Filed Pursuant to Rule 424(b)(3)

Registration No. 333-213590

PROSPECTUS

5,250,000 Shares of Common Stock

This prospectus relates to the offer and sale from time to time of up to 5,250,000 shares of our common stock under this prospectus by the selling stockholders named in this prospectus. We will not receive any of the proceeds from the sale of our common stock by the selling stockholders.

The shares of common stock registered hereunder were issued to the selling stockholders pursuant to a Securities Purchase Agreement, dated as of August 6, 2016, by and between us and the selling stockholders. The selling stockholders may resell or dispose of the shares of our common stock, or interests therein, at fixed prices, at prevailing market prices at the time of sale or at prices negotiated with purchasers, to or through underwriters, broker-dealers, agents, or through any other means described in this prospectus under “Plan of Distribution.” The selling stockholders will bear all commissions and discounts, if any, attributable to the sale or disposition of the shares, or interests therein. We will bear all costs, expenses and fees in connection with the registration of the shares.

You should read this document and any prospectus supplement or amendment carefully before you invest in our securities.

Our common stock is listed on The NASDAQ Global Market under the symbol “FATE.” On September 27, 2016, the closing price for our common stock, as reported on The NASDAQ Global Market, was $3.26 per share. Our principal executive offices are located at 3535 General Atomics Court, Suite 200, San Diego, CA 92121.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in this prospectus beginning on page 2 and any applicable prospectus supplement, and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is September 28, 2016.

TA

BLE OF CONTENTS

You should rely only on the information contained in this prospectus, any applicable prospectus supplement and the information incorporated by reference in this prospectus. We have not authorized anyone to provide you with additional or different information. This document may only be used where it is legal to sell these securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

ABOUT THIS

PROSPECTUS

This prospectus and the documents incorporated by reference into it are part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC. The selling stockholders may from time to time sell up to 5,250,000 shares of common stock, as described in this prospectus, in one or more offerings. We have agreed to pay the expenses incurred in registering these shares, including legal and accounting fees.

This prospectus provides you with a general description of the securities the selling stockholders may offer. You should read this prospectus and the additional information described under the heading “Where You Can Find More Information” beginning on page 13 of this prospectus.

You should rely only on the information contained in or incorporated by reference in this prospectus. Neither we nor any selling stockholder have authorized anyone to provide you with different information. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where it is lawful to do so. The selling stockholders should not make an offer of these shares in any jurisdiction where the offer is not permitted. Brokers or dealers should confirm the existence of an exemption from registration or effect a registration in connection with any offer or sale of these shares.

You should assume that the information appearing in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

Unless the context otherwise indicates, references in this prospectus to “Fate Therapeutics”, “we”, “our”, “us” and “the Company” refer, collectively, to Fate Therapeutics, Inc., a Delaware corporation.

1

RISK FA

CTORS

Investing in our securities involves a high degree of risk.

In addition to the other information included in, or incorporated by reference into, this prospectus, you should carefully consider the risk factors incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2015, and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016 and June 30, 2016, which are on file with the SEC and are incorporated by reference into this prospectus, as the same may be updated from time to time by our future filings under the Exchange Act, when determining whether or not to purchase the securities offered under this prospectus, in addition to the following:

Our principal stockholders exercise significant control over our company.

As of September 6, 2016, our executive officers, directors and entities affiliated with our five percent stockholders beneficially own, in the aggregate, shares representing approximately 67% of our outstanding voting stock, of which 14% represents shares offered under this prospectus by the Selling Stockholders. Although we are not aware of any voting arrangements in place among these stockholders, if these stockholders were to choose to act together, as a result of their stock ownership, they would be able to influence our management and affairs and control all matters submitted to our stockholders for approval, including the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets. This concentration of ownership may have the effect of delaying or preventing a change in control of our company or affecting the liquidity and volatility of our common stock, and might affect the market price of our common stock.

