Capstone Companies, Inc. Revenue Increased 50% to a Record $11.7 Million

November 14 2016 - 4:15PM

Capstone Companies, Inc. (OTC:CAPC) (“Capstone” or the “Company”),

a designer of innovative LED lighting solutions including power

failure lighting, today reported its financial results for the

third quarter 2016.

Stewart Wallach, Capstone’s Chairman and CEO,

commented, “We believe our performance this year has clearly

substantiated that we have the right strategy, have successfully

established a distinct niche in the home LED lighting space and

have the talent and experience to execute well. We have once

again broken our quarterly revenue record on the back of our

successful introduction of accent lighting products through the

warehouse club channels. Our product innovation, responsive

and reliable customer service and strong brands have gained

traction resulting in substantial revenue and earnings growth in

the first nine months of 2016.

“We will continue to drive growth by developing new

lighting products that incorporate previously unmet functionality

while utilizing the efficiency of LED lighting. We are

starting to see a preliminary picture of what the first part of

2017 may look like for Capstone, and all indications at this point

are for a first half of 2017 that outperforms our strong

performance in the first half of 2016.”

Third Quarter Financial Summary ($

in thousands, except per share data)

| |

Q3

2016 |

|

Q3

2015 |

|

Change |

|

%

Change |

| U.S. revenue |

$ |

11,396 |

|

|

$ |

7,425 |

|

|

|

3,971 |

|

|

|

53 |

% |

| International revenue |

|

297 |

|

|

|

323 |

|

|

|

(26 |

) |

|

|

-8 |

% |

| Total revenue |

|

11,692 |

|

|

|

7,747 |

|

|

|

3,945 |

|

|

|

51 |

% |

| Gross profit |

|

2,851 |

|

|

|

1,980 |

|

|

|

871 |

|

|

|

44 |

% |

| Gross margin |

|

24.4 |

% |

|

|

25.6 |

% |

|

|

|

|

| Operating income |

|

1,604 |

|

|

|

1,359 |

|

|

|

245 |

|

|

|

18 |

% |

| Operating margin |

|

13.7 |

% |

|

|

17.5 |

% |

|

|

|

|

| Net income |

$ |

1,490 |

|

|

$ |

1,247 |

|

|

|

242 |

|

|

|

19 |

% |

| Earnings per diluted share |

$ |

0.03 |

|

|

$ |

0.03 |

|

|

|

- |

|

|

|

NM |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue growth in the third quarter of 2016 was

primarily the result of strong demand for the Company’s battery

powered portable lighting products and wireless remote control

products. Products sold under both the Capstone Lighting and

Hoover® Home LED brands experienced significantly improved

revenue.

Increased gross profit was driven by strong revenue

growth. Gross margin as a percent of revenue declined due to

significantly higher levels of promotional spending in the 2016

quarter, to support the introduction of new products, which reduced

gross margin by approximately 5 percentage points when compared

with the prior-year period.

Selling, general and administrative expenses

(SG&A) increased to $1.2 million, from $0.6 million in the

prior-year period on higher revenue. SG&A as a percent of

revenue increased to 10.7%, primarily due to higher sales and

marketing expenses reflecting $221 thousand of royalty payments

related to the Company’s licensing of the Hoover® brand name that

did not occur in the third quarter of 2015. As a result of

these factors, operating income increased by 18% over the

prior-year period to a record $1.6 million.

Net income increased to a record $1.5 million, or

$0.03 per diluted share, in the third quarter of 2016.

2016 First Nine Months Financial

Summary ($ in thousands, except per share data)

