Devon Energy Corp. (NYSE: DVN) today reported operational and

financial results for the third quarter of 2016 and provided

guidance for the fourth quarter of 2016.

Highlights

- Achieved record-setting well results in

U.S. resource plays

- Increased STACK production 38 percent

year over year

- Decreased lease operating expenses 37

percent from peak rates

- Expected cost savings to reach $1

billion in 2016

- Completed $3.2 billion asset

divestiture program

- Repurchased $1.2 billion of debt

“Devon delivered an outstanding operational performance in the

third quarter,” said Dave Hager, president and CEO. “Our

development programs generated the best quarterly drill-bit results

in Devon’s 45 year history. These prolific well results were

centered in the STACK play, where production increased by 38

percent. We also continued to achieve significant cost savings in

the quarter and we are on pace to reduce operating and G&A

expenses by $1 billion in 2016.”

“In addition to our strong operating performance, we were able

to successfully complete our $3.2 billion divestiture program,”

Hager said. “These accretive transactions strengthened our

investment-grade position and significantly reduced our leverage

from earlier this year. This improved financial strength allows us

to further accelerate investment in our best-in-class U.S. resource

plays, led by the STACK and Delaware Basin.”

Record-Setting Well Results in U.S. Resource Plays

Total production averaged 577,000 oil-equivalent barrels (Boe)

per day in the third quarter of 2016. Excluding divestiture

properties, production from Devon’s retained asset base amounted to

550,000 Boe per day. With the shift to higher-margin production,

oil is now the largest component of the company’s product mix at 45

percent of total volumes. To further enhance the profitability of

production, Devon rejected approximately 6,000 barrels per day of

ethane during the third quarter.

The majority of Devon’s retained asset production was

attributable to its U.S. resource plays, which averaged 410,000 Boe

per day. Production in the third quarter benefited from new well

activity that achieved record-setting productivity. In aggregate,

Devon commenced production on 20 development wells, with initial

30-day rates averaging an all-time quarterly high of 2,000 Boe per

day. These prolific results were concentrated in the company’s

STACK play, where production increased 38 percent year over

year.

In Canada, Devon’s heavy-oil operations also delivered

impressive results with net oil production reaching 137,000 barrels

per day in the third quarter. Driven by the industry-leading

performance of the Jackfish complex, Canadian oil production

increased 13 percent compared to the third quarter of 2015.

In the upcoming fourth quarter, oil production from retained

assets is expected to be relatively stable compared to the third

quarter, ranging between 238,000 and 248,000 barrels per day. Key

drivers of the stabilized oil production are high activity levels

in the STACK and accelerated completion activity in the Eagle Ford.

Top-line production from retained assets is projected to range

between 524,000 and 546,000 Boe per day in the fourth quarter.

Operating and G&A Cost Savings to Reach $1 Billion in

2016

Devon’s successful cost-reduction initiatives resulted in lease

operating expenses (LOE) of $355 million in the third quarter,

which was 7 percent below the low end of guidance. This strong cost

result represents a decline of 37 percent from peak costs in

mid-2015. The decrease in LOE was primarily driven by improved

power and water-handling infrastructure, declining labor expense

and lower supply chain costs.

The company also realized significant general and administrative

(G&A) cost savings. Net G&A expenditures declined to $141

million in the third quarter. Including capitalized costs, total

G&A expense declined to $195 million, a 44 percent improvement

compared to peak rates in early 2015. The decrease was driven by

reduced personnel costs.

Due to the strong cost performance achieved year to date, the

company is lowering its full-year 2016 LOE outlook by $55 million

to a midpoint of $1.6 billion. With this improved outlook, Devon is

on track to reduce LOE, production taxes and G&A costs by $1

billion compared to 2015.

Upstream Revenue Rises; EnLink Profitability Expands

Improving commodity prices advanced the company’s upstream

revenue to $1.1 billion in the third quarter, with per-unit

realizations increasing 13 percent compared to the previous

quarter. Oil revenue increased to 67 percent of total upstream

sales in the third quarter.

Devon’s midstream results also improved, with operating profits

totaling $210 million in the third quarter, bringing the

year-to-date total to $619 million. This steady source of

profitability was driven by the company’s investment in EnLink

Midstream. Year-to-date, EnLink-related operating profit has

expanded 7 percent compared to the same period in 2015.

