Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on December 30, 2016.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CLEAN DIESEL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

(State of other jurisdiction of

incorporation or organization)

|

|

06-1393453

(I.R.S. Employer

Identification No.)

|

1621 Fiske Place

Oxnard, California 93033

(805) 639-9458

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Tracy Kern

Chief Financial Officer

Clean Diesel Technologies, Inc.

1621 Fiske Place

Oxnard, California 93033

(805) 639-9458

(Name, address, including zip code, and telephone number, including area code of agent for service)

Copy to:

John J. McIlvery, Esq.

Stubbs Alderton & Markiles, LLP

15260 Ventura Boulevard, 20

th

Floor

Sherman Oaks, California 91403

(818) 444-4500

Approximate date of commencement of proposed sale to the public:

FROM TIME TO TIME AFTER THE EFFECTIVE DATE OF THIS REGISTRATION STATEMENT.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if smaller

reporting company)

|

|

Smaller reporting company

ý

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of securities

to be registered(1)

|

|

Amount to be

Registered(2)(3)

|

|

Proposed maximum

offering price per

security(3)

|

|

Proposed maximum

aggregate offering

price(3)

|

|

Amount of

registration fee

|

|

|

|

Common Stock, par value $0.01 per share

|

|

5,743,275 shares

|

|

$2.10

|

|

$12,060,877.50

|

|

$1,397.86

|

|

|

|

Common Stock, par value $0.01 per share, underlying Warrants

|

|

489,475 shares

|

|

$2.10

|

|

$1,027,897.50

|

|

$119.13

|

|

|

|

Total:

|

|

6,232,750 shares

|

|

|

|

$13,088,775.00

|

|

$1,516.99

|

|

|

-

(1)

-

The

shares being registered hereunder consist of 5,743,275 shares of common stock and 489,475 shares of common stock that may be acquired upon exercise of warrants,

in each case which shares of common stock may be sold from time to time by the selling stockholders.

-

(2)

-

Pursuant

to Rule 416 under the Securities Act of 1933, as amended, the shares being registered hereunder include such indeterminate number of shares of common

stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

-

(3)

-

Estimated

solely for the purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the

average of the high and low per share prices of the registrant's common stock as report on The Nasdaq Capital Market on December 27, 2016.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as

amended (the "Securities Act") or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission (the "SEC"), acting pursuant to said

Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is

not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 30, 2016

PROSPECTUS

6,232,750 Shares

Common Stock

This prospectus relates solely to the offer and sale from time to time of up to an aggregate of 6,232,750 shares of our common stock by the

selling stockholders identified in this prospectus or a supplement hereto. These shares consist of shares of our common stock that we issued to the selling stockholders pursuant to private placements

of our common stock or upon the exercise of warrants to purchase our common stock.

This

prospectus describes the general manner in which the shares of common stock may be offered and sold by the selling stockholders. If necessary, the specific manner in which shares of

common stock may be offered and sold will be described in a supplement to this prospectus.

We

are not offering any shares of common stock for sale under this prospectus, and we will not receive any of the proceeds from the sale or other disposition of the shares of common

stock offered hereby.

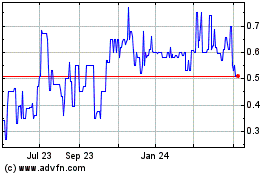

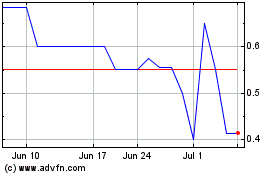

Our

common stock is listed on The Nasdaq Capital Market under the symbol "CDTI." On December 29, 2016, the last reported sale price of our common stock on The Nasdaq Capital

Market was $2.20.

Investing in our common stock involves risks. You should carefully consider the risks described under "Risk Factors" in Item 1A of our most

recent Annual Report on Form 10-K and Item 1A of any subsequently filed Quarterly Reports on Form 10-Q (which documents are incorporated by reference herein), as well as the other

information contained or incorporated by reference in this prospectus or in any prospectus supplement hereto before making a decision to invest in our common stock. See "Where You Can Find More

Information" below.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is .

Table of Contents

TABLE OF CONTENTS

You

should rely only on the information that we have provided or incorporated by reference in this prospectus, any applicable prospectus supplement and any related free writing

prospectus that we may authorize to be provided to you. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any

information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that we may authorize to be provided to you. You must

not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful

to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the

document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus,

any applicable prospectus supplement or any related free writing prospectus, or any sale of a security.

2

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission utilizing a

"shelf" registration process. Under this shelf registration process, the selling stockholders may offer from time to time up to an aggregate of 6,232,750 shares of common stock in one or more

offerings.