2

CAUTIONARY STATEMENT REGARDIN

G FOR

WARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “may,” “will,” “could,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “continue,” and similar expressions, or the negative of these terms, or similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus, and in particular those factors referenced in the section “Risk Factors.”

This prospectus contains forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. These statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

|

|

·

|

the initiation, timing, progress and results of our ongoing and planned clinical trials, our preclinical studies and our research and development programs;

|

|

|

·

|

our ability to advance our product candidates into, and successfully complete, clinical studies;

|

|

|

·

|

the timing and likelihood of, and our ability to obtain and maintain regulatory approval of our product candidates;

|

|

|

·

|

the potential benefits of strategic collaboration agreements and our ability to enter into and maintain strategic arrangements;

|

|

|

·

|

our ability to enroll patients in our ongoing and planned clinical trials at the pace we project;

|

|

|

·

|

the performance of third parties in connection with the development and manufacture of our product candidates, including third parties conducting our clinical trials as well as third-party suppliers and manufacturers;

|

|

|

·

|

our ability to develop sales and marketing capabilities, whether alone or with actual or potential collaborators, to commercialize our product candidates, if approved;

|

|

|

·

|

our ability to successfully manufacture and commercialize our product candidates;

|

|

|

·

|

the pricing and reimbursement, and the degree of market acceptance, of our product candidates, if approved;

|

|

|

·

|

the size and growth of the potential markets for our product candidates and our ability to serve those markets;

|

|

|

·

|

regulatory developments and approval pathways in the United States and foreign countries for our product candidates;

|

|

|

·

|

our ability, and the ability of our licensors, to obtain, maintain, defend and enforce intellectual property rights protecting our product candidates, and our ability to develop and commercialize our product candidates without infringing the proprietary rights of third parties;

|

|

|

·

|

our ability to retain and recruit key personnel;

|

|

|

·

|

our ability to obtain funding for our operations;

|

|

|

·

|

the implementation of our business model, strategic plans for our business, product candidates and technology;

|

|

|

·

|

the accuracy of our estimates regarding our expenses, ongoing losses, capital requirements and revenues;

|

|

|

·

|

developments relating to our competitors and our industry; and

|

|

|

·

|

other risks and uncertainties, including those described under the caption “Risk Factors” in this prospectus and any prospectus supplement that we may file.

|

3

THE CO

MPANY

We are a clinical-stage biopharmaceutical company dedicated to the development of programmed cellular immunotherapies for cancer and immune disorders. We are developing our product candidates based on a simple notion: we believe that better cell therapies start with better cells. Our therapeutic approach, which we refer to as cell programming, utilizes pharmacologic modulators, such as small molecules, to enhance the biological properties and therapeutic function of cells

ex vivo

, or outside the body. These programmed cells are then adoptively transferred to patients as therapies. We believe that this highly-differentiated therapeutic paradigm – systematically and precisely programming the biological properties and therapeutic function of cells

ex vivo

prior to adoptive transfer – is an elegant, cost-effective and scalable approach for maximizing the safety and efficacy of cell therapies. Utilizing our cell programming approach, we program immune cells, such as CD34+ cells, Natural Killer (NK) cells and T cells.

We are advancing a pipeline of programmed cellular immunotherapies, including both donor-sourced and off-the-shelf, pluripotent cell-derived immune cell therapies, in the fields of immuno-oncology and immuno-regulation. Our clinical program is ProTmune™, a programmed immuno-regulatory cell therapy consisting of donor-sourced mobilized peripheral blood cells which have been modulated using two small molecules, for the prevention of acute graft-versus-host disease (GvHD) and cytomegalovirus (CMV) infection in immunocompromised patients undergoing allogeneic hematopoietic cell transplantation (HCT). Our preclinical programs include NK- and T-cell cancer immunotherapies, including off-the-shelf therapies derived from engineered induced pluripotent cells (denoted as an iNK Cell Therapy and an iT Cell Therapy, respectively), and a CD34+ cell immuno-regulatory therapy to suppress aberrant auto-reactive effector cells for autoimmune diseases.

