Filed Pursuant to Rule 424(b)(2)

SEC File No. 333-210238

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered(1)

|

|

Maximum

Offering Price

Per Share

|

|

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration

Fee(2)

|

|

Common stock; par value $0.01 per share

|

|

10,350,000

|

|

$46.25

|

|

$478,687,500

|

|

$55,480

|

|

|

|

|

|

(1)

|

Includes 1,350,000 shares of our common stock issuable upon exercise of the underwriters’ option to purchase additional shares of our common stock.

|

|

(2)

|

Calculated in accordance with Rule 456(b) and Rule 457(r) of the Securities Act of 1933, as amended, and relates to the Registration Statement on Form S-3 (File No. 333-210238) filed by the

registrant.

|

PROSPECTUS SUPPLEMENT

(To prospectus dated March 16, 2016)

9,000,000 Shares

U.S. Silica Holdings, Inc.

Common Stock

U.S. Silica Holdings, Inc.

(“U.S. Silica”) is selling 9,000,000 shares of its common stock. All of the 9,000,000 shares of common stock are being sold by U.S. Silica.

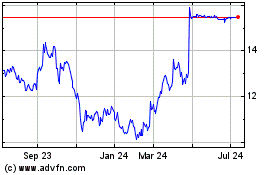

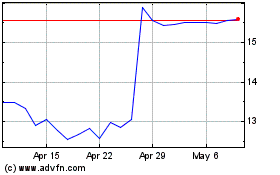

Our

common stock is traded on the New York Stock Exchange under the symbol “SLCA.” On November 8, 2016, the last reported sale price for our common stock on the New York Stock Exchange was $45.57 per share.

Investing in the common stock involves risks that are described in the “

Risk Factors

” section beginning

on page S-4 of this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

|

Price to the public

|

|

$

|

46.25

|

|

|

$

|

416,250,000

|

|

|

Underwriting discounts and commissions

|

|

$

|

1.10

|

|

|

$

|

9,900,000

|

|

|

Proceeds, before expenses, to U.S. Silica Holdings, Inc. (1)

|

|

$

|

45.15

|

|

|

$

|

406,350,000

|

|

|

(1)

|

We refer you to “Underwriting” on page S-11 of this prospectus supplement for additional information regarding underwriting compensation. See “Underwriting.”

|

We have granted the underwriters a 30-day option to purchase up to 1,350,000 additional shares of common stock from us at public offering price less the

underwriting discount.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or

determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to

deliver the shares on or about November 16, 2016.

Prospectus Supplement dated November 9, 2016

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The

second part is the accompanying prospectus, which contains more general information, some of which may not apply to this offering. You should read both this prospectus supplement and the accompanying prospectus, together with additional information

described in this prospectus supplement under the heading “Incorporation by Reference of Certain Information” and the accompanying prospectus under the heading “Where You Can Find More Information.”

If the description of the offering varies between this prospectus supplement and the accompanying prospectus or in any document incorporated

by reference that was filed with the Securities and Exchange Commission (the “Commission” or the “SEC”) before the date of this prospectus supplement, you should rely on the information in this prospectus supplement. If any

statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a subsequently filed document deemed incorporated by reference in the accompanying prospectus—the statement in the

document having the later date modifies or supersedes the earlier statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

We and the underwriters have not authorized anyone to provide you with any different or additional information other than that contained in or

incorporated by reference into this prospectus supplement and the accompanying prospectus or in any free writing prospectus prepared by us or on our behalf or to which we have directed to you. We and the underwriters take no responsibility for, and

can provide no assurance as to the reliability of, any other information that others may provide.

Neither we nor the underwriters are

making an offer to sell our common stock in any jurisdiction where the offer or sale is not permitted. You should not assume that the information appearing in this prospectus supplement, the accompanying prospectus, any free writing prospectus we

have authorized for use in connection with this offering or any document incorporated by reference therein is accurate as of any date other than the date of the applicable document. Our business, financial condition, results of operations, and

prospects may have changed since that date. Neither this prospectus supplement nor the accompanying prospectus constitutes an offer, or an invitation on our behalf or on behalf of the underwriters, to subscribe for and purchase any of the

securities, and may not be used for or in connection with an offer or solicitation by anyone, in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

INCORPORATION BY REFERENCE OF CERTAIN INFORMATION

The SEC allows us to “incorporate by reference” information into this prospectus supplement, which means that we can disclose

important information about us by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus supplement. This prospectus supplement incorporates by

reference the documents and reports listed below filed by us with the SEC (File No. 001-35416) (other than portions of these documents that are furnished under Item 2.02 or Item 7.01 of a Current Report on

Form 8-K,

including any exhibits included with such Items):

|

|

•

|

|

our Annual Report on

Form 10-K

for the fiscal year ended December 31, 2015;

|

|

|

•

|

|

our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2016, June 30, 2016 and September 30, 2016;

|

|

|

•

|

|

our Current Reports on Form 8-K filed on February 23, 2016, March 22, 2016, April 26, 2016 (Item 8.01 only), May 10, 2016, July 20, 2016, August 4, 2016, August 18, 2016 (as amended on September 30, 2016) and

August 24, 2016 (as amended on September 30, 2016); and

|

|

|

•

|

|

our Registration Statement on Form 8-A filed on January 31, 2012.

|

S-ii

We also incorporate by reference the information contained in all other documents we file with

the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than portions of these documents that are furnished under Item 2.02 or Item 7.01 of a Current Report on

Form 8-K,

including any exhibits included with such Items, unless otherwise indicated therein) after the date of this prospectus supplement and prior to the termination of this offering. The information contained in any such document will be considered part

of this prospectus supplement from the date the document is filed with the SEC.

Any statement contained in this prospectus supplement or

in a document incorporated or deemed to be incorporated by reference in this prospectus supplement will be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is

or is deemed to be incorporated by reference in this prospectus supplement modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this

prospectus supplement.

We undertake to provide without charge to you, upon oral or written request, a copy of any or all of the documents

that have been incorporated by reference in this prospectus supplement, other than exhibits to such other documents (unless such exhibits are specifically incorporated by reference therein), by request directed to our Corporate Secretary, U.S.

Silica Holdings, Inc., (301) 682-0600.

S-iii

SUMMARY

This summary highlights material information regarding the offering contained elsewhere in this prospectus supplement, but may not contain

all of the information that may be important to you. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the matters discussed under the caption “Risk Factors” in this prospectus

supplement and in our Annual Report on Form 10-K for the year ended December 31, 2015 and the more detailed information and financial statements and related notes appearing in the documents incorporated by reference into the accompanying

prospectus. As used herein, the “Company,” “U.S. Silica,” “we,” “us” and “our” refer to “U.S. Silica Holdings, Inc.” and its consolidated subsidiaries.

