Return of brisk buying and selling on Wall Street provided an

infusion for lenders

By Liz Hoffman and Christina Rexrode

The historic U.S. election jolted Wall Street trading desks,

buoying investor confidence and sparking activity that pushed the

five biggest U.S. investment banks to sharply higher fourth-quarter

profits.

The performance marks what could be a turning point for banks

after a fallow period that had some worried the trading business --

the lifeblood of Wall Street and its billion-dollar bonus pools --

was dying for good.

Goldman Sachs Group Inc. and Citigroup Inc. reported quarterly

earnings Wednesday that beat analyst expectations and grew from a

year ago, thanks to a resurgence in long-challenged trading

businesses.

Citigroup's $3.7 billion trading haul was its best

fourth-quarter showing since the financial crisis. J.P. Morgan

Chase & Co., which reported its results last week, had its best

fourth-quarter for trading ever.

"There was increased optimism around the world," said Harvey

Schwartz, chief financial officer at Goldman, where trading

revenues jumped 25% over last year. Noting rising interest rates

and confidence that President-Elect Donald Trump's policies will

spur the economy, he said: "Those are the kinds of things that

always drive our business."

Overall, the five largest Wall Street firms -- Goldman, J.P.

Morgan, Citigroup, Bank of America Corp. and Morgan Stanley -- had

$18.1 billion in trading revenue during the quarter, up 26% from

2015. Those combined results are the highest in any fourth quarter

since the financial crisis.

Banks tend to do better when their clients, such as asset

managers and corporations, are putting money to work, which often

reflects confidence in the economy. In turn, higher bank profits

can make them more confident about lending, spurring further

economic growth.

The hum on bank trading desks also reflects a bout of volatility

after years of calm. Investors shifted billions of dollars from

technology stocks to financial stocks in the wake of the election,

routing more trades through Wall Street's equities trading

desks.

Meanwhile, Mr. Trump's election -- and his steady stream of

comments on everything from outsourcing of U.S. jobs to the

strength of the dollar -- has spurred frantic buying and selling in

global debt, currencies and commodities.

The strong 2016 finish was a welcome respite for trading desks

that started the year in a deep slump. The first quarter is

typically the strongest for trading desks as clients set their

priorities for the year and a fresh wave of corporate securities

flood the market. But in 2016, first-quarter trading revenue fell

about 20%.

Sluggish trading, though, had been a problem for banks for the

better part of this decade. Since the financial crisis, Goldman,

Morgan Stanley and other firms have struggled with tougher rules,

which made trading less profitable, and investor apathy, which

proved hard to shake as interest rates ground lower and economies

across the globe struggled to lift off.

In the following three quarters, however, an acceleration of the

U.S. economy, combined with hopes that the surprise election of Mr.

Trump could usher in lower taxes and other pro-growth policies in

2017, gave Wall Street a string of strong trading results.

The bounce was particularly strong in fixed-income products,

which include corporate and government debt, currencies and

commodities. The performance helped shake the belief that the

business was in secular decline. J.P. Morgan CEO James Dimon last

month estimated that half of the fixed-income trading fees lost

since the crisis would eventually return.

More recently, UBS Group AG analysts estimated that the biggest

banks could post an additional $15 billion in fixed-income trading

revenue over the next two years, with the lion's share accruing to

firms like Goldman, whose hedge-fund clients tend to be

particularly active when markets turn choppier.

Bank stockholders have embraced the surge. The KBW Nasdaq index,

a collection of large bank stocks, is up around 20% since the

election on hopes of lower taxes, lighter regulation and

enforcement, and more-stimulative economic policies.

"The bar has clearly moved higher," said Devin Ryan of JMP

Securities. "The question is whether we will see the real policy

changes" to justify the new valuations.

No firm has benefited more than Goldman, whose shares are up

nearly 30% since the election and have flirted in recent weeks with

highs not seen since 2007.

Goldman on Wednesday reported that earnings rose to $2.35

billion, driven by a 70% surge in bond-trading, which broke $2

billion in revenue for the first time since 2014. Goldman is more

dependent on trading than many rivals and has clung more tightly to

the business, even in the wake of punitive capital charges and

enhanced regulatory oversight. Goldman's shares Wednesday fell

0.6%.

At Citigroup, fourth-quarter trading zoomed up 31%, far better

than the 20% range that the bank guided to early last month. The

gains were shared across both fixed-income, Citigroup's traditional

stronghold, and the smaller stock-trading unit it has been trying

to expand. The bank reported a quarterly profit of $3.57 billion.

Citigroup's stock Wednesday dropped 1.7%.

--Telis Demos contributed to this article

Write to Liz Hoffman at liz.hoffman@wsj.com and Christina

Rexrode at christina.rexrode@wsj.com

(END) Dow Jones Newswires

January 19, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

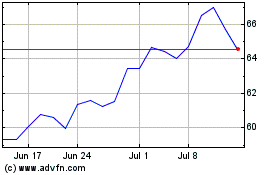

Citigroup (NYSE:C)

Historical Stock Chart

From Aug 2024 to Sep 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Sep 2023 to Sep 2024