FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of

1934

For the month of February 2017

Commission File Number: 001-34406

Advantage Oil & Gas Ltd.

(Exact name of registrant as specifiec

in its charter)

300,

440 2 Ave SW,

Calgary, AB, T2P 5E9

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Note: Regulation S-T Rule 101(b)(1) only

permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):_______

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s "home country"), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing

the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “ Yes” is marked, indicate

below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________

EXHIBIT INDEX

| EXHIBIT |

|

TITLE |

| |

|

|

| 99.1 |

|

News Release dated February 7, 2017 - Advantage Announces 2016 Year-End Reserves |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ADVANTAGE OIL & GAS LTD. |

| |

(Registrant) |

| |

|

|

| Date: February 7, 2017 |

By: |

/s/ Craig Blackwood |

| |

|

Name: Craig Blackwood |

| |

|

Title: Vice President, Finance and CFO |

Exhibit 99.1

Advantage Announces 2016 Year-End Reserves

Record Low Proved Developed Producing

Reserve Addition Cost of $0.84/mcfe ($5.04/boe) Underscores Outperformance In All Reserve Categories

(TSX: AAV, NYSE: AAV)

CALGARY, Feb. 7, 2017 /CNW/ - Advantage Oil & Gas Ltd.

("Advantage" or the "Corporation") is pleased to report that the Corporation achieved record low reserves addition

costs and capital efficiencies in 2016 which continues to demonstrate the ongoing strength of its industry leading low cost and

profitable natural gas development at its Glacier Montney property. Year-on-year gains in well production performance generated

significant positive technical revisions that accounted for 46% of proved plus probable ("2P") reserve additions while

Advantage's development and delineation drilling program at Glacier contributed the balance of natural gas and liquids reserves

additions. 2P reserves grew 13% to 2.2 Tcfe (366.1 million boe) including natural gas liquids which increased by 17% to 23.5

million barrels.

During 2016, Advantage brought 15 new wells on-production

which helped increase annual production by 44% over 2015. These wells and the improved performance of historical

producing wells contributed to a 26% increase in proved developed producing ("PDP") reserves at a record low finding

and development ("F&D") cost of $0.84/mcfe ($5.04/boe) and a PDP recycle ratio of 3.4. The Corporation's 2P

reserve additions replaced 429% of its 2016 annual production while lower future development capital combined with significant

positive technical revisions resulted in a negative 2016 F&D cost of -$0.01/mcfe (-$0.06/ boe) and a three year average 2P

F&D cost including the change in future development capital ("FDC") of $0.46/mcfe ($2.76/boe).

As the Corporation continues to advance its Montney growth

plan and expand its 100% owned Glacier gas plant to 400 mmcf/d (66,670 boe/d), we believe Advantage's Glacier development is and

will continue to be an industry leading and competitive North American low cost natural gas supply source as demonstrated by record

achievements in its operating, financial and reserve addition results in 2016.

PDP reserves increased 26% to 381 Bcfe at a F&D cost

of $0.84/mcfe ($5.04/boe). PDP reserves increased due to the recognition of 15 new wells that were brought on-production

in 2016 and higher reserves assignments on historical producing wells due to shallower longer term declines than previously assumed.

Proved ("1P") reserves increased 20% to 1.53

Tcfe (255.1 million boe) at a F&D cost of $0.25/mcfe ($1.49/boe) including the change in FDC. Reserve increases

resulted from technical revisions which accounted for 60% of the 1P reserves additions and the conversion of probable locations

to the proved reserves category as a result of Advantage's successful drilling program.

2P reserves increased 13% to 2.20 Tcfe (366.1 million

boe) at a F&D cost including the change in FDC of -$0.01/mcfe (-$0.06/boe). 2P FDC decreased by $131

million reflective of lower future well costs which were partly offset by increases in facilities costs to include an upsized Glacier

gas plant expansion to 400 mmcf/d and future infrastructure costs including a frac water supply system, gas gathering system expansions

and additional utilities. This reduction in FDC is due to Advantage's ongoing achievements in improving capital efficiencies and

lowering costs which has reduced capital requirements to support growth. The 2016 2P reserves include an addition of 24 new

Glacier Montney well locations including 10 undeveloped locations that were added in 2016. A total of 307 undeveloped locations

were booked in the 2016 reserve report. Management estimates approximately 1,100 total Montney locations remain undrilled

at Glacier.

