Filed pursuant to Rule 424(b)(3)

|

|

Registration No. 333-210686

|

Prospectus Supplement No. 4

to prospectus dated April 20, 2016

This prospectus supplement no. 4 supplements

and amends our prospectus dated April 20, 2016, as previously supplemented by prospectus supplement nos. 1, 2 and 3 dated May 16,

2016, August 15, 2016 and September 21, 2016, respectively, which we refer to collectively as the “prospectus.” The

prospectus relates to the offer and resale of up to 25,000,000 shares of our common stock, par value $0.001 per share, by the selling

stockholder, River North Equity, LLC (“River North”). All of such shares represent shares that River North has agreed

to purchase from us pursuant to the terms and conditions of an Equity Purchase Agreement we entered into with them on March 16,

2016, as amended (the “Equity Purchase Agreement”). Subject to the terms and conditions of the Equity Purchase Agreement,

we have the right to “put,” or sell, up to $5,000,000 worth of shares of our common stock to River North. This arrangement

is also sometimes referred to in the prospectus as the “Equity Line.” We will not receive any proceeds from the resale

of shares of common stock by River North. We will, however, receive proceeds from the sale of shares directly to River North pursuant

to the Equity Line.

This prospectus supplement

no. 4 is filed for the purpose of including in the prospectus our Current Reports on Form 8-K filed with the Securities and

Exchange Commission on October 4, 2016, November 2, 2016 and December 9, 2016, copies of which are attached hereto, although the

exhibits to such reports have been omitted. The information set forth in the attached Current Reports on Form 8-K supplements

and amends the information contained in the prospectus.

This prospectus supplement

no. 4 should be read in conjunction with, and delivered with, the prospectus and is qualified by reference to the prospectus

except to the extent that the information in this prospectus supplement no. 4 supplements and amends the information contained

in the prospectus.

Our common stock is quoted

on the OTCQB Marketplace operated by the OTC Markets Group, Inc., or “OTCQB,” under the ticker symbol “ECPN.”

On December 6, 2016, the average of the high and low sales prices of our common stock was $0.055 per share.

Investing in our common

stock involves significant risk. See the “Risk Factors” section of the prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if the prospectus or this prospectus

supplement no. 4 is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement no. 4

is December 9, 2016.

FORM 8-K FILED OCTOBER 4, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 28, 2016

_________________________

EL CAPITAN

PRECIOUS METALS, INC.

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

|

333-56262

|

|

88-0482413

|

|

(State or Other Jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification No.)

|

|

|

5871 Honeysuckle Road

Prescott, AZ

|

|

86305-3764

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(928) 515-1942

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

|

At the Company’s annual meeting of stockholders

held September 28, 2016, the Company’s stockholders approved an amendment (the “Amendment”) to the Company’s

Articles of Incorporation to increase the number of authorized shares of the Company’s common stock from 400,000,000 to

500,000,000 shares. The change in the authorized number of shares of common stock was effected pursuant to an Certificate

of Amendment (the “Certificate of Amendment”) filed with the Secretary of State of the State of Nevada on October

4, 2016 and was effective as of such date. The foregoing description of the Amendment is qualified in its entirety by the

Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by

reference.

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

The registrant held its annual meeting

of stockholders on September 28, 2016. At the meeting, the registrant’s shareholders took the following actions:

|

|

(i)

|

The stockholders elected the following five directors to serve as

members of the registrant’s Board of Directors until the next annual meeting of stockholders:

• John F. Stapleton

• Timothy J. Gay

• Clyde L. Smith

• Daniel Gabino Martinez

• Charles C. Mottley

The stockholders present in person or by proxy cast the following

numbers of votes in connection with the election of directors:

|

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

Votes

For

|

|

Votes

Withheld

|

|

|

|

John F. Stapleton

|

|

127,937,525

|

|

19,460,867

|

|

|

|

Timothy J. Gay

|

|

128,116,568

|

|

19,281,824

|

|

|

|

Clyde L. Smith

|

|

137,852,098

|

|

9,546,294

|

|

|

|

Daniel Gabino Martinez

|

|

127,873,277

|

|

19,525,115

|

|

|

|

Charles C. Mottley

|

|

117,089,210

|

|

30,309,182

|

|

|

|

In addition to the nominees listed above, the following individuals

received votes:

|

|

|

|

John R. Balding

|

|

2,396,000

|

|

|

|

|

|

Larry Balding

|

|

275,000

|

|

|

|

|

|

Darren A. Fish

|

|

2,396,000

|

|

|

|

|

|

Douglas R. Sanders

|

|

5,496,000

|

|

|

|

|

|

Scott L. Sanders

|

|

1,571,000

|

|

|

|

|

|

Robert W. Shirk

|

|

1,871,000

|

|

|

|

|

(ii)

|

The stockholders ratified the appointment of MaloneBailey, LLP as the independent registered public accounting firm of the registrant for fiscal 2016. There were 264,579,409 votes cast for the proposal; 6,725,991 votes were cast against the proposal; 5,544,117 votes abstained; and there was one broker non-vote; and

|

|

|

(iii)

|

The stockholders approved an amendment to the registrant’s Articles of Incorporation to increase the number of authorized shares of the Company’s common stock from 400,000,000 to 500,000,000 shares. There were 542,535,254 votes cast for the proposal (of which 365,655,720 shares were cast by the holders of the Company’s Series B Convertible Preferred Stock); 92,361,876 votes were cast against the proposal; 6,825,168 votes abstained; and there were 782,941 broker non-votes. Holders of outstanding shares of Series B Convertible Preferred Stock were entitled to vote such shares at the meeting only with respect to this proposal, and did not have the right to vote such shares on the other proposals brought before the meeting.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

3.1

|

|

Certificate of Amendment

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EL CAPITAN PRECIOUS METALS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen J. Antol

|

|

Date: October 4, 2016

|

|

Name: Stephen J. Antol

|

|

|

|

Title: Chief Financial Officer

|

FORM 8-K FILED NOVEMBER 2, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 31, 2016

_________________________

EL CAPITAN

PRECIOUS METALS, INC.