The

registration statement of which this prospectus is a part is being filed in accordance with the registration rights agreement, dated as of November 4, 2016, by and among Clean

Diesel Technologies, Inc. and the selling stockholders party thereto. Pursuant to the registration rights agreement, we have agreed to indemnify and hold harmless, to the extent permitted by

law, each of the selling stockholders party to the registration rights agreement and each of such selling stockholder's officers, directors, members, managers, employees and agents, successors and

assigns, and each other person, if any, who controls such selling stockholder within the meaning of the Securities Act of 1933,

as amended (the "Securities Act"), from and against certain losses, claims, damages and liabilities, including certain liabilities under the Securities Act.

The

information appearing in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document and

any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable

prospectus supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All

of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as

exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading "Where You Can Find More Information."

This

prospectus and the information incorporated herein by reference include trademarks, services marks and trade names owned by us or other companies. All trademarks, service marks and

trade names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any related free writing prospectuses are the property of their respective owners.

Unless

the context otherwise requires, the terms "we," "our," "us," "our company," and "CDTi" refer to Clean Diesel Technologies, Inc. and its subsidiaries.

3

Table of Contents

CLEAN DIESEL TECHNOLOGIES, INC.

Clean Diesel Technologies, Inc. currently commercializes its materials technology by manufacturing and distributing light duty vehicle

catalysts and heavy duty diesel emissions control systems and products to major automakers, distributors, integrators and retrofitters.

We

are transitioning our business from being a niche manufacturer of emissions control solutions for the automotive and heavy duty diesel markets to becoming an advanced materials

technology provider for these markets. We have a proven ability to develop proprietary materials incorporating various base metals that replace costly platinum group metals, or PGMs, in coatings on

vehicle catalytic converters. Recently, we have expanded our materials platform to include new synergized-PGM diesel oxidation catalysts (SPGM™ DOC), Base-Metal Activated Rhodium Support

(BMARS™), and Spinel™ technologies, and we are in the process of introducing these new catalyst technologies to Original Equipment Manufacturers, or OEMs, and other vehicle

catalyst manufacturers in a proprietary powder form. We believe that our advanced materials

focus and strategic repositioning will allow us to achieve greater scale and higher return on our technology investment than in the past.

Our

business is driven by increasingly stringent global emission standards for internal combustion engines, which are major sources of a variety of harmful pollutants. We have operations

in the United States, the United Kingdom, Japan and Sweden as well as an Asian investment.

We

are incorporated in the state of Delaware. Our principal executive offices are located at 1621 Fiske Place, Oxnard, California 93033, and our telephone number at this location is

(805) 639-9458. Our website address is www.cdti.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks and uncertainties discussed under the section titled "Risk Factors" contained in our most recent Annual Report on Form 10-K and in our most recent Quarterly Report on

Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety, together with other

information in this prospectus, the documents incorporated by reference and any free writing prospectus that we may authorize for use in connection with a specific offering. The risks described in

these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that

could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate

results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the

trading price of our securities to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below titled "Forward-Looking Statements."

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference contain forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, or Exchange Act. These statements involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the

forward-looking statements. In some cases,

you can identify forward-looking statements by terms such as "anticipates," "believes", "could", "estimates", "expects", "intends", "may", "plans", "potential", "predicts", "projects", "should",

"will", "would" as well as

4

Table of Contents

similar

expressions. Forward-looking statements reflect our current views with respect to future events, are based on assumptions and are subject to risks, uncertainties and other important factors.

We discuss many of these risks, uncertainties and other important factors in greater detail under the heading "Risk Factors" contained in our most recent annual report on Form 10-K and in our

most recent quarterly report on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC. Given these risks, uncertainties and other important factors, you

should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date such forward-looking statements

are made. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to reflect facts and circumstances after the date of this prospectus. Before deciding

to purchase our securities, you should carefully read both this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated

herein by reference as described under the heading "Incorporation of Certain Information by Reference," completely and with the understanding that our actual future results may be materially different

from what we expect.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders.

DESCRIPTION OF CAPITAL STOCK

Our authorized capital stock consists of 50,000,000 shares of common stock, $0.01 par value, and 100,000 shares of preferred stock, $0.01 par

value. As of December 19, 2016, there were 15,693,172 shares of common stock outstanding and no shares of preferred stock outstanding.

The

following summary description of our capital stock is based on the provisions of our certificate of incorporation and bylaws and the applicable provisions of the Delaware General

Corporation Law. This

information is qualified entirely by reference to the applicable provisions of our certificate of incorporation, bylaws and the Delaware General Corporation Law. For information on how to obtain

copies of our certificate of incorporation and bylaws, which are exhibits to the registration statement of which this prospectus is a part, see "Where You Can Find More Information."

Common Stock

The holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders.