We also have entered into a research collaboration and license agreement with Juno Therapeutics, Inc. to identify and apply small molecule modulators to enhance the therapeutic function of genetically-engineered CAR (chimeric antigen receptor) T-cell and TCR (T-cell receptor) immunotherapies.

We own various U.S. federal trademark registrations and applications, and unregistered trademarks, including Fate Therapeutics®, our corporate logo, and ProTmune™.

We were incorporated in Delaware in 2007 and our principal executive offices are located at 3535 General Atomics Court, Suite 200, San Diego, CA 92121 and our telephone number is (858) 875-1800.

4

USE OF P

ROCEEDS

The selling stockholders are offering all of the shares of our common stock being offered pursuant to this prospectus. Accordingly, we will not receive any proceeds from the sale of shares of our common stock by any selling stockholder. We have agreed to pay all costs, expenses and fees relating to registering the shares of our common stock referenced in this prospectus. The selling stockholders will pay any brokerage commissions and/or similar charges incurred in connection with the sale or other disposition by them of the shares covered hereby.

5

DESCRIPTION OF

CAPITAL STOCK

The following description of our common stock and preferred stock, together with the additional information we include in any applicable prospectus supplements, summarizes the material terms and provisions of our capital stock. The following description of our capital stock does not purport to be complete and is subject to, and qualified in its entirety by, our certificate of incorporation and bylaws, which are exhibits to the registration statement of which this prospectus forms a part, and by applicable law. The terms of our common stock and preferred stock may also be affected by Delaware law.

Authorized Capital Stock

Our authorized capital stock consists of 150,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share. As of September 27, 2016, we had 34,147,385 shares of common stock outstanding and no shares of preferred stock outstanding.

Common Stock

The holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of the stockholders. The holders of our common stock do not have any cumulative voting rights. Holders of our common stock are entitled to receive ratably any dividends declared by the board of directors out of funds legally available for that purpose, subject to any preferential dividend rights of any outstanding preferred stock. Our common stock has no preemptive rights, conversion rights or other subscription rights or redemption or sinking fund provisions.

In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in all assets remaining after payment of all debts and other liabilities and any liquidation preference of any outstanding preferred stock. All outstanding shares, including the shares of common stock offered under this prospectus, are fully paid and nonassessable.

Exchange Listing

Our common stock is listed on The NASDAQ Global Market under the symbol “FATE.” On September 27, 2016, the closing price for our common stock, as reported on The NASDAQ Global Market, was $3.26 per share. As of September 27, 2016, we had approximately 54 stockholders of record.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC. The transfer agent and registrar’s address is 6201 15th Avenue, Brooklyn, NY 11219.

Preferred Stock

Our board of directors is authorized to issue up to 5,000,000 shares of preferred stock in one or more series without stockholder approval. Our board of directors may determine the rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each series of preferred stock, any or all of which may be more favorable than the rights of our common stock. The issuance of our preferred stock could adversely affect the voting power of holders of common stock and the likelihood that such holders will receive dividend payments and payments upon our liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change in control of our company or other corporate action.

Provisions of our Certificate of Incorporation and Bylaws and Delaware Anti-Takeover Law

Certain provisions of the Delaware General Corporation Law and of our certificate of incorporation and bylaws could have the effect of delaying, deferring or discouraging another party from acquiring control of us. These provisions, which are summarized below, are expected to discourage certain types of coercive takeover practices and inadequate takeover bids and, as a consequence, they might also inhibit temporary fluctuations in the market price of our common stock that often result from actual or rumored hostile takeover attempts. These provisions are also designed in part to encourage anyone seeking to acquire control of us to first negotiate with our board of directors. These provisions might also have the effect of preventing changes in our management. It is possible that these provisions could make it more difficult to accomplish transactions that stockholders might otherwise deem to be in their best interests. However, we believe that the advantages gained by protecting our ability to negotiate with any unsolicited and potentially unfriendly

6

acquirer outweigh the disadva

ntages of discouraging such proposals, including those priced above the then-current market value of our common stock, because, among other reasons, the negotiation of such proposals could improve their terms.