EnLink’s growing profitability is derived from an asset base

that is positioned in some of the most attractive markets in North

America, including the STACK, Midland Basin, Delaware Basin and an

NGL business that services end-user demand along the Gulf Coast. In

aggregate, the company’s ownership in EnLink is valued at

approximately $3.5 billion and will generate cash distributions of

$270 million in 2016.

Third-Quarter 2016 Operations Report

For additional details on Devon’s E&P operations, please

refer to the company’s third-quarter 2016 operations report at

www.devonenergy.com. Highlights from the report include:

- Record-setting well results in the

STACK

- Raising Meramec and Woodford type

curves

- Accelerating Delaware Basin rig

activity

- Wolfcamp drilling to ramp up in

2017

- Eagle Ford resumes completion

activity

- Jackfish complex production exceeds

nameplate capacity

Divestiture Program Complete: Proceeds Reach $3.2

Billion

Devon’s divestiture program is now complete with total proceeds

reaching $3.2 billion. During the quarter, the company closed on

the sale of non-core assets in the Midland Basin, East Texas and

Granite Wash for $1.8 billion. With the closing of these

transactions, the company’s upstream divestiture proceeds have

reached $2.1 billion.

Subsequent to quarter end, on Oct. 6, 2016, the company closed

on the sale of its 50 percent interest in the Access Pipeline for

USD $1.1 billion. In addition to these initial proceeds, Devon also

has the right to receive an incremental USD $120 million payment

with the sanctioning and development of a new thermal-oil project

on Devon’s Pike lease in Alberta, Canada. The sale agreement

further allows for Access Pipeline tolls to be reduced by as much

as 30 percent with the future development of multiple projects at

Pike.

Significant Liquidity and Financial Strength

Devon’s financial position remains exceptionally strong, with

investment-grade credit ratings and excellent liquidity. The

company exited the third quarter with $2.4 billion of cash on hand.

Adjusted for the Access Pipeline sale, cash balances reached $3.5

billion.

In August, the company successfully tendered for $1.2 billion of

debt, which is expected to reduce interest expense by $54 million

annually. With the tendering activity focused on near-term

maturities, Devon has no significant long-term debt maturities

until mid-2021.

At the end of September, the company’s consolidated debt totaled

$11.4 billion. Excluding non-recourse EnLink obligations and

adjusting for Access Pipeline proceeds, adjusted net debt has

declined to $4.7 billion.

Devon Increases Hedging Position in 2017

In recent months, Devon has had the opportunity to materially

increase its hedging position in 2017. For oil volumes, Devon has

utilized a combination of swaps and collars to hedge 83,000 barrels

per day of production. For gas volumes, Devon now has 390 million

cubic feet per day of production. These hedging positions represent

more than 30 percent of current oil and natural gas production.

The company expects to continue to add to its hedging position

and is targeting to have approximately 50 percent of its estimated

revenues protected in 2017. This risk-management program will be a

combination of systematic hedges added on a quarterly basis and

discretionary hedges that take advantage of favorable market

conditions.

Operating Cash Flow Grows 117 Percent; Earnings Beat Wall

Street Consensus

Operating cash flow reached $726 million in the third quarter, a

117 percent increase compared to the second quarter of 2016.

Combined with proceeds received from the sale of non-core assets,

Devon’s total cash inflows for the quarter reached $2.4

billion.

Devon’s reported net earnings totaled $993 million or $1.89 per

diluted share in the third quarter. These earnings results were

impacted by certain items securities analysts typically exclude

from their published estimates, with the most significant of these

items being $1.4 billion in gains related to U.S. asset sales.

Excluding these gains and other adjusting items, Devon’s core

earnings were $47 million or $0.09 per diluted share, exceeding

consensus analyst estimates.

Devon’s core earnings calculation in the third quarter was

negatively impacted by an $85 million, non-cash tax charge.

Excluding this charge, the company’s core earnings would have been

$0.16 per share higher, further widening the margin of

outperformance versus analyst expectations.

Updated 2016 Outlook

Detailed forward-looking guidance for the fourth quarter of 2016

is provided later in the release. Based on year-to-date results and

Devon’s fourth-quarter outlook, most operating and financial

metrics remain relatively unchanged compared to previous guidance

disclosures.

Of note, in the fourth quarter, the company expects to increase

its rig activity in the U.S. from five operated rigs running in the

third quarter to as many as 10 operated rigs by year end. This

activity is expected to result in approximately $400 million to

$425 million of E&P capital expenditures in the fourth

quarter.