Company Overview

We are one of the

largest domestic producers of commercial silica, a specialized mineral that is a critical input into a variety of attractive end markets. During our 116-year history, we have developed core competencies in mining, processing, logistics and materials

science that enable us to produce and cost-effectively deliver over 230 products to customers across these markets. Our operations are organized into two segments based on end markets served: (1) Oil & Gas Proppants and

(2) Industrial & Specialty Products. In our largest end market, oil and gas proppants, our frac sand is used to stimulate and maintain the flow of hydrocarbons in oil and natural gas wells. Our silica is also used as an

economically irreplaceable raw material in a wide range of industrial applications, including glassmaking and chemical manufacturing. Additionally, in recent years a number of attractive new end markets have developed for our high-margin,

performance silica products, including high-performance glass, specialty coatings, polymer additives and geothermal energy systems. Our segments are complementary because our ability to sell to a wide range of customers across end markets allows us

to maximize recovery rates in our mining operations, optimize our asset utilization and reduce the cyclicality of our earnings.

After our

acquisition of New Birmingham, Inc. on August 16, 2016, as of September 30, 2016, we operate 18 production facilities across the United States and own one of the largest frac sand processing plants in the United States. Including the purchase of

reserves adjacent to our Ottawa, Illinois, facility in May 2016, we now control 471 million tons of reserves of commercial silica, 278 million tons of which can be processed to meet American Petroleum Institute (API) frac sand size specifications.

Additionally, on August 22, 2016, we completed the acquisition of Sandbox Enterprises, LLC as a “last mile” logistics solution for frac sand in the oil and gas industry. We produce a wide range of frac sand sizes and are capable of rail

delivery of large quantities of API grade frac sand to most of the major U.S. shale basins via our transload network. We believe that, due to a combination of these favorable attributes, we have become a preferred commercial silica supplier to our

customers in the oil and gas proppants end market.

Corporate Information

We were incorporated under the laws of the State of Delaware on November 14, 2008. We began operations 116 years ago in Ottawa, Illinois.

Since that time, we have merged with and acquired many additional commercial silica production facilities. We continue to evaluate a number of potential acquisition opportunities, some of which may be material.

Our corporate headquarters is located at 8490 Progress Drive, Suite 300, Frederick, Maryland 21701 and our telephone number is

(301) 682-0600. Our website address is http://www.ussilica.com. The information on our website is not deemed to be part of this prospectus supplement.

S-1

THE OFFERING

|

Common stock offered

|

9,000,000 shares (or 10,350,000 shares if the underwriters’ option to purchase additional shares is exercised in full)

|

|

Common stock outstanding immediately after this offering

|

79,636,662 shares

|

|

Option to purchase additional shares

|

We have granted the underwriters a 30-day option to purchase up to 1,350,000 additional shares of common stock from us at public offering price less the underwriting discount.

|

|

Use of proceeds

|

We expect to receive net proceeds from this offering of approximately $406.0 million, or $466.9 million if the underwriters exercise their option to purchase additional common stock in full, after deducting the underwriting discounts and

estimated offering expenses. We intend to use the net proceeds to us from this offering primarily for general corporate purposes, including the potential acquisition of complementary businesses or assets. We have not entered into any agreements or

commitments with respect to any specific acquisitions and have no commitments or agreements with respect to any such acquisition or investment at this time, although we are currently engaged in discussions with respect to potential acquisitions, any

of which could result in an agreement or commitment, including in the near-term after the closing of this offering. For a more complete description of our intended use of proceeds from this offering, see “Use of Proceeds.”

|

|

Dividend policy

|

We have paid quarterly dividends since July 2013. We pay dividends on our common stock after the Board of Directors (the “Board”) declares them. Management and the Board remain committed to evaluating additional ways of creating

shareholder value. Any determination to pay dividends and other distributions in cash, stock, or property by U.S. Silica in the future will be at the discretion of the Board and will be dependent on then-existing conditions, including our business

conditions, our financial condition, results of operations, liquidity, capital requirements, contractual restrictions including restrictive covenants contained in debt agreements and other factors.

|

|

Risk factors

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” on page S-4 of this prospectus supplement for a discussion of factors you should carefully consider before deciding to invest in our common stock.

|

|

Symbol for trading on the New York Stock Exchange

|

“SLCA”

|

Unless otherwise indicated, all information in this prospectus supplement relating to the number

of shares of our common stock to be outstanding immediately after this offering:

|

|

•

|

|

includes 76,677 shares of unvested restricted stock outstanding as of November 2, 2016 pursuant to the Amended and Restated 2011 Incentive Compensation Plan (the “2011 Plan”);

|

S-2

|

|

•

|

|

excludes 973,871 shares of our common stock issuable upon the exercise of options outstanding as of November 2, 2016, pursuant to the 2011 Plan, of which 545,227 options are currently exercisable;

|

|

|

•

|

|

excludes 1,629,323 shares of our common stock issuable upon the vesting of restricted stock units and performance share units (assuming at target performance) outstanding as of November 2, 2016 pursuant to the 2011

Plan;

|

|

|

•

|

|

excludes 4,111,056 shares of our common stock reserved for future grants under the 2011 Plan; and

|

|

|

•

|

|

assumes no exercise by the underwriters of their option to purchase up to 1,350,000 additional shares.

|

S-3

RISK FACTORS

Our business is subject to uncertainties and risks. You should carefully consider and evaluate all of the information included and

incorporated by reference into this prospectus supplement and the accompanying prospectus, including the risk factors under the caption “Risk Factors” incorporated by reference from our Annual Report on Form 10-K for the year ended

December 31, 2015 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2016. It is possible that our business, financial condition, liquidity or results of operations could be materially adversely affected by any of these

risks.

