LyondellBassell Trial to Focus on LBO -- Week Ahead

October 14 2016 - 4:16PM

Dow Jones News

By Lillian Rizzo

Years after LyondellBasell Industries AF exited bankruptcy, its

creditors are getting another shot at a payout.

On Monday, U.S. Bankruptcy Court Judge Martin Glenn will hear

opening arguments in trial over a $1.2 billion-plus clawback

lawsuit brought for the benefit of the chemical giant's

creditors.

Prior to seeking chapter 11 protection in the midst of the

global financial downturn, LyondellBasell was formed through a

nearly $13 billion leveraged buyout. In 2007, Luxembourg-based

Basell AF S.C.A., then controlled by Russian-born investor Leonard

Blavatnik's Access Industries Inc., acquired Texas-based Lyondell

Chemical Co.

The company filed for bankruptcy in 2009 and emerged in 2010

after cutting about $5 billion from its debt load and with Access

Industries as a significant stakeholder.

In connection with the restructuring, a trust was created to

pursue lawsuits that could ultimately increase creditors'

recoveries. Among the lawsuits filed by litigation trustee and

Brown Rudnick attorney Ed Weisfelner is one related to the LBO

against Mr. Blavatnik, individuals associated with Access and

companies with ties to Mr. Blavatnik.

Creditors are alleging the buyout was made in bad faith on the

basis of inflated Lyondell financial projections, which they say

drove the buyout price higher.

Lawyers for Mr. Weisfelner plan to argue that the companies knew

the shaky nature of the leveraged buyout in 2007 and "that Lyondell

was insolvent" once the deal closed that December, court papers

show. The creditors' focus will be on Lyondell's pre-bankruptcy

balance sheet, capital structure and financial projections.

The lawsuit looks to recover more than $1.2 billion in payments

allegedly made with the intention of defrauding the post-LBO

company's creditors. The lawsuit also seeks to recover another $128

million in financial advisory and management fees, damages for

alleged breaches of fiduciary duty and other payments.

Namely, the creditors will look to prove that Mr. Blavatnik

orchestrated payments for his benefit and that of his companies,

according to court papers.

Mr. Blavatnik and the other defendants' lawyers argue there was

no way of knowing it was the wrong time for a leveraged buyout "on

the eve of that unprecedented and unforeseeable global

dislocation," according to court papers.

"To suggest [LyondellBasell] was foreseeably 'doomed to fail' in

2007, is, simply put, to rewrite history," they add. "No evidence

will suggest that a single participant in the transaction expected

[the company] to fail." Court papers point out that shareholders

and financial institutions invested and "risked" billions of

dollars in the merger with the expectation of the deal's

success.

"Among the many problems with these tales is the trustee's utter

failure to address the impact of the Great Recession on

[LyondellBasell]," the defendants' lawyers argue.

Court papers add that the creditors' trustee "cannot plausibly

explain why a long-term equity investor like Blavatnik would put

Basell at risk to benefit Lyondell shareholders, a fact recognized

by the district court."

-Jacqueline Palank contributed to this article.

Write to Lillian Rizzo at Lillian.Rizzo@wsj.com

(END) Dow Jones Newswires

October 14, 2016 16:01 ET (20:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

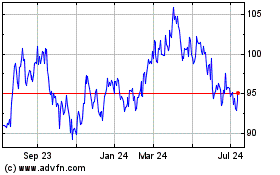

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

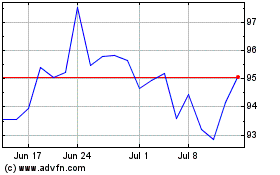

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Apr 2023 to Apr 2024