Non-GAAP Reconciliations

Pursuant to regulatory disclosure requirements, Devon is

required to reconcile non-GAAP (generally accepted accounting

principles) financial measures to the related GAAP information. Net

debt, adjusted net debt, core earnings, and core earnings per share

referenced within the commentary of this release are non-GAAP

financial measures. Reconciliations and other important information

regarding these non-GAAP measures are provided within the tables of

this release.

Conference Call Webcast and Supplemental Earnings

Materials

Please note that as soon as practicable today, Devon will post

an operations report to its website at www.devonenergy.com. The

company’s third-quarter conference call will be held at 10 a.m.

Central (11 a.m. Eastern) on Wednesday, Nov. 2, 2016, and will

serve primarily as a forum for analyst and investor questions and

answers.

Forward-Looking Statements

This press release includes "forward-looking statements" as

defined by the Securities and Exchange Commission (SEC). Such

statements include those concerning strategic plans, expectations

and objectives for future operations, and are often identified by

use of the words “expects,” “believes,” “will,” “would,” “could,”

“forecasts,” “projections,” “estimates,” “plans,” “expectations,”

“targets,” “opportunities,” “potential,” “anticipates,” “outlook”

and other similar terminology. All statements, other than

statements of historical facts, included in this press release that

address activities, events or developments that the company

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are

beyond the control of the company. Statements regarding our

business and operations are subject to all of the risks and

uncertainties normally incident to the exploration for and

development and production of oil and gas. These risks include, but

are not limited to: the volatility of oil, gas and NGL prices,

including the currently depressed commodity price environment;

uncertainties inherent in estimating oil, gas and NGL reserves; the

extent to which we are successful in acquiring and discovering

additional reserves; the uncertainties, costs and risks involved in

exploration and development activities; risks related to our

hedging activities; counterparty credit risks; regulatory

restrictions, compliance costs and other risks relating to

governmental regulation, including with respect to environmental

matters; risks relating to our indebtedness; our ability to

successfully complete mergers, acquisitions and divestitures; the

extent to which insurance covers any losses we may experience; our

limited control over third parties who operate our oil and gas

properties; midstream capacity constraints and potential

interruptions in production; competition for leases, materials,

people and capital; cyberattacks targeting our systems and

infrastructure; and any of the other risks and uncertainties

identified in our Form 10-K and our other filings with the SEC.

Investors are cautioned that any such statements are not guarantees

of future performance and that actual results or developments may

differ materially from those projected in the forward-looking

statements. The forward-looking statements in this press release

are made as of the date of this press release, even if subsequently

made available by Devon on its website or otherwise. Devon does not

undertake any obligation to update the forward-looking statements

as a result of new information, future events or otherwise.

The SEC permits oil and gas companies, in their filings with the

SEC, to disclose only proved, probable and possible reserves that

meet the SEC's definitions for such terms, and price and cost

sensitivities for such reserves, and prohibits disclosure of

resources that do not constitute such reserves. This release

may contain certain terms, such as resource potential, potential

locations, risk and unrisked locations, estimated ultimate recovery

(or EUR), exploration target size and other similar

terms. These estimates are by their nature more speculative

than estimates of proved, probable and possible reserves and

accordingly are subject to substantially greater risk of being

actually realized. The SEC guidelines strictly prohibit us from

including these estimates in filings with the SEC. Investors are

urged to consider closely the disclosure in our Form 10-K,

available at www.devonenergy.com. You can also obtain this form

from the SEC by calling 1-800-SEC-0330 or from the SEC’s website at

www.sec.gov.

About Devon Energy

Devon Energy is a leading independent energy company engaged in

finding and producing oil and natural gas. Based in Oklahoma City

and included in the S&P 500, Devon operates in several of the

most prolific oil and natural gas plays in the U.S. and Canada with

an emphasis on a balanced portfolio. The company is the

second-largest oil producer among North American onshore

independents. For more information, please visit

www.devonenergy.com.