Our stockholders do not have cumulative voting rights in the election of directors. Subject to preferences that may be applicable to any outstanding shares of preferred stock, the holders of common

stock are entitled to receive ratably only those dividends as may be declared by our board of directors out of legally available funds. Upon our liquidation, dissolution or winding up, holders of our

common stock are entitled to share ratably in all assets remaining after payment of liabilities and the liquidation preferences of any outstanding shares of preferred stock. Holders of common stock

have no preemptive or other subscription or conversion rights. There are no redemption or sinking fund provisions applicable to our common stock. Shares of our common stock outstanding, and to be

issued, are, and will be, fully paid and non-assessable. Additional shares of authorized common stock may be issued, as authorized by our board of directors from time to time, without stockholder

approval, except as may be required by applicable stock exchange requirements.

Preferred Stock

Pursuant to our certificate of incorporation, our board of directors has the authority, without further action by the stockholders (unless such

stockholder action is required by applicable law or the

5

Table of Contents

rules

of The Nasdaq Stock Market), to designate and issue up to 100,000 shares of preferred stock in one or more series, to establish from time to time the number of shares to be included in each such

series, to fix the designations, powers, preferences and rights of the shares of each wholly unissued series, and any qualifications, limitations or restrictions thereon, and to increase or decrease

the

number of shares of any such series, but not below the number of shares of such series then outstanding. Shares of our preferred stock, if issued, will be fully paid and non-assessable.

We

will fix the designations, powers, preferences and rights of the preferred stock of each series, as well as the qualifications, limitations or restrictions thereon, in the certificate

of designation relating to that series, including:

-

•

-

the title and stated value;

-

•

-

the number of shares of such series;

-

•

-

the liquidation preference per share;

-

•

-

the purchase price;

-

•

-

the dividend rate, period and payment date and method of calculation for dividends;

-

•

-

whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

-

•

-

the provisions for a sinking fund, if any;

-

•

-

the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase

rights;

-

•

-

whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price, or how it will be calculated,

and the conversion period;

-

•

-

whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated,

and the exchange period;

-

•

-

voting rights, if any, of the preferred stock;

-

•

-

preemptive rights, if any;

-

•

-

restrictions on transfer, sale or other assignment, if any;

-

•

-

the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs;

-

•

-

any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock

as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and

-

•

-

any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock.

The

General Corporation Law of the State of Delaware, or DGCL, the state of our incorporation, provides that the holders of preferred stock will have the right to vote separately as a

class (or, in some cases, as a series) on an amendment to our certificate of incorporation if the amendment would change the par value or, unless the certificate of incorporation provided otherwise,

the number of authorized shares of the class or change the powers, preferences or special rights of the class or series so as to adversely affect the class or series, as the case may be. This right is

in addition to any voting rights that may be provided for in the applicable certificate of designation.

6

Table of Contents

Our

board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our

common stock. Preferred stock could be issued quickly with terms designed to delay or prevent a change in control of our company or make removal of management more difficult. Additionally, the

issuance of preferred stock may have the effect of decreasing the market price of our common stock.

Anti-takeover Effects of Provisions of Charter Documents and Delaware Law

Our certificate of incorporation and bylaws and the Delaware General Corporation Law contain provisions that could make the following

transactions more difficult: acquisition of us by means of a tender offer; acquisition of us by means of a proxy contest or otherwise; or removal of our incumbent officers and directors. It is

possible that these provisions could make it more difficult to accomplish or could deter transactions that stockholders may otherwise consider to be in their best interest or in our best interests,

including transactions that might result in a premium over the market price for our shares.

The

provisions of our certificate of incorporation and bylaws and the DGCL summarized below may have the effect of deterring hostile takeovers or delaying changes in control or

management of us. They are designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors. We believe that the benefits of increased protection of our

potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages of discouraging these proposals because negotiation

of these proposals could result in an improvement of their terms.

Charter and Bylaw Provisions

Our certificate of incorporation and bylaws contain provisions relating to corporate governance and to the rights of stockholders. Our bylaws

provide that special meetings of stockholders may only be called by our board of directors, our chairman of the board or our chief executive officer and shall be called by our chairman, chief

executive officer or secretary at the request in writing of stockholders owning at least one-fourth of the outstanding shares of capital stock entitled to vote. In addition, our certificate of

incorporation provides that our board of directors may authorize the issuance of preferred stock without further stockholder approval and upon those terms and conditions, and having those rights,

privileges and preferences, as our board of directors may determine.

Delaware Anti-Takeover Law

We are subject to Section 203 of DGCL, which prohibits a Delaware corporation from engaging in any business combination with any

interested stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

-

•

-

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the

stockholder becoming an interested holder;

-

•

-

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at

least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock

owned by the interested stockholder) those shares owned (i) by persons who are directors and also officers and (ii) employee stock plans in which employee participants do not have the

right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

7

Table of Contents

-

•

-

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the

stockholders, and not by written consent, by the affirmative vote of at least 66

2

/

3

% of the outstanding voting stock that is not owned by the interested stockholder.

