Forward Reports Fiscal 2016 and Fourth Quarter Results

December 12 2016 - 9:00AM

December 12, 2016 – Forward Industries, Inc. (NASDAQ:FORD), a

designer and distributor of custom carry and protective solutions,

today announced financial results for its fiscal year ended

September 30, 2016.

Full Fiscal Year 2016

Highlights

- Net income was $607 thousand in Fiscal 2016 compared to a net

loss of $1.4 million in Fiscal 2015.

- Earnings per share was $0.07 per share for Fiscal 2016 compared

to a loss per share of $0.23 per share for Fiscal 2015.

- Total Revenues were $27.5 million in Fiscal 2016, down 8% from

Fiscal 2015.

- Gross profit percentage decreased by 0.8% to 18.5% in Fiscal

2016 from 19.3% in Fiscal 2015.

Fourth Quarter 2016 Financial

Highlights

- Net income was $140 thousand, which is down from $260 thousand

in the fourth quarter of 2015.

- Earnings per share was $0.02 per share compared to $0.03 per

share for the fourth quarter of 2015.

- Revenues were $6.7 million compared to $7.6 million in the

fourth quarter of 2015.

- Gross profit percentage decreased by 1.0% to 19.2% from 20.2%

in the fourth quarter of 2015.

- Cash and cash equivalents totaled $4.8 million at September 30,

2016, up from $4.0 million at September 30, 2015.

Terry Wise, Chief Executive Officer of Forward

Industries, stated: “For the first time in a decade, I am delighted

to report that the company has earned positive net income for the

full fiscal year 2016. This is a watershed in the Company’s history

and marks the start of a significant turnaround for the Company. In

a challenging environment, we have streamlined our business as a

platform for growth whilst successfully renewing major contracts

with our blue-chip pharmaceutical customers. These extensions are a

resounding endorsement of the quality of our products and

reliability of our supply capability. Going forward, our focus is

to grow revenues through an expansion of our customer base,

broadening our product offering to both new and existing customers

and extending our relationships with our existing customers through

long-term sourcing agreements.”

Cautionary Note Regarding

Forward-Looking Statements This press release contains

forward-looking statements including statements regarding

profitability, growth in revenues, and expansion of customer base.

The words “believe,” “may,” “estimate,” “continue,” “anticipate,”

“intend,” “should,” “plan,” “could,” “target,” “potential,” “is

likely,” “will,” “expect” and similar expressions, as they relate

to us, are intended to identify forward-looking statements. We have

based these forward-looking statements largely on our current

expectations and projections about future events and financial

trends that we believe may affect our financial condition, results

of operations, business strategy and financial needs. Important

factors that could cause actual results to differ from those in the

forward-looking statements include unexpected issues with Forward

China and our customers going directly to our sourcing agents for

their products. Further information on our risk factors is

contained in our filings with the SEC, including our Form

10-K. Any forward-looking statement made by us herein speaks

only as of the date on which it is made. Factors or events that

could cause our actual results to differ may emerge from time to

time, and it is not possible for us to predict all of them. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by law.

About Forward

IndustriesIncorporated in 1962, and headquartered West

Palm Beach, Florida, Forward Industries is a global designer and

distributor of mobile device cases and accessories. Forward’s

products can be viewed online at www.forwardindustries.com.

| FORWARD INDUSTRIES, INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS) |

| |

| |

For the Fiscal Years Ended |

|

| |

September 30, |

|

| |

|

2016 |

|

|

|

2015 |

|

|

| |

|

|

|

|

| Net

revenues |

$ |

27,479,896 |

|

|

$ |

30,013,891 |

|

|

| Cost of goods sold |

|

22,399,734 |

|

|

|

24,220,698 |

|

|

| Gross

profit |

|

5,080,162 |

|

|

|

5,793,193 |

|

|

| |

|

|

|

|

| Operating

expenses: |

|

|

|

|

| Sales and

marketing |

|

1,891,409 |

|

|

|

2,362,553 |

|

|

| General

and administrative |

|

2,571,799 |

|

|

|

4,943,184 |

|

|

| Total

operating expenses |

|

4,463,208 |

|

|

|

7,305,737 |

|

|

| |

|

|

|

|

| Income (loss)

from operations |

|

616,954 |

|

|

|

(1,512,544 |

) |

|

| |

|

|

|

|

| Other (income)

expense: |

|

|

|

|

| Interest

income |

|

- |

|

|

|

(3,022 |

) |

|

| Loss on

marketable securities, net |

|

- |

|

|

|

110,001 |

|

|

| Other

expense, net |

|

10,392 |

|

|

|

13,421 |

|

|

| Total

other (income) expense, net |

|

10,392 |

|

|

|

120,400 |

|

|

| |

|

|

|

|

| Income (loss)

