CSX Sees Improving Demand Trends, Notably for Coal Shipments

November 30 2016 - 11:20AM

Dow Jones News

CSX Corp. reported improving demand trends for the current

quarter in many of its markets, particularly for coal, which in

recent years has seen shipment declines that have hit results

across the railroad sector.

The railroad operator's shares, up 18% in the past month, rose

3% to $35.90 in recent trading.

Stocks of coal-related companies have climbed since the election

of Donald Trump, whose campaign included promises to revive the

U.S. coal industry.

At a conference Wednesday, CSX finance chief Frank Lonegro said

the company now expects its bottom line may increase for the fourth

quarter, thanks to moderating volume declines as well as a property

sale that will offset the effect of previously disclosed

debt-refinancing charges.

For the quarter to date, CSX volume has declined 3% and the

company now expects fourth-quarter volume will be flat to up

slightly, compared with its previous estimate for volume to remain

unchanged.

Meanwhile, coal volume has stabilized from the third quarter and

is essentially unchanged so far during the current quarter, CSX

stated.

Mr. Lonegro also highlighted CSX's cost-savings efforts, which

helped the company post better-than-expected earnings for the third

quarter despite weaker volume, including a 21% decline in coal

shipments.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

November 30, 2016 11:05 ET (16:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

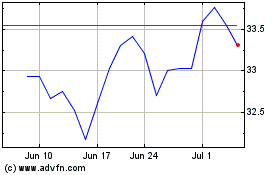

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024