In

general, Section 203 defines business combination to include the following:

-

•

-

any merger or consolidation involving the corporation and the interested stockholder;

-

•

-

any sale, lease, transfer, pledge or other disposition of 10% or more of the assets of the corporation to or with the interested stockholder;

-

•

-

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to

the interested stockholder;

-

•

-

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the

corporation beneficially owned by the interested stockholder; or

-

•

-

the receipt by the interested stockholder of the benefit of any loss, advances, guarantees, pledges or other financial benefits by or through

the corporation.

In

general, Section 203 defines interested stockholder as an entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation or any entity or

person affiliated with or controlling or controlled by such entity or person.

Although

Section 203 permits us to elect not to be governed by its provisions, we have not made this election. As a result of the application of Section 203, potential

acquirers of CDTi may be discouraged from attempting to effect an acquisition transaction with us, thereby possibly depriving holders of our securities of certain opportunities to sell or otherwise

dispose of such securities at above-market prices pursuant to such transactions.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC.

Listing on The NASDAQ Capital Market

Our common stock is listed on The NASDAQ Capital Market under the symbol "CDTI."

8

Table of Contents

SELLING STOCKHOLDERS

2016 Private Placement Financing

On November 3, 2016, we entered into a securities purchase agreement with investors that provided for the sale of 5,172,250 shares of

common stock at a price of $2.00 per share for gross proceeds to us of $10,344,500 before placement agent fees and transaction expenses. The investors include four of our directors and officers, each

of whom purchased shares of common stock on the same terms and conditions as the other investors.

We

consummated the private placement in two closings. On November 4, 2016, we sold 949,960 shares of common stock for aggregate gross proceeds of $1,899,920. On

December 16, 2016, we sold 4,222,290 shares of common stock for gross proceeds of $8,444,580. Each of the investors in the private placement is a selling stockholder.

In

connection with the private placement, we entered into a registration rights agreement, dated November 4, 2016, with the investors, pursuant to which we agreed to register for

resale by the investors the shares of common stock purchased by the investors pursuant to the securities purchase agreement. We committed to file the registration statement no later than

January 30, 2017 and to cause the registration statement to become effective no later than April 15, 2017. The registration rights agreement provides for liquidated damages upon the

occurrence of certain events, including our failure to file the registration statement on or before January 30, 2017 or cause it to become effective on or before April 15, 2017. The

amount of liquidated damages payable to an investor would be 1.0% of the aggregate amount invested by such investor for each 30-day period, or pro rata portion thereof, during which the default

continues, up to a maximum amount of 10% of the aggregate amount invested by such investor. We filed the registration statement of which this prospectus is a part with the SEC pursuant to the

registration rights agreement.

Issuance of Securities to MDB Capital Group

MDB Capital Group, LLC acted as placement agent in the private placement financing. For its services as placement agents, we agreed to

issue to MDB Capital Group (i) a number of shares of common stock equal to 10% of the number of shares of common stock issued to the investors in the private placement, and

(ii) five-year warrants to purchase a number of shares of common stock equal to 10% of the number of shares of common stock issued to the investors in the private placement at an exercise price

of $2.20 per share; provided that no shares of common stock or warrants would be issued to the placement agent in respect of shares sold to our officers and directors and their respective affiliates.

Pursuant to this agreement, at the first and second closings of the financing, we issued to MDB Capital Group an aggregate of 489,475 shares of common stock and five-year warrants to purchase up to

489,475 shares of common stock. We also paid for the out-of-pocket expenses incurred by MDB Capital Group of $50,000. The warrants are exercisable for a period commencing 6 months and ending

60 months after issuance. MDB Capital Group is a selling stockholder.

In

addition, on December 16, 2016, we entered into a securities purchase agreement pursuant to which we issued to MDB Capital Group 81,550 shares of common stock in payment of

$163,100 of outstanding trade payables, for an equivalent purchase price of $2.00 per share. We incurred the trade payables for patent services provided by MDB Capital Group. We agreed to register the

shares for resale by MDB Capital Group pursuant to the registration statement of which this prospectus is a part.

MDB

Capital Group is a member firm of the Financial Industry Regulatory Authority and may be considered an underwriter in connection with the sale of the securities for which it is

listed as a selling stockholder. MDB Capital Group (i) acquired its securities included in this prospectus for resale in the ordinary course of business, and (ii) had no agreements or

understandings, directly or indirectly, with any person to distribute the securities at the time of their acquisition. MDB Capital Group has no

9

Table of Contents

agreements

or understandings, directly or indirectly, to distribute or to arrange the sale of the securities included in this prospectus of the other selling stockholders; provided however, MDB

Capital Group may be engaged in the ordinary course of its business by one or more of the selling stockholders as a broker dealer to act for them in respect of the securities included in this

prospectus.