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

|

333-56262

|

|

88-0482413

|

|

(State or Other Jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification No.)

|

|

|

5871 Honeysuckle Road

Prescott, AZ

|

|

86305-3764

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(928) 515-1942

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment

of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Amendment to 2015 Equity Incentive Plan

Effective October 31, 2016, the

Board of Directors of the Company adopted Amendment No. 4 to the Company’s 2015 Equity Incentive Plan (the

“2015 Plan”) pursuant to which the number of shares of the common stock issuable under the 2015 Plan was

increased from 50,000,000 to 75,000,000. A copy of Amendment No. 4 to the 2015 Plan is attached as Exhibit 10.1 to this

report and is incorporated by reference herein.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Amendment No. 4 to El Capitan Precious Metals, Inc. 2015 Equity Incentive Plan

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EL CAPITAN PRECIOUS METALS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen J. Antol

|

|

Date: November 2, 2016

|

|

Name: Stephen J. Antol

|

|

|

|

Title: Chief Financial Officer

|

FORM 8-K FILED DECEMBER 9, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 9, 2016

_________________________

EL CAPITAN

PRECIOUS METALS, INC.

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

|

333-56262

|

|

88-0482413

|

|

(State or Other Jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification No.)

|

|

|

5871 Honeysuckle Road

Prescott, AZ

|

|

86305-3764

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(928) 515-1942

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

Amendment

No. 1 to Equity Purchase Agreement with River North Equity, LLC

On March 16, 2016, El Capitan Precious Metals,

Inc. (the “Company”) entered into an Equity Purchase Agreement (the “Purchase Agreement”) with River North

Equity, LLC (“River North”), pursuant to which the Company may from time to time, in its discretion, sell shares of

its common stock to River North for aggregate gross proceeds of up to $5,000,000. On December 9, 2016, the Company entered into

Amendment No. 1 to the Purchase Agreement (the “Amendment”) in order to amend the formula pursuant to which the purchase

price for the Company’s shares is calculated and to make certain other amendments to the terms of the Purchase Agreement.

Pursuant to the Purchase Agreement, and prior

to the Amendment, the purchase price for each share of the Company’s common stock purchased under the Purchase Agreement

was equal to 85.0% of the Market Price, which is defined as the average of the two lowest closing bid prices on the Over-the-Counter

Bulletin Board, as reported by Bloomberg Finance L.P., during the five consecutive trading days including and immediately prior

to the date on which the applicable put notice is delivered to River North (the “Pricing Period”). If the Company was

not deposit/withdrawal at custodian (“DWAC”) eligible or if the Company was under Depository Trust Company (“DTC”)

“chill” status at the time of a sale, an additional 5.0% and 10% discount to the Market Price, respectively, applied.

As amended, the Pricing Period includes the

five consecutive trading days including and immediately prior to the settlement date of the sale, which in most circumstances will

be the trading day immediately following the date that a put notice is delivered to River North (a “Put Date”). In

addition, if either (i) the closing bid price the common stock is less than $0.10 per share on the Put Date, or (ii) the average

daily trading volume in dollar amount for the common stock during the ten trading days including and immediately preceding a Put

Date is less than $50,000, then an additional 10% discount to the Market Price will be taken when calculating the purchase price

for the shares. The prior discounts for DWAC ineligibility and DTC chill status remain.

The foregoing description of the terms of the

Amendment does not purport to be complete and is subject to and qualified in its entirety by reference to the agreement itself,

a copy of which is filed as Exhibit 10.1 to this report, and the terms of which are incorporated herein by reference. The benefits

and representations and warranties set forth in such agreement (if any) are not intended to and do not constitute continuing representations

and warranties of the Company or any other party to persons not a party thereto.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Amendment No. 1 dated December 9, 2016 to Equity Purchase Agreement dated March 16, 2016 by and between El

Capitan Precious Metals, Inc. and River North Equity, LLC

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EL CAPITAN PRECIOUS METALS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen J. Antol

|

|

Date: December 9, 2016

|

|

Name: Stephen J. Antol

|

|

|

|

Title: Chief Financial Officer

|

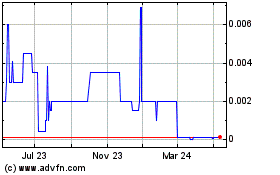

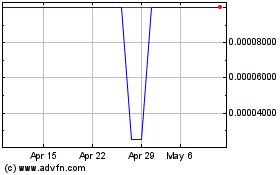

El Capitan Precious Metals (CE) (USOTC:ECPN)

Historical Stock Chart

From Aug 2024 to Sep 2024

El Capitan Precious Metals (CE) (USOTC:ECPN)

Historical Stock Chart

From Sep 2023 to Sep 2024