Brazil's Bradesco to Form Joint Venture With Swiss Re on High-Risk Area

October 13 2016 - 8:30AM

Dow Jones News

By Rogerio Jelmayer

SAO PAULO--Brazil's retail bank Banco Bradesco SA said Thursday

that it agreed to form a joint venture with Swiss Re AG, one of the

two biggest reinsurers world-wide, to insure high-risk

projects.

Swiss Re will hold a 60% of the joint venture and Bradesco will

control the remaining stake, the Brazilian bank said in a

statement. However, it didn't unveil financial value of the

transaction.

With the deal, the joint venture will be able to explore a

network of 4,600 Bradesco branches across the nation, to sell their

products to the bank's clients, it said.

The deal still must to be approved by the local authorities.

In recent years, Brazilian banks opted to sell part of their

insurance divisions in high-risk areas in order to concentrate in

their core businesses, such as retail bank activity and insurance

for individuals.

In July 2014, Bradesco's local rival, Itau Unibanco Holding

S.A., sold its high-risk insurance unit to U.S. insurance company

ACE Ltd. for a total of 1.5 billion Brazilian reais ($468

million).

Write to Rogerio Jelmayer at rogerio.jelmayer@wsj.com

(END) Dow Jones Newswires

October 13, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

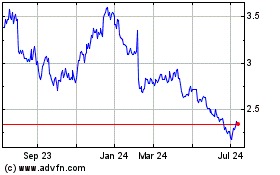

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Sep 2023 to Sep 2024