Provisions of our Certificate of Incorporation and Bylaws

Our certificate of incorporation and bylaws include a number of provisions that may have the effect of delaying, deferring or discouraging another party from acquiring control of us and encouraging persons considering unsolicited tender offers or other unilateral takeover proposals to negotiate with our board of directors rather than pursue non-negotiated takeover attempts. These provisions include the items described below.

Board Composition and Filling Vacancies

. Our certificate of incorporation provides for the division of our board of directors into three classes serving staggered three-year terms, with one class being elected each year. Our certificate of incorporation also provides that directors may be removed only for cause and then only by the affirmative vote of the holders of 75% or more of the shares then entitled to vote at an election of directors. Furthermore, any vacancy on our board of directors, however occurring, including a vacancy resulting from an increase in the size of our board, may only be filled by the affirmative vote of a majority of our directors then in office even if less than a quorum.

No Written Consent of Stockholders

. Our certificate of incorporation provides that all stockholder actions are required to be taken by a vote of the stockholders at an annual or special meeting, and that stockholders may not take any action by written consent in lieu of a meeting.

Meetings of Stockholders

.

Our certificate of incorporation and bylaws provide that only a majority of the members of our board of directors then in office may call special meetings of stockholders and only those matters set forth in the notice of the special meeting may be considered or acted upon at a special meeting of stockholders. Our bylaws limit the business that may be conducted at an annual meeting of stockholders to those matters properly brought before the meeting.

Advance Notice Requirements.

Our bylaws establish advance notice procedures with regard to stockholder proposals relating to the nomination of candidates for election as directors or new business to be brought before meetings of our stockholders. These procedures provide that notice of stockholder proposals must be timely given in writing to our corporate secretary prior to the meeting at which the action is to be taken. Generally, to be timely, notice must be received at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date of the annual meeting for the preceding year. Our bylaws specify the requirements as to form and content of all stockholders’ notices.

Amendment to Certificate of Incorporation and Bylaws

.

As required by the Delaware General Corporation Law, any amendment of our certificate of incorporation must first be approved by a majority of our board of directors, and if required by law or our certificate of incorporation, must thereafter be approved by a majority of the outstanding shares entitled to vote on the amendment and a majority of the outstanding shares of each class entitled to vote thereon as a class, except that the amendment of the provisions relating to stockholder action, board composition, limitation of liability and the amendment of our certificate of incorporation must be approved by not less than 75% of the outstanding shares entitled to vote on the amendment, and not less than 75% of the outstanding shares of each class entitled to vote thereon as a class. Our bylaws may be amended by the affirmative vote of a majority of the directors then in office, subject to any limitations set forth in the bylaws; and may also be amended by the affirmative vote of at least 75% of the outstanding shares entitled to vote on the amendment, or, if our board of directors recommends that the stockholders approve the amendment, by the affirmative vote of the majority of the outstanding shares entitled to vote on the amendment, in each case voting together as a single class.

Undesignated preferred stock.

Our certificate of incorporation provides for 5,000,000 authorized shares of preferred stock. The existence of authorized but unissued shares of preferred stock may enable our board of directors to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise. For example, if in the due exercise of its fiduciary obligations, our board of directors were to determine that a takeover proposal is not in the best interests of our stockholders, our board of directors could cause shares of preferred stock to be issued without stockholder approval in one or more private offerings or other transactions that might dilute the voting or other rights of the proposed acquirer or insurgent stockholder or stockholder group. In this regard, our certificate of incorporation grants our board of directors broad power to establish the rights and preferences of authorized and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and assets available for distribution to holders of shares of common stock. The issuance may also adversely affect the rights and powers, including voting rights, of these holders and may have the effect of delaying, deterring or preventing a change in control of us.