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL

INFORMATION

Quarter Ended Nine Months Ended PRODUCTION

NET OF ROYALTIES September 30, September 30,

2016 2015 2016

2015 Oil and bitumen (MBbls/d)

U. S. - Core 108 140 124 143 Heavy Oil 137 121 128 107 Retained

assets 245 261 252 250 Divested assets 6 21 13 24 Total 251 282 265

274

Natural gas liquids (MBbls/d) U. S. - Core 96 108 107

109 Divested assets 8 26 17 27 Total 104 134 124 136

Gas

(MMcf/d) U. S. - Core 1,231 1,319 1,292 1,336 Heavy Oil 18 16

20 21 Retained assets 1,249 1,335 1,312 1,357 Divested assets 75

251 165 262 Total 1,324 1,586 1,477 1,619

Oil equivalent

(MBoe/d) U. S. - Core 410 467 446 474 Heavy Oil 140 124 132 111

Retained assets 550 591 578 585 Divested assets 27 89 57 95 Total

577 680 635 680

KEY OPERATING STATISTICS BY REGION

Quarter Ended September 30, 2016 Avg. Production

Gross Wells Operated Rigs at (MBoe/d)

Drilled September 30, 2016 STACK 92 37 4 Delaware

Basin 59 8 1 Eagle Ford 61 4 — Heavy Oil 140 3 1 Barnett Shale 166

— — Rockies Oil 16 — — Other assets 16 — — Retained assets 550 52 6

Divested assets 27 — — Total 577 52 6

PRODUCTION TREND 2015

2016 Quarter 3 Quarter 4

Quarter 1 Quarter 2

Quarter 3 Oil and bitumen

(MBbls/d) STACK 7 9 15 19 21 Delaware Basin 41 42 38 36 31

Eagle Ford 62 60 59 41 33 Heavy Oil 121 121 126 121 137 Barnett

Shale 1 1 1 1 1 Rockies Oil 16 15 17 15 11 Other assets 13 12 12 11

11 Retained assets 261 260 268 244 245 Divested assets 21 18 17 15

6 Total 282 278 285 259 251

Natural gas liquids (MBbls/d)

STACK 22 24 30 30 23 Delaware Basin 8 11 12 13 12 Eagle Ford 26 27

24 17 13 Barnett Shale 47 49 46 46 44 Rockies Oil 2 1 1 1 1 Other

assets 3 3 2 3 3 Retained assets 108 115 115 110 96 Divested assets

26 24 22 21 8 Total 134 139 137 131 104

Gas (MMcf/d) STACK

229 253 306 289 292 Delaware Basin 70 82 84 99 92 Eagle Ford 155

152 144 103 85 Heavy Oil 16 24 15 28 18 Barnett Shale 807 786 768

757 730 Rockies Oil 41 38 32 31 19 Other assets 17 16 17 14 13

Retained assets 1,335 1,351 1,366 1,321 1,249 Divested assets 251

232 215 206 75 Total 1,586 1,583 1,581 1,527 1,324

Oil

equivalent (MBoe/d) STACK 67 75 96 97 92 Delaware Basin 61 66

63 65 59 Eagle Ford 113 113 107 76 61 Heavy Oil 124 125 129 126 140

Barnett Shale 183 181 175 173 166 Rockies Oil 25 23 23 21 16 Other

assets 18 18 18 16 16 Retained assets 591 601 611 574 550 Divested

assets 89 80 74 70 27 Total 680 681 685 644 577

BENCHMARK

PRICES

(average prices)

Quarter 3 September YTD

2016 2015 2016 2015 Oil ($/Bbl) - West

Texas Intermediate (Cushing) $ 45.02 $ 46.69 $ 41.41 $ 51.11

Natural Gas ($/Mcf) - Henry Hub $ 2.81 $ 2.77 $ 2.28 $ 2.80

REALIZED PRICES Quarter Ended September 30, 2016

Oil /Bitumen NGL Gas Total (Per

Bbl) (Per Bbl) (Per Mcf) (Per Boe) United

States $ 42.51 $ 9.80 $ 2.24 $ 20.26 Canada $ 23.71 N/M

N/M $ 23.23 Realized price without hedges $ 32.27 $ 9.80 $

2.24 $ 20.98 Cash settlements $ 0.84 $ 0.10 $ (0.04 ) $ 0.32

Realized price, including cash settlements $ 33.11 $ 9.90 $ 2.20 $

21.30

Quarter Ended September 30, 2015 Oil

/Bitumen NGL Gas Total (Per Bbl)

