UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October 2016

Commission File Number 001-34837

MAKEMYTRIP

LIMITED

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

Mauritius

(Jurisdiction

of incorporation or organization of registrant)

Tower A, SP

Infocity, 243,

Udyog Vihar, Phase 1

Gurgaon, Haryana 122016, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover

Form 20-F

or

Form 40-F.

Form

20-F

x

Form

40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

¨

MakeMyTrip Limited is incorporating by reference the information set forth in this Form 6-K into

its registration statement on Form F-3 (File No. 333-193943) filed with the United States Securities and Exchange Commission on February 14, 2014, as amended, which became effective on March 10, 2014.

Entry Into a Material Definitive Agreement

Further to the prior announcement by MakeMyTrip Limited (“MakeMyTrip”) of its proposed acquisition of Ibibo Group Holdings

(Singapore) Private Limited (“ibibo Group), below is a brief summary of the material transaction documents.

Transaction Agreement

On October 18, 2016, MakeMyTrip entered into a Transaction Agreement (the “Transaction Agreement”) with MIH Internet SEA Private

Limited (“Parent”) and MIH B2C Holdings B.V. (“Guarantor”), providing for, among other things, the acquisition of ibibo Group (collectively, the acquisition of ibibo Group together with the other transactions contemplated by the

Transaction Agreement are referred to as the “Transaction”).

Prior to the consummation of the Transaction, Parent has agreed to

carveout certain of ibibo Group’s businesses to allow MakeMyTrip to only acquire those businesses of ibibo Group that relate to its business-to-consumer online travel business. The businesses being carved out include ibibo Group’s stake in

(i) PayU Global B.V., a company focused on online payment processing and other payment products and (ii) Tek Travels Private Limited, a company focused on business-to-business online travel (“TBO”). MakeMyTrip will be entitled to a portion

of the proceeds of a TBO sale in the event Parent sells TBO within 5 years of the closing of the Transaction or a capital infusion from Parent, in the event such a sale does not occur within 5 years. In addition, certain intellectual property rights

related to ibibo Group’s business, but held by Parent or its affiliates will be transferred to ibibo Group prior to the closing of the Transaction. The guarantee of Parent’s obligations under the Transaction Agreement provided by Guarantor

will terminate upon the completion of the foregoing pre-closing restructuring transactions; however, the guarantee will be reinstated in certain instances following the closing of the Transaction in the event Parent transfers a sufficient percentage

of its Class B Shares (as defined below).

As a result of the Transaction, MakeMyTrip will acquire all of the issued and outstanding

ordinary shares of ibibo Group from Parent and Parent will be issued Class B convertible ordinary shares (“Class B Shares”) of MakeMyTrip, the rights and preferences of which will be governed by the terms of issue described below.

Following the Transaction, Parent’s Class B Shares will represent 40% of the outstanding voting securities of MakeMyTrip, calculated on a fully diluted basis and after giving effect to the issuance of the ordinary shares issuable to Ctrip.com

International, Ltd. (“Ctrip”) upon conversion of its outstanding 4.25% convertible notes due 2021. Parent will also be required to contribute enough cash at closing to ensure that ibibo Group’s net working capital represents 40% of

MakeMyTrip’s consolidated net working capital after giving effect to the Transaction (subject to certain adjustments). Parent will also have the right to purchase at closing up to 413,035 ordinary shares of MakeMyTrip at $21.19 per share.

The Transaction Agreement contains customary representations and warranties as well as customary covenants. Parent is generally free to

purchase additional ordinary shares of MakeMyTrip without regard to an ownership limitation and is entitled to proportionate board representation. Parent has agreed that it will not transfer, subject to certain exceptions, any of its Class B Shares

or certain other ordinary shares of MakeMyTrip it may acquire to (i) certain competitors, for two years following the closing of the Transaction and (ii) any person, who after giving effect to such transfer, would beneficially own more than 15% of

MakeMyTrip, for one year following the closing of the Transaction.

Effective upon the closing of the Transaction, the size of

MakeMyTrip’s board of directors will be decreased to ten members, of whom (i) four (one of whom will be a resident of Mauritius) will be nominated by Parent, (ii) one will be nominated by Ctrip, (iii) two will be nominated by MakeMyTrip and

(iv) three (one of whom will be a resident of Mauritius) will be individuals who qualify as independent directors under the Securities and Exchange Commission and Nasdaq rules.

The closing of the Transaction is subject to certain conditions precedent, including without limitation (i) the approval of the Transaction by

MakeMyTrip’s shareholders holding a majority of the voting power present and voting on the Transaction, (ii) the approval from the Competition Commission of India in respect of the Transaction or the expiration or termination of applicable

waiting periods during which the Competition Commission of India is required to provide its decision in respect of the Transaction, (iii) receipt of certain regulatory and governmental approvals (including receipt of approval from the South African

Reserve Bank), (iv) there being no material adverse change to MakeMyTrip or ibibo Group prior to the closing of the Transaction and (v) other customary conditions.