7

Delaware Anti-Takeover Law

We are subject to the provisions of Section 203 of the Delaware General Corporation Law. In general, Section 203 prohibits a publicly-held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a three-year period following the time that this stockholder becomes an interested stockholder, unless the business combination is approved in a prescribed manner. A “business combination” includes, among other things, a merger, asset or stock sale or other transaction resulting in a financial benefit to the interested stockholder. In general, Section 203 defines an “interested stockholder” as any person or entity who, together with affiliates and associates, owns, or did own within three years prior to the determination of interested stockholder status, 15% or more of the corporation’s voting stock. Under Section 203, a business combination between a corporation and an interested stockholder is prohibited unless it satisfies one of the following conditions:

|

|

·

|

before the stockholder became interested, the board of directors approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

|

|

|

·

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding, shares owned by persons who are directors and also officers, and employee stock plans, in some instances; or

|

|

|

·

|

at or after the time the stockholder became interested, the business combination was approved by the board of directors of the corporation and authorized at an annual or special meeting of the stockholders by the affirmative vote of at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

|

Exclusive Jurisdiction of Certain Actions

. Our certificate of incorporation provides that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders, (iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, our certificate of incorporation or our bylaws, or (iv) any action asserting a claim against us governed by the internal affairs doctrine. Although we believe this provision benefits us by providing increased consistency in the application of Delaware law in the types of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against our directors and officers. The enforceability of similar exclusive forum provisions in other companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that a court could rule that this provision in our certificate of incorporation is inapplicable or unenforceable.

Registration Rights

In connection with the private placement described below in the section entitled “Selling Stockholders,” we entered into the Registration Rights Agreement with the selling stockholders, pursuant to which we agreed to file a registration statement with the SEC within 90 days from August 10, 2016 in order to register for resale the shares of common stock purchased by such selling stockholders in the private placement,

and to use commercially reasonable efforts to have the registration statement declared effective within 120 days if there is no review by the SEC, and within 150 days in the event of such review

.

We are required to use commercially reasonable efforts to cause such registration statement to become effective and to remain continuously effective for a period that will terminate upon the earlier of (i) the date on which all shares of common stock registered pursuant to the registration statement have been disposed of pursuant to such registration statement, or (ii) the date on which all such shares of common stock may be sold by non-affiliates without volume or manner of sale restrictions pursuant to Rule 144. We are filing the registration statement to which this prospectus forms a part in satisfaction of our obligations under the above-described registration rights agreement.

The registration rights agreement also granted the selling stockholders customary piggyback registration rights; provided however such piggyback registration rights will not be available during any period in which there is an effective registration statement for the shares of common stock purchased by the selling stockholders in the private placement described below.

8

SELLING ST

OCKHOLDERS

We have prepared this prospectus to allow the selling stockholders to sell or otherwise dispose of, from time to time, up to 5,250,000 shares of our common stock.

On August 6, 2016, we and Franklin Strategic Series - Franklin Biotechnology Discovery Fund, Franklin Templeton Investment Funds — Franklin Biotechnology Discovery Fund, AlephPoint Capital, LP and Brookside Investors LP entered into a Securities Purchase Agreement, or the Purchase Agreement, and a Registration Rights Agreement, or

the Registration Rights Agreement

. Pursuant to the Purchase Agreement, we sold an aggregate of 5,250,000 shares of our common stock in a private placement at a price per share of $1.96.

When we refer to “selling stockholders” in this prospectus, we mean the stockholders listed in the table below and their pledgees, donees, transferees or other successors in interest.

Pursuant to the Registration Rights Agreement, we agreed to prepare and file a Registration Statement on Form S-3 within 90 days of the closing of the transaction to provide for the resale of the issued shares. This prospectus is a part of the Registration Statement filed in satisfaction of that obligation.