(Per Bbl) (Per Mcf) (Per Boe) United States $

42.09 $ 8.80 $ 2.24 $ 20.66 Canada $ 25.10 N/M N/M $

24.55 Realized price without hedges $ 34.78 $ 8.80 $ 2.24 $ 21.37

Cash settlements $ 21.16 $ — $ 0.47 $ 9.86 Realized price,

including cash settlements $ 55.94 $ 8.80 $ 2.71 $ 31.23

Nine Months Ended September 30, 2016 Oil /Bitumen

NGL Gas Total (Per Bbl) (Per

Bbl) (Per Mcf) (Per Boe) United States $ 36.89 $

8.84 $ 1.70 $ 17.16 Canada $ 18.58 N/M N/M $ 18.15

Realized price without hedges $ 28.03 $ 8.84 $ 1.70 $ 17.37 Cash

settlements $ (0.57 ) $ (0.06 ) $ 0.12 $ 0.02 Realized price,

including cash settlements $ 27.46 $ 8.78 $ 1.82 $ 17.39

Nine Months Ended September 30, 2015 Oil /Bitumen

NGL Gas Total (Per Bbl) (Per

Bbl) (Per Mcf) (Per Boe) United States $ 45.91 $

9.50 $ 2.27 $ 22.18 Canada $ 27.84 N/M N/M $ 27.06

Realized price without hedges $ 38.81 $ 9.50 $ 2.27 $ 22.98 Cash

settlements $ 19.48 $ — $ 0.53 $ 9.11 Realized price, including

cash settlements $ 58.29 $ 9.50 $ 2.80 $ 32.09

CONSOLIDATED STATEMENTS OF EARNINGS (in millions,

except per share amounts)

Quarter Ended Nine Months

Ended September 30, September 30, 2016

2015 2016 2015 Oil, gas and NGL sales $ 1,113

$ 1,338 $ 3,023 $ 4,264 Oil, gas and NGL derivatives 79 414 (30 )

426 Marketing and midstream revenues 1,690 1,849 4,503 5,569 Gains

on asset sales 1,351 - 1,351

- Total revenues and other 4,233

3,601 8,847 10,259 Lease

operating expenses 355 510 1,215 1,625 Marketing and midstream

operating expenses 1,480 1,637 3,884 4,939 General and

administrative expenses 141 198 482 661 Production and property

taxes 67 91 220 315 Depreciation, depletion and amortization 394

744 1,420 2,488 Asset impairments 319 5,851 4,851 15,479

Restructuring and transaction costs (5 ) — 266 — Other operating

items 17 14 41 54

Total operating expenses 2,768 9,045

12,379 25,561 Operating income

(loss) 1,465 (5,444 ) (3,532 ) (15,302 ) Net financing costs 243

136 570 378 Other nonoperating items 44 43

150 46 Earnings (loss) before

income taxes 1,178 (5,623 ) (4,252 ) (15,726 ) Income tax expense

(benefit) 171 (1,714 ) (228 )

(5,435 ) Net earnings (loss) 1,007 (3,909 ) (4,024 ) (10,291 ) Net

earnings (loss) attributable to noncontrolling interests 14

(402 ) (391 ) (369 ) Net earnings

(loss) attributable to Devon $ 993 $ (3,507 ) $ (3,633 ) $

(9,922 ) Net earnings (loss) per share attributable to Devon: Basic

$ 1.90 $ (8.64 ) $ (7.22 ) $ (24.45 ) Diluted $ 1.89 $ (8.64 ) $

(7.22 ) $ (24.45 ) Weighted average common shares

outstanding: Basic 524 411 509 411 Diluted 527 411 509 411

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

Quarter Ended Nine Months Ended

September 30, September 30, 2016 2015

2016 2015 Cash flows from operating activities: Net

earnings (loss) $ 1,007 $ (3,909 ) $ (4,024 ) $ (10,291 )

Adjustments to reconcile net earnings (loss) to net cash

from operating activities:

Depreciation, depletion and amortization 394 744 1,420 2,488 Asset

impairments 319 5,851 4,851 15,479 Gains on asset sales (1,351 ) -

(1,351 ) - Deferred income tax expense (benefit) 86 (1,708 ) (300 )

(5,348 ) Derivatives and other financial instruments (58 ) (481 )

359 (606 ) Cash settlements on derivatives and financial

instruments 15 730 (133 ) 1,913 Other 169 171 190 437 Net change in

working capital 136 67 181 93 Change in long-term other assets (3 )

52 10 211 Change in long-term other liabilities 12

36 7 (74 ) Net cash from

operating activities 726 1,553

1,210 4,302 Cash flows from investing

activities: Capital expenditures (421 ) (1,080 ) (1,659 ) (4,229 )

Acquisitions of property, equipment and businesses (3 ) (113 )

