By Paul Ziobro and Richard Rubin

Mattel Inc., Hasbro Inc. and other U.S. toy makers are bracing

for an overhaul of the U.S. tax code that is likely to hit

especially hard an industry long reliant on overseas labor to

manufacture Barbie dolls, Nerf guns and Hot Wheels cars.

A proposal to apply a border adjustment to the U.S. corporate

tax would strip toy makers of the ability to deduct the cost of

imported goods from their profits, potentially forcing major price

increases. The proposal, still in early stages, aims to cut tax

rates and keep jobs in the U.S. But the implications are

challenging for an industry that sells many of its products in the

U.S. while producing nearly all of them overseas.

Hasbro and Mattel both generate about half of their revenue

domestically but roughly 95% of Hasbro products and 100% of

Mattel's are made overseas, said Timothy Conder, a toy-industry

analyst at Wells Fargo.

Other groups such as big-box retailers who mostly sell goods

made overseas, are also on guard about the tax. But it could be

particularly costly for U.S. toy companies: Their home market is

their biggest in terms of sales, but with an average manufacturing

cost of $10 per toy, the U.S. isn't a cost-effective place to

produce them.

Mr. Conder estimates that the proposed tax change, under a

worst-case scenario, could lower toy maker Mattel's 2017 earnings,

which he forecasts to be $1.87 a share, by as much as 56 cents, and

ding Hasbro's 2017 estimated profit of $4.76 a share by 62

cents.

Mattel, based in El Segundo, Calif., declined to comment.

Hasbro, in Pawtucket, R.I., didn't respond to requests for

comment.

The border adjustment, part of the Republicans' plan for a

revamped tax system, would apply taxes based on where a product is

sold rather than where it is made or where the maker's operations

or executives are based. Imports couldn't be deducted as a cost of

doing business, while exports would be exempted.

For instance, if a company imports $1 million of foreign-made

toys, spends $500,000 on domestic costs and sells the products for

$2 million, it would only be able to deduct the $500,000 in local

costs under the proposal. Thus, it would pay taxes -- at the

proposed lower corporate tax rate of 20% -- on $1.5 million. A

similarly situated company now would deduct all the costs and pay

35% in taxes on just the $500,000.

Economists say that the tax change would help push up the dollar

-- which would in turn lowering the cost of imports and help to

offset the extra taxes.

According to Douglas Holtz-Eakin, a Republican economist, some

of importers' concerns are overblown, and they aren't factoring in

the benefits they would get from stronger economic growth and the

rising dollar. Companies and analysts looking only at what the

corporations pay in taxes are analyzing the plan incorrectly, he

said.

"Your cost of doing business won't change," Mr. Holtz-Eakin

said. "It will consist less of the cost of imports, which will be

cheaper, and more in taxes.

But large importers doubt that will happen as smoothly as

projected. The tax code has long allowed companies to deduct costs

for business purposes without a distinction between domestic and

foreign goods.

Importers are fighting the still-developing plan in Washington,

and Republican senators and the incoming administration of

President-elect Donald Trump haven't embraced it. House GOP

members, though, see it as a key pillar of their proposal, because

it provides roughly $1 trillion over a decade to offset proposed

corporate tax-rate cuts.

U.S. toy makers decamped to Asia decades ago for its cheaper

labor and manufacturing. Companies refined their operations over

the years as their design and engineering capabilities improved,

and modern highways and ports proliferated in China, making it

easier for companies to move raw materials and finished goods

around the world.

"It really morphed into what you would call the toy industrial

complex," said Richard Gottlieb, founder of Global Toy Experts, a

consulting firm, of the production facilities in China. "You have

something of a scale that's not repeatable in the world."

Some toy makers warn that attempting to bring it back to the

U.S. would be an expensive undertaking. Isaac Larian, chief

executive of MGA Entertainment Inc., the Los Angeles-based maker of

Bratz dolls and other toys, said that moving production

domestically would force the company to triple its prices.

"U.S. consumers will not accept it," he said in an email.

Mr. Larian said his company does make some products for its

Little Tikes line in a Hudson, Ohio, factory, and it has invested

millions in new machinery to ramp up its output there. He added,

however, that retailers and consumers are reluctant to pay more for

"Made in the U.S.A." products.

The Toy Industry Association, the industry's main trade group in

the U.S., has been working with other trade associations that rely

on imports in an attempt to sway Congress to drop the

border-adjustment tax proposal, emphasizing that the $25 billion

toy industry supports nearly half a million American jobs.

If that doesn't work, the New York-based association has

promised to fight.

"We are fully prepared to work productively or be a royal,

boisterous, media-friendly pain in the backsides of people who

would take away children's happy birthdays, steal Christmas and

destroy quality U.S.-based jobs," its president, Steve Pasierb,

wrote last month in his year-end letter to members. "And no one

wants to have to explain to their children why Santa was put out of

work."

Write to Paul Ziobro at Paul.Ziobro@wsj.com and Richard Rubin at

richard.rubin@wsj.com

(END) Dow Jones Newswires

January 11, 2017 09:14 ET (14:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

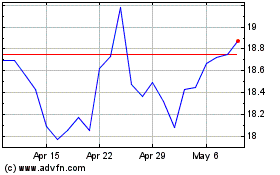

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

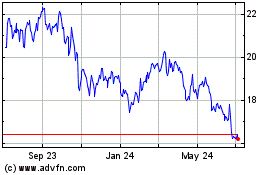

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Apr 2023 to Apr 2024