- Technology and Design-in Progress on

Track

- Significant Revenue Growth Expected in

2017

- Major Announcements Expected at CES and

Mobile World Congress

- Strong Financial Position

Maintained

Kopin Corporation (NASDAQ: KOPN), a leading developer of

innovative wearable computing technologies and solutions, today

provided an update on its business initiatives and reported

financial results for the third quarter ended September 24,

2016.

“The enthusiasm and excitement around wearables continues to

grow and Kopin made further progress in the third quarter testing

and evaluating opportunities with potential partners,” said Dr.

John C.C. Fan, Kopin’s President and CEO. “We are confident our

displays, optics and Whisper™ Chip technology will be key

components in many upcoming products from global technology

companies. On my recent trip to Asia to further many of these

opportunities, it became clear that Asian companies are ahead in

monetizing augmented reality (AR) and virtual reality (VR), and

many are close to commercial manufacturing. It also confirmed that

the Asian view around these emerging technologies is more closely

aligned with Kopin’s thoughts: AR/VR should be used for mobile

applications, with interface to a smart phone and not a stationary

PC; the headsets should be small, light weight and comfortable to

wear but still provide an immersive experience; and the devices

should be voice centric and not touch centric. With this similar

outlook and the technology to power it, Kopin is a highly respected

partner in Asia and would place Kopin products across different

verticals and companies throughout Asia.

“In fact, we are already seeing this view played out by

Softbank, which has recently exhibited our Solos™ wearables in

Japan. Solos, our headset targeted to the elite cycling community,

features Kopin’s unique Pupil Optics and micro display. Solos uses

our world’s smallest heads-up display module and pairs it with our

best in class performance tracking, precision training tools and

other useful features. The response from our Kickstarter campaign

was very strong, and we are exploring refinements to target Solos

at other markets such as runners.

“Even without these developments utilizing our new technologies,

our core business is on track for significant revenue growth next

year. Production is under way for the displays Kopin provides to

the world’s most advanced augmented reality pilot helmet used in

the Joint Strike Fighter (F-35). The program is progressing in line

with typical new programs, and we look for revenues from this

opportunity to increase in 2017. We received additional orders for

shipments under the Family of Weapon Sight – I (FWS-I) program,

which is an integrated night vision targeting solution. These

shipments are part of the Low Rate Initial Production (LRIP) phase

of the program. We also expect to receive development contracts by

year end for the companion program to the FWS-I, the Family of

Weapon Sight – C (FWS-C) and we look for revenues to grow

throughout 2017 from both programs.

“Another opportunity is the new Scott Sight for firefighters

introduced by Scott Safety, a division of Tyco. Kopin is providing

the display module for the world’s first in-mask thermal imaging

camera system that provides firefighters improved visibility in

smoke-filled environments. Currently firefighters carry a thermal

imaging camera in their hands which impedes their ability to

perform. Popular Science just awarded the Scott Sight a “Best of

What’s New” award due to the ‘situational intelligence’ the headset

provides to firefighters. We look for strong revenue growth in this

segment in 2017. One can expect new applications for Kopin’s

technology in the health and safety fields, where the use of AR can

enhance situational awareness and productivity. VR is also helping

to drive our sport drone business, primarily out of China, and we

are on track for that business to grow 30-40% this year, increasing

again next year.

“In the third quarter of 2016 we had 11 new patents granted and

11 new applications. Our portfolio of over 300 patents and patent

pendings covers various wearables technologies and designs and

helps ensure Kopin will be a leading provider for mobile AR/VR

markets. With over $84 million in cash and equivalents and

marketable securities at the end of the third quarter of 2016 we

have the financial resources to fund our current plans and the

opportunities ahead with partners. We are very encouraged by our

progress this year and are very excited to see these achievements

monetized in 2017,” concluded Dr. Fan.

We expect exciting developments in the next six to nine months,

with major announcements in the coming CES in January, 2017 and

Mobile World Congress in March, 2017 and we hope you will have an

opportunity to visit us at these major shows.

Third Quarter Financial Results

Total revenues for the third quarter ended September 24, 2016

were $5.8 million, compared with $8.0 million for the third quarter

ended September 26, 2015. Sales of products for wearable

applications were $1.5 million for the third quarter of 2016 as

compared to $3.5 million in the third quarter of 2015. Included in

the third quarter of 2015 revenues was $1.8 million related to

renegotiated contract terms due to the customer’s lowered

forecasted program volumes.

Research and development (R&D) expenses for the third

quarter of 2016 were $4.1 million compared with $4.0 million for

the third quarter of 2015.

Selling, general and administrative (SG&A) expenses were

$4.0 million for the third quarter of 2016 as compared with

approximately $4.6 million for the same period in 2015.

Net loss attributable to the controlling interest for the third

quarter of 2016 was $7.8 million, or $0.12 per share, compared with

net loss of $4.7 million, or $0.07 per share, for the third quarter

of 2015.