Either MakeMyTrip or Parent may terminate the Transaction Agreement if (i) MakeMyTrip and Parent

mutually agree, (ii) the Transaction has not closed by January 16, 2017 or (iii) MakeMyTrip’s shareholders fail to approve the Transaction. In addition, either MakeMyTrip or Parent may terminate the Transaction Agreement in certain instances in

which the other party has breached or failed to perform any of its representations, warranties or covenants contained in the Transaction Agreement.

Terms of Issue

In connection with the

Transaction, MakeMyTrip and Parent have agreed on certain terms of issue (the “Terms of Issue”) pursuant to which Parent will be issued Class B Shares of MakeMyTrip as set forth in the Transaction Agreement. The Terms of Issue generally

provide that the Class B Shares issued to Parent will have the same powers and relative participation rights as ordinary shares of MakeMyTrip and shall vote together with ordinary shares as a single class on all matters on which MakeMyTrip

shareholders are entitled to vote, except as required by applicable law.

The Class B Shares will be convertible into an equal number of

ordinary shares, which shall be fully paid, non-assessable and free of any preemptive rights, of MakeMyTrip on demand at the election of the holder, and will be automatically converted into an equal number of ordinary shares upon the transfer of

Class B Shares to another party, except in the case of transfers to certain permitted transferees, transfers involving substantially all of Parent’s Class B Shares or pursuant to bona fide pledges as collateral security for indebtedness for

borrowed money.

Furthermore, the Terms of Issue provide the holders of Class B Shares certain preemptive rights to purchase additional

Class B Shares in certain circumstances where MakeMyTrip proposes to issue additional shares of capital stock in order to allow the holders of Class B Shares to maintain their same relative ownership percentage of MakeMyTrip following such

issuance.

The holders of Class B Shares shall be entitled to appoint four of the ten board of directors of MakeMyTrip (each, a

“Class B Director”) so long as their ownership percentage of permitted holders of Class B Shares stays above a required threshold. Furthermore, subject to certain conditions, the holders of Class B Shares are entitled to the following

rights with respect to MakeMyTrip’s board of directors: (i) to have one Class B Director on each committee of the board of directors, (ii) to not have the board of directors form an executive committee unless the holders of Class B Shares are

given proportional representation on such committee in relation to their ownership of share and (iii) to have all consideration and voting on business combinations and other acquisition or sale transactions to take place at the level of the full

board of directors. Furthermore, so long as permitted holders of Class B Shares hold at least 15 percent ownership of shares of MakeMyTrip, MakeMyTrip will not take any action in respect of certain matters without the prior approval of the majority

of the board of directors and a majority of the total Class B directors.

Amendment to Investor Rights Agreement

In connection with the Transaction, MakeMyTrip and Ctrip have entered into an amendment (the “Amendment to Investor Rights

Agreement”) to the Investors Rights Agreement, dated January 7, 2016 among MakeMyTrip and Ctrip. Under the terms of the Amendment to Investor Rights Agreement, the threshold above which Ctrip must maintain ownership of shares of MakeMyTrip in

order to retain rights to appoint a member to MakeMyTrip’s board of directors will be increased and the competitor list attached to the agreement will be amended.

Registration Rights Agreement

In

connection with the Transaction Agreement, each of Parent, Travogue Electronic Travel Private Limited, Deep Kalra, Keyur Joshi, Ctrip, SB Asia Investment Fund II L.P. and MakeMyTrip entered into a Registration Rights Agreement (the

“Registration Rights Agreement”), which upon the closing of the Transaction, will supersede entirely the registration rights provisions in the (i) Fourth Amended and Restated Shareholders Agreement, dated July 26, 2010 among MakeMyTrip, SB

Asia Investment Fund II L.P., Travogue Electronic Travel Private Limited, Deep Kalra and Keyur Joshi and (ii) Investor Rights Agreement, dated January 7, 2016 among MakeMyTrip and Ctrip. Under the terms of the Registration Rights Agreement, among

other things, MakeMyTrip has agreed to provide the shareholders party to the Registration Rights Agreement with certain demand registration rights and piggyback registration rights. The Registration Rights Agreement will only become effective upon

the closing of the Transaction.

Change In Control Severance Agreements

In connection with the Transaction, MakeMyTrip (India) Private Limited (“MakeMyTrip PL”) entered into Change In Control Severance

Agreements (each a “CIC Agreement”) with each of MakeMyTrip PL’s executives, Deep Kalra and Rajesh Magow (each an “Executive”). Pursuant to the respective CIC Agreements, in the event either Executive’s employment is

terminated by MakeMyTrip PL, other than for cause, death or disability, or by the Executive for good reason, such Executive will be entitled to (i) if such termination occurs within two years following the closing of the Transaction, certain

severance payments calculated with reference to the Executive’s annual salary and target bonus and (ii) if such termination occurs prior to the end of the relevant vesting period, have all of his equity grants under MakeMyTrip’s incentive

plans to fully vest and be immediately exercisable. Furthermore, each Executive has agreed to non-solicitation and non-competition restrictions, which shall continue until two years following the termination of his employment.