| |

Q3 2016

YTD |

|

Q3 2015

YTD |

|

Change |

|

%

Change |

| U.S. revenue |

$ |

20,826 |

|

|

$ |

7,962 |

|

|

12,864 |

|

|

162 |

% |

| International revenue |

|

1,847 |

|

|

|

789 |

|

|

1,058 |

|

|

134 |

% |

| Total revenue |

|

22,673 |

|

|

|

8,751 |

|

|

13,922 |

|

|

159 |

% |

| Gross profit |

|

5,594 |

|

|

|

2,341 |

|

|

3,253 |

|

|

139 |

% |

| Gross margin |

|

24.7 |

% |

|

|

26.7 |

% |

|

|

|

|

| Operating income (loss) |

|

2,724 |

|

|

|

357 |

|

|

2,367 |

|

|

663 |

% |

| Operating margin |

|

12.0 |

% |

|

|

4.1 |

% |

|

|

|

|

| Net income (loss) |

$ |

2,473 |

|

|

$ |

151 |

|

|

2,322 |

|

|

1538 |

% |

| Earnings (loss) per diluted

share |

$ |

0.05 |

|

|

$ |

- |

|

|

- |

|

|

NM |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial results for the first nine months 2016

improved significantly over the prior-year period, reflecting the

successful introduction of new Capstone lighting products and the

Hoover Home LED® brand. Improved operating and net margins

are reflected in the operating leverage that the Company realized

on higher sales levels.

Webcast and Teleconference to Review

Results and Outlook

The Company will host a live webcast and conference

call on Tuesday, November 15, 2016 at 10:30 a.m. Eastern

Time. During the call, management will review the financial

and operating results and discuss the Company’s corporate strategy

and outlook, followed by a question-and-answer session. The

conference call can be accessed by dialing (201) 689-8562.

The listen-only audio webcast can be monitored at

www.capstonecompaniesinc.com.

A telephonic replay will be available from 1:30

p.m. Eastern Time the day of the teleconference until Tuesday,

November 22, 2016. To listen to the replay of the call, dial

(858) 384-5517 and enter replay pin number 13645717.

Alternatively, the archive of the webcast will be available on the

Company’s website at www.capstonecompaniesinc.com. A

transcript will also be posted to the website, once available.

About Capstone Companies, Inc.

Capstone Companies, Inc. is a public holding company that engages,

through its wholly-owned subsidiaries, Capstone Industries, Inc.,

Capstone Lighting Technologies, LLC, and Capstone International HK,

Ltd., in the development, manufacturing, logistics, and

distribution of consumer and institutional products, including the

Hoover® HOME LED lighting product line, to accounts throughout

North America and in international markets. See

www.capstonecompaniesinc.com for more information about the Company

and www.capstoneindustries.com for information on our current

product offerings.

FORWARD-LOOKING STATEMENTS:This

news release contains "forward-looking statements" as that term is

defined in the Private Securities Litigation Reform Act of 1995, as

amended. Such statements consist of words like “anticipate,”

“expect,” “project,” “continue” and similar words. These

statements are based on the Company’s and its subsidiaries’ current

expectations and involve risks and uncertainties, which may cause

results to differ materially from those set forth in the

forward-looking statements. Factors that may cause actual

results to differ materially from those contemplated by such

forward-looking statements, include consumer acceptance of the

Company’s products, its ability to deliver new products, the

success of its strategy to broaden market channels and the

relationships it has with retailers and distributors. Prior

success in operations does not necessarily mean success in future

operations. The ability of the Company to adequately and

affordably fund operations and any growth will be critical to

achieving and sustaining any expansion of markets and

revenue. The introduction of new products or the expanded

availability of products does not mean that the Company will enjoy

better financial or business performance. The risks associated with

any investment in Capstone Companies, Inc., which is a small

business concern and a "penny-stock Company” and, as such, a highly

risky investment suitable for only those who can afford to lose

such investment, should be evaluated together with the risks and

uncertainties more fully described in the Company’s Annual and

Quarterly Reports filed with the Securities and Exchange

Commission. Capstone Companies, Inc. undertakes no obligation

to publicly update or revise any forward-looking statement, whether

as a result of new information, future events, or otherwise.

Contents of referenced URLs are not incorporated into this press

release.