Selling Stockholder Table

The following table sets forth for each selling stockholder, the name, the number and percentage of shares of common stock beneficially owned as

of December 19, 2016, the maximum number of shares of common stock that may be offered pursuant to this prospectus and the number and percentage of shares of common stock that would be

beneficially owned after the sale of the maximum number of shares of common stock, and is based upon information provided to us by each selling stockholder for use in this prospectus. The information

presented in the table is based on 15,693,172 shares of our common stock outstanding on December 19, 2016.

Beneficial

ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Unless otherwise indicated below,

to our knowledge, the persons and entities named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

For purposes of the table below, shares of common stock issuable pursuant to options and restricted stock units held by a selling stockholder that can be acquired within 60 days of

December 19, 2016, and shares of common stock issuable pursuant to warrants held by a selling stockholder without regard to restrictions on exercise, are deemed to be outstanding and to be

beneficially owned by the selling stockholder holding the securities but are not treated as outstanding for the purpose of computing the percentage ownership of any other selling stockholder.

The

warrants held by MDB Capital Group, LLC are not exercisable until May 4, 2017 (with respect to 94,996 shares) and June 16, 2017 (with respect to 394,479 shares).

The shares of common stock and

percentage ownership listed in the following table do not reflect these contractual limitations on MDB Capital Group, LLC's ability to purchase shares of common stock upon exercise of warrants.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially

Owned After the

Sale of the Maximum

Number of Shares

|

|

|

|

Shares Beneficially

Owned

|

|

|

|

|

|

Maximum

Number of

Shares to be

Sold Hereunder

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

Percentage

|

|

Number

|

|

Percentage

|

|

|

Employees and Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matthew Beale(1)

|

|

|

166,993

|

|

|

1.1

|

%

|

|

12,500

|

|

|

154,493

|

|

|

*

|

|

|

Bell Family Trust dated 2/2/1995 as amended, Lon E. Bell, Trustee(2)

|

|

|

598,493

|

|

|

3.8

|

%

|

|

250,000

|

|

|

348,493

|

|

|

2.2

|

%

|

|

Tracy Kern(3)

|

|

|

15,000

|

|

|

*

|

|

|

10,000

|

|

|

5,000

|

|

|

*

|

|

|

David Shea(4)

|

|

|

10,122

|

|

|

*

|

|

|

5,000

|

|

|

5,122

|

|

|

*

|

|

|

Other Selling Stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Teddy Adelstein

|

|

|

9,000

|

|

|

*

|

|

|

9,000

|

|

|

0

|

|

|

—

|

|

|

Per Magnus Andersson(5)

|

|

|

30,000

|

|

|

*

|

|

|

30,000

|

|

|

0

|

|

|

—

|

|

|

Matthew Antoun

|

|

|

37,500

|

|

|

*

|

|

|

37,500

|

|

|

0

|

|

|

—

|

|

|

Peter A. Appel

|

|

|

375,000

|

|

|

2.4

|

%

|

|

375,000

|

|

|

0

|

|

|

—

|

|

|

Louis J. Basenese III

|

|

|

5,000

|

|

|

*

|

|

|

5,000

|

|

|

0

|

|

|

—

|

|

|

Robert Edward Beaudine

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

BEBE, LLC(6)

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

Bibicoff Family Trust(7)

|

|

|

20,000

|

|

|

*

|

|

|

20,000

|

|

|

0

|

|

|

—

|

|

|

Broumand Family Trust(8)

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Broumand Family Trust(9)

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

10

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially

Owned After the

Sale of the Maximum

Number of Shares

|

|

|

|

Shares Beneficially

Owned

|

|

|

|

|

|

Maximum

Number of

Shares to be

Sold Hereunder

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

Percentage

|

|

Number

|

|

Percentage

|

|

|

Brenden Broumand

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Candlestick Lane Investments, LP(10)

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Sivan Padnos Caspi

|

|

|

10,000

|

|

|

*

|

|

|

10,000

|

|

|

0

|

|

|

—

|

|

|

Catalysis Partners, LLC(11)

|

|

|

125,000

|

|

|

*

|

|

|

125,000

|

|

|

0

|

|

|

—

|

|

|

Jason Cavalier

|

|

|

125,000

|

|

|

*

|

|

|

125,000

|

|

|

0

|

|

|

—

|

|

|

Michael Cavalier

|

|

|

100,000

|

|

|

*

|

|

|

100,000

|

|

|

0

|

|

|

—

|

|

|

CBH 2007 Trust(12)

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Francis Y L Chen and Peierh Penny Yang

