spain as a partner.

|

|

|

·

|

The early termination of the contract is solely based on the confessed bribes made by Odebrecht

to Government officials and is not associated to how the road was being built and operated. There is no ambivalence on this issue.

|

|

|

·

|

Our interest on offering loans to 4th generation concession projects has not changed because of

the issue being discussed.

|

|

|

·

|

Having said so, for our banks and all of the other banks exposed to Ruta del Sol, it is of the

utmost importance to see this resolved as soon as possible.

|

|

|

·

|

Aside from the loans granted to Ruta del Sol, one of our banks made financial leases to Odebrecht

in connection with another of their projects whose current balance is approximately US$14 million. These leases are current as

of today and are adequately guaranteed by the assets themselves.

|

|

|

·

|

As mentioned before, Aval has a direct 10% stake in Corficolombiana. Additionally, Banco de Bogotá,

Occidente and Popular have combined stakes of 48% in Corficolombiana. On a regular basis the banks perform a valuation exercise

of their equity investments, audited by KPMG. We do not expect any impairment of their investment in Corficolombiana at this point

because the value of that company should not be materially affected due to: the limited financial repercussion that Ruta del Sol

might have on Corficolombiana, its undeterred potential for growth and its diverse sources of income.

|

|

|

·

|

However, and given the vast amount of news, the price of the shares of Corficolombiana has been

negatively affected this year. We believe that a major driver in the decline of the price has been speculation.

|

With this I conclude

my presentation. However before I sign off I would leave you with these last thoughts: First, I have shared all my knowledge about

the Odebrecht scandal with you. Secondly, we are all equally informed. Thirdly, I hope that this information puts you in a position

to be able to asses any potential financial repercussions and legal ramifications. Lastly, I want to reiterate that Grupo Aval,

Corficolombiana and Episol were not aware of the acts committed by Odebrecht. We condemn those acts and we will continue to offer

our full cooperation with all

of the Government entities involved to get this matter resolved as fast as possible.

For the past 60 years

the results of this financial group that I have proudly led for the past 17 years have been based solely on principles of high

standards, strong ethics, and respect for the law. It is tough to be so negatively affected by who we thought was the optimal partner

due to its business acumen and technical expertise. As we get through this and move on, we will use every single lesson that we

have learned from this and we will put in place every additional control that we deem necessary to stop something similar from

happening again.

Thank you and rest assured

that as more information becomes available we will keep the market posted.

This transcript may

not be entirely accurate and is not intended to be a literal transcript of the call. Grupo Aval retains all rights

to this transcript and provides it solely for personal, non-commercial use. Grupo Aval, its suppliers and third-party agents shall

not be liable for errors or omissions in this transcript or any actions based on the information contained herein.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: February 16, 2017

|

|

|

GRUPO AVAL ACCIONES Y VALORES S.A.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge Adrián Rincón Plata

|

|

|

|

|

|

Name:

|

Jorge Adrián Rincón Plata

|

|

|

|

|

|

Title:

|

Chief Legal Counsel

|

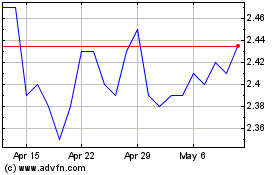

Grupo Aval Acciones y Va... (NYSE:AVAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

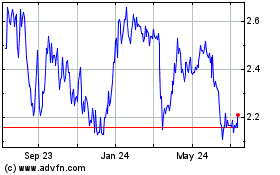

Grupo Aval Acciones y Va... (NYSE:AVAL)

Historical Stock Chart

From Sep 2023 to Sep 2024