FINANCIAL TABLES FOLLOW. THE

FOLLOWING SUMMARY FINANCIAL STATEMENT SHOULD BE READ ALONG WITH THE

FORM 10-K FINANCIAL STATEMENT FILED BY THE COMPANY WITH THE

SECURITIES AND EXCHANGE COMMISSION.

| |

CAPSTONE COMPANIES, INC. AND

SUBSIDIARIES |

|

| |

CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| |

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

| |

|

|

|

September 30, |

|

September 30, |

|

| |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues, net |

|

|

$ |

11,692,146 |

|

|

$ |

7,747,450 |

|

|

$ |

22,672,551 |

|

|

$ |

8,750,951 |

|

|

| |

Cost of sales |

|

|

|

(8,841,148 |

) |

|

|

(5,767,306 |

) |

|

|

(17,079,271 |

) |

|

|

(6,410,197 |

) |

|

| |

Gross Profit |

|

|

|

2,850,998 |

|

|

|

1,980,144 |

|

|

|

5,593,280 |

|

|

|

2,340,754 |

|

|

| |

Gross margin |

|

|

|

24.4 |

% |

|

|

25.6 |

% |

|

|

24.7 |

% |

|

|

26.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Operating

Expenses: |

|

|

|

|

|

|

|

|

|

|

| |

Sales and marketing |

|

|

|

488,057 |

|

|

|

16,716 |

|

|

|

903,888 |

|

|

|

185,229 |

|

|

| |

Compensation |

|

|

|

325,283 |

|

|

|

313,953 |

|

|

|

949,753 |

|

|

|

1,007,341 |

|

|

| |

Professional fees |

|

|

|

111,339 |

|

|

|

56,947 |

|

|

|

286,681 |

|

|

|

202,511 |

|

|

| |

Product development |

|

|

|

127,367 |

|

|

|

74,747 |

|

|

|

227,552 |

|

|

|

181,157 |

|

|

| |

Other general and

administrative |

|

|

|

195,046 |

|

|

|

158,796 |

|

|

|

501,458 |

|

|

|

407,114 |

|

|

| |

Total Operating Expenses |

|

|

|

1,247,092 |

|

|

|

621,159 |

|

|

|

2,869,332 |

|

|

|

1,983,352 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Net Operating

Income |

|

|

|

1,603,906 |

|

|

|

1,358,985 |

|

|

|

2,723,948 |

|

|

|

357,402 |

|

|

| |

Operating margin |

|

|

|

13.7 |

% |

|

|

17.5 |

% |

|

|

12.0 |

% |

|

|

4.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Other Income

(Expense): |

|

|

|

|

|

|

|

|

|

|

| |

Interest income |

|

|

|

13,664 |

|

|

|

- |

|

|

|

13,664 |

|

|

|

- |

|

|

| |

Interest expense |

|

|

|

(103,363 |

) |

|

|

(111,654 |

) |

|

|

(227,522 |

) |

|

|

(205,933 |

) |

|

| |

Total Other Income (Expense) |

|

|

|

(89,699 |

) |

|

|

(111,654 |

) |

|

|

(213,858 |

) |

|

|

(205,933 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Income Before Tax

Provision |

|

|

|

1,514,207 |

|

|

|

1,247,331 |

|

|

|

2,510,090 |

|

|

|

151,469 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Provision for Income Tax |

|

|

|

(24,412 |

) |

|

|

- |

|

|

|

(37,012 |

) |

|

|

- |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Net Income |

|

|

$ |

1,489,795 |

|

|

$ |

1,247,331 |

|

|

$ |

2,473,078 |

|

|

$ |

151,469 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Net Income per Common