(1,641 ) (530 ) Divestitures of property and equipment 1,680 27

1,889 35 Other 34 (3 ) 7

(8 ) Net cash from investing activities 1,290

(1,169 ) (1,404 ) (4,732 ) Cash flows from financing

activities: Borrowings of long-term debt, net of issuance costs 816

277 1,662 3,328 Repayments of long-term debt (2,173 ) (252 ) (2,722

) (1,773 ) Net short-term debt repayments — (169 ) (626 ) (932 )

Early retirement of debt (82 ) — (82 ) — Issuance of common stock —

— 1,469 — Sale of subsidiary units — — — 654 Issuance of subsidiary

units 59 9 835 13 Dividends paid on common stock (32 ) (99 ) (190 )

(296 ) Contributions from noncontrolling interests 146 5 151 12

Distributions to noncontrolling interests (77 ) (68 ) (224 ) (186 )

Other (2 ) (3 ) (9 ) (18 ) Net cash

from financing activities (1,345 ) (300 ) 264

802 Effect of exchange rate changes on cash

(9 ) (22 ) 5 (65 ) Net change in

cash and cash equivalents 662 62 75 307 Cash and cash equivalents

at beginning of period 1,723 1,725

2,310 1,480 Cash and cash equivalents

at end of period $ 2,385 $ 1,787 $ 2,385 $

1,787

CONSOLIDATED BALANCE SHEETS (in millions)

September

30, December 31, 2016 2015 Current assets:

Cash and cash equivalents $ 2,385 $ 2,310 Accounts receivable 1,092

1,105 Assets held for sale 717 — Other current assets 257

606 Total current assets 4,451

4,021 Property and equipment, at cost: Oil and gas,

based on full cost accounting: Subject to amortization 75,431

78,190 Not subject to amortization 3,637 2,584

Total oil and gas 79,068 80,774 Midstream and other

10,320 10,380 Total property and equipment, at

cost 89,388 91,154 Less accumulated depreciation, depletion and

amortization (73,219 ) (72,086 ) Property and

equipment, net 16,169 19,068 Goodwill

3,963 5,032 Other long-term assets 2,230 1,330

Total assets $ 26,813 $ 29,451 Current

liabilities: Accounts payable $ 529 $ 906 Revenues and royalties

payable 860 763 Short-term debt 350 976 Liabilities held for sale

202 — Other current liabilities 910 650

Total current liabilities 2,851 3,295

Long-term debt 11,004 12,056 Asset retirement obligations 1,230

1,370 Other long-term liabilities 1,036 853 Deferred income taxes

631 888 Stockholders’ equity: Common stock 52 42 Additional paid-in

capital 7,487 4,996 Retained earnings (accumulated deficit) (1,977

) 1,781 Accumulated other comprehensive earnings 278

230 Total stockholders’ equity attributable to Devon

5,840 7,049 Noncontrolling interests 4,221

3,940 Total stockholders’ equity 10,061

10,989 Total liabilities and stockholders’ equity $ 26,813

$ 29,451 Common shares outstanding 524 418

CONSOLIDATING STATEMENTS OF OPERATIONS

(in millions)

Quarter Ended September 30, 2016

Devon U.S.& Canada

EnLink Eliminations Total Oil, gas and NGL

sales $ 1,113 $ — $ — $ 1,113 Oil, gas and NGL derivatives 79 — —

79 Marketing and midstream revenues

766

1,104 (180 ) 1,690 Gains on asset sales 1,351

— — 1,351 Total revenues and

other 3,309 1,104 (180 )

4,233 Lease operating expenses 355 — — 355 Marketing and

midstream operating expenses 784 876 (180 ) 1,480 General and

administrative expenses 111 30 — 141 Production and property taxes

57 10 — 67 Depreciation, depletion and amortization 268 126 — 394

Asset impairments 319 — — 319 Restructuring and transaction costs

(5 ) — — (5 ) Other operating items 20 (3 )

— 17 Total operating expenses

1,909 1,039 (180 ) 2,768

Operating income 1,400 65 — 1,465 Net financing costs 195 48 — 243

Other nonoperating items 46 (2 ) —

44 Earnings before income taxes 1,159 19 —

1,178 Income tax expense 164 7 —

171 Net earnings 995 12 — 1,007 Net earnings

attributable to noncontrolling interests — 14

— 14 Net earnings (loss)

attributable to Devon $ 995 $ (2 ) $ — $ 993

OTHER KEY STATISTICS (in

millions)

Quarter Ended September 30, 2016

Devon U.S.& Canada

EnLink

Eliminations Total Cash flow

statement related items: Operating cash flow $ 517 $ 209 $ — $

726 Capital expenditures $ (285 ) $ (136 ) $ — $ (421 )

Divestitures of property and equipment $ 1,676 $ 4 $ — $ 1,680

EnLink distributions received (paid) $ 66 $ (143 ) $ — $ (77 )

Issuance of subsidiary units $ — $ 59 $ — $ 59

Balance

sheet statement items:

Net debt (1)

$ 5,784 $ 3,185 $ — $ 8,969

(1) Net debt is a non-GAAP measure. For a reconciliation of the

comparable GAAP measure, see "Non-GAAP Financial Measures" later in

this release.