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus contain

forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on current expectations, estimates,

forecasts and projections about us, our future performance, our liquidity, the commercial silica industry, our beliefs and management’s assumptions. Words such as “anticipate,” “estimate,” “expect,”

“project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have”, “likely” and variations of such words and similar expressions are intended to

identify such forward-looking statements. All statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus regarding our business strategy, future operations,

financial position, cost savings, prospects, plans and objectives, as well as information concerning industry trends and expected actions of third parties, are forward-looking statements. All forward-looking statements speak only as of the date on

which they are made. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions concerning future events that are difficult to predict. Therefore, actual future events or results may differ

materially from these statements. We believe that the factors that could cause our actual results to differ materially include the factors that we describe under the caption “Risk Factors.” These factors, risks and uncertainties include,

but are not limited to, the following:

|

|

•

|

|

fluctuations in demand for commercial silica;

|

|

|

•

|

|

the cyclical nature of our customers’ businesses;

|

|

|

•

|

|

operating risks that are beyond our control, such as changes in the price and availability of transportation, natural gas or electricity; unusual or unexpected geological formations or pressures; cave-ins, pit wall

failures or rock falls; or unanticipated ground, grade or water conditions;

|

|

|

•

|

|

our dependence on three of our plants for a significant portion of our sales;

|

|

|

•

|

|

the level of activity in the natural gas and oil industries;

|

|

|

•

|

|

decreased demand for frac sand or the development of either effective alternative proppants or new processes to replace hydraulic fracturing;

|

|

|

•

|

|

federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing and the potential for related regulatory action or litigation affecting our customers’ operations;

|

|

|

•

|

|

our rights and ability to mine our properties and our renewal or receipt of the required permits and approvals from governmental authorities and other third parties;

|

|

|

•

|

|

our ability to implement our capacity expansion plans within our current timetable and budget and our ability to secure demand for our increased production capacity, and the actual operating costs once we have completed

the capacity expansion;

|

|

|

•

|

|

our ability to succeed in competitive markets;

|

|

|

•

|

|

loss of, or reduction in, business from our largest customers;

|

|

|

•

|

|

increasing costs or a lack of dependability or availability of transportation services and transload network access infrastructure;

|

|

|

•

|

|

extensive regulation of trucking services;

|

|

|

•

|

|

our ability to recruit and retain truckload drivers;

|

S-4

|

|

•

|

|

increases in the prices of, or interruptions in the supply of, natural gas and electricity, or any other energy sources;

|

|

|

•

|

|

increases in the price of diesel fuel;

|

|

|

•

|

|

diminished access to water;

|

|

|

•

|

|

our ability to successfully complete acquisitions or integrate acquired businesses;

|

|

|

•

|

|

our ability to make capital expenditures to maintain, develop and increase our asset base and our ability to obtain needed capital or financing on satisfactory terms;

|

|

|

•

|

|

our substantial indebtedness and pension obligations;

|

|

|

•

|

|

restrictions imposed by our indebtedness on our current and future operations;

|

|

|

•

|

|

contractual obligations that require us to deliver minimum amounts of frac sand or purchase minimum amounts of services;

|

|

|

•

|

|

the accuracy of our estimates of mineral reserves and resource deposits;

|

|

|

•

|

|

a shortage of skilled labor and rising costs in the mining industry;

|

|

|

•

|

|

our ability to attract and retain key personnel;

|

|

|

•

|

|

our ability to maintain satisfactory labor relations;

|

|

|

•

|

|

our reliance on trade secrets and contractual restrictions, rather than patents, to protect our proprietary rights;

|

|

|

•

|

|

our significant unfunded pension obligations and post-retirement health care liabilities;

|

|

|

•

|

|

our ability to maintain effective quality control systems at our mining, processing and production facilities;

|

|

|

•

|

|

seasonal and severe weather conditions;

|

|

|

•

|

|

fluctuations in our sales and results of operations due to seasonality and other factors;

|

|

|

•

|

|

interruptions or failures in our information technology systems;

|

|

|

•

|

|

the impact of a terrorist attack or armed conflict;

|

|

|

•

|

|

extensive and evolving environmental, mining, health and safety, licensing, reclamation and other regulation (and changes in their enforcement or interpretation);

|

|

|

•

|

|

silica-related health issues and corresponding litigation;

|

|

|

•

|

|

our ability to acquire, maintain or renew financial assurances related to the reclamation and restoration of mining property; and

|

|

|

•

|

|

other risk factors disclosed in our Annual Report on Form 10-K for the year ended December 31, 2015.

|

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements included in this

prospectus supplement, the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. These risks and uncertainties, as well as other risks of which we are not aware or which we currently do not believe to

be material, may cause our actual future results to be materially different than those expressed in our forward-looking statements. We caution you not to place undue reliance on these forward-looking statements. We do not undertake any obligation to

make any revisions to these forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events, except as required by law, including the securities laws of the United States and

rules and regulations of the SEC.

S-5

USE OF PROCEEDS

We expect to receive net proceeds from this offering of approximately $406.0 million, or $466.9 million if the underwriters exercise their

option to purchase additional shares of common stock in full, after deducting the underwriting discounts and estimated offering expenses payable by us.

We currently intend to use the net proceeds received by us from this offering primarily for general corporate purposes, including the

potential acquisition of complementary businesses or other assets. We have not entered into any agreements or commitments with respect to any specific acquisitions and have no commitments or agreements with respect to any such acquisition or

investment at this time, although we are currently engaged in discussions with respect to potential acquisitions, any of which could result in an agreement or commitment, including in the near-term after the closing of this offering. And, while

it is uncertain that any such agreement, commitment or transaction will be completed, we are presently pursuing several potential transactions that would be substantially larger than the ones we have completed to date, each of which we believe

investors would consider material to us. We intend to finance any such acquisition opportunities with a combination of cash on hand (inclusive of cash raised in this offering) and the issuance of additional shares to selling

shareholders. We cannot, at present, estimate the dilutive effect of any such issuances were they to occur. Our primary objective is to acquire assets with differing levels of frac sand qualities that are complementary to our

Oil & Gas Proppants segment, with a focus on mining, processing and logistics to further enhance our market presence. We prioritize acquisitions that provide opportunities to realize synergies (and, in some cases, the acquisition may be

accretive assuming synergies), including entering new geographic and frac sand product markets, acquiring attractive customer contracts and improving operations. There can be no assurance that we will reach a definitive agreement and complete

any potential transactions, nor can there be any assurance that synergies will be realized from any potential transactions or that any transactions will be accretive. See the risk factors disclosed in Item 1A of Part I of our Annual Report on

Form 10-K for the year ended December 31, 2015, including the risk factor entitled, “If we cannot successfully complete acquisitions or integrate acquired businesses, our growth may be limited and our financial condition may be adversely

affected.” We cannot specify with certainty the particular uses for the net proceeds to be received by us from this offering. Accordingly, our management team will have broad discretion in using the net proceeds to be received by us from this

offering.

