Virgin Media Secured Finance PLC (the “Issuer”) today

announced that it has commenced an offer to exchange (the

“Exchange Offer”) any and all outstanding

sterling-denominated 5.5% senior secured notes due 2021 (the

“Original Sterling Notes”) for new sterling-denominated 6.0

% senior secured notes due 2025 (the “New Notes”) upon the

terms and conditions of the offering memorandum dated as of

February 8, 2017 (as amended or supplemented, the “Offering

Memorandum”).

Eligible Holders (as defined below) who validly tender and do

not validly withdraw their Original Sterling Notes in the Exchange

Offer prior to 11:59 p.m., New York time, on February 23, 2017 (as

it may be extended, the “Early Exchange Deadline”) will

receive £1,000 in principal amount of New Notes per £1,000

principal amount of Original Sterling Notes. For any Original

Sterling Notes tendered after the Early Exchange Deadline, but

before the Expiration Time (as defined below), Eligible Holders

will receive £970 in principal amount of New Notes per £1,000

principal amount of Original Sterling Notes. Interest on the New

Notes will initially accrue at the rate of 6.0% per annum, provided

that from (and including) January 15, 2021, the New Notes will

accrue interest at a rate of 11.0% per annum. Prior to January 15,

2021, the New Notes will not be redeemable by the Issuer without

paying a “make whole” premium. On or after January 15, 2021, the

Issuer may redeem all or part of the New Notes at an initial

redemption price (expressed as a percentage of the principal amount

of New Notes) of 105.0%, with two further step downs in the

redemption price of 102.5% and par from January 15, 2022 and

January 15, 2023 respectively. The New Notes will be issued

promptly following the Expiration Time, which is expected to be on

the second business day following the Expiration Time (the

“Exchange Date”). Eligible Holders will also receive accrued

and unpaid interest in cash on Original Sterling Notes accepted for

exchange through, but not including, the Exchange Date. We actively

manage our debt maturity profile and this Exchange Offer is part of

our on-going refinancing efforts that focus on extending our debt

maturities.

In connection with the Exchange Offer, the Issuer is also

seeking to solicit (the “Consent Solicitation” and, together

with the Exchange Offer, the “Offer”) consents (the

“Consents”) from Eligible Holders participating in the

Exchange Offer to make certain proposed amendments to the indenture

governing the Original Sterling Notes (the “Proposed

Amendments”). The Proposed Amendments will amend substantially

all of the restrictive covenants, certain events of default and

certain additional covenants, rights and obligations contained in

the indenture governing the Original Sterling Notes in order to

align covenants of the Original Sterling Notes to those for the New

Notes. Eligible Holders who tender their Original Sterling Notes in

the Exchange Offer will be deemed to have consented to the Proposed

Amendments and Eligible Holders may not tender their Original

Sterling Notes in the Exchange Offer without delivering Consents.

The purpose of the Consent Solicitation is to align the covenants

of the Original Sterling Notes to the New Notes and to other series

of our existing senior secured notes, in order to streamline our

covenant compliance obligations across our debt documentation.

The Offer is being made solely pursuant to the Offering

Memorandum, which more fully sets forth and governs the terms and

conditions of the Offer, how to tender Original Sterling Notes in

the Offer and deliver Consents thereby, and certain conditions to

the Offer. The Offering Memorandum contains important information

that should be read carefully before any decision is made with

respect to the Offer. The Exchange Offer and Consent Solicitation

will expire at 11:59 p.m., New York time, on March 9, 2017, (as it

may be extended, the “Expiration Time”). Tendered Original

Sterling Notes may be validly withdrawn at any time prior to the

earlier of (i) the Early Exchange Deadline and (ii) the date on

which the requisite consents to the Proposed Amendments are

received, but not thereafter.

Copies of the Offering Memorandum can be obtained by Eligible

Holders) of the Original Sterling Notes from the Exchange Agent and

Information Agent at the telephone number below.

Virgin Media Secured Finance PLCMedia HouseBartley Wood Business

ParkHook, Hampshire RG27 9UPUnited Kingdom Vani Bassi, Head of

Investor Relations, +44 1256 752347Issued by: Virgin Media Secured

Finance PLC

About Virgin Media

Virgin Media offers four multi award-winning services across the

UK and Ireland: broadband, TV, mobile phone and landline. The

company’s dedicated, ultrafast network delivers the fastest widely

available broadband speeds to homes and businesses. We’re expanding

this through our £3bn Project Lightning programme to pass an

incremental 4 million premises. Our interactive TV service brings

live programmes, thousands of hours of on-demand programming and

the best apps and games in a set-top box, as well as on-the-go

services for tablets and smartphones. We launched the world’s first

virtual mobile network, offering fantastic value and services. We

are also one of the largest fixed-line phone providers in the UK

and Ireland. Through Virgin Media Business, we support

entrepreneurs, businesses and the public sector, delivering the

fastest speeds and tailor-made services. Virgin Media is part of

Liberty Global, the world’s largest international cable company,

with operations in more than 30 countries.

