Virgin Media Launches Minimum $750 Million Term Loan Due 2025

December 07 2016 - 3:00PM

Business Wire

Virgin Media today announced the launch of a new minimum $750

million senior secured Term Loan due 31 January 2025. Proceeds of

the Loan, if successful, will be used to refinance the existing

£100 million Term Loan D due June 2022, a portion of the £990

million 6.0% Senior Secured Notes due April 2021, a portion of the

$900 million 5.375% Senior Secured Notes due April 2021 and to pay

related transaction costs. The Loan is expected to be rated Ba3 by

Moody’s and BB- by S&P. Citigroup is acting as global

coordinator on the transaction, alongside Barclays, BofA Merrill

Lynch, Crédit Agricole CIB, Credit Suisse, Deutsche Bank, J.P.

Morgan and Scotiabank as joint bookrunners.

The transaction is consistent with our policy to maximise tenor

across our capital structure. We will continue to opportunistically

access the loan and bond capital markets going forward, typically

making use of optional redemption flexibility to refinance debt

well in advance of maturity. However under specific circumstances,

we may elect to refinance certain tranches of debt at or close to

maturity to avoid incurring significant make-whole costs, to the

extent that such payments are adequately covered by existing

liquidity, including headroom under revolving credit

facilities.

Forward Looking Statement

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements about whether or not we will consummate

the transaction, draw any or all of the Loan commitments, the

anticipated size and/or terms of the new Loan commitments, and the

anticipated use of the proceeds from the transaction. These

forward-looking statements involve certain risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by these statements, including the failure to

consummate the transaction, redeem or repay any existing

indebtedness and potential changes in market conditions that could

cause actual results to differ materially. We expressly disclaim

any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statement contained herein to

reflect any change in our expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based.

About Virgin Media

Virgin Media offers four multi award-winning services across the

UK and Ireland: broadband, TV, mobile phone and landline.

The company’s dedicated, ultrafast network delivers the fastest

widely available broadband speeds to homes and businesses. We’re

expanding this through our £3bn Project Lightning programme to pass

an incremental 4 million premises.

Our interactive TV service brings live programmes, thousands of

hours of on-demand programming and the best apps and games in a

set-top box, as well as on-the-go services for tablets and

smartphones.

We launched the world’s first virtual mobile network, offering

fantastic value and services. We are also one of the largest

fixed-line home phone providers in the UK and Ireland.

Through Virgin Media Business, we support entrepreneurs,

businesses and the public sector, delivering the fastest speeds and

tailor-made services.

Virgin Media is part of Liberty Global, the world’s largest

international cable company, with operations in more than 30

countries.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161207006155/en/

Virgin MediaInvestor Relations:Oskar Nooij, +1 303

220 4218Christian Fangmann, +49 221 8462 5151John Rea, +1 303 220

4238Vani Bassi,+44 1256 752347orCorporate

Communications:Matt Beake, +44 20 8483 6428Rebecca Pike, +44 20

8483 6216

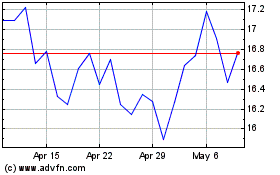

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

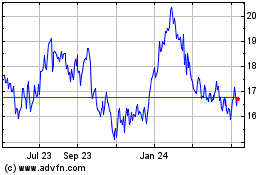

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024