The Corporation replaced 429% of its 2016 annual production

on a 2P basis, 438% on a 1P basis and 206% on a PDP basis at Recycle Ratios of -266.6x (7.0x excluding the change in FDC),

11.4x and 3.4x, respectively. The strong recycle ratios reinforces Advantage's industry leading low cost structure which

continues to support strong netbacks and profit margins. These recycle ratios included the Corporation's hedges and were achieved

in the environment where the AECO daily natural gas price averaged Cdn $2.16/mcf in 2016.

At year-end 2016, Advantage's 2P reserves grew 13% and

18% on a debt adjusted basis and 1P reserves grew 20% and 26% on a debt adjusted per share basis compared to year-end 2015.

Since Advantage's Glacier Montney development program began

in 2008, 2P reserves have grown 3,800% to 2.2 Tcfe (366.1 million boe) with a 2P reserve Net Present Value of $2.2

Billion as at December 31, 2016 (10% discount factor on a pre-tax basis).

The cumulative efficiencies achieved to date have allowed

the Corporation to continue to deliver profitable and sustainable growth. This is further reflected in our 2017 through 2019 strategic

growth plan which is targeted to deliver 52% production growth per share (16% on an average annual production per share basis)

while reducing estimated year-end total debt to trailing cash flow to 0.2x in 2019 at an average AECO natural gas price of Cdn

$2.95/mcf ($2.80/GJ) as outlined in Advantage's "2017 Budget and Development Plan" press release dated November 28, 2016.

Notable 2016 Reserve Changes and Analysis

Sproule Associates Ltd. ("Sproule") was engaged

as an independent qualified reserve evaluator to evaluate Advantage's year-end reserves as of December 31, 2016 ("Sproule

2016 reserve report") in accordance with National Instrument 51-101 ("NI 51-101") and the Canadian Oil and Gas Evaluation

Handbook ("COGE Handbook"). Reserves are stated on a gross (before royalties) working interest basis unless otherwise

indicated. Additional details are provided in the accompanying tables to this release and additional reserve information

as required under NI 51-101 will be included in our Annual Information Form which will be filed on SEDAR on or before March 31,

2017.

All references to 2016 operational and financial results are

estimates only and have not been reviewed or audited by our independent auditor. Advantage is expected to release its fourth

quarter and year-end results after markets close on March 2, 2017.

| · | The Sproule 2016 reserve report demonstrates the continued

and efficient conversion of identified natural gas and natural gas liquids resources into 2P reserves. The reserves by category

and year over year changes compared to 2015 are indicated below: |

Reserve

Category |

Conventional

Natural Gas

Tcf |

NGLs

Million bbls |

Total Gas

Equivalent

Tcfe |

% Change from

2015 |

| PDP |

0.36 |

3.65 |

0.38 |

26% |

| 1P |

1.44 |

15.53 |

1.53 |

20% |

| 2P |

2.06 |

23.54 |

2.20 |

13% |

| · | The total number of 2P future well locations booked

and the 2P estimated ultimate recoverable ("EUR") conventional natural gas volumes per well assigned by Sproule in the