Share |

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

$ |

0.031 |

|

|

$ |

0.026 |

|

|

$ |

0.051 |

|

|

$ |

0.003 |

|

|

| |

Diluted |

|

|

$ |

0.031 |

|

|

$ |

0.026 |

|

|

$ |

0.051 |

|

|

$ |

0.003 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted Average Common

Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

48,132,664 |

|

|

|

48,132,664 |

|

|

|

48,132,664 |

|

|

|

46,057,590 |

|

|

| |

Diluted |

|

|

|

48,371,158 |

|

|

|

48,132,664 |

|

|

|

48,320,017 |

|

|

|

46,057,590 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

CAPSTONE COMPANIES, INC. AND

SUBSIDIARIES |

|

| |

CONSOLIDATED BALANCE SHEETS |

|

| |

|

|

| |

|

September 30, |

|

December 31, |

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

| |

|

(Unaudited) |

|

|

|

| |

Assets: |

|

|

|

|

| |

Current Assets: |

|

|

|

|

| |

Cash |

$ |

359,587 |

|

|

$ |

364,714 |

|

|

| |

Accounts receivable, net |

|

11,832,358 |

|

|

|

5,077,182 |

|

|

| |

Inventory |

|

480,758 |

|

|

|

205,708 |

|

|

| |

Prepaid expenses |

|

522,694 |

|

|

|

566,459 |

|

|

| |

Total Current

Assets |

|

13,195,397 |

|

|

|

6,214,063 |

|

|

| |

|

|

|

|

|

| |

Fixed Assets: |

|

|

|

|

| |

Computer equipment and

software |

|

19,767 |

|

|

|

19,767 |

|

|

| |

Machinery and equipment |

|

396,133 |

|

|

|

380,633 |

|

|

| |

Furniture and fixtures |

|

5,665 |

|

|

|

5,665 |

|

|

| |

Less: Accumulated depreciation |

|

(339,579 |

) |

|

|

(295,180 |

) |

|

| |

Total Fixed

Assets |

|

81,986 |

|

|

|

110,885 |

|

|

| |

|

|

|

|

|

| |

Other Non-current

Assets: |

|

|

|

|

| |

Deposit |

|

12,193 |

|

|

|

12,193 |

|

|

| |

Investment (AC Kinetics) |

|

- |

|

|

|

500,000 |

|

|

| |

Note receivable |

|

513,654 |

|

|

|

- |

|

|

| |

Goodwill |

|

1,936,020 |

|

|

|

1,936,020 |

|

|

| |

Total Other Non-current Assets |

|

2,461,867 |

|

|

|

2,448,213 |

|

|

| |

Total Assets |

$ |

15,739,250 |

|

|

$ |

8,773,161 |

|

|

| |

|

|

|

|

|

| |

Liabilities and

Stockholders’ Equity: |

|

|

|

|

| |

Current

Liabilities: |

|

|

|

|

| |

Accounts payable and accrued

liabilities |

$ |

3,023,561 |

|

|

$ |

2,164,283 |

|

|

| |

Income tax payable |

|

12,600 |

|

|

|

7,500 |

|

|

| |

Note payable - Sterling National

Bank |

|

6,620,023 |

|

|

|

2,275,534 |

|

|

| |

Notes and loans payable to related

parties |

|

1,301,596 |

|

|

|

2,064,034 |

|

|

| |

Total Current

Liabilities |

|

10,957,780 |

|

|

|

6,511,351 |

|

|

| |

|

|

|

|

|

| |

Commitments and

Contingent Liabilities (Note 5): |

|

|

|

|

| |

Stockholders'