S-6

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS TO NON-U.S. HOLDERS

The following is a summary of material U.S. federal income tax consequences of the ownership and disposition of our common stock to a

non-U.S. holder (as described below) that purchases shares of our common stock in this offering. This summary is general in nature and does not discuss all aspects of U.S. federal income taxation that may be relevant to a non-U.S. holder of our

common stock in light of its particular circumstances. For purposes of this summary, a “non-U.S. holder” means a beneficial owner of our common stock that is, for U.S. federal income tax purposes:

|

|

•

|

|

a nonresident alien individual;

|

|

|

•

|

|

a foreign corporation (or entity treated as a foreign corporation for U.S. federal income tax purposes); or

|

|

|

•

|

|

a foreign estate or foreign trust.

|

In the case of a holder that is classified as a

partnership for U.S. federal income tax purposes, the tax treatment of a partner in such partnership generally will depend on the status of the partner and the activities of the partner and the partnership. If you are a partner in a partnership

holding our common stock, then you should consult your own tax adviser.

This summary is based upon the provisions of the Internal Revenue

Code of 1986, as amended (the “Code”), the Treasury regulations promulgated thereunder and administrative and judicial interpretations thereof, all as of the date hereof. Those authorities may be changed, perhaps retroactively, so as to

result in U.S. federal income tax consequences different from those summarized below. We cannot assure you that a change in law, possibly with retroactive application, will not alter significantly the tax considerations that we describe in this

summary. We have not sought and do not plan to seek any ruling from the U.S. Internal Revenue Service (the “IRS”), with respect to statements made and the conclusions reached in the following summary, and there can be no assurance that the

IRS or a court will agree with our statements and conclusions.

This summary does not address all aspects of U.S. federal income taxes and

does not deal with non-U.S., state, local, alternative minimum or estate and gift tax, the Medicare contribution tax on net investment income or other tax considerations that may be relevant to non-U.S. holders in light of their personal

circumstances. Special rules, not discussed here, may apply to certain non-U.S. holders, including:

|

|

•

|

|

controlled foreign corporations;

|

|

|

•

|

|

passive foreign investment companies; and

|

|

|

•

|

|

investors in pass-through entities that are subject to special treatment under the Code.

|

Such

non-U.S. holders should consult their own tax advisers to determine the U.S. federal, state, local and other tax consequences that may be relevant to them.

This summary applies only to a non-U.S. holder that holds our common stock as a capital asset (within the meaning of Section 1221 of the

Code).

If you are considering the purchase of our common stock, you should consult your own tax adviser concerning the particular U.S.

federal income tax consequences to you of the ownership and disposition of our common stock, as well as the consequences to you arising under U.S. tax laws other than the federal income tax law or under the laws of any other taxing jurisdiction.

S-7

Dividends

In the event that we make a distribution of cash or property (other than certain stock distributions) with respect to our common stock (or

certain redemptions that are treated as distributions with respect to common stock), any such distributions will be treated as a dividend for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits

(as determined for U.S. federal income tax purposes). Dividends paid to you generally will be subject to withholding of U.S. federal income tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty. However,

dividends that are effectively connected with the conduct of a trade or business by you within the United States and, where a tax treaty applies, are generally attributable to a U.S. permanent establishment, are not subject to the withholding tax,

but instead are subject to U.S. federal income tax on a net income basis at applicable graduated individual or corporate rates. Certain certification and disclosure requirements including delivery of a properly executed IRS Form W-8ECI must be

satisfied for effectively connected income to be exempt from withholding. Any such effectively connected dividends received by a foreign corporation may be subject to an additional “branch profits tax” at a 30% rate or such lower rate as

may be specified by an applicable income tax treaty.

If the amount of a distribution paid on our common stock exceeds our current and

accumulated earnings and profits, such excess will be allocated ratably among each share of common stock with respect to which the distribution is paid and treated first as a tax-free return of capital to the extent of your adjusted tax basis in

each such share, and thereafter as capital gain from a sale or other disposition of such share of common stock treated as described below under the heading “Gain on Disposition of Common Stock.” Your adjusted tax basis is generally the

purchase price of such shares, reduced by the amount of any such tax-free returns of capital.

If you wish to claim the benefit of an

applicable treaty rate to avoid or reduce withholding of U.S. federal income tax for dividends, then you must (a) provide the withholding agent with a properly completed IRS Form W-8BEN or IRS Form W-8BEN-E (or other applicable form) and

certify under penalties of perjury that you are not a U.S. person and are eligible for treaty benefits, or (b) if our common stock is held through certain foreign intermediaries, satisfy the relevant certification requirements of applicable

U.S. Treasury regulations. Special certification and other requirements apply to certain non-U.S. holders that act as intermediaries (including partnerships).

You should consult your tax adviser regarding the certification requirements for non-U.S. persons.

If you are eligible for a reduced rate of U.S. federal income tax pursuant to an income tax treaty, then you may obtain a refund or credit of

any excess amounts withheld by filing timely an appropriate claim with the IRS.

Gain on Disposition of Common Stock

Subject to the discussions below on backup withholding and FATCA, you generally will not be subject to U.S. federal income tax with respect to

gain realized on the sale or other taxable disposition of our common stock, unless:

|

|

•

|

|

the gain is effectively connected with a trade or business you conduct in the United States, and, in cases in which certain tax treaties apply, is attributable to a U.S. permanent establishment;

|

|

|

•

|

|

you are an individual who is present in the United States for 183 days or more in the taxable year of that disposition, and certain other conditions are met; or

|

|

|

•

|

|

we are or have been during a specified testing period a “U.S. real property holding corporation” (“USRPHC”) for U.S. federal income tax purposes, and certain other conditions are met.

|

If you are engaged in a trade or business in the United States and the gain on disposition of the common stock is

effectively connected with the conduct of this trade or business, you will be subject to tax on the net gain derived from the sale under regular graduated U.S. federal income tax rates. In addition, if you are a foreign

S-8

corporation, you may be subject to the branch profits tax equal to 30% of your effectively connected earnings and profits or at such lower rate as may be specified by an applicable income tax

treaty. If you are an individual described in the second bullet point above, you will generally be subject to U.S. federal income tax at a rate of 30% (or at a reduced rate under an applicable income tax treaty) on the amount by which your capital

gains allocable to U.S. sources exceed capital losses allocable to U.S. sources during the taxable year of the disposition.