Sproule 2016 reserve report are illustrated in the following table: |

| |

Sproule

# of Gross Horizontal

Wells Booked |

Sproule

Average EUR/well

(bcf raw /well) |

| |

Developed |

Undeveloped |

Undeveloped |

| Upper |

102 |

141 |

5.9 |

| Middle |

22 |

82 |

4.9 |

| Lower |

43 |

84 |

6.4 |

| Total |

167 |

307 |

|

| · | The Sproule 2016 reserve report average 2P recovery

per well increased for Upper Montney undeveloped locations from 5.5 bcf/well to 5.9 bcf/well. The average 2P recovery per well

increased for Middle Montney undeveloped locations from 4.6 bcf/well to 4.9 bcf/well reflective of higher initial production rates

and lower declines. The average 2P recovery per well for Lower Montney undeveloped locations increased from 5.9 bcf/well to 6.4

bcf/well. Advantage's Management estimates over 1,100 locations remain undrilled at Glacier based on the five Montney development

layers within our 300 meter thick Montney reservoir. |

| · | Advantage's 1P reserve life index is 19 years and

its 2P reserve life index is 27 years based on the Corporation's average fourth quarter 2016 production rate of approximately 221

mmcfe/d. |

| · | The 2P Reserve Net Present Value determined by Sproule

is approximately $2.2 billion as at December 31, 2016 (10% discount factor on a pre-tax basis). |

2016 Summary Results

During the fourth quarter of 2016 production increased 42%

over the same period in 2015 to 221 mmcfe/d and Advantage outperformed its annual 2016 Guidance targets (please refer to Advantage's

Operational Update press release dated January 18, 2017).

Key operational results during the fourth quarter of 2016

and for calendar 2016 are indicated below:

| |

|

Q4 2016E |

2016E |

| Production (mmcfe/d) |

|

221 |

203 |

| Royalties % |

|

5.6% |

3.0% |

| Operating Cost ($/mcfe) |

|

$0.22 |

$0.27 |

| Operating netback ($/mcfe) |

|

$2.83 |

$2.46 |

| Capital Expenditures ($ millions) |

|

$30 |

$128 |

| Total Debt including working capital ($ millions) |

|

$159 |

$159 |

(References to 2016 operational and financial results are

estimates only and have not been reviewed or audited by our independent auditor. Advantage is expected to release its fourth

quarter and year-end results after markets close on March 2, 2017)

Looking Forward

The Sproule 2016 reserve report demonstrates another year

of highly efficient reserve additions at Glacier reaffirming the exceptional quality of our Montney asset and the outstanding achievements

of our team who accomplished this in a safe and environmentally responsible manner. Looking ahead, Advantage remains highly

focused on maintaining operational and financial flexibility in conjunction with growth plans that generate profitability during

lower commodity price cycles while preserving significant upside torque. We look forward to reporting on our progress through

2017.

RESERVE SUMMARY TABLES

Company Gross (before royalties) Working Interest Reserves

Summary as at December 31, 2016

| |

Light

& Medium

Oil

(mbbl) |

Natural

Gas Liquids

(mbbl) |

Conventional

Natural Gas

(mmcf) |

Total

Oil

Equivalent

(mboe) |

| Proved |

|

|

|

|

| Developed Producing |

8 |

3,645 |

358,980 |

63,484 |

| Developed Non-producing |

- |

597 |

50,736 |

9,053 |

| Undeveloped |

- |

11,281 |

1,027,433 |

182,520 |

| Total Proved |

8 |

15,524 |

1,437,149 |

255,057 |

| Probable |

3 |

8,005 |

618,249 |

111,049 |

| Total Proved + Probable |

11 |

23,529 |

2,055,398 |

366,106 |

| |

| (1) Tables may not add due to rounding. |

Company Net Present Value of Future Net Revenue using Sproule

price and cost forecasts (1)(2)(3)

($000)

| |

Before Income Taxes Discounted at |

| |

0% |

10% |

15% |

| Proved |

|

|

|

| Developed Producing |

1,084,909 |

720,793 |

616,180 |

| Developed Non-producing |

186,551 |

90,765 |

72,810 |

| Undeveloped |

2,587,841 |

614,694 |

298,395 |

| |

|

|

|

| Total Proved |

3,859,301 |

1,426,251 |

987,386 |

| |

|

|

|

| Probable |

2,384,445 |

787,492 |

546,369 |

| |

|

|

|

| Total Proved + Probable |

6,243,745 |

2,213,743 |

1,533,754 |

| |

|

| (1) |

Advantage's light and medium oil, conventional natural gas and natural gas liquid reserves were evaluated using Sproule's product price forecast effective December 31, 2016 prior to the provision for income taxes, interests, debt services charges and general and administrative expenses. It should not be assumed that the discounted future net revenue estimated by Sproule represents the fair market value of the reserves. |