The table below lists the names of the selling stockholders and other information regarding the beneficial ownership of the shares of common stock held by each of the selling stockholders, including the nature of any position, office or other material relationship, if any, that the selling stockholder (or the individuals or entities who have control over such selling stockholders) has had within the past three years with us or with any of our predecessors or affiliates. The first column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership as of August 31, 2016, as such beneficial ownership is determined in accordance with the rules of the SEC. The second column lists the shares of common stock being offered by this prospectus by each selling stockholder. The third and fourth columns assume the sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

Beneficial ownership is determined in accordance with rules promulgated by the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. This table is based upon information supplied to us by the selling stockholders and information filed with the SEC. The percent of beneficial ownership for the selling stockholders is based on 34,147,385 shares of our common stock outstanding as of August 31, 2016.

Information about the selling stockholders may change over time. Any changed information will be set forth in supplements to this prospectus to the extent required.

|

Name and Address of Selling Stockholder

|

|

Number of

Shares

Beneficially

Owned

Prior to

the Offering

|

|

|

Number of

Shares

Registered for

Sale

|

|

|

Number of

Shares

Beneficially

Owned

After the

Offering(1)

|

|

|

Percent

of Class

Beneficially

Owned

After the

Offering(1)

|

|

|

Franklin Strategic Series – Franklin Biotechnology Discovery Fund(2)

c/o Franklin Advisers, Inc.

One Franklin Parkway

San Mateo, CA 94403

|

|

|

2,084,200

|

|

|

|

1,888,500

|

|

|

|

195,700

|

|

|

|

*

|

|

|

Franklin Templeton Investment Funds — Franklin Biotechnology Discovery Fund(2)

c/o Franklin Advisers, Inc.

One Franklin Parkway

San Mateo, CA 94403

|

|

|

3,240,800

|

|

|

|

2,936,500

|

|

|

|

304,300

|

|

|

|

*

|

|

|

AlephPoint Capital, LP

246 5th Avenue, 3rd Floor

New York, NY 10001(3)

|

|

|

90,000

|

|

|

|

50,000

|

|

|

|

40,000

|

|

|

|

*

|

|

|

Brookside Investors LP

2999 Turtle Creek Blvd.

Dallas, TX 75219(4)

|

|

|

766,500

|

|

|

|

375,000

|

|

|

|

391,500

|

|

|

|

1.15

|

%

|

|

|

(1)

|

We do not know when or in what amounts the selling stockholders will offer shares for sale, if at all. The selling stockholders may sell any or all of the shares included in and offered by this prospectus. Because the selling stockholders may offer all or some of the shares pursuant to this offering, we cannot estimate the number of shares that will be held by

|

9

|

|

|

the selling stockholders after completion of the offering. However, for purposes of this table, we have assumed that after completion of the offering

, none of the shares included in and covered by this prospectus will be held by the selling stockholders.

|

|

|

(2)

|

Franklin Advisers, Inc., or FAV, an indirectly wholly owned subsidiary of a publicly traded company, Franklin Resources, Inc., or FRI, may be deemed to be the beneficial owner of these securities for purposes of Rule 13d-3 under the Exchange Act in its capacity as the investment adviser to Franklin Strategic Series - Franklin Biotechnology Discovery Fund and Franklin Templeton Investment Funds - Franklin Biotechnology Discovery Fund pursuant to investment management contracts that grant investment and/or voting power to FAV. When an investment management contract (including a sub-advisory agreement) delegates to FAV investment discretion or voting power over the securities held in the investment advisory accounts that are subject to that agreement, FRI treats FAV as having sole investment discretion or voting authority, as the case may be, unless the agreement specifies otherwise. Accordingly, FAV reports for purposes of Section 13(d) of the Exchange Act that it has sole investment discretion and voting authority over the securities covered by any such investment management agreement, unless otherwise specifically noted.