We have maintained our strong financial position. Net cash used

in operating activities for the nine months ended September 24,

2016 was approximately $19.4 million. Kopin’s cash and equivalents

and marketable securities were approximately $84.3

million at September 24, 2016 as compared to $80.7

million at December 26, 2015 and we have no long-term debt.

All amounts above are estimates and readers should refer to our

Form 10-Q for the quarter ended September 24, 2016 for final

disposition.

Financial Results Conference Call

In conjunction with its third quarter 2016 financial

results, Kopin will host a teleconference call for

investors and analysts at 8:30 a.m. ET today. To

participate, please dial (877) 709-8150 (U.S. and Canada) or

(201) 689-8354 (International). The call will also be available as

a live and archived audio webcast on the “Investors” section of

the Kopin website, www.kopin.com.

About Kopin

Kopin Corporation is a leading developer and provider of

innovative wearable technologies and solutions for integration into

head-worn computing and display systems to military, industrial and

consumer customers. Kopin’s technology portfolio includes

ultra-small displays, optics, speech enhancement technology, system

and hands-free control software, low-power ASICs, and ergonomically

designed smart headset reference systems. Kopin’s proprietary

components and technology are protected by more than 300 global

patents and patents pending. For more information, please visit

Kopin’s website at www.kopin.com.

Kopin, Whisper, and Solos are trademarks of Kopin

Corporation.

Forward-Looking Statements

Statements in this press release may be considered

“forward-looking” statements under the “Safe Harbor” provisions of

the Private Securities Litigation Reform Act of 1995. These

include, without limitation, statements relating to our expectation

that we are confident our displays, optics and Whisper Chip

technology will be key components in many upcoming products from

global technology companies; our core business is on track for

significant revenue growth next year; the F-35 program is

progressing in line with typical new programs, and we look for

revenues from this opportunity to increase in 2017; we also expect

to receive development contracts by year end for the companion

program to the FWS-I, the Family of Weapon Sight – C (FWS-C) and we

look for revenues to grow throughout 2017 from both programs; we

look for strong revenue growth in the public safety segment in

2017; for new applications for Kopin’s technology in the health and

safety fields; we are on track for our sport drone business to grow

30-40% this year, increasing again next year; with over $84 million

in cash at the end of the third quarter of 2016 we have the

financial resources to fund our current plans and the opportunities

ahead with partners; and our expectation of exciting developments

in the next six to nine months, with major announcements in the

coming CES in January, 2017 and Mobile World Congress in March,

2017. These statements involve a number of risks and uncertainties

that could cause actual results to differ materially from those

expressed in the forward-looking statements. These risks and

uncertainties include, but are not limited to, the following: there

may not be demand for our products and therefore they may not be

key components in products from global technology companies; our

core business may not grow next year; revenues from the F-35

program may not increase in 2017; the F-35 program may be postponed

or cancelled; we may not receive development contracts for the

FWS-C program; our revenue from the FWS-I and FWS-C program may not

increase in 2017; our sports drone business may not increase 30-40%

this year and may not increase next year; our $84 million in cash

and marketable securities might not be sufficient financial

resources to fund our current plans and the opportunities ahead

with partners; the final amounts in the Company’s Form 10-Q for the

period ended September 24, 2016 may differ from the amounts

included in the release above; it may take longer than the Company

estimates to develop products; the Company’s products may not

be accepted by the market place; there may be issues that prevent

the adoption or further development of the Company’s wearable

computing technologies; manufacturing, marketing or other

issues may prevent either the adoption or acceptance of products;

the Company might be adversely affected by competitive products and

pricing; new product initiatives and other research and development

efforts may be unsuccessful; the Company could experience the loss

of significant customers; costs to produce the Company’s products

might increase significantly, or yields could decline; the

Company’s customers might be unable to ramp production volumes of

their products, or the Company’s product forecasts could turn out

to be wrong; manufacturing delays, technical issues, economic

conditions or external factors may prevent the Company from

achieving its goals; we are dependent upon certain sole source

providers of some components of our products and if such providers

are not able to provide us such components for any reason,

including, without limitation, U.S. regulatory issues such as

compliance with EPA regulations, we could be delayed in shipping

some of our products; and other risk factors and cautionary

statements listed in the Company’s periodic reports and

registration statements filed with the Securities and Exchange

Commission, including the Annual Report on Form 10-K for the 12

months ended December 26, 2015, and the Company’s subsequent

filings with the Securities and Exchange Commission. You

should not place undue reliance on any forward-looking statements,

which are based only on information currently available to the

Company and only as of the date on which they are made. The Company

undertakes no obligation to update any of these forward-looking

statements to reflect events or circumstances occurring after the

date of this release.