Update re Amendment to MakeMyTrip 2010 Share Incentive Plan

In its Form 6-K submission of 18 October 2016, MakeMyTrip had disclosed that it was amending its 2010 Share Incentive Plan so that the

total number of shares available for issuance thereunder would be 7,741,073 shares. This was a typographical error. The total number of shares available for issuance under the plan after giving effect to the amendment will be 7,662,009, of which

4,566,169 shares have been previously issued or are subject to awards outstanding as of the date hereof, with the remaining balance of 3,095,840 shares available for future issuances.

The foregoing discussion of the Transaction Agreement, Terms of Issue, Amendment to Investor Rights Agreement, Registration Rights Agreement

and Amendment to MakeMyTrip 2010 Share Incentive Plan (the “Filed Documents”) does not purport to be complete and is qualified in its entirety by reference to the full text of (i) the Transaction Agreement, a copy of which is attached to

this Form 6-K as Exhibit 99.1; (ii) the Terms of Issue, a copy of which is attached to this Form 6-K as Exhibit 99.2; (iii) the Amendment to Investor Rights Agreement, a copy of which is attached to this Form 6-K as Exhibit 99.3; (iv) the

Registration Rights Agreement, a copy of which is attached to this Form 6-K as Exhibit 99.4; and (v) the Amendment to MakeMyTrip 2010 Share Incentive Plan, a copy of which is attached to this Form 6-K as Exhibit 99.5, which Transaction Agreement,

Terms of Issue, Amendment to Investor Rights Agreement, Registration Rights Agreement and Amendment to MakeMyTrip Share Incentive Plan are incorporated into this Form 6-K by reference.

Each of the Filed Documents has been included solely to provide investors and security holders with information regarding its terms. Neither

is intended to be a source of financial, business or operational information about MakeMyTrip, Parent or their respective subsidiaries or affiliates. The representations, warranties and covenants contained in the Filed Documents, respectively, are

made only for purposes of the agreement and are made as of specific dates; are solely for the benefit of the parties; may be subject to qualifications and limitations agreed upon by the parties in connection with negotiating the terms of the Filed

Documents, respectively, including being qualified by confidential disclosures made for the purpose of allocating contractual risk between the parties instead of establishing matters as facts; and may be subject to standards of materiality

applicable to the contracting parties that differ from those applicable to investors or security holders. Investors and security holders should not rely on the representations, warranties and covenants or any description thereof as characterizations

of the actual state of facts or condition of MakeMyTrip, Parent or their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the

Filed Documents, which subsequent information may or may not be fully reflected in public disclosures.

Important Information For Investors And

Shareholders

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a

solicitation of any vote or approval. The proposed transaction will be submitted to the shareholders of MakeMyTrip for their consideration. MakeMyTrip will provide a proxy statement to its respective shareholders for consideration of the proposed

transaction. Investors and security holders are urged to read the proxy statement and any other relevant documents filed with the SEC when they become available, as well as any amendments or supplements to those documents, because they will contain

important information about MakeMyTrip, ibibo Group and the proposed transaction. Investors and security holders will be able to obtain a free copy of the proxy statement, as well as other filings containing information about MakeMyTrip and the

transaction free of charge at the SEC’s Web Site at http://www.sec.gov. In addition, the proxy statement, the SEC filings that will be incorporated by reference in the proxy statement and the other documents filed with the SEC by MakeMyTrip may

be obtained free of charge by directing such request to Jonathan Huang, Vice President – Investor Relations at Jonathan.Huang@makemytrip.com or +1 (917) 769-2027.

MakeMyTrip and its directors, executive officers, and certain other members of management and

employees may be deemed to be participants in the solicitation of proxies in favor of the proposed transaction from the shareholders of MakeMyTrip. Information about the directors and executive officers of MakeMyTrip is set forth in

MakeMyTrip’s annual report on Form 20-F, which was filed with the SEC on June 14, 2016. Additional information regarding participants in the proxy solicitation may be obtained by reading the proxy statement regarding the proposed transaction

when it becomes available.

Special Notice Regarding Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to, (i) statements about the benefits of the acquisition of ibibo Group by MakeMyTrip, including financial and operating results and synergy benefits that may be realized from the acquisition

and the timeframe for realizing those benefits; MakeMyTrip’s plans, objectives, expectations and intentions and other statements contained in this communication that are not historical facts; and (ii) other statements identified by words such

as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning.