|

|

|

(3)

|

William Ho, the managing member of AlephPoint Capital GP, LLC, which is the general partner of AlephPoint Capital, LP, has sole voting and investment control over the shares held by AlephPoint Capital, LP.

|

|

|

(4)

|

The officers of Belmont Management Partners, which is the general partner of Brookside Investors LP, share voting and investment control over the shares held by Brookside Investors LP. The officers of Belmont Management Partners are John P. Boone, Steven M. Harasym, Michael R. Willis, Andrew Kasik, and J. Russell McWilliams and each of the officers disclaims beneficial ownership over the shares.

|

Relationship with the Selling Stockholders

Registration Rights Agreement

The selling stockholders are a party to a registration rights agreement. For more information, see description in section titled “Description of Capital Stock—Registration Rights” above.

10

PLAN OF DIS

TRIBUTION

The selling stockholders, including their pledgees, donees, transferees, distributees, beneficiaries or other successors in interest, may from time to time offer some or all of the shares of common stock covered by this prospectus. We will not receive any of the proceeds from the sale of the shares of common stock covered by this prospectus by the selling stockholders. We will bear all fees and expenses incident to our obligation to register the shares of our common stock covered by this prospectus.

The selling stockholders may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common stock may be sold on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at privately negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions.

The selling stockholders may use any one or more of the following methods when disposing of shares or interests therein:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an over-the-counter distribution;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

short sales effected after the effective date of the registration statement of which this prospectus is a part;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

·

|

broker-dealers may agree with a selling stockholder to sell a specified number of such shares at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale; or

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of the selling stockholder(s) to include the pledgee, transferee, or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of shares of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Broker-dealers engaged by a selling stockholder may arrange for other broker-dealers to participate in sales. If the selling stockholders effect certain transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders

11

or commissions from purchasers of the shares of common stock for whom they may act as agent or to whom they may sell as principal. Such c

ommissions will be in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction will not be in excess of a customary brokerage commission in compliance with applicable Financial Industry Reg

ulatory Authority, Inc., or FINRA, rules; and in the case of a principal transaction a markup or markdown in compliance with applicable FINRA rules.

The aggregate proceeds to a selling stockholder from the sale of the common stock offered by it will be the purchase price of the common stock less discounts or commissions, if any. Each selling stockholder reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

The selling stockholders also may resell all or a portion of their shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that it meets the criteria and conforms to the requirements of that rule.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be deemed to be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. The selling stockholders are subject to the prospectus delivery requirements of the Securities Act.

To the extent required pursuant to Rule 424(b) under the Securities Act, the shares of our common stock to be sold, the name of the selling stockholder, the purchase price and public offering price, the names of any agents, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the common stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

The selling stockholders and any other person participating in a sale of the common stock registered under this prospectus will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Securities Exchange Act, which may limit the timing of purchases and sales of any of the shares of common stock by the selling stockholders and any other participating person. All of the foregoing may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the shares of common stock. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed with the selling stockholders to keep the registration statement, of which this prospectus constitutes a part, effective until the earlier of (a) such time as all of the shares registered hereunder shall have been resold or (b) such time as all of the shares registered hereunder may be resold without restrictions pursuant to Rule 144 under the Securities Act.

We have agreed, among other things, to pay all expenses of the registration of the shares of common stock, including, without limitation, SEC filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that the selling stockholders will pay all underwriting discounts and selling commissions applicable to the sale of the shares of common stock.

We have agreed to indemnify the selling stockholders against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the shares offered by this prospectus. The selling stockholders have, subject to certain limitations, agreed to indemnify us against liabilities under the Securities Act that may arise from any written information furnished to us by the selling stockholders specifically for use in this prospectus.

12

LEGAL

M

ATTERS

Certain legal matters in connection with this offering will be passed upon for us by Goodwin Procter LLP, San Francisco, California.