| (2) |

Assumes that development of Glacier will occur, without regard to the likely availability to the Corporation of funding required for that development. |

| (3) |

Future Net Revenue incorporates Managements' estimates of required abandonment and reclamation costs, including expected timing such costs will be incurred, associated with all wells, facilities and infrastructure. No abandonment and reclamation costs have been excluded. |

| (4) |

Tables may not add due to rounding. |

Sproule Price Forecasts

The net present value of future net revenue at December 31,

2016 was based upon natural gas and natural gas liquids pricing assumptions prepared by Sproule effective December 31, 2016. These

forecasts are adjusted for reserve quality, transportation charges and the provision of any applicable sales contracts. The price

assumptions used over the next seven years are summarized in the table below:

| Year |

Alberta AECO-C

Natural Gas

($Cdn/mmbtu) |

Henry Hub

Natural Gas

($US/mmbtu) |

Edmonton

Propane

($Cdn/bbl) |

Edmonton

Butane

($Cdn/bbl) |

Edmonton

Pentanes Plus

($Cdn/bbl) |

Exchange

Rate

($US/$Cdn) |

| 2017 |

3.44 |

3.50 |

22.74 |

47.60 |

67.95 |

0.78 |

| 2018 |

3.27 |

3.50 |

28.04 |

55.49 |

75.61 |

0.82 |

| 2019 |

3.22 |

3.50 |

30.64 |

57.65 |

78.82 |

0.85 |

| 2020 |

3.91 |

4.00 |

32.27 |

58.80 |

80.47 |

0.85 |

| 2021 |

4.00 |

4.08 |

33.95 |

59.98 |

82.15 |

0.85 |

| 2022 |

4.10 |

4.16 |

35.68 |

61.18 |

83.86 |

0.85 |

| 2023 |

4.19 |

4.24 |

37.46 |

62.40 |

85.61 |

0.85 |

| |

|

|

|

|

|

|

Company Gross (before royalties) Working Interest Reserves

Reconciliation (1):