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Richard Duane Clarkson

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Richard L. Clarkson

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Connective Capital Emerging Energy QP, LP(13)

|

|

|

78,552

|

|

|

*

|

|

|

78,552

|

|

|

0

|

|

|

—

|

|

|

Connective Capital I Master Fund, Ltd.(14)

|

|

|

171,448

|

|

|

1.1

|

|

|

171,448

|

|

|

0

|

|

|

—

|

|

|

James Crank

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Darwin Ret LLC(15)

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

David S. Nagelberg 2003 Revocable Trust DTD 7-2-2003(16)

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

Laurence Dunn

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Carolyn Fan

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Fatima, LLC(17)

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

FLMM Ltd.(18)

|

|

|

270,000

|

|

|

1.7

|

%

|

|

270,000

|

|

|

0

|

|

|

—

|

|

|

Peter C. Gerlach

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

GFLT 1999(19)

|

|

|

125,000

|

|

|

*

|

|

|

125,000

|

|

|

0

|

|

|

—

|

|

|

Matthew Hayden

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Erwin Martin Holmann

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Ryan Hong

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Austin Hough

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Charles B. Humphrey

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Israel Living Trust(20)

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

JAZTB, LLC(21)

|

|

|

8,000

|

|

|

*

|

|

|

8,000

|

|

|

0

|

|

|

—

|

|

|

Jeffrey & Margaret Padnos 2010 Generation Trust FBO Benjamin Padnos(22)

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Jeffrey & Margaret Padnos 2010 Generation Trust FBO Joshua Padnos(23)

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Jeffrey & Margaret Padnos 2010 Generation Trust FBO Rebecca Padnos Altamirano(24)

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Jeffrey & Margaret Padnos 2010 Generation Trust FBO Samuel Padnos(25)

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Jason Kim

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Benjamin King

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Lee Kolligian(26)

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Kevin Leung

|

|

|

75,000

|

|

|

*

|

|

|

75,000

|

|

|

0

|

|

|

—

|

|

|

James Keet Lewis

|

|

|

1,250

|

|

|

*

|

|

|

1,250

|

|

|

0

|

|

|

—

|

|

11

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially

Owned After the

Sale of the Maximum

Number of Shares

|

|

|

|

Shares Beneficially

Owned

|

|

|

|

|

|

Maximum

Number of

Shares to be

Sold Hereunder

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

Percentage

|

|

Number

|

|

Percentage

|

|

|

James Lin

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

LKCM Technology Partnership, L.P.(27)

|

|

|

62,500

|

|

|

*

|

|

|

62,500

|

|

|

0

|

|

|

—

|

|

|

Stephen A. Mao

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

Jeffrey Brian Maroz

|

|

|

87,500

|

|

|

*

|

|

|

87,500

|

|

|

0

|

|

|

—

|

|

|

Shawn R. and Amanda McAllister

|

|

|

10,000

|

|

|

*

|

|

|

10,000

|

|

|

0

|

|

|

—

|

|

|

MDB Capital Group, LLC(28)

|

|

|

1,060,500

|

|

|

6.6

|

%

|

|

1,060,500

|

|

|

0

|

|

|

—

|

|

|

Phillip David Mervis & Sheryl Facktor JTWROS

|

|

|

10,000

|

|

|

*

|

|

|

10,000

|

|

|

0

|

|

|

—

|

|

|

Andrew G. Miller

|

|

|

10,000

|

|

|

*

|

|

|

10,000

|

|

|

0

|

|

|

—

|

|

|

Jonathan Miller and Deborah L. Miller

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

Lewis Mitchell

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

David Michael Mossberg

|

|

|

2,500

|

|

|

*

|

|

|

2,500

|

|

|

0

|

|

|

—

|

|

|

Napean Capital Group, LLC(29)

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Benjamin L. Padnos

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Daniel Padnos

|

|

|

15,000

|

|

|

*

|

|

|

15,000

|

|

|

0

|

|

|

—

|

|

|

Jeffrey S. Padnos & Margaret M. Padnos JTWROS

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Jonathan Padnos

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Edwin Rommel Holmann Pastora

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Nimish Patel

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

Polaris Prime Small Cap Value, LP(30)

|

|

|

100,000

|

|

|

*

|

|

|

100,000

|

|

|

0

|

|

|

—

|

|

|

Edmund Purcell

|

|

|

5,000

|

|

|

|

|

|

5,000

|

|

|

0

|

|

|

—

|

|

|

Richard and Lisa Rosenblatt Family Trust(31)

|

|

|

75,000

|

|

|

*

|

|

|

75,000

|

|

|

0

|

|

|

—

|

|

|

RVCA Partners, L.L.C.(32)

