Innovative Solutions & Support, Inc. (NASDAQ: ISSC) today

announced its financial results for the fourth quarter and full

fiscal year ended September 30, 2016.

Revenues for fiscal 2016 were $28.0 million compared to $20.1

million for fiscal 2015. For the current year, operating income was

$2.4 million, and net income was $2.0 million or $0.12 per share.

In fiscal 2015, the Company reported an operating loss of $(3.6)

million and a net loss of $(5.9) million or $(0.35) per share.

Geoffrey Hedrick, Chairman and Chief Executive Officer of

Innovative Solutions & Support, Inc. said, “Fiscal 2016 was a

year of significant improvement, returning to positive growth in

revenues, profits and cash flow, while also positioning ISSC to

capitalize on emerging opportunities expected to arise with the

approach of new NextGen mandates. We believe our strategy is sound

and is working as we transformed the nature of our revenue over the

past year so that we now generate over 90% of our revenue from

profitable production contracts. The transformation of the air

traffic control system, often referred to as the 'NextGen

mandates', holds great promise, as it is expected to yield

significant improvements to both aircraft safety and performance.

Over the past year, we have significantly increased our commitment

to internally developed new products and are expanding our

distribution channels in order to further penetrate this market.

The fully NextGen - compliant cockpit we’ve developed - capable of

meeting all known upcoming mandates over the next 10 years -

illustrates our ability to quickly respond to emerging

opportunities. I am confident that we have adopted strategy,

developed the technologies, and the financial strength that will

enable us to continue to create value for our shareholders.”

At September 30, 2016, the Company had $18.8 million of cash on

hand and remained debt free. Cash increased by $2.5 million during

the course of fiscal 2016. New orders for the fourth quarter of

fiscal 2016 were $4.4 million, and backlog at September 30, 2016

was $4.6 million, compared to $6.4 million at June 30, 2016.

Backlog excludes potential future sole-source production orders

from products in development under the Company’s engineering

development contracts, including the Pilatus PC-24, and the KC-46A,

both of which the Company expects to remain in production for a

decade following completion of their respective development phases.

The Company expects that these contracts will add to production

sales already in backlog.

For the fourth quarter of fiscal 2016, the Company reported

revenues of $6.2 million, compared to revenues of $3.1 million for

the fourth quarter of fiscal 2015. Cash provided by operating

activities was $1.9 million for the quarter. The Company reported

fourth quarter fiscal 2016 operating income of $500,000 and net

income of $400,000, or $0.02 per share. The Company reported a

fourth quarter fiscal 2015 net loss of $2.6 million, or $(0.15) per

share.

Shahram Askarpour, President of ISSC, commented, “Fiscal 2016

was a transformational year in which we modified our strategy,

realigned our resources and strengthened relationships, all of

which now serve as a solid foundation from which to continue to

grow. By concentrating on production contracts, we’ve sharpened our

focus, which has returned gross margins to their higher, historic

levels. A greater emphasis on internally funded research and

development investment has enabled us to create new products that

we believe can quickly capitalize on current market needs. These

products also appeal to broad market opportunities in contrast to

the narrower market potential of the customer-funded engineering

programs that characterized many past development efforts. And, by

supplementing our strong base of customers with an expanding

distribution network, we can continue to build a steady stream of

increasingly more stable underlying book-and-ship production

revenue. At the same time, we are preparing for a market that is

anxious to implement the latest in NextGen technology. By

incorporating NextGen technologies such as ADS-B in, ADS-B out, LPV

and RNP capabilities into our products, many operators are not

waiting for FAA mandates and are choosing to start to update their

cockpits now. This is creating increased interest, especially in

our Flight Management System. We enter fiscal 2017 in strong

financial position, and with a game plan that is intended to

optimize the value of our franchise and benefit our

shareholders.”

Conference Call

The Company will be hosting a conference call on Thursday,

December 15, 2016 at 10:00 a.m. ET to discuss these results and its

business outlook. Please use the following dial in number to

register your name and company affiliation for the conference call:

877-883-0383 and enter the PIN Number 5238989. The call will also

be carried live on the Investor Relations page of the Company web

site at www.innovative-ss.com.

About Innovative Solutions &

Support, Inc.

Headquartered in Exton, Pa., Innovative Solutions & Support,

Inc. (www.innovative-ss.com) is a systems integrator that designs

and manufactures flight guidance and cockpit display systems for

Original Equipment Manufacturers (OEM’s) and retrofit applications.