We believe we

are not currently a USRPHC for U.S. federal income tax purposes. However, because the determination of whether we are a USRPHC depends on the fair market value of our U.S. real property interests relative to the fair market value of our other trade

or business assets and our non-U.S. real property interests from time to time, there can be no assurance that we are not or will not become a USRPHC. Even if we are a USRPHC, any gain arising from the sale or other taxable disposition by you of our

common stock will not be subject to tax if such class of stock is considered to be “regularly traded” on an established securities market, and you own, actually or constructively, 5% or less of such class of our stock throughout the

shorter of the five-year period ending on the date of the sale or other taxable disposition of the stock or your holding period for such stock. We expect our common stock to be “regularly traded” on an established securities market,

although we cannot guarantee it will be so traded. If a gain on the sale or other taxable disposition of our stock were subject to taxation due to USRPHC status, you would be subject to U.S. federal income tax with respect to such gain in the same

manner as a U.S. person (subject to any applicable alternative minimum tax and a special alternative minimum tax in the case of nonresident alien individuals) and the person acquiring our stock from you generally would have to withhold 15% of the

amount of the proceeds of the disposition. A non-U.S. holder subject to withholding under such circumstances should consult its tax adviser as to whether such non-U.S. holder can obtain a refund or credit for all or a portion of the withheld

amounts.

You should consult your own tax adviser about the consequences that could result if we are, or become, a USRPHC.

Information Reporting and Backup Withholding

We must report annually to the IRS and to you the amount of dividends paid to you and the amount of tax, if any, withheld with respect to such

dividends. The IRS may make this information available to the tax authorities in the country in which you are resident.

In addition, you

may be subject to information reporting requirements and backup withholding with respect to dividends paid on, and the proceeds of disposition of, shares of our common stock, unless, generally, you certify under penalties of perjury (usually on IRS

Form W-8BEN or IRS Form W-8BEN-E) that you are not a U.S. person or you otherwise establish an exemption. Additional rules relating to information reporting requirements and backup withholding with respect to payments of the proceeds from the

disposition of shares of our common stock are as follows:

|

|

•

|

|

If the proceeds are paid to or through the U.S. office of a broker, the proceeds generally will be subject to backup withholding and information reporting, unless you certify under penalties of perjury (usually on IRS

Form W-8BEN or IRS Form W-8BEN-E) that you are not a U.S. person or you otherwise establish an exemption.

|

|

|

•

|

|

If the proceeds are paid to or through a non-U.S. office of a broker that is not a U.S. person and is not a foreign person with certain specified U.S. connections (a “U.S.-related person”), information

reporting and backup withholding generally will not apply.

|

|

|

•

|

|

If the proceeds are paid to or through a non-U.S. office of a broker that is a U.S. person or a U.S.-related person, the proceeds generally will be subject to information reporting (but not to backup withholding),

unless you certify under penalties of perjury (usually on IRS Form W-8BEN or IRS Form W-8BEN-E) that you are not a U.S. person or you otherwise establish an exemption.

|

S-9

Backup withholding is not an additional tax. Any amounts withheld under the backup withholding

rules may be allowed as a refund or a credit against your U.S. federal income tax liability, provided the required information is timely furnished by you to the IRS.

Foreign Account Tax Compliance Act

Sections 1471 through 1474 of the Code (commonly referred to as “FATCA”) may impose, in certain circumstances, U.S. federal

withholding tax at a rate of 30% on payments to certain foreign entities, either as beneficial owners or as intermediaries, of (a) dividends on our common stock and (b) gross proceeds from the sale or other disposition of our common stock

on or after January 1, 2019. In the case of payments made to a “foreign financial institution” as defined under FATCA (including, among other entities, an investment fund), the tax generally will be imposed, subject to certain

exceptions, unless such institution (i) collects and provides to the IRS or other relevant foreign tax authorities certain information regarding U.S. account holders of such institution pursuant to an agreement with the IRS or applicable

foreign law enacted in connection with an intergovernmental agreement between the United States, the relevant foreign jurisdiction and (ii) complies with obligations to withhold on certain payments to its account holders and certain other

persons. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different rules. In the case of payments made to a foreign entity that is not a

foreign financial institution, the tax generally will be imposed, subject to certain exceptions, unless such foreign entity provides the applicable withholding agent (for further provision to the IRS) either (1) a certification that it does not

have any “substantial United States owners” as defined under FATCA or (2) certain information regarding its substantial United States owners. Accordingly, the entity through which a non-U.S. Holder holds our common stock will affect

the determination of whether such withholding is required. These requirements may be modified by future Treasury regulations or other guidance.

You should consult your own tax advisers regarding the possible impact of these rules on your investment in our common stock, and the entities

through which you hold our common stock, including, without limitation, the process and deadlines for meeting the applicable requirements to prevent the imposition of this 30% withholding tax under FATCA.

THE SUMMARY OF MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES ABOVE IS INCLUDED FOR GENERAL INFORMATION PURPOSES ONLY. POTENTIAL PURCHASERS OF

OUR COMMON STOCK ARE URGED TO CONSULT THEIR OWN TAX ADVISERS TO DETERMINE THE U.S. FEDERAL, STATE, LOCAL AND NON-U.S. TAX CONSIDERATIONS OF OWNING AND DISPOSING OF OUR COMMON STOCK.

S-10

UNDERWRITING

Morgan Stanley & Co. LLC and Barclays Capital Inc. are acting as the joint bookrunning managers and underwriters of this offering. Under

the terms of an underwriting agreement, which will be filed with the SEC and incorporated by reference into the registration statement, each of the underwriters named below, have severally agreed to purchase from us the respective numbers of shares

of common stock shown opposite its name below:

|

|

|

|

|

|

|

Underwriters

|

|

Number of

Shares

|

|

|

Morgan Stanley & Co. LLC

|

|

|

4,500,000

|

|

|

Barclays Capital Inc.

|

|

|

4,500,000

|

|

|

|

|

|

|

|

|

Total

|

|

|

9,000,000

|

|

The underwriting agreement provides that the underwriters’ obligation to purchase shares of common stock

depends on the satisfaction of the conditions contained in the underwriting agreement including:

|

|

•

|

|

the obligation to purchase all of the shares of common stock offered hereby (other than those shares of common stock covered by their option to purchase additional shares as described below), if any of the shares are

purchased;

|

|

|

•

|

|

the representations and warranties made by us to the underwriters are true;

|

|

|

•

|

|

there is no material change in our business or the financial markets; and

|

|

|

•

|

|

we deliver customary closing documents to the underwriters.

|

Commissions and Expenses

The following table summarizes the underwriting discounts and commissions we will pay to the underwriters. These amounts are shown assuming

both no exercise and full exercise of the underwriters’ option to purchase additional shares. The underwriting fee is the difference between the initial price to the public and the amount the underwriters pay to us for the shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

No Exercise

|

|

|

Full Exercise

|

|

|

Per Share

|

|

$

|

1.10

|

|

|

$

|

1.10

|

|

|

Total

|

|

$

|

9,900,000

|

|

|

$

|

11,385,000

|

|

Each of the underwriters has advised us that it proposes to offer the shares of common stock directly to the

public at the public offering price on the cover of this prospectus supplement and to selected dealers, which may include the underwriters, at such offering price less a selling concession not in excess of $0.20 per share. After the offering, the

underwriters may change the offering price and other selling terms.

