Franklin Street Properties Corp. (the “Company”, “FSP”, “our”

or “we”) (NYSE MKT: FSP), a real estate investment trust

(REIT), announced that it is reaffirming its FFO (Funds from

Operations) guidance for full year 2016 at approximately $1.03 per

diluted share. We are also updating our FFO guidance for the fourth

quarter of 2016 to be in the range of approximately $0.24 to $0.25

per diluted share. In addition, our initial full year FFO guidance

for 2017 is estimated to be in the range of approximately $1.04 to

$1.09 per diluted share. This guidance (a) excludes the impact of

future acquisitions, developments, dispositions, debt financings or

repayments or other capital market transactions; (b) reflects

estimates from our ongoing portfolio of properties, other real

estate investments and general and administrative expenses; and (c)

reflects our current expectations of economic conditions. We will

update guidance quarterly in our earnings releases. There can be no

assurance that the Company’s actual results will not differ

materially from the estimates set forth above.

George J. Carter, Chairman and Chief Executive Officer,

commented as follows:

“As we near completion of the fourth quarter, we continue to

believe that full year 2016 will mark the bottom of the reductive

effects that our ongoing property portfolio transition is having on

FFO. Our forecast is for resumed FFO growth in 2017. We look

forward with anticipation to the balance of 2016 and beyond.”

Funds From Operations (FFO)

The Company evaluates performance based on Funds From

Operations, which we refer to as FFO, as management believes that

FFO represents the most accurate measure of activity and is the

basis for distributions paid to equity holders. The Company defines

FFO as net income (computed in accordance with GAAP), excluding

gains (or losses) from sales of property, hedge ineffectiveness and

acquisition costs of newly acquired properties that are not

capitalized, plus depreciation and amortization, including

amortization of acquired above and below market lease intangibles

and impairment charges on properties or investments in

non-consolidated REITs, and after adjustments to exclude equity in

income or losses from, and, to include the proportionate share of

FFO from, non-consolidated REITs.

FFO should not be considered as an alternative to net income

(determined in accordance with GAAP), nor as an indicator of the

Company’s financial performance, nor as an alternative to cash

flows from operating activities (determined in accordance with

GAAP), nor as a measure of the Company’s liquidity, nor is it

necessarily indicative of sufficient cash flow to fund all of the

Company’s needs.

Other real estate companies and the National Association of Real

Estate Investment Trusts (NAREIT), may define this term in a

different manner. We have included FFO as defined by NAREIT as of

May 17, 2016 in the table below and note that other REITs may not

define FFO in accordance with the current NAREIT definition or may

interpret the current NAREIT definition differently than we do.

We believe that in order to facilitate a clear understanding of

the results of the Company, FFO should be examined in connection

with net income and cash flows from operating, investing and

financing activities in the consolidated financial statements.

Note Regarding FFO Definition

During the three months ended June 30, 2016, we changed the

definition of FFO to exclude hedge ineffectiveness, which does not

affect any prior period. Our interest rate swaps effectively fix

interest rates on our term loans; however, there is no floor on the

variable interest rate of the swaps whereas the current term loans

are subject to a zero percent floor. As a result, there is a

mismatch and the ineffective portion of the derivatives’ changes in

fair value are recognized directly into earnings each quarter as

hedge ineffectiveness. We believe that FFO excluding hedge

ineffectiveness is a useful supplemental measure regarding our

operating performance as it provides a more meaningful and

consistent comparison of our operating performance and allows

investors to more easily compare our operating results.

Reconciliation of Net Income to FFO

A reconciliation of Net Income to FFO for each of the three and

nine month periods ended September 30, 2015 and 2016 is shown

below. Management believes FFO is used broadly throughout the real

estate investment trust (REIT) industry as measurements of

performance. The Company has included FFO as defined by NAREIT as

of May 17, 2016 in the table below and notes that other REITs may

not define FFO in accordance with the current NAREIT definition or

may interpret the current NAREIT definition differently. The

Company’s computation of FFO may not be comparable to FFO reported

by other REITs or real estate companies that define FFO

differently.

