Apollo Commercial Real Estate Finance, Inc. (the “Company” or

“ARI”) (NYSE:ARI), today announced the Company closed four

commercial real estate loan transactions totaling $325.5 million

and funded $16.6 million for previously closed loans, bringing

year-to-date total capital commitment and deployment to

approximately $749.0 million. ARI also announced the Company closed

a new credit facility with Deutsche Bank to fund first mortgage

investments.

Commenting on the new transactions and the facility, Scott

Weiner, Chief Investment Officer of the Company’s manager, said:

“Over the past few months, ARI built a strong pipeline of

commercial real estate debt investments in anticipation of the

approximately $400 million of investable capital the Company

generated from the acquisition of Apollo Residential Mortgage, Inc.

(“AMTG”) and the subsequent sale of AMTG assets. As a result, ARI

had a very active September and closed four first mortgage loan

transactions totaling $325.5 million, representing a mix of

property types and locations. In addition, ARI closed a new credit

facility with Deutsche Bank to finance first mortgage loan

investments, further diversifying the Company’s funding sources and

providing ARI with incremental financing to fund our active

investment pipeline.”

Investment Activity

ARI closed a $133.0 million first mortgage loan ($128.0 million

of which was funded at closing) secured by a 735,382 square foot

office building located in the North Michigan Avenue retail

corridor of Chicago which will be redeveloped into a mixed use

project. The floating rate loan has a two-year initial term with

two two-year extension options and an appraised loan-to-value

(“LTV”) of approximately 58%. The loan has been underwritten to

generate a levered internal rate of return (“IRR”)(1) of

approximately 14%.

ARI closed a $105.0 million first mortgage loan ($78.1 million

of which was funded at closing) secured by a newly- constructed,

612-key full service hotel located in the Times Square district of

New York City. The loan is part of a $215.0 million financing which

consists of ARI’s $105.0 million loan and another $110.0 million

pari passu loan. The floating rate loan has a two-year initial term

with three one-year extension options and an appraised LTV of

approximately 62%. The loan has been underwritten to generate a

levered IRR(1) of approximately 14%.

ARI closed an $80.0 million first mortgage loan (all of which is

expected to be funded by year end) secured by a to-be-developed

data center in Manassas, Virginia which has been substantially

pre-leased on a long-term basis to a credit tenant. The loan is

part of a $365.0 million financing which consists of ARI’s $80.0

million loan and additional pari passu notes totaling $285.0

million. The fixed-rate loan has a three-year term and an

underwritten, as-stabilized LTV of approximately 55%. The loan has

been underwritten to generate a levered IRR(1) of approximately

14%.

ARI closed a $7.5 million first mortgage loan secured by a 6,500

square foot retail property. The loan is cross-collateralized and

cross-defaulted with the $121.4 million of financing ARI has

provided to the same borrower in connection with the aggregation of

retail parcels for redevelopment in downtown Brooklyn, New York.

The total floating rate financing has a remaining six month term

and an appraised LTV of approximately 60%.

Funding of Previously Closed Loans

- Since July 27, 2016, ARI has funded $16.6 million for previously

closed loans.

Loan Repayments – Since July 27,

2016, ARI received $122.9 million from loan repayments and

condominium sales. The loans that fully repaid include a

subordinate loan on an office building in Michigan, a first

mortgage predevelopment loan for a condominium conversion in New

York City and a subordinate predevelopment loan for a condominium

conversion in London.

Credit Facility

ARI entered into a master repurchase agreement with Deutsche

Bank AG (the “DB Facility”) to provide up to $300.0 million of

advances in connection with financing first mortgage loans. The DB

Facility has a one year term with two one-year extension options

and will accrue interest at a per annum pricing equal to the sum of

one-month LIBOR plus an applicable spread.

About Apollo Commercial Real Estate Finance, Inc.

Apollo Commercial Real Estate Finance, Inc. (NYSE: ARI) is a

real estate investment trust that primarily originates, invests in,

acquires and manages performing commercial real estate first

mortgage loans, subordinate financings, commercial mortgage-backed

securities and other commercial real estate-related debt

investments. The Company is externally managed and advised by

ACREFI Management, LLC, a Delaware limited liability company and an

indirect subsidiary of Apollo Global Management, LLC, a leading

global alternative investment manager with approximately $186.3

billion of assets under management as of June 30, 2016.

Additional information can be found on the Company's website at

www.apolloreit.com.

(1) The underwritten IRR for the investments shown above reflect

the returns underwritten by ACREFI Management, LLC, the Company’s

external manager, taking into account leverage and calculated on a

weighted average basis assuming no dispositions, early prepayments

or defaults but assuming that extension options are exercised and

that the cost of borrowings remains constant over the remaining

term. With respect to certain loans, the underwritten IRR

calculation assumes certain estimates with respect to the timing

and magnitude of future fundings for the remaining commitments and

associated loan repayments, and assumes no defaults. IRR is the

annualized effective compounded return rate that accounts for the

time-value of money and represents the rate of return on an

investment over a holding period expressed as a percentage of the

investment. It is the discount rate that makes the net present

value of all cash outflows (the costs of investment) equal to the

net present value of cash inflows (returns on investment). It is

derived from the negative and positive cash flows resulting from or

produced by each transaction (or for a transaction involving more

than one investment, cash flows resulting from or produced by each

of the investments), whether positive, such as investment returns,

or negative, such as transaction expenses or other costs of

investment, taking into account the dates on which such cash flows

occurred or are expected to occur, and compounding interest

accordingly. There can be no assurance that the actual IRRs will

equal the underwritten IRRs shown in the table. See “Item

1A—Risk Factors—The Company may not achieve its underwritten

internal rate of return on its investments which may lead to future

returns that may be significantly lower than anticipated” included

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2015 for a discussion of some of the factors that

could adversely impact the returns received by the Company from the

investments shown over time.

Forward-Looking Statements

Certain statements contained in this press release constitute

forward-looking statements as such term is defined in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and such statements

are intended to be covered by the safe harbor provided by the same.

Forward-looking statements are subject to substantial risks and

uncertainties, many of which are difficult to predict and are

generally beyond the Company's control. These forward-looking

statements include information about possible or assumed future

results of the Company's business, financial condition, liquidity,

results of operations, plans and objectives. When used in this

release, the words "believe," "expect," "anticipate," "estimate,"

"plan," "continue," "intend," "should," "may" or similar

expressions are intended to identify forward-looking statements.

Statements regarding the following subjects, among others, may be

forward-looking: the return on equity; the yield on investments;

the ability to borrow to finance assets; and risks associated with

investing in real estate assets, including changes in business

conditions and the general economy. For a further list and

description of such risks and uncertainties, see the reports filed

by the Company with the Securities and Exchange Commission. The

forward-looking statements, and other risks, uncertainties and

factors are based on the Company's beliefs, assumptions and

expectations of its future performance, taking into account all

information currently available to the Company. Forward-looking

statements are not predictions of future events. The Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161004005457/en/

Apollo Commercial Real Estate Finance, Inc.Hilary Ginsberg,

212-822-0767

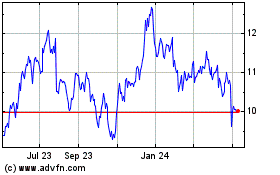

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Mar 2024 to Apr 2024

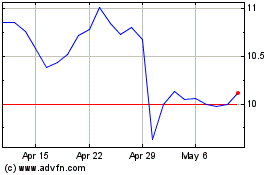

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Apr 2023 to Apr 2024