The Buckle, Inc. (NYSE: BKE) announced today that net income for

the fiscal quarter ended October 29, 2016 was $23.4 million,

or $0.49 per share ($0.48 per share on a diluted basis).

Net sales for the 13-week fiscal quarter ended October 29,

2016 decreased 14.6 percent to $239.2 million from net sales of

$280.2 million for the prior year 13-week fiscal quarter ended

October 31, 2015. Comparable store net sales for the 13-week

period ended October 29, 2016 decreased 15.3 percent from

comparable store net sales for the prior year 13-week period ended

October 31, 2015. Online sales decreased 8.5 percent to $23.7

million for the 13-week period ended October 29, 2016,

compared to net sales of $25.9 million for the 13-week period ended

October 31, 2015.

Net sales for the 39-week fiscal period ended October 29,

2016 decreased 11.8 percent to $694.9 million from net sales of

$787.6 million for the prior year 39-week fiscal period ended

October 31, 2015. Comparable store net sales for the 39-week

period ended October 29, 2016 decreased 12.5 percent from

comparable store net sales for the prior year 39-week period ended

October 31, 2015. Online sales decreased 3.7 percent to $67.6

million for the 39-week period ended October 29, 2016,

compared to net sales of $70.2 million for the 39-week period ended

October 31, 2015.

Net income for the third quarter of fiscal 2016 was $23.4

million, or $0.49 per share ($0.48 per share on a diluted basis),

compared with $35.9 million, or $0.75 per share ($0.74 per share on

a diluted basis) for the third quarter of fiscal 2015.

Net income for the 39-week fiscal period ended October 29,

2016 was $62.0 million, or $1.29 per share ($1.28 per share on a

diluted basis), compared with $92.9 million, or $1.93 per share

($1.93 per share on a diluted basis) for the 39-week period ended

October 31, 2015.

Please note that net sales for the 13-week and 39-week periods

ended October 29, 2016 are reported net of the impact of both

reward redemptions and accruals for estimated future rewards

related to the Company’s new Guest Loyalty program, which launched

during the fiscal quarter ended April 30, 2016.

Management will hold a conference call at 10:00 a.m. EST today

to discuss results for the quarter. To participate in the call,

please call (888) 428-4476 for domestic calls or (651) 291-0561 for

international calls and reference the conference code 405754. A

replay of the call will be available for a two-week period

beginning today at 12:00 p.m. EST by calling (800) 475-6701 for

domestic calls or (320) 365-3844 for international calls and

entering the conference code 405754.

About Buckle

Offering a unique mix of high-quality, on-trend apparel,

accessories, and footwear, Buckle caters to fashion-conscious young

men and women. Known as a denim destination, each store carries a

wide selection of fits, styles, and finishes from leading denim

brands, including the Company’s exclusive brand, BKE. Headquartered

in Kearney, Nebraska, Buckle currently operates 471 retail stores

in 44 states. As of the end of the fiscal quarter, it operated 470

stores in 44 states compared with 468 stores in 44 states at the

end of the third quarter of fiscal 2015.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995: All forward-looking statements made by the

Company involve material risks and uncertainties and are subject to

change based on factors which may be beyond the Company’s control.

Accordingly, the Company’s future performance and financial results

may differ materially from those expressed or implied in any such

forward-looking statements. Such factors include, but are not

limited to, those described in the Company’s filings with the

Securities and Exchange Commission. The Company does not undertake

to publicly update or revise any forward-looking statements even if

experience or future changes make it clear that any projected

results expressed or implied therein will not be realized.

Note: News releases and other information on The Buckle, Inc.

can be accessed at www.buckle.com on the Internet.

THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF

INCOME (Amounts in Thousands Except Per Share Amounts)

(Unaudited)

Thirteen Weeks Ended Thirty-Nine

Weeks Ended October 29, October 31,

October 29, October 31, 2016

2015 2016 2015 SALES, Net of returns

and allowances $ 239,213 $ 280,187 $ 694,913 $ 787,585 COST

OF SALES (Including buying, distribution, and occupancy costs)

142,339 162,923 423,428 462,129 Gross

profit 96,874 117,264 271,485 325,456

OPERATING EXPENSES: Selling 50,820 52,268 144,448 147,780 General

and administrative 9,234 8,701 29,705 31,399

60,054 60,969 174,153 179,179 INCOME

FROM OPERATIONS 36,820 56,295 97,332 146,277 OTHER INCOME,

Net 497 951 1,500 1,959 INCOME BEFORE

INCOME TAXES 37,317 57,246 98,832 148,236 PROVISION FOR

INCOME TAXES 13,920 21,353 36,866 55,292

NET INCOME $ 23,397 $ 35,893 $ 61,966 $

92,944 EARNINGS PER SHARE: Basic $ 0.49 $ 0.75

$ 1.29 $ 1.93 Diluted $ 0.48 $ 0.74

$ 1.28 $ 1.93 Basic weighted average shares

48,107 48,073 48,107 48,074 Diluted weighted average shares 48,259

48,219 48,230 48,203

THE BUCKLE, INC.

CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except

Share and Per Share Amounts) (Unaudited)

October 29, January

30, October 31, ASSETS 2016 2016

(1) 2015 CURRENT ASSETS: Cash and cash

equivalents $ 163,006 $ 161,185 $ 121,430 Short-term investments

49,987 36,465 28,181 Receivables 13,427 9,651 12,855 Inventory

148,193 149,566 175,852 Prepaid expenses and other assets 7,320

6,030 28,917 Total current assets 381,933

362,897 367,235 PROPERTY AND EQUIPMENT

464,507 450,762 450,185 Less accumulated depreciation and

amortization (289,547 ) (277,981 ) (271,813 ) 174,960

172,781 178,372 LONG-TERM INVESTMENTS 19,828

33,826 42,372 OTHER ASSETS 4,850

3,269

1,914 Total assets $ 581,571 $ 572,773

$ 589,893

LIABILITIES AND STOCKHOLDERS’

EQUITY CURRENT LIABILITIES: Accounts payable $ 36,314 $

33,862 $ 52,537 Accrued employee compensation 15,651 33,126 21,382

Accrued store operating expenses 16,440 6,639 11,410 Gift

certificates redeemable 16,088 22,858 16,738 Income taxes payable

2,751 11,141 6,420 Total current liabilities

87,244 107,626 108,487 DEFERRED

COMPENSATION 12,571 12,849 13,358 DEFERRED RENT LIABILITY 38,602

39,655 39,623 OTHER LIABILITIES — — 9,821

Total liabilities 138,417 160,130 171,289

COMMITMENTS STOCKHOLDERS’ EQUITY:

Common stock, authorized 100,000,000

shares of $.01 par value; issued and outstanding; 48,622,780 shares

at October 29, 2016, 48,428,110 shares at January 30, 2016, and

48,511,876 shares at October 31, 2015

486 484 485 Additional paid-in capital 139,670 134,864 134,886

Retained earnings 303,176 277,626 283,658 Accumulated other

comprehensive loss (178 ) (331 ) (425 ) Total stockholders’ equity

443,154 412,643 418,604 Total

liabilities and stockholders’ equity $ 581,571 $ 572,773

$ 589,893 (1) Derived from audited financial

statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161118005085/en/

The Buckle, Inc.Karen B. Rhoads, 308-236-8491Chief

Financial Officer

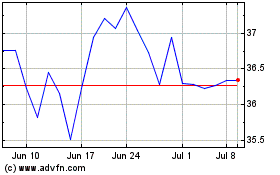

Buckle (NYSE:BKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

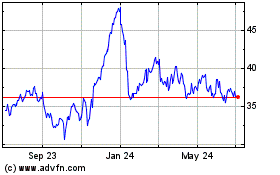

Buckle (NYSE:BKE)

Historical Stock Chart

From Apr 2023 to Apr 2024