Current Report Filing (8-k)

January 27 2017 - 2:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

January 23, 2017

Date of Report (Date of earliest event reported)

WRAPmail, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Florida

|

|

____333-208293_______

|

|

20-3624118

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.

|

|

|

|

|

445 NE 12

th

Ave. Fort Lauderdale, Florida

|

|

33301

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

516-205-4751

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

¨

|

Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement.

On January 23, 2017, WRAPmail, Inc (

“

WRAP

”

or the

“

Company

”

) entered into a share purchase agreement (the “Agreement”) with Health Max Group, Inc., a Washington corporation (“Health Max”) and the shareholders of Health Max (“Shareholders”). Pursuant to the Agreement, the Shareholders will sell all of the issued and outstanding common stock of Health Max (the “Health Max Shares”) to WRAP by delivering to WRAP a stock certificate issued in the name of WRAP evidencing the Health Max Shares.

1

In consideration for the sale of the Health Max Shares, WRAP has agreed to issue to the Shareholders, ratably apportioned based on their ownership in Health Max, 700 shares of Series B Preferred Stock of WRAP (“WRAP Shares”). It was acknowledged and agreed that there would be a total of 1,000 shares of Series B Preferred Stock authorized in WRAP, which preferred stock in the aggregate shall be convertible into an aggregate of 87.5% of WRAP’s issued and outstanding common shares, calculated on a fully diluted basis as of the closing of the Health Max acquisition, with no other rights of privileges. The acquisition of Health Max is expected to close 70 days from execution of the Agreement.

In conjunction with the Agreement, the Company agreed to change its name to HealthMax Group, Inc. and trading symbol to “HMAX.” It also agreed to appoint three new directors to the Board of Director, one at execution of the Agreement and two at closing, and Rolv Heggenhougen agreed to resign at execution. Marco Alfonsi will be given a three year employment agreement as the Company’s CEO as a term of the Agreement and will receive 100 Series B Preferred Stock and a salary as compensation therefor. The remaining 200 Series B Shares shall be reserved to raise up to $2,000,000 in Company capital. The Agreement otherwise contains standard representations and warranties. The Agreement also contains mutual indemnity provisions.

This current report contains forward-looking statements regarding our intentions to Acquire Health Max. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events or otherwise.

Item 5.02

Departure of Directors or Certain Officers; Appointment of Certain Officers

On December 23, 2016, WRAP received the resignation of Rolv Heggenhougen from his position on the WRAP Board of Directors and as an officer of the Company. Mr. Heggenhougen’s resignation was not the result of any disagreement with the Company. Marco Alfonsi, the Company’s CEO, was appointed to serve as the Company’s interim chairman and CFO until replacements can be found.

On January 23, 2017, S. Neil Ford, Jr. was appointed to WRAP’s Board of Directors, filling the vacancy left by Mr. Heggenhougen. Mr. Ford’s appointment was a term of the Agreement but there was no other arrangement relating to his appointment.

2

Item 5.07 Submission of Matters to a Vote of Security Holders

On January 23, 2017, a majority of the stockholders of WRAP took the following actions by written consent pursuant to Florida law:

·

Approved a name change from WRAPmail, Inc. to HealthMax Group, Inc.

·

Approved increase of the total number of authorized common shares to five billion (5,000,000,000).

·

Authorized the issuance of up to 1,000,000 shares of preferred stock, to be designated by the board.

·

Designated a preferred class of preferred shares as Series B. The Company shall designate 1,000 shares of its preferred stock as Series B Preferred Stock, which shall be collectively convertible into common shares representing 87.5% of the issued and outstanding commons shares of the Company, calculated as of the date of the Company closing the acquisition of Health Max pursuant to the Agreement (“Closing”), presuming all Series B Preferred Stock is converted to common stock at Closing. No fractional common shares shall be issued upon conversion and, in the case a fractional share would otherwise be issued, the number of shares to be issued shall be rounded up to the nearest whole share. The Series B Preferred Stock shall have no other rights or privileges.

·

Approved the Agreement.

It is expected that the foregoing actions shall become effective following proper notice to FINRA.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

WRAPmail, INC.

|

|

|

|

|

|

|

|

Date: January 27, 2017

|

By:

|

/s/ Marco Alfonsi

________

Marco Alfonsi, CEO

|

|

|

|

|

|

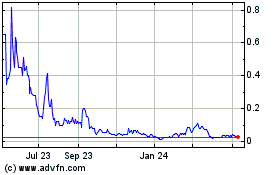

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Aug 2024 to Sep 2024

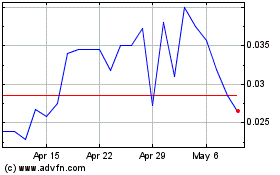

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Sep 2023 to Sep 2024