CAPITAL

EXPENDITURES (in millions)

Quarter Ended September 30,

2016 Nine Months Ended September 30, 2016 Exploration

and development capital $ 231 $ 816 Capitalized G&A and

interest 71 230 Acquisitions 16 1,547 Other 7 19

Devon capital expenditures (1) $ 325 $ 2,612

(1) Excludes $132 million and $816 million attributable to

EnLink for the third quarter and first nine months of 2016,

respectively.

NON-GAAP FINANCIAL MEASURES

This press release includes non-GAAP financial measures. These

non-GAAP measures are not alternatives to GAAP measures, and you

should not consider these non-GAAP measures in isolation or as a

substitute for analysis of our results as reported under GAAP.

Below is additional disclosure regarding each of the non-GAAP

measures used in this press release, including reconciliations to

their most directly comparable GAAP measure.

CORE EARNINGS

Devon’s reported net earnings include items of income and

expense that are typically excluded by securities analysts in their

published estimates of the company’s financial results.

Accordingly, the company also uses the measures of core earnings

and core earnings per share attributable to Devon. Devon believes

these non-GAAP measures facilitate comparisons of its performance

to earnings estimates published by securities analysts. Devon also

believes these non-GAAP measures can facilitate comparisons of its

performance between periods and to the performance of its peers.

The following table summarizes the effects of these items on

third-quarter 2016 earnings.

(in millions, except per share amounts)

Quarter Ended September 30, 2016 Before-tax

After-tax

AfterNoncontrollingInterests

Per Share (Millions) Earnings

attributable to Devon (GAAP) $ 1,178 $ 1,007 $ 993 $ 1.89

Adjustments: Gains on asset sales (1,351 ) (787 ) (787 ) (1.48 )

Deferred tax asset valuation allowance — (408 ) (408 ) (0.78 ) Fair

value changes in financial instruments and foreign currency (16 )

(3 ) (3 ) (0.01 ) Restructuring and transaction costs (5 ) (3 ) (3

) (0.01 ) Early retirement of debt 84 53 53 0.10 Asset impairments

319 202 202 0.38

Core earnings attributable to Devon (Non-GAAP) (1) $ 209

$ 61 $ 47 $ 0.09

(1) Devon's core earning calculation was negatively impacted by

an $85 million, non-cash tax charge or $0.16 per share.

NET DEBT AND ADJUSTED NET DEBT

Devon defines net debt as debt less cash and cash equivalents

and net debt attributable to the consolidation of EnLink Midstream

as presented in the following table. Adjusted net debt is net debt

further adjusted for the proceeds Devon received from the Access

Pipeline divestiture transaction that closed in October of 2016 or

the cash consideration for the Felix acquisition. Devon believes

that adjusting for these items, including the asset sale proceeds

and the Felix cash consideration, against debt and adjusting for

EnLink net debt provides a clearer picture of the future demands on

cash from Devon to repay debt.

(in millions)

September 30, 2016

Devon U.S. & Canada EnLink

Devon Consolidated Total debt (GAAP) $

8,109 $ 3,245 $ 11,354 Less cash and cash equivalents (2,325

) (60 ) (2,385 ) Net debt (Non-GAAP) 5,784 3,185

8,969 Proceeds from asset sales (1,100 ) —

(1,100 ) Adjusted net debt (Non-GAAP) $ 4,684 $ 3,185

$ 7,869 (in millions)

December 31, 2015 Devon U.S. & Canada

EnLink Devon

Consolidated Total debt (GAAP) $ 10,023 $ 3,090 $ 13,113 Less

cash and cash equivalents (2,292 ) (18 )

(2,310 ) Net debt (Non-GAAP) 7,731 3,072 10,803 Cash consideration

for Felix acquisition 850 — 850

Adjusted net debt (Non-GAAP) $ 8,581 $ 3,072 $

11,653

DEVON ENERGY CORPORATION

FORWARD LOOKING GUIDANCE

PRODUCTION GUIDANCE Quarter 4 Low

High Oil and bitumen (MBbls/d)

U.S. 103 108 Heavy Oil 135 140 Total 238 248

Natural gas liquids

(MBbls/d) Total 85 90

Gas (MMcf/d) U.S. 1,190 1,230

Heavy Oil 14 16 Total 1,204 1,246

Oil equivalent (MBoe/d)

U.S.

