SunEdison's Canadian Unit Files for Bankruptcy Protection

October 28 2016 - 4:40PM

Dow Jones News

Renewable energy giant SunEdison Inc. has placed its Canadian

arm into bankruptcy while the parent company seeks more time under

court protection in the U.S. to sell off assets and work out a

strategy for repaying billions of dollars in debt.

The company's Canadian division, which also designs and develops

renewable energy projects, says it can no longer fund its

operations. It sought protection Thursday from both creditors and

lawsuits under Canada's Companies' Creditors Arrangement Act, or

CCAA, the equivalent of chapter 11 in the U.S.

The Canadian operation, which is concentrated in Ontario, says

its financial woes are largely tied to liquidity issues stemming

from the bankruptcy of its parent company in the U.S. The Canadian

unit's businesses listed about $80 million in total assets and

about $30 million in liabilities, in addition to about $90 million

in other potential liabilities that are the subject of pending

litigation.

In court papers filed Thursday in New York, SunEdison said it is

at a "critical juncture" in its own chapter 11 case and asked

Bankruptcy Judge Stuart Bernstein to give it until at least Feb. 15

to formulate a plan that maximizes the value of its assets.

A hearing on SunEdison's request to extend the U.S. proceeding

is scheduled for Nov. 17. A so-called exclusivity extension, common

in chapter 11 cases, would keep SunEdison in the driver's seat and

bar creditors from proposing their own plans for the company's

future. Allowing exclusivity to expire would jeopardize the work

the company has already put into the bankruptcy, lawyers for

SunEdison said in court papers.

The bill for lawyers and other professionals working on the case

already exceeds $60 million, court papers show.

SunEdison has been selling off bits and pieces of the business

it built up in a debt-fueled expansion that abruptly collapsed

earlier this year. Since then, the company says it has completed

sales of 19 assets, bringing in proceeds of about $609 million.

The sales, which the company plans to continue, include a

collection of its North American solar- and wind-power projects

that it won court approval last month to hand off to an affiliate

of NRG Energy Inc. for $144 million.

SunEdison says it also needs more time to determine the right

path forward for handling its complex ties to TerraForm Global,

Inc. and Terraform Power Inc., the so-called yieldco companies that

are separate publicly traded companies and were part of the

financial engineering that helped fuel SunEdison's boom. The two

yieldcos have not sought bankruptcy protection.

SunEdison says it is exploring a number of options, including a

sale of its controlling stakes in the yieldcos, but hasn't yet

named lead bidders.

Lawyers for SunEdison must also work out claims by TerraForm

Global and Terraform Power that SunEdison's troubles have done more

than $3 billion of damage in the aggregate to their businesses.

SunEdison says it disagrees with many of the claims but is in

settlement talks with the yieldcos, another reason why it has asked

the judge to give it more time.

SunEdison filed for chapter 11 while under investigation by the

Securities and Exchange Commission and Justice Department

concerning its cash levels and dealings with TerraForm Global,

among other things.

Judge Bernstein has already said SunEdison is "hopelessly

insolvent" and likely to leave behind more than $1 billion in

unpaid debts.

Peg Brickley and Jacqueline Palank contributed to this

article.

Write to Tom Corrigan at tom.corrigan@wsj.com

(END) Dow Jones Newswires

October 28, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

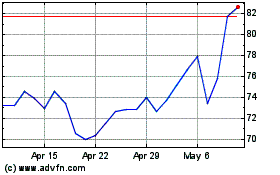

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

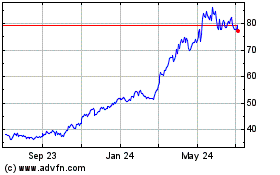

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024