| Proved |

Light

&

Medium Oil

(mbbl) |

Natural Gas

Liquids

(mbbl) |

Conventional

Natural

Gas

(mmcf) |

Total Oil

Equivalent

(mboe) |

| |

|

|

|

|

| Opening balance Dec. 31, 2015 |

9.4 |

12,097 |

1,206,484 |

213,187 |

| Extensions |

- |

3,166 |

142,211 |

26,868 |

| Infill Drilling |

- |

- |

- |

- |

| Improved recovery |

- |

- |

- |

- |

| Technical revisions |

0.5 |

846 |

190,852 |

32,655 |

| Discoveries |

- |

- |

- |

- |

| Acquisitions |

- |

- |

- |

- |

| Royalty Changes |

- |

(166) |

(20,901) |

(3,650) |

| Economic factors |

(0.1) |

(86) |

(9,087) |

(1,600) |

| Production |

(1.4) |

(334) |

(72,410) |

(12,404) |

| |

|

|

|

|

| Closing balance at Dec. 31, 2016 |

8.4 |

15,524 |

1,437,149 |

255,057 |

| |

|

|

|

|

| Proved Plus Probable |

Light

&

Medium Oil

(mbbl) |

Natural Gas

Liquids

(mbbl) |

Conventional

Natural

Gas

(mmcf) |

Total Oil

Equivalent

(mboe) |

| |

|

|

|

|

| Opening balance Dec. 31, 2015 |

12.2 |

20,121 |

1,831,284 |

325,347 |

| Extensions |

- |

3,966 |

174,684 |

33,080 |

| Infill Drilling |

- |

- |

- |

- |

| Improved recovery |

- |

- |

- |

- |

| Technical revisions |

0.5 |

(225) |

149,264 |

24,653 |

| Discoveries |

- |

- |

- |

- |

| Acquisitions |

- |

- |

- |

- |

| Royalty Changes |

- |

106 |

(15,929) |

(2,549) |

| Economic factors |

(0.2) |

(106) |

(11,495) |

(2,022) |

| Production |

(1.4) |

(334) |

(72,410) |

(12,404) |

| |

|

|

|

|

| Closing balance at Dec. 31, 2016 |

11.1 |

23,529 |

2,055,398 |

366,106 |

| |

|

| (1) |

Technical revisions accounted for 60% of the total proved additions and 46% of the total proved plus probable additions. Percentage of each category calculated by dividing the technical revisions in the category by the total reserve additions in the same category before production. |

| (2) |

Tables may not add due to rounding. |

Company Finding & Development Costs ("F&D")

Company 2016 F&D Costs – Gross (before royalties)

Working Interest Reserves including Future Development Capital (1)(2)(3)

| |

Proved |

Proved + Probable |

| Capital expenditures ($000) |

128,014 |

128,014 |

| Net change in Future Development Capital ($000) |

(47,091) |

(131,400) |

| Total capital ($000) |

80,923 |

(3,386) |

| |

|

|

| Total mboe, end of year |

255,057 |

366,106 |

| Total mboe, beginning of year |

213,187 |

325,347 |

| Production, mboe |

12,404 |

12,404 |

| Reserve additions, mboe |

54,274 |

53,163 |

| |

|

|

| 2016 F&D costs ($/boe) |

$1.49 |

$(0.06) |

| 2015 F&D costs ($/boe) |

$5.22 |

$4.65 |

| Three-year average F&D costs ($/boe) |

$4.53 |

$2.76 |

| |

|

| (1) |

F&D costs are calculated by dividing total capital by reserve additions during the applicable period. Total capital includes both capital expenditures incurred and changes in FDC required to bring the proved undeveloped and probable reserves to production during the applicable period. Reserve additions is calculated as the change in reserves from the beginning to the ending of the applicable period excluding production. |

| (2) |

The aggregate of the exploration and development costs incurred in the most recent financial year and the change during that year in estimated FDC generally will not reflect total finding and development costs related to reserves additions for that year. Changes in forecast FDC occur annually as a result of development activities, acquisition and disposition activities and capital cost estimates that reflect Sproule's best estimate of what it will cost to bring the proved undeveloped and probable reserves on production. |

| (3) |

The change in FDC is primarily from lower future well costs which were partly offset by increases in facilities costs to include an upsized Glacier gas plant expansion to 400 mmcf/d and future infrastructure costs such as a frac water supply system, gas gathering system expansions and additional utilities. |

Advisory

The information in this press release contains certain

forward-looking statements, including within the meaning of the United States Private Securities Litigation Reform Act of 1995.

These statements relate to future events or our future intentions or performance. All statements other than statements of historical

fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such

as "seek", "anticipate", "plan", "continue", "estimate", "demonstrate",

"expect", "may", "can", "will", "project", "predict", "potential",

"target", "intend", "could", "might", "should", "guidance", "believe",

"would" and similar expressions and include statements relating to, among other things, Advantage's anticipated future

production from the Glacier Montney resource play and the expected timing thereof; Advantage's belief that its Glacier development

will continue to be an industry leading North American low cost natural gas supply source; Advantage's 2017 through 2019 development

plan, including estimated production per share growth and year-end total debt to trailing cash flow ratio; the expected timing

of release of Advantage's 2016 financial and operational results; estimated production from Advantage's wells and the timing of

achievement thereof; estimated number of drilling locations; Advantage's estimated fourth quarter and full year 2016 financial

and operating results including production, royalties, operating costs, operating netback, capital expenditures and total debt

including working capital; and Advantage's focus on maintaining operational and financial flexibility in conjunction with growth

plans that generate profitability during lower commodity price cycles. In addition, statements relating to "reserves"

are by their nature forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions

that the reserves described can be profitably produced in the future. The recovery and reserve estimates of Advantage's reserves

provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Advantage's actual

decisions, activities, results, performance or achievement could differ materially from those expressed in, or implied by, such

forward-looking statements and accordingly, no assurances can be given that any of the events anticipated by the forward-looking

statements will transpire or occur or, if any of them do, what benefits that Advantage will derive from them.

