SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of November, 2016

Commission File Number: 001-12102

YPF Sociedad

Anónima

(Exact name of registrant as specified in its charter)

Macacha Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

¨

No

x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Yes

¨

No

x

YPF Sociedád Anonima

TABLE OF CONTENTS

|

|

|

|

|

1

|

|

Translation of Q3 2016 Earnings Presentation.

|

2

3rd Quarter 2016 Earnings Webcast

November 9, 2016

Safe harbor statement under the US

Private Securities Litigation Reform Act of 1995. This document contains statements that YPF believes constitute forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. These forward-looking

statements may include statements regarding the intent, belief, plans, current expectations or objectives of YPF and its management, including statements with respect to YPF’s future financial condition, financial, operating, reserve

replacement and other ratios, results of operations, business strategy, geographic concentration, business concentration, production and marketed volumes and reserves, as well as YPF’s plans, expectations or objectives with respect to future

capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings and dividend payout policies. These forward-looking statements may also include assumptions regarding future

economic and other conditions, such as future crude oil and other prices, refining and marketing margins and exchange rates. These statements are not guarantees of future performance, prices, margins, exchange rates or other events and are subject

to material risks, uncertainties, changes and other factors which may be beyond YPF’s control or may be difficult to predict. YPF’s actual future financial condition, financial, operating, reserve replacement and other ratios, results of

operations, business strategy, geographic concentration, business concentration, production and marketed volumes, reserves, capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments,

cost savings and dividend payout policies, as well as actual future economic and other conditions, such as future crude oil and other prices, refining margins and exchange rates, could differ materially from those expressed or implied in any such

forward-looking statements. Important factors that could cause such differences include, but are not limited to, oil, gas and other price fluctuations, supply and demand levels, currency fluctuations, exploration, drilling and production results,

changes in reserves estimates, success in partnering with third parties, loss of market share, industry competition, environmental risks, physical risks, the risks of doing business in developing countries, legislative, tax, legal and regulatory

developments, economic and financial market conditions in various countries and regions, political risks, wars and acts of terrorism, natural disasters, project delays or advancements and lack of approvals, as well as those factors described in the

filings made by YPF and its affiliates with the Securities and Exchange Commission, in particular, those described in “Item 3. Key Information—Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in

YPF’s Annual Report on Form 20-F for the fiscal year ended December 31, 2015 filed with the US Securities and Exchange Commission. In light of the foregoing, the forward-looking statements included in this document may not occur. Except as

required by law, YPF does not undertake to publicly update or revise these forward-looking statements even if experience or future changes make it clear that the projected performance, conditions or events expressed or implied therein will not be

realized. These materials do not constitute an offer for sale of YPF S.A. bonds, shares or ADRs in the United States or otherwise. Disclaimer

Contents Q3 2016 Results Financial

Situation Summary 1 2 3

Revenues of Ps 55.8 billion (+39.4%)

Crude oil production was 247.1 Kbbl/d (-0.9%) Natural gas production was 44.9 Mm3/d (1.1%) Diesel and gasoline sales were down 4.2% and 2.5%, respectively Operating Income without impairment was Ps 1.6 billion (-71.4%) Impairment charge was Ps 36.2

billion Total Capex was Ps 15.0 billion (-4.7%) Q3 2016 Results – Highlights Adj. EBITDA(1) reached Ps 14.6 billion (+9.3%) See description of Adj. EBITDA in footnote (2) on page 5

Revenues (1) (in millions of USD)

Operating Income (1) (in millions of USD) Adj. EBITDA (1) (2) (in millions of USD) YPF financial statement values in IFRS converted to USD using average exchange rate of Ps 9.2 and Ps 14.9 per U.S $1.00 for Q3 2015 and Q3 2016, respectively.