The expenses of the offering that are payable by us are estimated to

be approximately $0.4 million (excluding underwriting discounts and commissions).

Option to Purchase Additional Shares

We have granted the underwriters an option exercisable for 30 days after the date of this prospectus supplement to purchase, from time to time,

in whole or in part, up to an aggregate of 1,350,000 shares from us at the public offering price less underwriting discounts and commissions. To the extent that this option is exercised, each underwriter will be obligated, subject to certain

conditions, to purchase its pro rata portion of these additional shares based on the underwriter’s percentage underwriting commitment in the offering as indicated in the table at the beginning of this Underwriting section.

S-11

Lock-Up Agreements

We and all directors and officers have agreed that, without the prior written consent of Morgan Stanley & Co. LLC and Barclays Capital

Inc., we and they will not, during the period ending 30 days after the date of this prospectus supplement (the “restricted period”):

|

|

•

|

|

offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of,

directly or indirectly, any shares of common stock or any securities convertible into or exercisable or exchangeable for shares of common stock; or

|

|

|

•

|

|

enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the common stock; or

|

|

|

•

|

|

file any registration statement with the Securities and Exchange Commission relating to the offering of any shares of common stock or any securities convertible into or exercisable or exchangeable for common stock

|

whether any such transaction described in the first two bullets above is to be settled by delivery of common stock or such other

securities, in cash or otherwise.

The restrictions described in the immediately preceding paragraph do not apply to: (a) the sale of

shares to the underwriters; (b) the issuance by us of shares of common stock upon the exercise of an option or a warrant or the conversion or vesting of a security outstanding on the date of this prospectus supplement and disclosed herein or in

documents incorporated by reference herein; (c) the issuance by us of options or other stock-based compensation pursuant to equity compensation plans in existence on the date hereof and disclosed herein or in documents incorporated by reference

herein; (d) any repurchase by us or any of our subsidiaries of any shares of common stock or any security convertible into common stock held by any of our directors or officers pursuant to any management equity plan or stock option plan or any

other management or employee benefit plan or agreement in connection with such director’s or officer’s termination of employment with us, subject to certain limitations; (e) transactions relating to shares of common stock or other

securities acquired in open market transactions after the completion of this offering, subject to certain limitations; (f) transfers of shares of common stock or any security convertible into common stock as a gift or by will or intestacy;

(g) transfers of shares of common stock or any security convertible into common stock to any trust for the direct or indirect benefit of the lock-up agreement signatories or the immediate family of the lock-up agreement signatories, with each

of clauses (f) and (g) subject to certain limitations; (h) shares of common stock (1) withheld by us in connection with the exercise or vesting, as applicable, of outstanding equity awards granted under our equity incentive plans

and held by our directors or officers on the date hereof and disclosed herein or in documents incorporated by reference herein, provided that the delivery of shares of common stock by us in connection with such exercise or vesting, as applicable,

takes place on a “net” basis for the limited purpose of covering any associated payment of exercise price and/or tax withholding obligation of our directors or officers, or (2) acquired pursuant to a net exercise or cashless exercise

by our directors or officers of outstanding equity awards pursuant to our equity incentive plans in existence on the date hereof and disclosed herein or in documents incorporated by reference herein, provided that such acquired shares shall be

subject to the lock-up restrictions described above; (i) sales of shares of common stock pursuant to a trading plan established pursuant to Rule 10b5-1 under the Exchange Act in existence on the date hereof, subject to certain limitations;

(j) the establishment or amendment of a trading plan pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, for the transfer of shares of common stock, subject to certain limitations; (k) the issuance by us of

shares of common stock as consideration for bona fide acquisitions, joint ventures, strategic partnerships or collaboration arrangements, subject to certain limitations; (l) the filing of one or more registration statements on Form S-8 with the

Securities and Exchange Commission with respect to shares of common stock issued or issuable under any equity compensation plan or one or more registration statements on Form S-4 with respect to any shares of common stock permitted to be issued

pursuant to clause (k) above; (m) any transfer of shares of common stock or any security convertible into common stock pursuant to a bona fide third-party tender offer, merger, consolidation or other similar transaction

S-12

made to all holders of the common stock involving a change of control of us, subject to certain limitations;

(n) making any demand for, or exercising any right with respect to, the registration of any shares of common stock or any security convertible into or exercisable or exchangeable for common stock, subject to certain limitations; (o) the

exercise of any options to purchase common stock held by lock-up agreement signatories in accordance with their terms and disclosed herein or in documents incorporated by reference herein, subject to certain limitations.

Morgan Stanley & Co. LLC and Barclays Capital Inc., in their sole discretion, may release the common stock and other securities subject to

the lock-up agreements described above in whole or in part at any time. When determining whether or not to release common stock and other securities from lock-up agreements, Morgan Stanley & Co. LLC and Barclays Capital Inc. will consider, among

other factors, the holder’s reasons for requesting the release, the number of shares of common stock and other securities for which the release is being requested and market conditions at the time.

Indemnification

We have agreed to

indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, and to contribute to payments that the underwriters may be required to make for these liabilities.

Stabilization, Short Positions and Penalty Bids

The underwriters may engage in stabilizing transactions, short sales and purchases to cover positions created by short sales, and penalty bids

or purchases for the purpose of pegging, fixing or maintaining the price of the common stock, in accordance with Regulation M under the Exchange Act:

|

|

•

|

|

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum.

|

|

|

•

|

|

A short position involves a sale by the underwriters of shares in excess of the number of shares the underwriters are obligated to purchase in the offering, which creates the syndicate short position. This short

position may be either a covered short position or a naked short position. In a covered short position, the number of shares involved in the sales made by the underwriters in excess of the number of shares they are obligated to purchase is not

greater than the number of shares that they may purchase by exercising their option to purchase additional shares. In a naked short position, the number of shares involved is greater than the number of shares in their option to purchase additional

shares. The underwriters may close out any short position by either exercising their option to purchase additional shares and/or purchasing shares in the open market. In determining the source of shares to close out the short position, the

underwriters will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through their option to purchase additional shares. A naked short position is

more likely to be created if the underwriters are concerned that there could be downward pressure on the price of the shares in the open market after pricing that could adversely affect investors who purchase in the offering.

|

|

|

•

|

|

Syndicate covering transactions involve purchases of the common stock in the open market after the distribution has been completed in order to cover syndicate short positions.

|

|

|

•

|

|

Penalty bids permit the underwriters to reclaim a selling concession from a syndicate member when the common stock originally sold by the syndicate member is purchased in a stabilizing or syndicate covering transaction

to cover syndicate short positions.

|

These stabilizing transactions, syndicate covering transactions and penalty bids may

have the effect of raising or maintaining the market price of our common stock or preventing or retarding a decline in the market price of the common stock. As a result, the price of the common stock may be higher than the price that might otherwise

exist in the open market. These transactions may be effected on the New York Stock Exchange or otherwise and, if commenced, may be discontinued at any time.