These statements involve substantial known and unknown

risks and uncertainties, certain of which are beyond Advantage's control, including, but not limited to: changes in general economic,

market and business conditions; industry conditions; actions by governmental or regulatory authorities including increasing taxes

and changes in investment or other regulations; changes in tax laws, royalty regimes and incentive programs relating to the oil

and gas industry; the effect of acquisitions; Advantage's success at acquisition, exploitation and development of reserves; unexpected

drilling results; changes in commodity prices, currency exchange rates, capital expenditures, reserves or reserves estimates and

debt service requirements; the occurrence of unexpected events involved in the exploration for, and the operation and development

of, oil and gas properties, including hazards such as fire, explosion, blowouts, cratering, and spills, each of which could result

in substantial damage to wells, production facilities, other property and the environment or in personal injury; changes or fluctuations

in production levels; delays in anticipated timing of drilling and completion of wells; delays in completion of the expansion of

the Glacier gas plant; individual well productivity; competition from other producers; the lack of availability of qualified personnel

or management; credit risk; changes in laws and regulations including the adoption of new environmental laws and regulations and

changes in how they are interpreted and enforced; our ability to comply with current and future environmental or other laws; stock

market volatility and market valuations; liabilities inherent in oil and natural gas operations; uncertainties associated with

estimating oil and natural gas reserves; competition for, among other things, capital, acquisitions of reserves, undeveloped lands

and skilled personnel; incorrect assessments of the value of acquisitions; geological, technical, drilling and processing problems

and other difficulties in producing petroleum reserves; ability to obtain required approvals of regulatory authorities; and ability

to access sufficient capital from internal and external sources. Many of these risks and uncertainties and additional risk factors

are described in the Corporation's Annual Information Form which is available at www.sedar.com ("SEDAR") and www.advantageog.com.

Readers are also referred to risk factors described in other documents Advantage files with Canadian securities authorities.

With respect to forward-looking statements contained in

this press release, Advantage has made assumptions regarding, but not limited to: conditions in general economic and financial

markets; effects of regulation by governmental agencies; current and future commodity prices and royalty regimes; future exchange

rates; royalty rates; future operating costs; availability of skilled labor; availability of drilling and related equipment; timing

and amount of capital expenditures; the impact of increasing competition; the price of crude oil and natural gas; that the Corporation

will have sufficient cash flow, debt or equity sources or other financial resources required to fund its capital and operating

expenditures and requirements as needed; that the Corporation's conduct and results of operations will be consistent with its expectations;

that the Corporation will have the ability to develop the Corporation's properties in the manner currently contemplated; current

or, where applicable, proposed assumed industry conditions, laws and regulations will continue in effect or as anticipated; and

the estimates of the Corporation's production and reserves volumes and the assumptions related thereto (including commodity prices

and development costs) are accurate in all material respects.

Management has included the above summary of assumptions

and risks related to forward-looking information above and in its continuous disclosure filings on SEDAR in order to provide shareholders

with a more complete perspective on Advantage's future operations and such information may not be appropriate for other purposes.

Advantage's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do so, what benefits that Advantage will derive there from. Readers are cautioned that the

foregoing lists of factors are not exhaustive. These forward-looking statements are made as of the date of this news release and

Advantage disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information,

future events or results or otherwise, other than as required by applicable securities laws.