Adjusted EBITDA = Net income attributable to shareholders + Net income (loss) for non-controlling interest - Deferred income tax - Income tax - Financial income gains (losses) on liabilities - Financial income gains (losses) on assets - Income on

investments in companies + Depreciation of fixed assets + Amortization of intangible assets + Unproductive exploratory drillings + Impairment of property, plant and equipment. Operating Income before impairment charge of Ps 36.2 billion (USD 2.4

billion) in Upstream segment. -13.9% -82.2% -32.5% Q3 2016 Results Expressed in US Dollars The devaluation of the local currency resulted in an immediate reduction of Revenues, Adj. EBITDA and Operating Income, which was also affected by higher

DD&A. (3)

Q3 2016 Operating Income (in millions

of Ps) Operating Income before impairment charge was down 71.4%. (1) (1) Operating Income before impairment charge of Ps 36.2 billion in Upstream segment.

(in millions of Ps) Q3 2016 Operating

Income Revenue increase of 39% was not enough to offset higher cost of sales, purchases and higher depreciation on our dollar-based assets. (1) (1) Operating Income before impairment charge of Ps 36.2 billion in Upstream segment.

Q3 2016 Upstream Results (In million

of Ps) Other expenses include: Ps +707 million of Purchases, Ps +265 million of Other expenses and Ps -231 million of SG&A Operating Income before impairment charge of Ps 36.2 billion. (1) Upstream Operating Income before impairment charge

was down 51.6% mainly due to higher increases in cash costs (other than lifting cost) and DD&A vis a vis increase in prices in pesos. (2)

Crude oil production (Kbbl/d) Natural

gas production (Mm3/d) Q3 2016 Upstream Results – Production Total production (Kboe/d) -0.9% +1.1% +1.3% Total production was up 1.3%, driven by 1.1% growth in natural gas and 14.8% growth in NGL; crude oil production was down by 0.9%.

Gross Shale O&G production

(Kboe/d)* *Total operated production (Loma Campana + El Orejano + Bandurria + La Amarga Chica ) 522 Producing wells 24 New wells in Q3 2016 58.2 Kboe/d Q3 2016 Shale production Q3 2016 Shale Development Update Q3 2016 Shale Update Significant well

cost reduction to USD 9.5 million. Good productivity of horizontal wells in Loma Campana and La Amarga Chica pushed up shale oil production. Increased treatment capacity in El Orejano up to 2.5 Mm3/d enabled shale gas production to increase.

Promising results in an extended well in El Orejano (2,000m lateral length and 27 frac stages) with 400 km3/d peak production. Loma Campana horizontal wells cost

Q3 2016 Vaca Muerta - recent

agreement with Neuquén Extension of pilot programs in core areas, La Amarga Chica and Bajada de Añelo until December 2019 and Bandurria Sur until July 2020. Total gross deferred commitment of USD 1,229 million. 11 contracts with Gas y

Petróleo de Neuquén (GyP) on core areas maturing within 2016 and 2017 shifted to 2 developement concessions for a 35-year term and 9 exploration permits for a 4-year term, all of them granted by the Province of Neuquén and without

participation of GyP. Return to GyP of 14 areas with contracts also maturing within 2016 and 2017; some of them outside the limits of Vaca Muerta and in which YPF had not planned any exploratory activity. Consideration of USD 30 million to the

Province of Neuquén, partially reimbursed to YPF by its partners.

Tight gas production represented

21% of total natural gas production in Q3 2016. Tight Gas Gross Production - Mm3/d Q3 2016 Tight Gas Production New compression facilities in RdM enabled significant production-per-well increase. First horizontal infill well with 5 frac stages in

RdM with 290km3/d peak production.

Q3 2016 Downstream Results

Downstream Operating Income declined 68.3% as revenue increase was below the increase in purchases; volumes sold were below expectations. (in millions of Ps) (1) Includes product stock variations

-1.7% Crude processed (kbbl/d)

Domestic sales of refined products (Km3) -1.1% Q3 2016 Downstream Results - Sales -2.5% -4.2% Refinery output affected by maintenance activity in our Luján de Cuyo refinery; sales volumes were down by 1.1% due to lower diesel and gasoline

demand.