from continuing operations |

|

606,562 |

|

|

|

(1,632,944 |

) |

|

| Income from

discontinued operations, net of tax provision of $0 |

|

- |

|

|

|

198,963 |

|

|

| Net income

(loss) |

|

606,562 |

|

|

|

(1,433,981 |

) |

|

| Preferred

stock dividends, accretion and beneficial conversion

feature |

|

- |

|

|

|

(475,580 |

) |

|

| Net income

(loss) applicable to common equity |

$ |

606,562 |

|

|

$ |

(1,909,561 |

) |

|

| |

|

|

|

|

| Net income

(loss) |

$ |

606,562 |

|

|

$ |

(1,433,981 |

) |

|

| Other

comprehensive loss: |

|

|

|

|

|

Translation adjustments |

|

- |

|

|

|

(1,374 |

) |

|

| Comprehensive

income (loss) |

$ |

606,562 |

|

|

$ |

(1,435,355 |

) |

|

| |

|

|

|

|

| Net income

(loss) per basic common share: |

|

|

|

|

| Income (loss) from

continuing operations |

$ |

0.07 |

|

|

$ |

(0.25 |

) |

|

| Income from

discontinued operations |

|

0.00 |

|

|

|

0.02 |

|

|

| Net income

(loss) per basic common share |

$ |

0.07 |

|

|

$ |

(0.23 |

) |

|

| |

|

|

|

|

| Net income

(loss) per diluted common share: |

|

|

|

|

| Income (loss) from

continuing operations |

$ |

0.07 |

|

|

$ |

(0.25 |

) |

|

| Income from

discontinued operations |

|

0.00 |

|

|

|

0.02 |

|

|

| Net income

(loss) per diluted common share |

$ |

0.07 |

|

|

$ |

(0.23 |

) |

|

| |

|

|

|

|

| Weighted

average number of common and |

|

|

|

|

|

common equivalent shares outstanding: |

|

|

|

|

|

Basic |

|

8,521,188 |

|

|

|

8,342,168 |

|

|

|

Diluted |

|

8,675,583 |

|

|

|

8,342,168 |

|

|

| |

|

|

|

|

| FORWARD INDUSTRIES, INC. AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

| |

September 30, |

| |

|

2016 |

|

|

|

2015 |

|

| |

|

|

|

|

Assets |

|

|

|

| |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

4,760,620 |

|

|

$ |

4,042,124 |

|

| Accounts

receivable |

|

4,864,423 |

|

|

|

5,454,129 |

|

|

Inventories |

|

2,572,980 |

|

|

|

2,866,464 |

|

| Prepaid

expenses and other current assets |

|

141,421 |

|

|

|

296,012 |

|

| |

|

|

|

| Total

current assets |

|

12,339,444 |

|

|

|

12,658,729 |

|

| |

|

|

|

| Property and equipment,

net |

|

43,030 |

|

|

|

78,733 |

|

| Other assets |

|

12,843 |

|

|

|

40,962 |

|

| |

|

|

|

| Total

assets |

$ |

12,395,317 |

|

|

$ |

12,778,424 |

|

| |

|

|

|

| Liabilities and

shareholders' equity |

|

|

|

| |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

62,136 |

|

|

$ |

122,803 |

|

| Due to

Forward China |

|

3,519,676 |

|

|

|

4,168,021 |

|

| Accrued

expenses and other current liabilities |

|

587,741 |

|

|

|

1,039,085 |

|

| Total

current liabilities |

|

4,169,553 |

|

|

|

5,329,909 |

|

| |

|

|

|

| Other liabilities |

|

51,486 |

|

|

|

115,202 |

|

| |

|

|

|

| Total

liabilities |

|

4,221,039 |

|

|

|

5,445,111 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| |

|

|

|

| Shareholders'

equity: |

|

|

|

| |

|

|

|

| Common

stock, par value $0.01 per share; 40,000,000 shares

authorized; |

|

|

|

| 8,780,830

and 8,641,755 shares issued and outstanding |

|

|

|

| at

September 30, 2016 and 2015, respectively |

|

87,808 |

|

|

|

86,418 |

|

|

Additional paid-in capital |

|

17,783,060 |

|

|

|

17,550,047 |

|

|

Accumulated deficit |

|

(9,674,805 |

) |

|

|

(10,281,367 |

) |

|

Accumulated other comprehensive loss |

|

(21,785 |

) |

|

|

(21,785 |

) |

| |

|

|

|

| Total

shareholders' equity |

|

8,174,278 |

|

|

|

7,333,313 |

|

| |

|

|

|

| Total

liabilities and shareholders' equity |

$ |

12,395,317 |

|

|

$ |

12,778,424 |

|

| |

|

|

|

Contact:

Forward Industries, Inc.

Michael Matte, CFO

(561) 465-0031

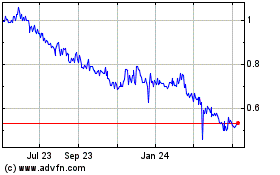

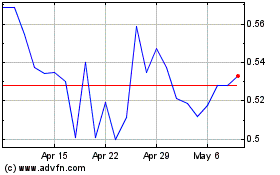

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Sep 2023 to Sep 2024