S-13

Neither we nor any of the underwriters make any representation or prediction as to the direction

or magnitude of any effect that the transactions described above may have on the price of the common stock. In addition, neither we nor any of the underwriters make any representation that the underwriters will engage in these stabilizing

transactions or that any transaction, once commenced, will not be discontinued without notice.

Listing on the New York Stock Exchange

Our common stock is listed on the New York Stock Exchange under the trading symbol “SLCA.”

Stamp Taxes

If you purchase

shares of common stock offered in this prospectus supplement, you may be required to pay stamp taxes and other charges under the laws and practices of the country of purchase, in addition to the offering price listed on the cover page of this

prospectus supplement.

Other Relationships

The underwriters and certain of their affiliates are full service financial institutions engaged in various activities, which may include

securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriters and certain of their affiliates have, from

time to time, performed, and may in the future perform, various commercial and investment banking and financial advisory services for the issuer and its affiliates, for which they received or may in the future receive customary fees and expenses.

In the ordinary course of their various business activities, the underwriters and certain of their affiliates may make or hold a broad

array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such investment and securities

activities may involve securities and/or instruments of the issuer or its affiliates. If the underwriters or their affiliates have a lending relationship with us, the underwriters or their affiliates may hedge, their credit exposure to us consistent

with their customary risk management policies. Typically, the underwriters and their affiliates would hedge such exposure by entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions

in our securities or the securities of our affiliates, including potentially the shares of common stock offered hereby. Any such credit default swaps or short positions could adversely affect future trading prices of the shares of common stock

offered hereby. The underwriters and certain of their affiliates may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect of such securities or

instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Selling Restrictions

This

prospectus supplement does not constitute an offer to sell to, or a solicitation of an offer to buy from, anyone in any country or jurisdiction (i) in which such an offer or solicitation is not authorized, (ii) in which any person making

such offer or solicitation is not qualified to do so or (iii) in which any such offer or solicitation would otherwise be unlawful. No action has been taken that would, or is intended to, permit a public offer of the shares of common stock or

possession or distribution of this prospectus supplement or any other offering or publicity material relating to the shares of common stock in any country or jurisdiction (other than the United States) where any such action for that purpose is

required. Accordingly, each underwriter has undertaken that it will not, directly or indirectly, offer or sell any shares of common stock or have in its possession, distribute or publish any prospectus, form of application, advertisement or other

document or information in any country or jurisdiction except under circumstances that will, to the best of its knowledge and belief, result in compliance with any applicable laws and regulations and all offers and sales of shares of common stock by

it will be made on the same terms.

S-14

European Economic Area

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member

State”) an offer to the public of any common stock which are the subject of the offering contemplated herein may not be made in that Relevant Member State, except that an offer to the public in that Relevant Member State of any common stock may

be made at any time under the following exemptions under the Prospectus Directive, if they have been implemented in that Relevant Member State:

|

|

•

|

|

to legal entities which are qualified investors as defined under the Prospectus Directive;

|

|

|

•

|

|

by the underwriters to fewer than 100, or, if the Relevant Member State has implemented the relevant provisions of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined

in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the underwriters for any such offer; or

|

|

|

•

|

|

in any other circumstances falling within Article 3(2) of the Prospectus Directive,

|

provided

that no such offer of common stock shall result in a requirement for us or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant to Article 16 of the Prospectus Directive.

Each person in a Relevant Member State who receives any communication in respect of, or who acquires any common stock under, the offers

contemplated here in this prospectus supplement will be deemed to have represented, warranted and agreed to and with each underwriter and us that:

|

|

•

|

|

it is a qualified investor as defined under the Prospectus Directive; and

|

|

|

•

|

|

in the case of any common stock acquired by it as a financial intermediary, as that term is used in Article 3(2) of the Prospectus Directive, (i) the common stock acquired by it in the offering have not been

acquired on behalf of, nor have they been acquired with a view to their offer or resale to, persons in any Relevant Member State other than qualified investors, as that term is defined in the Prospectus Directive, or in the circumstances in which

the prior consent of the underwriters has been given to the offer or resale or (ii) where common stock have been acquired by it on behalf of persons in any Relevant Member State other than qualified investors, the offer of such common stock to

it is not treated under the Prospectus Directive as having been made to such persons.

|

For the purposes of this

representation and the provision above, the expression an “offer of common stock to the public” in relation to any common stock in any Relevant Member State means the communication in any form and by any means of sufficient information on

the terms of the offer and any common stock to be offered so as to enable an investor to decide to purchase or subscribe for the common stock, as the same may be varied in that Relevant Member State by any measure implementing the Prospectus

Directive in that Relevant Member State, the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and

includes any relevant implementing measure in each Relevant Member State and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

United Kingdom

This prospectus

supplement has only been communicated or caused to have been communicated and will only be communicated or caused to be communicated as an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the

Financial Services and Markets Act of 2000 (the “FSMA”)) as received in connection with the issue or sale of the common stock in circumstances in which Section 21(1) of the FSMA does not apply to us. All applicable provisions of the

FSMA will be complied with in respect to anything done in relation to the common stock in, from or otherwise involving the United Kingdom.

S-15

Canada

The securities may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in

National Instrument 45-106

Prospectus Exemptions

or subsection 73.3(1) of the

Securities Act

(Ontario), and are permitted clients, as defined in National Instrument 31-103

Registration Requirements, Exemptions and Ongoing Registrant

Obligations

. Any resale of the securities must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this

prospectus supplement (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the

purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 (or, in the case of securities issued or guaranteed by the government of a non-Canadian jurisdiction, section 3A.4)

of National Instrument 33-105

Underwriting Conflicts

(“NI 33-105”), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this

offering.

S-16

LEGAL MATTERS

The validity of the common stock offered hereby will be passed upon for us by Kirkland & Ellis LLP, Chicago, Illinois. Certain

legal matters will be passed upon for the underwriters by Davis Polk

& Wardwell LLP, New York, New York.