Q3 2016 Downstream Results –

Demand Monthly Gasoline Sales (Km3) Monthly Diesel Sales (Km3) + 0.8% -4.2% - 2.5% Gasoline and diesel sales were down by 2.5% and 4.2%, respectively; slight reduction in market share. 56.8% Gasoline Market Share 2014 2015 57.7% 58.5% Diesel Market

Share 2014 2015 60.0% 55.3% 2016 55.9% 2016

Q3 2016 Capex -4.7% (in millions of

Ps) Downstream Upstream Finalization and start-up of the new coke unit in our La Plata refinery and progress on the revamping of the unit Topping III in our Luján de Cuyo refinery 15,730 14,997 Capex was down 41.1% in USD terms and 4.7% in

pesos, mostly due to reduced activity in the Upstream segment. Activity breakdown: 69% in drilling and workovers, 19% in facilities and 12% in exploration and other upstream activities.

Contents Q3 2016 Results Financial

Situation Summary 1 2 3

Includes Ps 9.9 billion of BONAR

2020 sovereign bonds received as payment of 2015 Plan Gas receivables. Includes effect of changes in exchange rates and revaluation of investments in financial assets. Effective spending in fixed asset acquisitions during the quarter. Includes Ps

3.1 billion of financial investments in BONAR 2021 sovereign bonds. Q3 2016 Cash Flow From Operations (2) (1) Consolidated statement of cash flows (in million of Ps) Cash flow from operations (in million of Ps) Strong cash position by the end of Q3

2016; Operating Cash Flow was up due to reduction in working capital mainly related to collection of 2015 gas receivables. (1) (3) (4)

74% denominated in USD, 23% in

Pesos and 3% in CHF Average interest rates of 7.76% in USD, 30.38% in Pesos and 3.75% in CHF Average life of almost 4.1 years Net Debt / Adj. LTM EBITDA(4) = 1.86x Financial debt amortization schedule (1) (2) (in millions of USD) As of September 30,

2016, does not include consolidated companies Converted to USD using the September 30, 2016 exchange rate of Ps 15.26 to U.S $1.00 and CHF 0.97 to U.S.$1,00 Includes cash & equivalents and Argentine sovereign bonds BONAR 2020 and BONAR 2021. Net

debt to Adj. EBITDA calculated in USD, Net debt at period end exchange rate of Ps 14.9 to U.S $1.00 and Adj. EBITDA LTM calculated as sum of quarters. Q3 2016 Financial Situation Update(1) Debt profile highlights Cash position strengthened by new

debt issuance and unusual strong cash flow generation in the quarter. USD denominated debt Peso denominated debt Swiss Franc denominated debt 909 750 750 617 (3)

Contents Q3 2016 Results Financial

Situation Summary 1 2 3

Q3 2016 Summary Lifting cost

reduction in dollars; labor productivity discussions under way Improve operating cash flow by reduction in receivables Recorded USD 1.5 billion of impairment (net) Ample liquidity; leverage above target Restructured short term capex commitments in

Vaca Muerta to better match our cash flow Maintained production in line with previous year and budget, despite reduction in capex Continued cost and productivity improvements in Vaca Muerta

Questions and Answers 3rd Quarter

2016 Earnings Webcast

3rd Quarter 2016 Earnings Webcast

November 9, 2016

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

YPF Sociedad Anónima

|

|

|

|

|

|

Date: November 9, 2016

|

|

By:

|

|

/s/ Diego Celaá

|

|

|

|

Name:

Title:

|

|

Diego Celaá

Market Relations

Officer

|

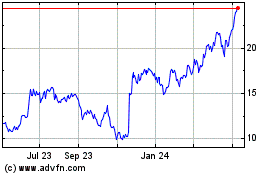

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

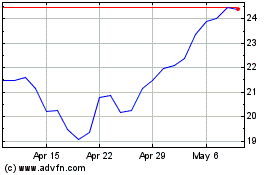

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024