Barrels of oil equivalent (boe) and thousand cubic feet

of natural gas equivalent (mcfe) may be misleading, particularly if used in isolation. Boe and mcfe conversion ratios have been

calculated using a conversion rate of six thousand cubic feet of natural gas equivalent to one barrel of oil. A boe and mcfe conversion

ratio of 6 mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent

a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural

gas is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

This press release contains a number of oil and gas metrics,

including F&D, operating netback, recycle ratio, EUR, reserve replacement and reserve life index, which do not have standardized

meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other

companies and should not be used to make comparisons. Such metrics have been included herein to provide readers with additional

measures to evaluate the Corporation's performance; however, such measures are not reliable indicators of the future performance

of the Corporation and future performance may not compare to the performance in previous periods and therefore such metrics should

not be unduly relied upon. Management uses these oil and gas metrics for its own performance measurements and to provide securityholders

with measures to compare Advantage's operations over time. Readers are cautioned that the information provided by these metrics,

or that can be derived from the metrics presented in this news release, should not be relied upon for investment or other purposes.Operating

netback is calculated by adding natural gas and liquids sales with realized gains on derivatives and subtracting royalty expense,

operating expense and transportation expense. Recycle ratio is calculated by dividing Advantage's fourth quarter operating netback

by the calculated F&D of the applicable year and expressed as a ratio. Reserve replacement is calculated by dividing

reserves net volume additions by the current annual production and expressed as a percentage. Reserve life index is calculated

by dividing the total volume of reserves by the fourth quarter production rate and expressed in years. Reserves per share is calculated

as the total volume of reserves divided by the number of common shares issued and outstanding at year end. Reserves per debt-adjusted

share assumes the issuance of additional common shares at the closing trading price on the TSX necessary to extinguish outstanding

debt at year end and is calculated as the total volume of reserves divided by the sum of the number of common shares issued and

outstanding at year end and the debt at year end divided by the Corporation's closing trading price on the TSX at year end.

The recovery and reserve estimates of reserves provided

in this news release are estimates only, and there is no guarantee that the estimated reserves will be recovered. Actual reserves

may eventually prove to be greater than, or less than, the estimates provided herein.

This press release discloses drilling locations in three

categories: (i) proved locations; (ii) probable locations; and (iii) unbooked locations. Proved locations and probable locations

are derived from the Corporation's most recent independent reserves evaluation as prepared by Sproule as of December 31, 2016 and

account for drilling locations that have associated proved and/or probable reserves, as applicable. Unbooked locations are internal

estimates based on the Corporation's prospective acreage and an assumption as to the number of wells that can be drilled per section

based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources. Unbooked locations

have been identified by management as an estimation of our multi-year drilling activities based on evaluation of applicable geologic,

seismic, engineering, production and reserves information. There is no certainty that the Corporation will drill all unbooked drilling

locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves, resources or

production. The drilling locations on which we actually drill wells will ultimately depend upon the availability of capital, regulatory

approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results, additional reservoir information

that is obtained and other factors. While certain of the unbooked drilling locations have been derisked by drilling existing wells

in relative close proximity to such unbooked drilling locations, other unbooked drilling locations are farther away from existing

wells where management has less information about the characteristics of the reservoir and therefore there is more uncertainty

whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional

oil and gas reserves, resources or production.

The Corporation discloses several financial measures that

do not have any standardized meaning prescribed under International Financial Reporting Standards ("IFRS"). These financial

measures include total debt to trailing cash flow ratio and operating netback. Total debt to trailing cash flow ratio is calculated

as bank indebtedness under the Corporation's credit facilities plus working capital deficit divided by funds from operations for

the prior twelve month period. Funds from operations is based on cash provided by operating activities, before expenditures on

decommissioning liability and changes in non-cash working capital, reduced for finance expense excluding accretion. Operating netback

is calculated as calculated by adding natural gas and liquids sales with realized gains on derivatives and subtracting royalty

expense, operating expense and transportation expense. Management believes that these financial measures are useful supplemental

information to analyze operating performance and provide an indication of the results generated by the Corporation's principal

business activities. Investors should be cautioned that these measures should not be construed as an alternative to net income

or other measures of financial performance as determined in accordance with IFRS. Advantage's method of calculating these measures

may differ from other companies, and accordingly, they may not be comparable to similar measures used by other companies. Please

see the Corporation's most recent Management's Discussion and Analysis, which is available at www.sedar.com and www.advantageog.com

for additional information about these financial measures.