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

Daniel Allen Sanker

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Brett Schafer

|

|

|

39,000

|

|

|

*

|

|

|

39,000

|

|

|

0

|

|

|

—

|

|

|

Andrew Schwartzberg

|

|

|

500,000

|

|

|

3.2

|

%

|

|

500,000

|

|

|

0

|

|

|

—

|

|

|

Samuel M. Selinger

|

|

|

2,500

|

|

|

*

|

|

|

2,500

|

|

|

0

|

|

|

—

|

|

|

Strome Mezzanine Fund, LP(33)

|

|

|

500,000

|

|

|

3.2

|

%

|

|

500,000

|

|

|

0

|

|

|

—

|

|

|

Thomas A. Stroup

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

Gregory Howard Suess

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Craig Jeffrey Taines

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Paul Teske and Rivers A. Teske

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

The Beth Anne Stanley Revocable Trust UAD 8-4-2006, Beth Anne Stanley TTEE(34)

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

The Fein Family Trust(35)

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

|

The Kingdom Trust Company, Custodian, FBO Erick Richardson SEP IRA

|

|

|

225,000

|

|

|

1.4

|

%

|

|

225,000

|

|

|

0

|

|

|

—

|

|

|

The Kingdom Trust Company, Custodian, FBO Keith Archer IRA

|

|

|

18,000

|

|

|

*

|

|

|

18,000

|

|

|

0

|

|

|

—

|

|

|

The Steven and Kristin Chapin Family Trust(36)

|

|

|

125,000

|

|

|

*

|

|

|

125,000

|

|

|

0

|

|

|

—

|

|

|

James P. Tierney

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

TKK Investors, LLC(37)

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Dominador D. Tolentino Jr.

|

|

|

12,500

|

|

|

*

|

|

|

12,500

|

|

|

0

|

|

|

—

|

|

12

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially

Owned After the

Sale of the Maximum

Number of Shares

|

|

|

|

Shares Beneficially

Owned

|

|

|

|

|

|

Maximum

Number of

Shares to be

Sold Hereunder

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

Percentage

|

|

Number

|

|

Percentage

|

|

|

UBS Financial Services Inc., as Custodian of the Roth IRA of Douglas Weitman A/C LO19876

|

|

|

75,000

|

|

|

*

|

|

|

75,000

|

|

|

0

|

|

|

—

|

|

|

Mauricio Umansky

|

|

|

17,000

|

|

|

*

|

|

|

17,000

|

|

|

0

|

|

|

—

|

|

|

Greg Alan Walker and Susan Hicks Walker JTWROS

|

|

|

15,000

|

|

|

*

|

|

|

15,000

|

|

|

0

|

|

|

—

|

|

|

Stephen M. Walker

|

|

|

25,000

|

|

|

*

|

|

|

25,000

|

|

|

0

|

|

|

—

|

|

|

Brian Weitman

|

|

|

75,000

|

|

|

*

|

|

|

75,000

|

|

|

0

|

|

|

—

|

|

|

Lonnie J. Williams

|

|

|

10,000

|

|

|

*

|

|

|

10,000

|

|

|

0

|

|

|

—

|

|

|

YKA Partners, LLC(38)

|

|

|

50,000

|

|

|

*

|

|

|

50,000

|

|

|

0

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

6,232,750

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

*

-

Represents

beneficial ownership of less than one percent.

-

(1)

-

Consists

of (i) 65,486 shares of common stock, (ii) 100,000 shares of common stock that may be acquired from us upon exercise of stock options that are

exercisable within 60 days of December 19, 2016, and (iii) 1,507 shares of common stock that may be acquired from us upon vesting of restricted stock units within 60 days

of December 19, 2016.

-

(2)

-

Consists

of (i) 266,000 shares of common stock owned by the Bell Family Trust, (ii) 8,000 shares of common stock that may be acquired from us by the

Bell Family Trust upon exercise of warrants, and (iii) 324,493 shares of common stock owned by Lon E. Bell, Ph.D. Dr. Bell, Trustee of the Bell Family Trust, has voting and dispositive

power with respect to securities owned by the Bell Family Trust.

-

(3)

-

Consists

of (i) 10,000 shares of common stock and (ii) 5,000 shares of common stock that may be acquired from us upon exercise of stock options that

are exercisable within 60 days of December 19, 2016.

-

(4)

-

Consists

of (i) 8,306 shares of common stock and (ii) 1,816 shares of common stock that may be acquired from us upon vesting of restricted stock units

within 60 days of December 19, 2016.

-

(5)

-

Does

not include shares held by FLMM, Ltd., a selling stockholder. Mr. Andersson exercises voting and investment authority over the shares held by

FLMM Ltd.

-

(6)

-

Erick

Richardson exercises voting and investment authority over the shares held by this selling stockholder. Does not include shares held by The Kingdom Trust

Company, Custodian, FBO Erick Richardson SEP IRA, a selling stockholder.

-

(7)

-

Harvey

Bibicoff exercises voting and investment authority over the shares held by this selling stockholder.