These forward-looking statements are based upon management’s current beliefs or expectations and are inherently subject to significant

business, economic and competitive uncertainties and contingencies and third-party approvals, many of which are beyond our control. The following factors, among others, could cause actual results to differ materially from those expressed or implied

in the forward-looking statements: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the Transaction Agreement; (ii) the inability to complete the Transaction due to the failure to obtain the

required shareholder approval; (iii) the inability to satisfy the other conditions specified in the Transaction Agreement, including without limitation, the receipt of necessary governmental or regulatory approvals required to complete the

transactions contemplated by the Transaction Agreement; (iv) the inability to successfully integrate the businesses of MakeMyTrip and ibibo Group or to integrate the businesses within the anticipated timeframe; (v) the risk that the proposed

transactions disrupt current plans and operations, increase operating costs and the potential difficulties in customer or supplier loss and employee retention as a result of the announcement and consummation of such transactions; (vi) the inability

to recognize the anticipated benefits of the combination of MakeMyTrip and ibibo Group, including the realization of revenue and cost synergy benefits and to recognize such benefits within the anticipated timeframe; (vii) the outcome of any legal

proceedings that may be instituted against MakeMyTrip, ibibo Group or others following announcement of the Transaction Agreement and transactions contemplated therein; and (viii) the possibility that MakeMyTrip or ibibo Group may be adversely

affected by other economic, business, and/or competitive factors.

Additional information concerning these and other important factors can

be found within MakeMyTrip’s filings with the SEC, which discuss the foregoing risks as well as other important risk factors that could contribute to such differences or otherwise affect our business, results of operations and financial

condition. Statements in this communication should be evaluated in light of these important factors. The forward-looking statements in this communication speak only as of the date they are made. Except for the ongoing obligations of MakeMyTrip to

disclose material information in accordance with law, MakeMyTrip does not undertake any obligation to, and expressly disclaim any such obligation to, update or alter any forward-looking statement to reflect new information, circumstances or events

that occur after the date such forward-looking statement is made unless required by law.

Exhibits

|

|

|

|

|

99.1

|

|

Transaction Agreement, dated October 18, 2016, by and among MakeMyTrip Limited, MIH Internet SEA Private Limited,

and solely for purposes of Article XIII thereof, MIH B2C Holdings B.V.

|

|

|

|

|

99.2

|

|

Terms of Issue of Class B Shares.

|

|

|

|

|

99.3

|

|

Amendment to Investor Rights Agreement, dated October 18, 2016, by and among MakeMyTrip Limited and Ctrip.com International, Ltd.

|

|

|

|

|

99.4

|

|

Registration Rights Agreement, dated October 18, 2016, by and among MIH Internet SEA Private Limited, Travogue Electronic Travel Private Limited, Deep Kalra, Keyur Joshi, Ctrip.com International, Ltd., SB Asia Investment Fund II

L.P. and MakeMyTrip Limited.

|

|

|

|

|

99.5

|

|

First Amendment to MakeMyTrip 2010 Share Incentive Plan.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: October 19, 2016

|

|

|

|

|

MAKEMYTRIP LIMITED

|

|

|

|

|

By:

|

|

/s/ Deep Kalra

|

|

|

|

|

Name:

|

|

Deep Kalra

|

|

Title:

|

|

Group Chairman and Group Chief Executive Officer

|

EXHIBIT INDEX

|

|

|

|

|

99.1

|

|

Transaction Agreement, dated October 18, 2016, by and among MakeMyTrip Limited, MIH Internet SEA Private Limited,

and solely for purposes of Article XIII thereof, MIH B2C Holdings B.V.

|

|

|

|

|

99.2

|

|

Terms of Issue of Class B Shares.

|

|

|

|

|

99.3

|

|

Amendment to Investor Rights Agreement, dated October 18, 2016, by and among MakeMyTrip Limited and Ctrip.com International, Ltd.

|

|

|

|

|

99.4

|

|

Registration Rights Agreement, dated October 18, 2016, by and among MIH Internet SEA Private Limited, Travogue Electronic Travel Private Limited, Deep Kalra, Keyur Joshi, Ctrip.com International, Ltd., SB Asia

Investment Fund II L.P. and MakeMyTrip Limited.

|

|

|

|

|

99.5

|

|

First Amendment to MakeMyTrip 2010 Share Incentive Plan.

|

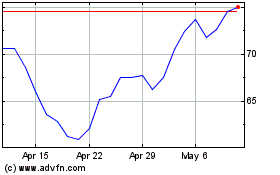

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Aug 2024 to Sep 2024

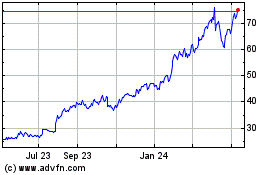

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Sep 2023 to Sep 2024