387

403 Heavy Oil 137 143 Total 524 546

PRICE REALIZATIONS GUIDANCE Quarter 4 Low

High Oil and bitumen - % of WTI U.S. 86

% 96 % Canada 50 % 60 % NGL - realized price $

8

$

13

Natural gas - % of Henry Hub 78 % 88 %

OTHER GUIDANCE ITEMS Quarter 4 ($ millions, except %)

Low High Marketing &

midstream operating profit $ 205 $ 225 Lease operating expenses $

360 $ 400 General & administrative expenses $ 140 $ 160

Production and property taxes $ 55 $ 65 Depreciation, depletion and

amortization $ 400 $ 450 Other operating items $ 20 $ 30 Net

financing costs (1) $ 140 $ 160 Current income tax rate 0.0 % 0.0 %

Deferred income tax rate 35.0 % 45.0 %

Total income tax rate

35.0 % 45.0 % Net earnings attributable to

noncontrolling interests $ - $ -

(1) Fourth quarter includes $13 million of non-cash accretion on

EnLink’s installment purchase obligations.

CAPITAL EXPENDITURES GUIDANCE

Quarter 4 (in millions)

Low

High Exploration and development $ 400 $ 425 Capitalized

G&A 50 60 Capitalized interest 15 20 Other 5 15

Devon capital expenditures (2) $ 470 $ 520

(2) Excludes capital expenditures related to EnLink.

COMMODITY HEDGES Oil

Commodity Hedges Price Swaps Price Collars

Call Options Sold Period

Volume(Bbls/d)

WeightedAveragePrice($/Bbl)

Volume(Bbls/d)

WeightedAverageFloor Price($/Bbl)

WeightedAverageCeiling Price($/Bbl)

Volume(Bbls/d)

WeightedAverage Price($/Bbl)

Q4-2016 40,848 $ 49.02 20,000 $ 40.85 $ 50.85 18,500 $ 55.00 Q1-Q4

2017 31,075 $ 52.48 51,744 $ 45.06 $ 57.96 - $ - Q1-Q4 2018 740 $

51.26 1,973 $ 45.96 $ 55.96 - $ -

Oil Basis Swaps Period

Index Volume (Bbls/d)

Weighted Average Differential toWTI

($/Bbl)

Q4-2016 Western Canadian Select 33,000 (13.40)

Natural Gas Commodity Hedges Price Swaps

Price Collars

Call Options Sold Period

Volume(MMBtu/d)

WeightedAveragePrice($/MMBtu)

Volume(MMBtu/d)

WeightedAverageFloor Price($/MMBtu)

WeightedAverageCeiling Price($/MMBtu)

Volume(MMBtu/d)

WeightedAveragePrice($/MMBtu)

Q4 2016 155,000 $ 2.83 385,000 $ 2.74 $ 2.97 400,000 $ 2.80 Q1-Q4

2017 159,151 $ 3.08 230,904 $ 2.91 $ 3.31 - $ - Q1-Q4 2018 11,096 $

3.35 8,630 $ 3.18 $ 3.48 - $ -

Devon’s oil derivatives settle against the average of the prompt

month NYMEX West Texas Intermediate futures price. Devon’s natural

gas derivatives settle against the Inside FERC first of the month

Henry Hub index. Commodity hedge positions are shown as of October

28, 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161101006642/en/

Devon Energy CorporationInvestor ContactsScott Coody,

405-552-4735Chris Carr, 405-228-2496Media ContactJohn

Porretto, 405-228-7506

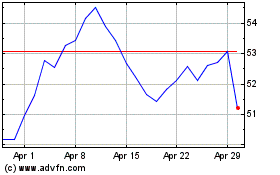

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2024 to May 2024

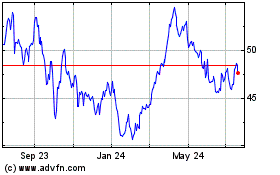

Devon Energy (NYSE:DVN)

Historical Stock Chart

From May 2023 to May 2024