The company supplies integrated Flight Management Systems (FMS) and

advanced GPS receivers for precision low carbon footprint

navigation.

Certain matters contained herein that are not descriptions of

historical facts are “forward-looking” (as such term is defined in

the Private Securities Litigation Reform Act of 1995). Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause results to

differ materially from those expressed or implied by such

forward-looking statements include, but are not limited to, those

discussed in filings made by the Company with the Securities and

Exchange Commission. Many of the factors that will determine the

Company’s future results are beyond the ability of management to

control or predict. Readers should not place undue reliance on

forward-looking statements, which reflect management’s views only

as of the date hereof. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

Innovative Solutions and Support, Inc.

Consolidated Balance Sheets (unaudited)

September 30, September 30, 2016 2015

ASSETS

Current assets Cash and cash equivalents $ 18,767,661 $ 16,282,039

Accounts receivable 4,511,091 2,394,695 Unbilled receivables, net

1,597,672 3,920,209 Inventories 3,645,828 4,597,316 Prepaid

expenses and other current assets 847,207

1,221,717 Total current assets 29,369,459 28,415,976

Property and equipment, net 6,962,562 7,095,330 Non-current

deferred income taxes - 426,315 Other assets 156,948

168,948 Total assets $ 36,488,969 $

36,106,569

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities Accounts payable $ 1,503,771 $ 1,435,981

Accrued expenses 1,889,908 2,568,531 Deferred revenue

179,585 756,745 Total current

liabilities 3,573,264 4,761,257 Non-current deferred income taxes

67,701 - Other liabilities - 2,826

Total liabilities 3,640,965 4,764,083

Commitments and contingencies - -

Shareholders' equity

Preferred stock, 10,000,000 shares

authorized, $.001 par value, of which 200,000 shares are authorized

as Class A Convertible stock. No shares issued and outstanding at

September 30, 2016 and 2015

- -

Common stock, $.001 par value: 75,000,000

shares authorized, 18,812,465 and 18,756,089 issued at September

30, 2016 and 2015, respectively

18,813 18,756 Additional paid-in capital 51,392,159

51,148,722 Retained earnings 2,805,569 818,768

Treasury stock, at cost, 2,096,451 shares

at September 30, 2016 and 1,846,451 at September 30, 2015

(21,368,537 ) (20,643,760 ) Total

shareholders' equity 32,848,004 31,342,486

Total liabilities and shareholders' equity $

36,488,969 $ 36,106,569

Innovative Solutions and Support, Inc. Consolidated

Statements of Operations (unaudited) Three

months ended Twelve months ended September 30, September 30, 2016

2015 2016 2015 Sales $ 6,220,551 $ 3,137,089 $ 27,969,703 $

20,067,084 Cost of sales 2,835,905 2,482,200

11,482,323 13,135,349 Gross

profit 3,384,646 654,889 16,487,380 6,931,735 Operating

expenses: Research and development 1,198,954 603,395 4,873,328

2,705,208

Selling, general and administrative

1,639,232 2,935,725 9,170,865

7,847,270 Total operating expenses 2,838,186 3,539,120

14,044,193 10,552,478 Operating income (loss) 546,460

(2,884,231 ) 2,443,187 (3,620,743 ) Interest income 9,047

6,535 33,504 24,804 Other income 6,950 1,878

78,440 33,283 Income (loss) before

income taxes 562,457 (2,875,818 ) 2,555,131 (3,562,656 )

Income tax expense (benefit) 165,328 (312,006 )

568,330 2,303,478 Net income (loss) $

397,129 $ (2,563,812 ) $ 1,986,801 $ (5,866,134 ) Net income

(loss) per common share: Basic $ 0.02 $ (0.15 ) $ 0.12 $ (0.35 )

Diluted $ 0.02 $ (0.15 ) $ 0.12 $ (0.35 ) Weighted

average shares outstanding: Basic 16,931,156 16,905,526 16,927,055

16,924,189 Diluted 17,075,535 16,905,526 17,039,296 16,924,189

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161214005938/en/

Innovative Solutions & Support, Inc.Relland Winand, Chief

Financial Officer610-646-0350

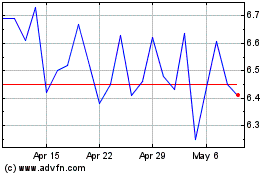

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

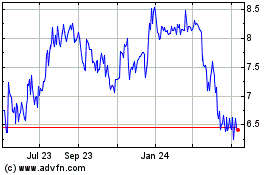

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Apr 2023 to Apr 2024