Disclaimer

None of the Issuer, the Dealer Manager, the trustee of the New

Notes, the trustee of the Original Sterling Notes, the Information

Agent, or the Exchange Agent (or their respective directors,

employees or affiliates) makes any recommendation as to whether or

not Eligible Holders of the Original Sterling Notes should submit

Original Sterling Notes for exchange and deliver Consents with

respect to such notes thereby. This announcement does not

constitute the solicitation of an offer to buy or an offer to sell

Original Sterling Notes or New Notes, as applicable, or a

solicitation of Consents, in any jurisdiction in which such offer,

sale or solicitation would be unlawful. The Offer is only being

made (1) to “qualified institutional buyers” as defined in Rule

144A under the Securities Act of 1933, as amended (the

“Securities Act”), in a private transaction in reliance upon

the exemption from the registration requirements of the Securities

Act provided by Section 4(a)(2) thereof and (2) outside the United

States to persons that are not “U.S. persons,” as such term is

defined in Rule 902 of Regulation S (“Regulation S”) under

the Securities Act and who would be participating in any

transaction in accordance with Regulation S. Holders of the

Original Sterling Notes who have certified to the Issuer that they

are eligible to participate in the Offer pursuant to at least one

of the foregoing conditions are referred to as “Eligible

Holders”. The New Notes to be offered have not been, and will

not be, registered under the Securities Act and may not be offered

or sold in the United States absent an applicable exemption from

registration requirements.

This announcement does not describe all the material terms of

the Offer and no decision should be made by any holder of the

Original Sterling Notes on the basis of this announcement. The

complete terms and conditions of the Offer are described in the

Offering Memorandum. This announcement must be read in conjunction

with the Offering Memorandum. The Offering Memorandum contains

important information which should be read carefully before any

decision is made with respect to the Offer. If any holder is in any

doubt as to the contents of this announcement or the Offer or the

action it should take, it is recommended to seek its own financial

and legal advice, including in respect of any tax consequences,

immediately from its stockbroker, bank manager, solicitor,

accountant or other independent financial, tax or legal adviser.

Any individual or company whose Original Sterling Notes are held on

its behalf by a broker, dealer, bank, custodian, trust company or

other nominee must contact such entity if it wishes to exchange

such Original Sterling Notes and deliver its Consent thereby

pursuant to the Offer.

The information contained in this announcement does not

constitute an invitation or inducement to engage in investment

activity within the meaning of the United Kingdom Financial

Services and Markets Act 2000. In the United Kingdom, this

announcement is being distributed only to, and is directed only to

persons who (i) are investment professionals, as such term is

defined in Article 19(5) of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005 (as amended, the

“Financial Promotion Order”), (ii) are persons falling

within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the Financial Promotion

Order, (iii) are outside the United Kingdom, or (iv) are

persons to whom an invitation or inducement to engage in investment

activity (within the meaning of section 21 of the Financial

Services and Markets Act 2000 (“FSMA”)) in connection with

the issue or sale of any New Notes may otherwise lawfully be

communicated or caused to be communicated (all such persons

together being referred to as “Relevant Persons”).The

information contained in this announcement must not be acted on or

relied on in the United Kingdom by persons who are not Relevant

Persons. In the United Kingdom, the New Notes are and any

investment or investment activity to which this announcement

relates, is available only to Relevant Persons, and will be engaged

in only with such persons. Any person who is not a Relevant Person

should not act or rely on the information contained in this

announcement.

Holders of Original Sterling Notes with questions regarding

the Offer procedures should contact the Exchange Agent and/or

Information Agent for further information. All other questions

concerning the Offer should be directed to the Dealer

Manager.

Disclosure of inside information by Virgin Media Secured Finance

plc under Article 17(1) of Regulation (EU) 596/2014.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170208005459/en/

Dealer ManagerCredit Suisse

Securities (Europe) LimitedOne Cabot SquareLondon E14 4QJUnited

KingdomTelephone: +44 (0)207 883 8763Attention: The Liability

Management DeskEmail:

liability.management@credit-suisse.comorExchange Agent and Information AgentLucid

Issuer Services LimitedAttention: Sunjeeve Patel / Paul

KammingaTel: +44 (0)20 7704 0880Email: virginmedia@lucid-is.com

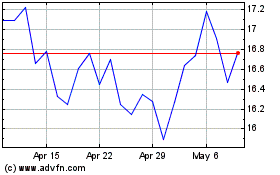

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

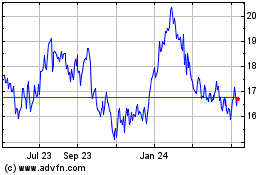

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024