Current Report Filing (8-k)

September 30 2016 - 6:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 26, 2016

PennyMac Mortgage Investment Trust

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

001-34416

|

27-0186273

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3043 Townsgate Road, Westlake Village, California

|

|

91361

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(818) 224‑7442

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Repurchase Agreements with Credit Suisse First Boston Mortgage Capital LLC

On September 26, 2016, PennyMac Mortgage Investment Trust (the “Company”), through its wholly-owned subsidiaries, PennyMac Operating Partnership, L.P. (“POP”), PennyMac Corp. (“PMC”), PennyMac Holdings, LLC (“PMH”) and PMC REO Financing Trust (“REO Subsidiary”), amended the terms of (i) its Amended and Restated Master Repurchase Agreement, dated as of March 31, 2016, by and among Credit Suisse First Boston Mortgage Capital LLC (“CSFB”), POP, PMC, PMH, REO Subsidiary and the Company (the “Consolidated Repurchase Agreement”), pursuant to which the Company, through POP, PMC and/or PMH, as applicable, may sell, and later repurchase, (a) newly originated mortgage loans that PMC purchases from correspondent lenders and holds pending sale and/or securitization, (b) newly originated mortgage loans that have been purchased by PMC from correspondent lenders and pledged by PMC to PMH or POP pending sale and/or securitization by PMC, and (c) distressed mortgage loans and equity interests in REO Subsidiary; and (ii) its Amended and Restated Master Repurchase Agreement, dated as of March 31, 2016, by and among CSFB, POP and the Company, pursuant to which POP may sell to CSFB, and later repurchase, newly originated mortgage loans for which POP provides financing to third-party mortgage loan originators (the “Re-warehouse Facility”). Prior to the amendments, the Consolidated Repurchase Agreement and the Re-warehouse Facility collectively provided for a maximum combined purchase price of $850 million.

Of this amount, $650 million was committed and available for purchases under the Consolidated Repurchase Agreement to the extent not reduced by purchased amounts outstanding under the Re-warehouse Facility, while $300 million was committed and available for purchases under the Re-warehouse Facility to the extent not reduced by purchased amounts outstanding under the Consolidated Repurchase Agreement

.

Pursuant to the terms of the amendments, CSFB agreed to increase the maximum combined purchase price provided for under the Consolidated Repurchase Agreement and the Re-warehouse Facility from $850 million to $1.15 billion until October 26, 2016, at which time the maximum combined purchase price will be reset to $850 million. All other terms and conditions of the Consolidated Repurchase Agreement and the Re-warehouse Facility, including the respective committed amounts thereunder, remain the same in all material respects.

The foregoing descriptions of the Consolidated Repurchase Agreement and the Re-warehouse Facility do not purport to be complete and are qualified in their entirety by reference to (i) the descriptions of the Consolidated Repurchase Agreement and the Re-warehouse Facility in the Company’s Current Report on Form 8-K as filed on April 6, 2016, and (ii) the full text of the Consolidated Repurchase Agreement and the Re-warehouse Facility attached thereto as Exhibits 10.1 and 10.3, respectively.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this report is incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

PENNYMAC MORTGAGE INVESTMENT TRUST

|

|

|

|

|

|

|

|

|

|

|

Dated: September 30, 2016

|

/s/ Anne D. McCallion

|

|

|

Anne D. McCallion

Senior Managing Director and Chief Financial Officer

|

|

|

|

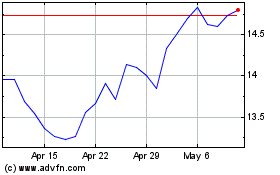

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

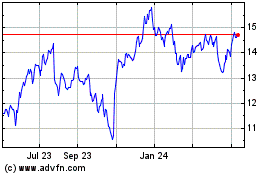

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Apr 2023 to Apr 2024