-

(8)

-

Cameron

Broumand exercises voting and investment authority over the shares held by this selling stockholder.

-

(9)

-

Houshang

Broumand exercises voting and investment authority over the shares held by this selling stockholder.

-

(10)

-

Daniel

Verret exercises voting and investment authority over the shares held by this selling stockholder.

13

Table of Contents

-

(11)

-

John

Francis exercises voting and investment authority over the shares held by this selling stockholder.

-

(12)

-

Jolie

D. Humphrey exercises voting and investment authority over the shares held by this selling stockholder.

-

(13)

-

Robert

Romero exercises voting and investment authority over the shares held by this selling stockholder.

-

(14)

-

Robert

Romero exercises voting and investment authority over the shares held by this selling stockholder.

-

(15)

-

Harvey

Kesner exercises voting and investment authority over the shares held by this selling stockholder.

-

(16)

-

David

S. Nagelberg exercises voting and investment authority over the shares held by this selling stockholder.

-

(17)

-

Andres

Ruzo exercises voting and investment authority over the shares held by this selling stockholder.

-

(18)

-

Per

Magnus Andersson exercises voting and investment authority over the shares held by this selling stockholder.

-

(19)

-

Steven

Gubner exercises voting and investment authority over the shares held by this selling stockholder.

-

(20)

-

Samuel

Israel exercises voting and investment authority over the shares held by this selling stockholder.

-

(21)

-

Jordan

Tabach-Bank exercises voting and investment authority over the shares held by this selling stockholder.

-

(22)

-

Benjamin

Padnos exercises voting and investment authority over the shares held by this selling stockholder.

-

(23)

-

Benjamin

Padnos exercises voting and investment authority over the shares held by this selling stockholder.

-

(24)

-

Benjamin

Padnos exercises voting and investment authority over the shares held by this selling stockholder.

-

(25)

-

Benjamin

Padnos exercises voting and investment authority over the shares held by this selling stockholder.

-

(26)

-

Does

not include shares held by TKK Investors, LLC, a selling stockholder. Mr. Kolligian exercises voting and investment authority over the shares

held by TKK Investors, LLC.

-

(27)

-

David

Lehmann exercises voting and investment authority over the shares held by this selling stockholder.

-

(28)

-

Consists

of (i) 571,025 shares of common stock and (ii) 489,475 shares of common stock that may be acquired from us upon exercise of warrants that are

exercisable commencing on May 4, 2017 (with respect to 94,996 shares) and June 16, 2017 (with respect to 394,479 shares). Gary Schuman exercises voting and investment authority over the

shares held by this selling stockholder.

-

(29)

-

Suren

Jain exercises voting and investment authority over the shares held by this selling stockholder.

14

Table of Contents

-

(30)

-

John

Pernell, Jr. exercises voting and investment authority over the shares held by this selling stockholder.

-

(31)

-

Richard

Rosenblatt exercises voting and investment authority over the shares held by this selling stockholder.

-

(32)

-

David

Hunt exercises voting and investment authority over the shares held by this selling stockholder.

-

(33)

-

Mark

Strome exercises voting and investment authority over the shares held by this selling stockholder.

-

(34)

-

Beth

Stanley exercises voting and investment authority over the shares held by this selling stockholder.

-

(35)

-

Joshua

Fein exercises voting and investment authority over the shares held by this selling stockholder.

-

(36)

-

Steven

Chapin exercises voting and investment authority over the shares held by this selling stockholder.

-

(37)

-

Lee

Kolligian exercises voting and investment authority over the shares held by this selling stockholder.

-

(38)

-

Kenneth

Aldrich exercises voting and investment authority over the shares held by this selling stockholder.

15

Table of Contents

PLAN OF DISTRIBUTION

The selling stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common

stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to

time, sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are

traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices

determined at the time of sale, or at negotiated prices.

The

selling stockholders may use any one or more of the following methods when disposing of shares or interests therein:

-

•

-

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

-

•

-

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as

principal to facilitate the transaction;

-

•

-

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

-

•

-

an exchange distribution in accordance with the rules of the applicable exchange;

-

•

-

privately negotiated transactions;

-

•

-

short sales effected after the date the registration statement of which this Prospectus is a part is declared effective by the SEC;

-

•

-

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

-

•

-

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share; and

-

•

-

a combination of any such methods of sale.

The

selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of

their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under

Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling

stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in

interest will be the selling beneficial owners for purposes of this prospectus.

In

connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver

these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or

other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial

institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such

transaction).

16

Table of Contents

The

aggregate proceeds to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any.

Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made

directly or through agents. We will not receive any of the proceeds from this offering.

The

selling stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of 1933, provided that they

meet the criteria and conform to the requirements of that rule.

The

selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be "underwriters" within the meaning of

Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the