EXPERTS

The audited consolidated financial statements of U.S. Silica Holdings, Inc. incorporated by reference into the accompanying prospectus have

been so included in reliance upon the reports of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

The consolidated financial statements of New Birmingham, Inc. as of and for the year ended December 31, 2015 and 2014 incorporated by

reference into this prospectus have been so incorporated in reliance on the report of BDO USA, LLP, independent auditor, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

The consolidated financial statements of Sandbox Enterprises, LLC incorporated by reference into the accompanying prospectus have been so

included in reliance on the report of BKD, LLP, independent certified public accountants, upon the authority of said firm as experts in auditing and accounting.

S-17

PROSPECTUS

Preferred Stock

Common Stock

Warrants

Purchase Contracts

Units

Hybrid Securities

Combining Elements of the Foregoing

U.S. Silica Holdings, Inc. may offer from time to time, in one or more offerings, any combination

of its preferred stock, common stock, warrants, purchase contracts, units and hybrid securities combining elements of the foregoing.

We

will provide the specific terms of any offering of these securities in a supplement to this prospectus. The applicable prospectus supplement will also describe the specific manner in which we will offer these securities and may also supplement,

update or amend information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement, as well as the documents incorporated by reference herein or therein, before you purchase these securities.

We may sell these securities on a continuous or delayed basis, directly, through agents, dealers or underwriters as designated from time

to time, or through a combination of these methods. If any agents, dealers or underwriters are involved in the sale of any securities, the applicable prospectus supplement will set forth their names and any applicable commissions or discounts. Our

net proceeds from the sale of securities also will be set forth in the applicable prospectus supplement.

Our common stock is listed on

the New York Stock Exchange under the trading symbol “SLCA.”

See “Risk Factors” on page 1 of this prospectus to

read about factors you should consider before investing in these securities.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 16, 2016.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a shelf registration statement that we filed with the Securities and Exchange Commission (the

“Commission” or the “SEC”). By using a shelf registration statement, we may, at any time and from time to time, in one or more offerings, sell the securities described in this prospectus.

Each time we use this prospectus to offer securities, we will provide you with a prospectus supplement that will describe the specific

amounts, prices and terms of the securities being offered. The prospectus supplement may also supplement, update or change information contained in this prospectus. Therefore, if there is any inconsistency between the information in this prospectus

and the prospectus supplement, you should rely on the information in the prospectus supplement.

We have not authorized anyone to provide

you with different information from that included or incorporated by reference in this prospectus or in any free writing prospectus prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no

assurance as to the reliability of, any other information that others may give you. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or

any applicable prospectus supplement is accurate as of any date other than the date of such document.

To understand the terms of the

securities described in this prospectus, you should carefully read the applicable prospectus supplement. You should also read the documents we have referred you to under “Where You Can Find More Information” and “Incorporation of

Certain Information by Reference” below for information about us. The shelf registration statement, including the exhibits thereto, can be read at the SEC’s website or at the SEC’s Public Reference Room as described under “Where

You Can Find More Information.”

This prospectus includes or incorporates by reference our trademarks, service marks and trade names

such as “U.S. Silica,” which are protected under applicable intellectual property laws and are the property of U.S. Silica Holdings, Inc. or its subsidiaries. Solely for convenience, trademarks, service marks and trade names referred to or

incorporated by reference in this prospectus may not appear with the

®

or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the

fullest extent under applicable law, our rights to our trademarks, service marks and trade names. In addition, this prospectus contains or incorporates by reference trademarks, service marks, and trade names of other companies, which are the

property of their respective owners.

Unless the context otherwise indicates, the terms “U.S. Silica,” “Company,”

“we,” “us,” and “our” as used in this prospectus refer to U.S. Silica Holdings, Inc. and its subsidiaries. Unless the context otherwise indicates, the phrase “this prospectus” refers to this prospectus and any

applicable prospectus supplement.

i

OUR COMPANY

We are one of the largest domestic producers of commercial silica, a specialized mineral that is a critical input into a variety of attractive

end markets. During our 115 year history, we have developed core competencies in mining, processing, logistics and materials science that enable us to produce and cost-effectively deliver over 260 products to customers across

these markets. Our operations are organized into two segments based on end markets served: (1) Oil & Gas Proppants and (2) Industrial & Specialty Products. In our largest end market, oil and gas proppants, our frac

sand is used to stimulate and maintain the flow of hydrocarbons in oil and natural gas wells. Our silica is also used as an economically irreplaceable raw material in a wide range of industrial applications, including glassmaking and chemical

manufacturing. Additionally, in recent years a number of attractive new end markets have developed for our high-margin, performance silica products, including high-performance glass, specialty coatings, polymer additives and geothermal energy

systems. Our segments are complementary because our ability to sell to a wide range of customers across end markets allows us to maximize recovery rates in our mining operations, optimize our asset utilization and reduce the cyclicality of our

earnings.

As of December 31, 2015, we operate 17 production facilities across the United States and control 400

million tons of reserves, including approximately 222 million tons of reserves that can be processed to meet the American Petroleum Institute (“API”) frac sand size specifications. We produce a wide range of frac sand sizes

and are capable of rail delivery of large quantities of API grade frac sand to most of the major U.S. shale basins via our transload network. We believe that, due to a combination of these favorable attributes, we have become a preferred commercial

silica supplier to our customers in the oil and gas proppants end market.

We were incorporated under the laws of the State of Delaware on

November 14, 2008. Our principal executive offices are located at 8490 Progress Drive, Suite 300, Frederick, Maryland 21701 and our telephone number is (301) 682-0600.

We maintain an Internet website at http://www.ussilica.com. We have not incorporated by reference into this prospectus the information on our

website, and you should not consider it to be a part of this prospectus.

RISK FACTORS

Our business is subject to uncertainties and risks. You should carefully consider and evaluate all of the information included and

incorporated by reference in this prospectus, including the risk factors incorporated by reference from our most recent annual report on Form 10-K, as updated by our quarterly reports on Form 10-Q, current reports on Form 8-K and other filings we

make with the SEC. It is possible that our business, financial condition, liquidity or results of operations could be materially adversely affected by any of these risks.

FORWARD-LOOKING

STATEMENTS

This prospectus and the documents we incorporate by reference contain forward-looking statements that are subject to risks and uncertainties.

All statements other than statements of historical fact included in this prospectus and the documents we incorporate by reference are forward-looking statements. Forward-looking statements give our current expectations and projections relating to