Reconciliation of Net Income to FFO: Three

Months Ended Nine Months Ended September 30, September 30, (In

thousands, except per share amounts) 2016 2015 2016 2015 Net

income $ 2,458 $ 3,166 $ 6,649 $ 19,602 Gain (loss) on sale of

properties and property held for sale, less applicable income tax

523 (1) 1,166 (11,411) GAAP loss from non-consolidated REITs 196

284 568 644 FFO from non-consolidated REITs 787 645 2,327 2,131

Depreciation & amortization 23,112 22,848

67,991 68,694 NAREIT FFO 27,076 26,942 78,701 79,660 Hedge

ineffectiveness (621) — 388 — Acquisition costs of new properties

215 12 349 154 Funds From Operations

(FFO) $ 26,670 $ 26,954 $ 79,438 $ 79,814 Per Share Data EPS

$ 0.02 $ 0.03 $ 0.07 $ 0.20 FFO $ 0.26 $ 0.27 $ 0.78 $ 0.80

Weighted average shares (basic and diluted) 103,709 100,187 101,370

100,187

This press release, along with other news about FSP, is

available on the Internet at www.fspreit.com. We routinely post

information that may be important to investors in the Investor

Relations section of our website. We encourage investors to consult

that section of our website regularly for important information

about us and, if they are interested in automatically receiving

news and information as soon as it is posted, to sign up for E-mail

Alerts.

About Franklin Street Properties Corp.

Franklin Street Properties Corp., based in Wakefield,

Massachusetts, is focused on investing in institutional-quality

office properties in the U.S. FSP’s strategy is to invest in select

urban infill and central business district (CBD) properties, with

primary emphasis on our top five markets of Atlanta, Dallas,

Denver, Houston, and Minneapolis. FSP seeks value-oriented

investments with an eye towards long-term growth and appreciation,

as well as current income. FSP is a Maryland corporation that

operates in a manner intended to qualify as a real estate

investment trust (REIT) for federal income tax purposes. To learn

more about FSP please visit our website at www.fspreit.com.

Forward-Looking Statements

Statements made in this press release that state FSP’s or

management’s intentions, beliefs, expectations, or predictions for

the future may be forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. This press

release may also contain forward-looking statements based on

current judgments and current knowledge of management, including

our estimates of Funds From Operations for future periods, which

are subject to certain risks, trends and uncertainties that could

cause actual results to differ materially from those indicated in

such forward-looking statements. Accordingly, readers are cautioned

not to place undue reliance on forward-looking statements.

Investors are cautioned that our forward-looking statements involve

risks and uncertainty, including without limitation, economic

conditions in the United States, disruptions in the debt markets,

economic conditions in the markets in which we own properties,

risks of a lessening of demand for the types of real estate owned

by us, changes in government regulations and regulatory

uncertainty, uncertainty about governmental fiscal policy,

geopolitical events and expenditures that cannot be anticipated

such as utility rate and usage increases, unanticipated repairs,

additional staffing, insurance increases and real estate tax

valuation reassessments. See the “Risk Factors” set forth in Part

I, Item 1A of our Annual Report on Form 10-K for the year ended

December 31, 2015, as the same may be updated from time to time in

subsequent filings with the United States Securities and Exchange

Commission. Although we believe the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, acquisitions, dispositions,

performance or achievements. We will not update any of the

forward-looking statements after the date of this press release to

conform them to actual results or to changes in our expectations

that occur after such date, other than as required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161214006150/en/

For Franklin Street Properties Corp.Georgia Touma,

877-686-9496

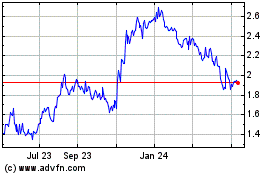

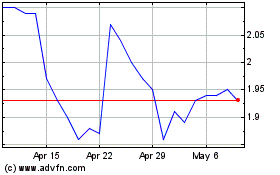

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Sep 2023 to Sep 2024