By Don Clark and Tim Higgins

Qualcomm Inc.'s agreement to pay $39 billion for the world's

largest developer of chips for automobiles represents a huge bet on

cars becoming the next smartphone -- a way to roll together

communications and services once handled by dozens of other

devices.

San Diego-based Qualcomm isn't the first tech company to eye the

automotive industry for expansion, and the jury is still out on

whether the deal will help make cars smarter and safer. But it

shows the degree to which interest in turning cars into

digital-technology showcases have cast a gold rush-like spell over

chip-makers, software developers and venture-backed startups.

Its deal for NXP Semiconductors NV, the biggest to date in the

semiconductor industry, puts the spotlight on Qualcomm Chief

Executive Steve Mollenkopf, who 20 years ago started at the company

he now runs designing the unseen chips used in mobile phones.

A low-key manager who associates said isn't prone to making

brash statements and listens more than he talks, Mr. Mollenkopf, 47

years old, relishes the deal's ability to broaden Qualcomm's chip

portfolio -- and industrial horizons.

"This feels like the type of ambition that is Qualcomm," Mr.

Mollenkopf said in an interview on Thursday.

Qualcomm, unlike NXP, leaves chip manufacturing to others. Mr.

Mollenkopf noted his company has been learning more about

manufacturing issues through a wireless-component joint venture

with Japan's TDK Corp.

Thursday's deal values NXP at $110 a share, which represents a

34% premium over where NXP shares traded before The Wall Street

Journal reported on the talks Sept. 29. Including debt, the deal is

worth $47 billion.

NXP's position in the fast-growing automotive-chip market was a

key motivation for the deal, as cars gain a variety of

driver-assistance features and ultimately begin to drive

themselves.

Qualcomm already supplies the chips that bring cellular

connections to cars. It views NXP's chips and its sales connections

with auto makers and their major suppliers as a way to penetrate

that business much more quickly, said Mr. Mollenkopf.

"Our ability to sell to them expands just incredibly

dramatically as a result of the deal," he said. More broadly, NXP

would help Qualcomm become a much bigger player in a trend called

the Internet of Things -- Silicon Valley shorthand for adding

sensors, computing and communications to everything from home

appliances to office machines and farm tractors. NXP chips called

microcontrollers are widely used in many such applications.

NXP also has a leading position in chips for near-field

communications, a short-range wireless technology used for

applications such as completing payments on smartphones and

unlocking car doors.

Qualcomm derives most of its revenue from designing and selling

chips, but it earns more than half of its profits from licensing

its wireless patents to nearly all makers of mobile phones. It had

reasons to diversify beyond its processors and wireless chips for

smartphones, a business that has reached a plateau.

The hurdles are several: NXP has about 44,000 employees,

according to public filings, many more than the 30,000 Qualcomm

disclosed last year in its most recent annual report. NXP also owns

seven factories in five countries that turn silicon wafers into

chips.

In addition, analysts say, NXP has older factories that wouldn't

be easily adapted to make Qualcomm's chips. The company inherited

operations that began more than 60 years ago as part of the Dutch

giant Philips NV and Motorola Inc., which spun off its chip

business to create Freescale.

Mr. Mollenkopf said he expects veteran NXP executives to help

run the manufacturing operations and points to its successful

integration of other operations. "We get a lot of expertise coming

in," he said.

Qualcomm said it expects the purchase to add significantly to

its adjusted earnings. The company projects generating $500 million

of annualized run-rate cost synergies within two years after the

transaction closes.

The company will use offshore cash and new debt to finance the

deal, noting that the transaction structure "allows tax-efficient

use of offshore cash flow and enables Qualcomm to reduce leverage

rapidly."

On Wednesday, NXP reported third-quarter profit of $91 million,

or 26 cents a share, down from $361 million, or $1.49 a share, in

the year-ago quarter. However, the Dutch company pointed to its

operating income, excluding certain items, which rose to $691

million from $449 million.

Revenue surged 62% to $2.47 billion, in line with the company's

projections. However, excluding revenue from Freescale and other

adjustments, NXP said, revenue would have been down about 3%.

Qualcomm has yet to report its results for the fourth quarter

ended in September. For the June quarter, Qualcomm reported a

profit of $1.4 billion, or 97 cents a share, up from $1.2 billion,

or 73 cents a share, a year earlier. Revenue increased 4% to $6

billion.

The agreement is the latest in a string of mergers and

acquisitions in the semiconductor industry, which has seen more

than $200 billion in deals since the beginning of 2015. The deals

come as sales growth has faded at many of the once-burgeoning

companies as big chip markets -- such as those for smartphones and

personal computers -- have ebbed.

The deal is the largest in Qualcomm's history and comes after

activist investor Jana Partners LLC exited its investment in the

company earlier this year. Last year, Jana pressed the company to

consider splitting its chip unit from its patent business. Qualcomm

evaluated a split but ultimately decided against it.

Qualcomm pioneered what the semiconductor industry calls the

"fabless" model. That avoids the cost of operating and building

advanced fabs, which can cost more than $10 billion each for

facilities that can create the most advanced chips.

Industry executives say running factories requires a different

set of management skills than designing chips. Those include

tracking the age and performance of manufacturing equipment,

overseeing a supply chain of materials and managing production

workers, who are represented by labor unions in some NXP

locations.

--George Stahl, Eyk Henning, Maria Armental and Dana Cimilluca

contributed to this article.

Write to Don Clark at don.clark@wsj.com and Tim Higgins at

Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

October 27, 2016 18:52 ET (22:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

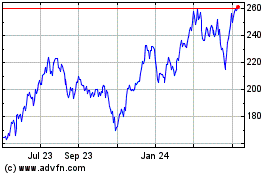

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

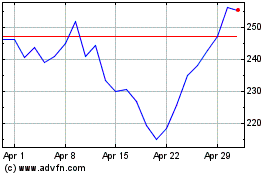

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Apr 2023 to Apr 2024