This press release and, in particular the information in

respect of the Corporation's expected 2016 operating costs, capital expenditures, total debt and operating netback, and 2019 total

debt to trailing cash flow ratio, may contain future oriented financial information ("FOFI") within the meaning of applicable

securities laws. The FOFI has been prepared by management to provide an outlook of the Corporation's activities and results and

may not be appropriate for other purposes. The FOFI has been prepared based on a number of assumptions, including the assumptions

discussed above, and assumptions with respect to the costs and expenditures to be incurred by the Corporation, capital equipment

and operating costs, foreign exchange rates, taxation rates for the Corporation, general and administrative expenses and the prices

to be paid for the Corporation's production. Management does not have firm commitments for all of the costs, expenditures, prices

or other financial assumptions used to prepare the FOFI or assurance that such operating results will be achieved and, accordingly,

the complete financial effects of all of those costs, expenditures, prices and operating results are not objectively determinable.

The actual results of operations of the Corporation and the resulting financial results may vary from the amounts set forth herein,

and such variations may be material. The Corporation and management believe that the FOFI has been prepared on a reasonable basis,

reflecting management's best estimates and judgments. However, because this information is highly subjective and subject to numerous

risks including the risks discussed above, it should not be relied on as necessarily indicative of future results. FOFI contained

in this press release was made as of the date of this press release and the Corporation disclaims any intention or obligations

to update or revise any FOFI contained in this press release, whether as a result of new information, future events or otherwise,

unless required pursuant to applicable law.

Certain financial and operating results included in this

news release including production, operating costs, operating netback, capital expenditures and total debt including working capital

are based on unaudited estimated results. These estimated results are subject to change upon completion of the Corporation's audited

financial statements for the year ended December 31, 2016, and changes could be material. Advantage anticipates filing its audited

financial statements and related management's discussion and analysis for the year ended December 31, 2016 on SEDAR on March 2,

2017.

The following abbreviations used in this press release

have the meanings set forth below:

| bbls |

barrels |

| bcfe |

bllion cubic feet equivalent |

| boe |

barrels of oil equivalent of natural gas, on the basis of one barrel of oil or NGLs for six thousand cubic feet of natural gas |

| mcf |

thousand cubic feet |

| mmcf |

million cubic feet |

| mmcf/d |

million cubic feet per day |

| mcfe |

thousand cubic feet equivalent on the basis of six thousand cubic feet of natural gas for one barrel of oil or NGLs |

| mmcfe |

million cubic feet equivalent |

| mmcfe/d |

million cubic feet equivalent per day |

| tcfe |

trillion cubic feet equivalent |

SOURCE Advantage Oil & Gas Ltd.

To view this news release in HTML formatting, please use the

following URL: http://www.newswire.ca/en/releases/archive/February2017/07/c3915.html

%CIK: 0001468079

For further information: Craig Blackwood, Vice President,

Finance and Chief Financial Officer, (403) 718-8005; OR Investor Relations, Toll free: 1-866-393-0393, Advantage Oil & Gas

Ltd., 300, 440 - 2nd Avenue SW, Calgary, Alberta T2P 5E9, Phone: (403) 718-8000, Fax: (403) 718-8332, Web Site: www.advantageog.com,

E-mail: ir@advantageog.com

CO: Advantage Oil & Gas Ltd.

CNW 21:28e 07-FEB-17

This regulatory filing also includes additional resources:

ex991.pdf

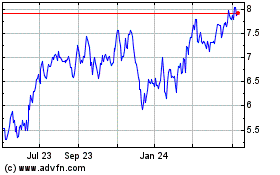

Advantage Energy (PK) (USOTC:AAVVF)

Historical Stock Chart

From Mar 2024 to Apr 2024

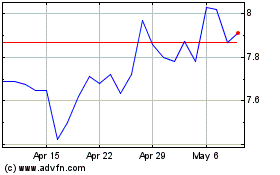

Advantage Energy (PK) (USOTC:AAVVF)

Historical Stock Chart

From Apr 2023 to Apr 2024