EXPERTS

The consolidated financial statements of Fate Therapeutics, Inc. appearing in our Annual Report (Form 10-K) for the year ended December 31, 2015 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the Exchange Act and, in accordance therewith, file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. These documents also may be accessed through the SEC’s electronic data gathering, analysis and retrieval system, or EDGAR, via electronic means, including the SEC’s home page on the Internet (

www.sec.gov

).

We have the authority to designate and issue more than one class or series of stock having various preferences, conversion and other rights, voting powers, restrictions, limitations as to dividends, qualifications, and terms and conditions of redemption. See “Description of Capital Stock.” We will furnish a full statement of the relative rights and preferences of each class or series of our stock which has been so designated and any restrictions on the ownership or transfer of our stock to any stockholder upon written or oral request and without charge. Written requests for such copies should be directed to Fate Therapeutics, Inc., 3535 General Atomics Court, Suite 200, San Diego, CA 92121, Attention: Secretary, or by telephone request to (858) 875-1800. Our website is located at

www.fatetherapeutics.com

. Information contained on our website is not incorporated by reference into this prospectus and, therefore, is not part of this prospectus or any accompanying prospectus supplement.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference the information and reports we file with it, which means that we can disclose important information to you by referring you to these documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede the information already incorporated by reference. We are incorporating by reference the documents listed below, which we have already filed with the SEC, and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including all filings made after the date of the filing of this registration statement and prior to the effectiveness of this registration statement, except as to any portion of any future report or document that is not deemed filed under such provisions, until we sell all of the securities:

|

|

·

|

Annual Report on Form 10-K for the year ended December 31, 2015;

|

|

|

·

|

The information specifically incorporated by reference into our Annual Report on Form 10-K for the year ended December 31, 2015 from our definitive proxy statement on Schedule 14A (other than information furnished rather than filed), which was filed with the SEC on March 30, 2016;

|

|

|

·

|

Quarterly Reports on Form 10-Q filed with the SEC for the quarters ended March 31, 2016 and June 30, 2016;

|

|

|

·

|

Current Reports on Form 8-K filed with the SEC on January 14, 2016, May 12, 2016, August 8, 2016 (only with respect to items 1.01 and 3.02 of the 8-K dated August 6, 2016) and September 7, 2016; and

|

|

|

·

|

The description of our common stock contained in our registration statement on Form 8-A (Registration No. 001-36076) filed with the SEC on September 17, 2013 under Section 12(b) of the Exchange Act, including any amendments or reports filed for the purpose of updating such description.

|

Upon request, we will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, a copy of the documents incorporated by reference into this prospectus but not delivered with the prospectus. You may request a copy of these filings, and any exhibits we have specifically incorporated by reference as an exhibit in this prospectus, at no cost by writing or telephoning us at the following address: Fate Therapeutics, Inc., 3535 General Atomics Court, Suite 200, San Diego, CA 92121, Attention: Secretary, or by telephone request to (858) 875-1800.

13

This prospectus is part of a registration stat

ement we filed with the SEC. We have incorporated exhibits into this registration statement. You should read the exhibits carefully for provisions that may be important to you.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus or in the documents incorporated by reference is accurate as of any date other than the date on the front of this prospectus or those documents.

14

5,250,000 Shares of Common Stock

PROSPECTUS

September 28, 2016

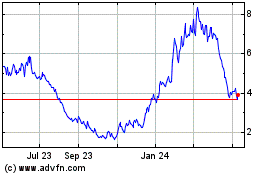

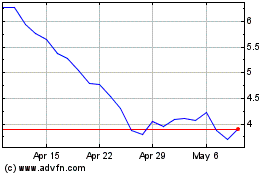

Fate Therapeutics (NASDAQ:FATE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fate Therapeutics (NASDAQ:FATE)

Historical Stock Chart

From Apr 2023 to Apr 2024