Equity: |

|

|

|

|

| |

Preferred Stock, Series A, par

value $.001 per share, authorized 6,666,667 shares, issued -0-

shares |

|

- |

|

|

|

- |

|

|

| |

Preferred Stock, Series B-1, par

value $.0001 per share, authorized 3,333,333 shares, issued -0-

shares |

|

- |

|

|

|

- |

|

|

| |

Preferred Stock, Series C, par

value $1.00 per share, authorized 67 shares, issued-0-shares |

|

- |

|

|

|

- |

|

|

| |

Common Stock, par value $.0001 per

share, authorized 56,666,667 shares, issued 48,132,664 shares |

|

4,813 |

|

|

|

4,813 |

|

|

| |

Additional paid-in capital |

|

7,390,697 |

|

|

|

7,344,115 |

|

|

| |

Accumulated deficit |

|

(2,614,040 |

) |

|

|

(5,087,118 |

) |

|

| |

Total Stockholders' Equity |

|

4,781,470 |

|

|

|

2,261,810 |

|

|

| |

Total Liabilities and

Stockholders’ Equity |

$ |

15,739,250 |

|

|

$ |

8,773,161 |

|

|

| |

|

|

|

|

|

| |

CAPSTONE COMPANIES, INC. AND

SUBSIDIARIES |

| |

CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| |

(Unaudited) |

| |

|

|

|

|

|

| |

|

|

For the Nine Months Ended |

| |

|

|

September 30, |

| |

|

|

|

2016 |

|

|

|

2015 |

|

| |

CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

| |

|

|

|

|

|

| |

Net Income |

|

$ |

2,473,078 |

|

|

$ |

151,469 |

|

| |

Adjustments necessary to reconcile

net income to net cash (used in) operating activities: |

|

|

|

|

| |

Depreciation and amortization |

|

|

44,400 |

|

|

|

49,311 |

|

| |

Accrued interest on note

receivable |

|

|

(13,654 |

) |

|

|

- |

|

| |

Stock based compensation

expense |

|

|

46,581 |

|

|

|

81,219 |

|

| |

Accrued sales allowance |

|

|

(94,203 |

) |

|

|

(196,978 |

) |

| |

(Increase) decrease in accounts

receivable |

|

|

(6,755,174 |

) |

|

|

(6,376,672 |

) |

| |

(Increase) decrease in

inventory |

|

|

(275,049 |

) |

|

|

38,337 |

|

| |

(Increase) decrease in prepaid

expenses |

|

|

43,764 |

|

|

|

(371,317 |

) |

| |

(Increase) decrease in other

assets |

|

|

- |

|

|

|

14,456 |

|

| |

Increase (decrease) in accounts

payable and accrued liabilities |

|

|

958,580 |

|

|

|

1,167,729 |

|

| |

Increase (decrease) in accrued

interest on notes payable |

|

|

(168,492 |

) |

|

|

148,385 |

|

| |

Net cash (used in)

operating activities |

|

|

(3,740,169 |

) |

|

|

(5,294,061 |

) |

| |

|

|

|

|

|

| |

CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

| |

Purchase of property

and equipment |

|

|

(15,501 |

) |

|

|

(58,194 |

) |

| |

Net cash (used

in) investing activities |

|

|

(15,501 |

) |

|

|

(58,194 |

) |

| |

|

|

|

|

|

| |

CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

| |

Proceeds from notes

payable |

|

|

19,393,834 |

|

|

|

5,791,914 |

|

| |

Repayments of notes

payable |

|

|

(15,049,345 |

) |

|

|

(1,895,194 |

) |

| |

Proceeds from notes and

loans payable to related parties |

|

|

860,000 |

|

|

|

2,500,000 |

|

| |

Repayments of notes and

loans payable to related parties |

|

|

(1,453,946 |

) |

|

|

(1,100,000 |

) |

| |

Net cash

provided by financing activities |

|

|

3,750,543 |

|

|

|

5,296,720 |

|

| |

|

|

|

|

|

| |

Net (Decrease) in Cash

and Cash Equivalents |

|

|

(5,127 |

) |

|

|

(55,535 |

) |

| |

Cash and Cash

Equivalents at Beginning of Period |

|

|

364,714 |

|

|

|

313,856 |

|

| |

Cash and Cash

Equivalents at End of Period |

|

$ |

359,587 |

|

|

$ |

258,321 |

|

| |

|

|

|

|

|

| |

SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

| |

Cash paid during the

period for: |

|

|

|

|

| |

Interest |

|

$ |

396,014 |

|

|

$ |

57,549 |

|

| |

Income taxes |

|

$ |

31,912 |

|

|

$ |

- |

|

| |

|

|

$ |

427,926 |

|

|

$ |

57,549 |

|

| |

Non-cash

financing and investing activities: |

|

|

|

|

| |

Conversion of Series C Preferred

Stock to Common Stock |

|

$ |

- |

|

|

$ |

1,000 |

|

| |

|

|

|

|

|

| |

Sale of Investment for Note

receivable |

|

$ |

500,000 |

|

|

$ |

- |

|

| |

|

|

|

|

|

For more information, contact

Company:

Aimee Gaudet

Corporate Secretary

(954) 252-3440, ext. 313

Investor Relations:

Kei Advisors LLC

Deborah K. Pawlowski / Garett K. Gough

(716) 843-3908 / (716) 846-1352

dpawlowski@keiadvisors.com / ggough@keiadvisors.com

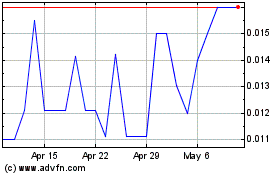

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Sep 2023 to Sep 2024