Kopin Corporation Condensed Consolidated

Balance Sheets

September 24,

2016

December 26,

2015

(Unaudited)

ASSETS Current assets: Cash and marketable securities $ 84,305,386

80,710,780 Accounts receivable, net 1,761,276 1,574,973 Inventory

3,197,984 2,512,473 Prepaid and other current assets 1,088,921

1,357,996 Note receivable 15,000,000 Total

current assets 90,353,567 101,156,222 Equipment and

improvements, net 2,442,943 2,677,103 Goodwill 869,984 946,082

Property and plant, held for sale - 819,263 Other assets

618,563 461,416 Total assets $ 94,285,057 $

106,060,086 LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Accounts payable $ 3,904,476 3,959,704 Accrued

expenses 5,243,478 4,702,574 Deferred income taxes 2,570,000

1,207,000 Billings in excess of revenue earned

1,274,826 1,407,566 Total current

liabilities 12,992,780 11,276,844 Lease commitments 259,404

298,463 Total Kopin Corporation stockholders' equity

80,794,444 94,740,875 Noncontrolling interest 238,429

(256,096 ) Total stockholders' equity 81,032,873

94,484,779 Total liabilities and stockholders' equity $

94,285,057 $ 106,060,086

Kopin Corporation

Condensed Consolidated Statements of

Operations

(Unaudited)

Three Months Ended

Nine Months Ended

September 24,

2016

September 26,

2015

September 24,

2016

September 26,

2015

Revenues: Component revenues $ 5,522,584 $ 7,119,145 $ 15,597,247 $

23,734,238 Research and development revenues

272,222 881,781

671,972 3,708,286

5,794,806 8,000,926 16,269,219 27,442,524 Expenses: Cost of

component revenues 4,577,960 5,357,217 13,907,848 17,000,729

Research and development 4,123,268 4,008,391 12,282,620 13,752,593

Selling, general and administrative 3,961,135 4,558,609 12,004,249

14,053,050 Gain on sale of property and plant

-

- (7,700,522

) - 12,662,363 13,924,217

30,494,195 44,806,372 Loss from operations (6,867,557 )

(5,923,291 ) (14,224,976 ) (17,363,848 ) Other (expense)

income, net

(1,016,761 )

1,199,141 (1,158,859

) 9,605,338

Loss before (provision) benefit for income

taxes, equity loss in unconsolidated affiliate and net loss

(income) from noncontrolling interest

(7,884,318 ) (4,724,150 ) (15,383,835 ) (7,758,510 )

(Provision) benefit for income taxes

18,427

62,500

(2,085,573 ) 37,500

Loss before equity loss in unconsolidated

affiliate and net loss (income) from noncontrolling interest

(7,865,891 ) (4,661,650 ) (17,469,408 ) (7,721,010 ) Equity

loss in unconsolidated affiliate

-

- -

(47,443 ) Net loss (7,865,891 )

(4,661,650 ) (17,469,408 ) (7,768,453 ) Net loss (income)

attributable to noncontrolling interest

42,737

(13,690 )

(400,310 ) 36,094

Net loss attributable to controlling interest

$ (7,823,154 )

$ (4,675,340 )

$ (17,869,718 )

$ (7,732,359 ) Net

loss per share: Basic $ (0.12 ) $ (0.07 ) $ (0.28 ) $ (0.12 )

Diluted $ (0.12 ) $ (0.07 ) $ (0.28 ) $ (0.12 ) Weighted

average number of common shares outstanding: Basic

64,047,852 63,068,321

64,012,490

63,072,668 Diluted

64,047,852 63,068,321

64,012,490

63,072,668

Kopin Corporation

Supplemental Information (Unaudited) Three

Months Ended Nine Months Ended

September 24,

2016

September 26,

2015

September 24,

2016

September 26,

2015

Display Revenues by Category (in millions) Wearable

Applications

$

1.5

$

3.5

$

5.9

$

10.6

Military Applications

1.2

1.9

3.6

8.9

Industrial Applications 2.4 1.2 4.6 2.9 Consumer Electronics

Applications 0.4 0.5 1.5 1.3 Research and Development 0.3

0.9 0.7 3.7 Total $ 5.8 $ 8.0 $ 16.3 $ 27.4

Stock-Based Compensation Expense Continuing

Operations Cost of component revenues $ 136,000 $ 159,000 $

426,000 $ 620,000 Research and development 129,000 166,000 378,000

670,000 Selling, general and administrative 263,000

439,000 675,000 1,496,000 $ 528,000 $ 764,000 $

1,479,000 $ 2,786,000

Other Financial

Information Depreciation and amortization $ 310,000 $ 670,000 $

962,000 $ 1,860,000 Capital expenditures $ 12,000 $ 114,000 $

317,000 $ 765,000

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161027005569/en/

Kopin CorporationRichard

Sneider, 508-870-5959Treasurer and Chief Financial

OfficerRichard_Sneider@kopin.comorMarket Street PartnersJoann

Horne, 415-445-3233JHorne@marketstreetpartners.com

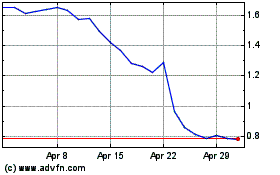

Kopin (NASDAQ:KOPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

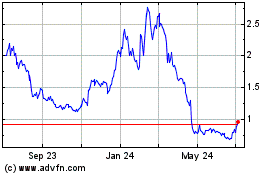

Kopin (NASDAQ:KOPN)

Historical Stock Chart

From Apr 2023 to Apr 2024